Key highlights:

- Gold prices ended November relatively unchanged despite sharp intra-month moves1

- The average Chinese gold price premium in the month witnessed a sharp fall despite robust physical gold demand in China2

- Holdings in Chinese gold ETFs fell by 6t (US$0.3bn, RMB2bn) in November after five consecutive months of inflows,3 reaching a collective AUM of 68t (US$4bn, RMB25bn )

- Wholesale physical gold demand has been strong so far in Q4: gold withdrawals from the Shanghai Gold Exchange (SGE) in November rose m-o-m and October’s gold imports reached the highest since December 2019.

Looking ahead:

- Inflationary concerns, a lowering opportunity cost and seasonality could all be supportive of future retail physical gold investment demand

- In the coming months, continued popularity of Heritage gold jewellery and an increasing focus among retailers on selling chunkier products, together with seasonal strength, might partially offset headwinds arising from recent economic growth slowdown and a reduction in the number of marriages.4

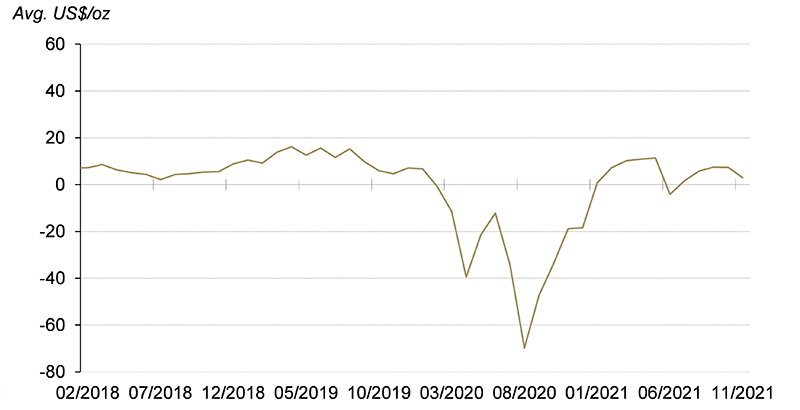

The Shanghai-London gold price spread fell amid a weaker local gold price

The LBMA Gold Price PM finished November slightly higher as declines towards the end of the month wiped off earlier rallies. While the LBMA Gold Price AM in USD – which we normally use when comparing to the Chinese local gold price ‒ increased by 0.1%, the SHAUPM in CNY saw a minor drop of 0.3%. The appreciating CNY against the dollar and a steadily rising equity market may have contributed to the underperformance of the RMB gold price.

The relatively weaker local gold price in China resulted in a dip in the Shanghai-London gold price spread last month despite robust wholesale physical gold demand. The local gold price premium averaged US$3/oz last month, compared with US$7/oz in October. More detailed demand analysis can be found here.

