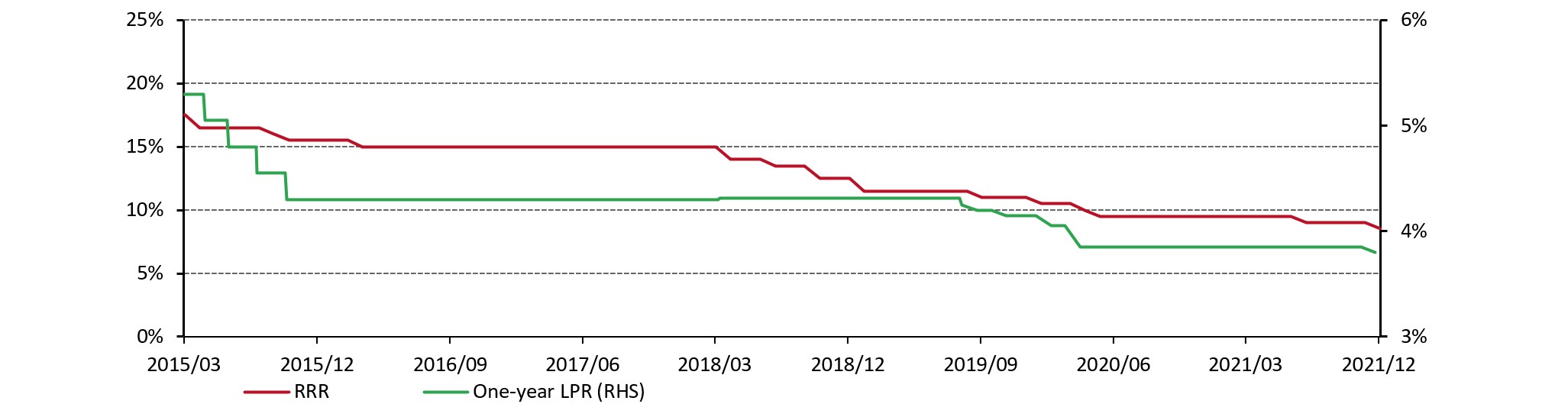

The Chinese central bank has intensified its easing monetary policy efforts to accommodate the nation’s slowing economic growth. On December 15, the People’s Bank of China (PBoC) made a 0.5% cut in financial institutions’ required reserve ratio (RRR), injecting around RMB1.2tn to the market. This was the second RRR cut in 2021 as local policy makers prioritise the pursuit of economic stability. And following last week’s RRR adjustment, the PBoC lowered the one-year local Loan Prime Rate (LPR) by 5bps this Monday, the first LPR cut in 20 months.

China’s easing monetary policy paints a positive picture for 2022’s retail gold investment demand

23 December, 2021

Just as global investors are pricing in possibilities of major central banks’ monetary tightening in the near future, China made rate cuts. We believe China’s easing monetary policy measures might lead to at least two consequences.

First, the opportunity of holding gold for Chinese investors is likely to fall

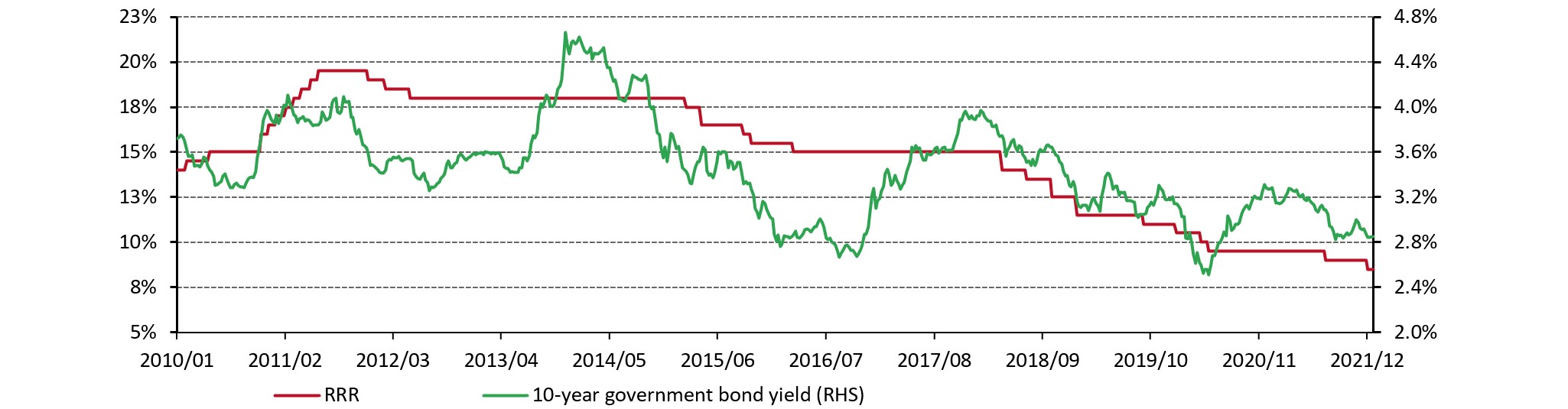

On the one hand, demand for fixed-income assets generally increases as the central bank injects liquidity to the market, pushing down bond yields as a result. On the other hand, the PBoC’s accommodative stance has boosted investors’ expectation of further reduction in China’s benchmark policy rates such as the medium-term lending facility (MLF) rate and the open market operation (OMO) rate, weighing on local bonds’ expected future yields as a result.