The local gold price premium fell in November

The average monthly spread between SHAUPM and LBMA Gold Price AM in US$/oz*

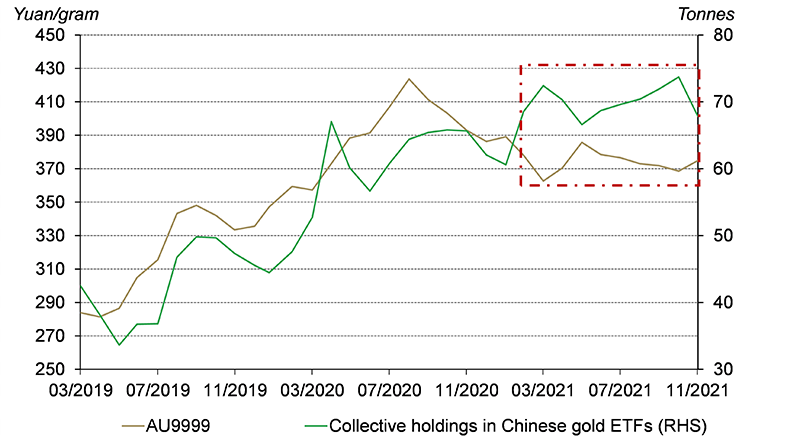

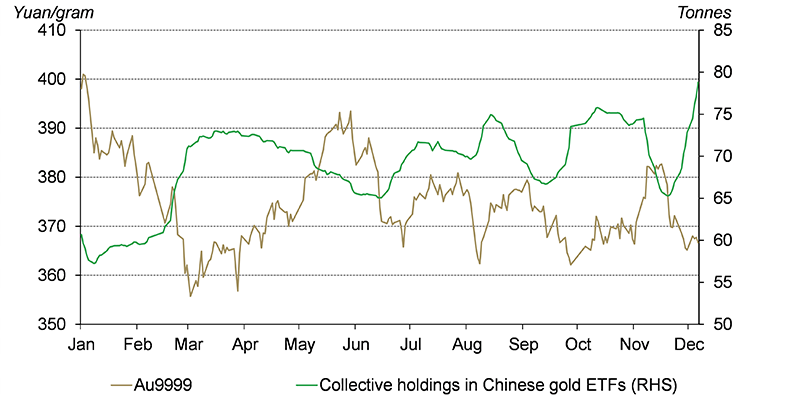

Chinese gold ETFs experienced the first monthly outflow since May

Having reached record highs in October, collective holdings in China’s gold ETFs fell to 68t (US$4bn, RMB25bn) at end-November, 6t lower m-o-m and the first outflow in six months. This brings the total y-t-d inflows into Chinese gold ETFs to 6t.

Local gold investors seemingly became more tactical in gold ETF allocation this year as the gold price momentum from last year cooled. Utilising the gold price rise during the month, many local investors sold their gold ETF holdings.

Chinese gold ETF investors might have become more tactical in 2021

Investor interest in gold ETFs rebounded towards the end of the month possibly due to the gold price weakness – an opportunity to enter the market with lower costs. And as the gold price remained stable, Chinese gold ETF holdings kept rising in December, generating a 10t inflow during the first nine days of the month as of December 9.

A closer look at daily changes in the local gold price and gold ETF holdings

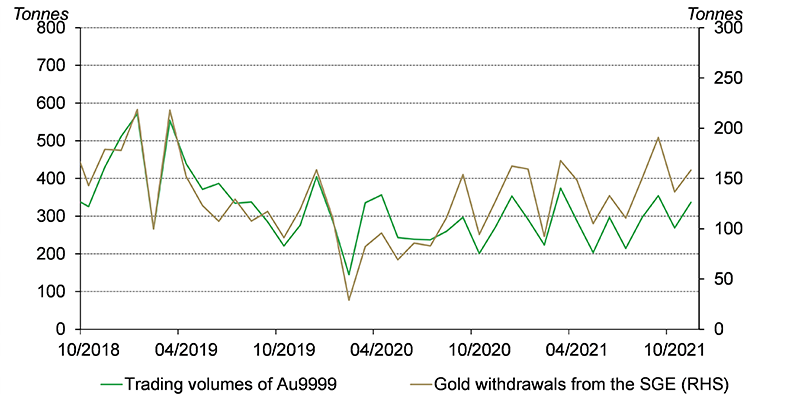

China’s wholesale physical gold demand paints a strong picture for Q4

As the seasonally strong fourth quarter of gold consumption unfolds, China’s wholesale physical gold demand ticked higher in November. The local gold industry withdrew 158t gold from the SGE last month, 22t higher m-o-m. The 1,552t y-t-d gold withdrawals from the SGE are significantly higher y-o-y and 5% above the 2019 level.

The surging popularity of Heritage gold jewellery products, together with a growing share of heavier products in retailers’ inventories (as they increasingly adopt the ‘per gram’ pricing model under which chunkier products often generate higher margins) could be the main contributors.5

China's wholesale physical gold demand ticked higher in November

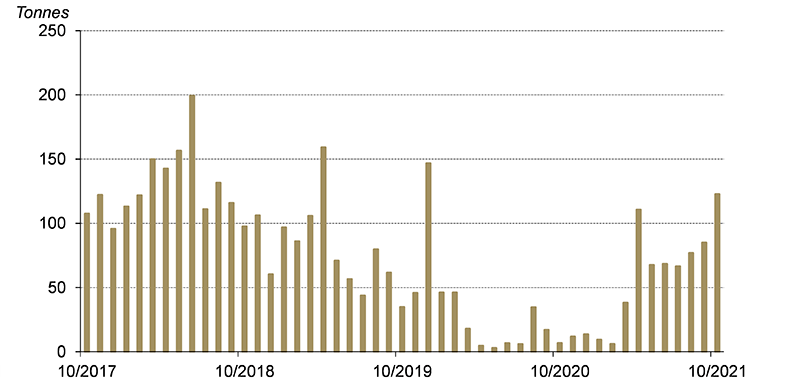

According to the latest data release by China Customs, 123t of gold flowed into China in October, 38t higher m-o-m and the highest since December 2019. China’s gold imports tend to rise in the fourth quarter due to seasonality of local demand. Y-t-d, Chinese gold imports total 651t, significantly higher than 2020.

Gold imports kept rising

Chinese gold imports reported by China Customs under HS code 7108

Looking ahead

Inflationary concerns, a low opportunity cost and seasonality might support future retail gold investment demand

As the Producers’ Price Index (PPI) surges, consumer inflation catches up: the Consumer Price Index and the Retail Price Index have both seen notable rises lately.6 And to counter rising costs many consumer goods companies have announced price increases, further fuelling local inflation.

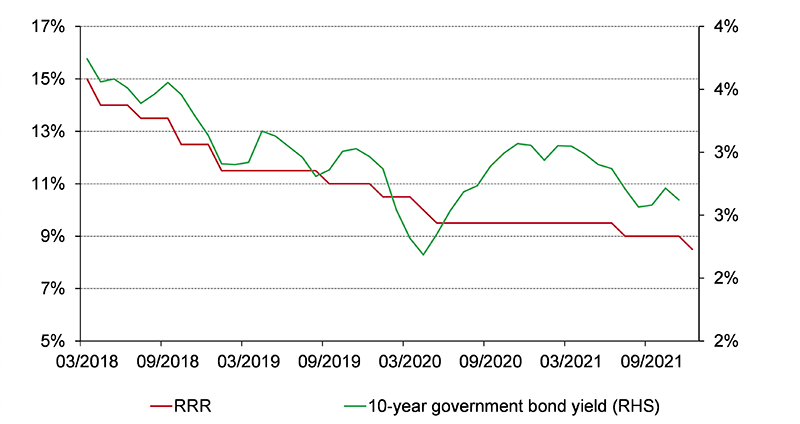

The People’s Bank of China (PBoC) recently announced a 0.5% cut in the required reserve ratio (RRR) for local financial institutions – effective 15 December – in an attempt to buffer the slowing economic growth.7 And this move could set the tone for the PBoC’s monetary policy stance in 2022 as Chinese economic growth uncertainties remain. Coupled with rising inflation, the opportunity cost of holding gold – represented by the real 10-year government bond yield – kept falling.

When RRR falls, the local government bond yield also lowers*

Finally, Q4 is traditionally a peak season for gold bar and coin sales as gifting and savings demand tend to rise ahead of the Chinese New Year holiday, which falls in early February next year. As such, we remain optimistic about China’s retail investment demand for gold over the coming months.

Seasonal strength in gold jewellery consumption might encounter some challenges

With China’s GDP growth slowing and the number of weddings decreasing – both main drivers of Chinese gold jewellery consumption – future gold jewellery demand is likely to be negatively impacted.

However, factors such as the surging popularity of Heritage gold jewellery and the increasing efforts of local retailers to sell chunkier products – a result of the gradual shift in the gold jewellery pricing method – might partially offset headwinds. In addition, seasonality is likely to provide further support. We remain cautiously optimistic about China’s gold jewellery sales in the coming months.

Footnotes

We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit Shanghai Gold Exchange.

For more information about premium calculation, please visit our local gold price premium/discount page. The y-t-d average refers to the average daily local gold price spread between January and July.

Please note that the inflow/outflow value term calculation is based on the end-of-period Au9999 prices in RMB and the USD/CNY rate.

Heritage gold jewellery products refer to 24K, chunky gold jewellery products with ancient craftsmanship, matte surface finishing and traditional Chinese cultural themes.

For more information, please visit: Jewellery | World Gold Council.

For more information, please visit: China's CPI up 1.5% in October (www.gov.cn).

For more information, please visit: PBC Officials Answer Press Questions on RRR Reduction for Financial Institutions.