Chart 2: The local bond yields tends to fall when the monetary policy is accommodative

The RRR and weekly average 10-year government bond yield in China

Coupled with the rising inflation of recent months and the expectation for consumer prices to further increase in 2022, the real yield of the 10-year local government bond, often viewed as the local opportunity cost of holding gold, has the potential to fall further.

Second, the Chinese Yuan (CNY) might face devaluation pressure

Generally speaking, a lower interest rate is beneficial for local demand and imports, increasing demand for foreign currencies and reducing demand for the domestic currency. Also, a lower interest rate tends to result in a higher supply of the local currency, coupled with its reduced demand, weighing on the domestic currency.

The divergence between China and other key regions’ monetary policy stances might accelerate the CNY’s depreciation. This is because capital tends to enter regions with rising yields from countries with falling interest rates, creating higher demand for the foreign currency and reduces demand for the lower-yielding country’s currency.

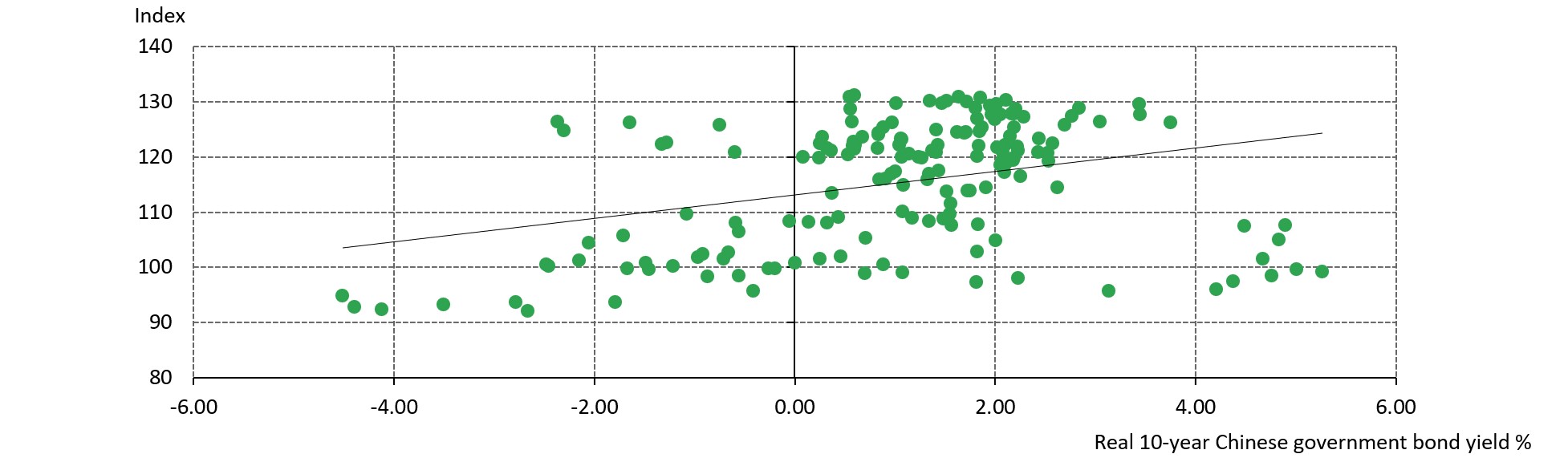

Chart 3: A lower local yield usually means a weaker RMB

The real effective RMB Index and the real 10-year Chinese government bond yield*

Implications for China’s physical gold demand in 2022

Our analysis of quarterly data in the past decade unveils four key factors impacting Chinese investors’ interest in physical gold investment:

- The 10-year government bond yield

A lower opportunity cost of holding gold often bodes well for local gold bar and coin demand - Inflation

Local investors tend to purchase more physical gold products for wealth preservation when inflation rises. - The local currency

Local bar and coin demand increases when there is a depreciation in the local currency as investors seek purchasing power protection. - Income

Our analysis also reveals a positive correlation between local gold bar and coin demand and households’ income changes in the previous period. Usually, Chinese consumers buy more gold bars and coins for gifting or long-term saving purposes when their wealth expands.

As 2021 comes to an end and 2022 approaches, we are actively searching for clues of possible changes in next year’s global and regional gold markets. Unlike other key markets, China is entering into a different economic cycle and stepping up its easing monetary policy. We believe this could be supportive for local retail and institutional investors’ interest in gold.

For more quantitative forecasts, in-depth economic and gold market outlook, please stay tuned for our Global Gold Market Outlook 2022 and Chinese Gold Market Outlook 2022 releasing early 2022.