China’s economy is facing challenges. Recently, many industries in major provinces have been impacted by power rationing and enforced cuts in a drive to meet targets for reducing energy and emission intensity.1 And this could last for some time, placing further pressure on the supply side of the economy which is already showing signs of a slowdown.

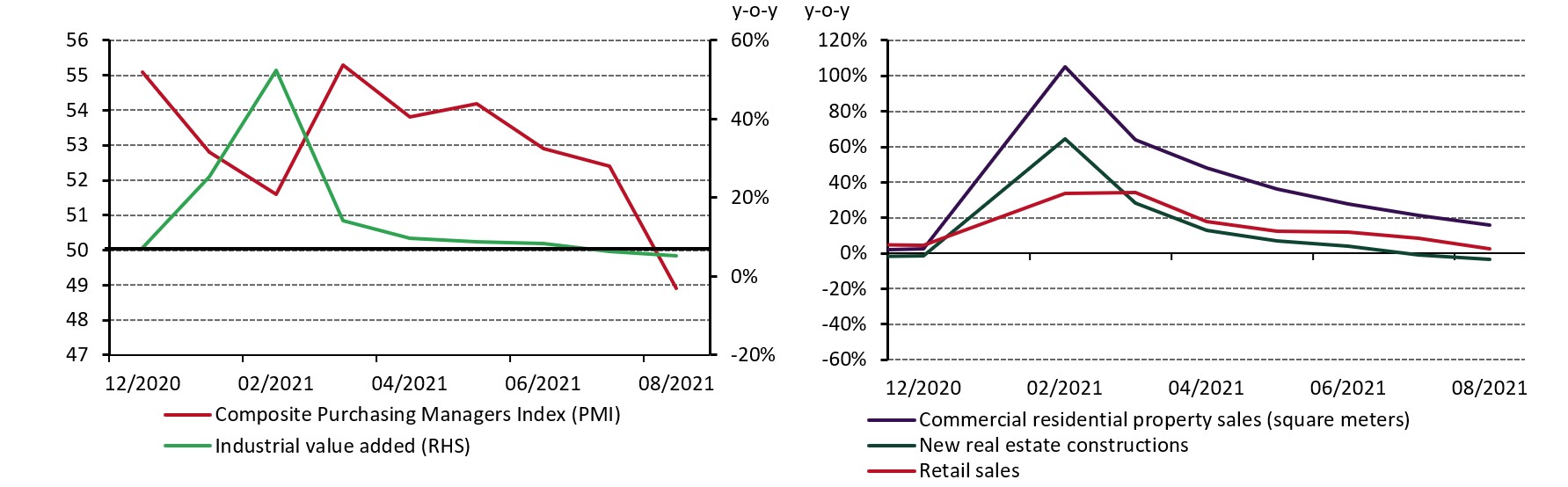

Meanwhile, the demand side of China’s economy is weakening. The y-o-y growth in China’s retail sales fell to 2.5% in August, a sharp drop from previous months. Growth in real estate investment, sales and new constructions are also rapidly trending down. This could be due to a combination of the Delta variant’s resurgence and tighter regulations in the property market.2

Chart 1: Both supply and demand sides of China’s economy encountered challenges recently

Source: National Bureau of Statistics, World Gold Council

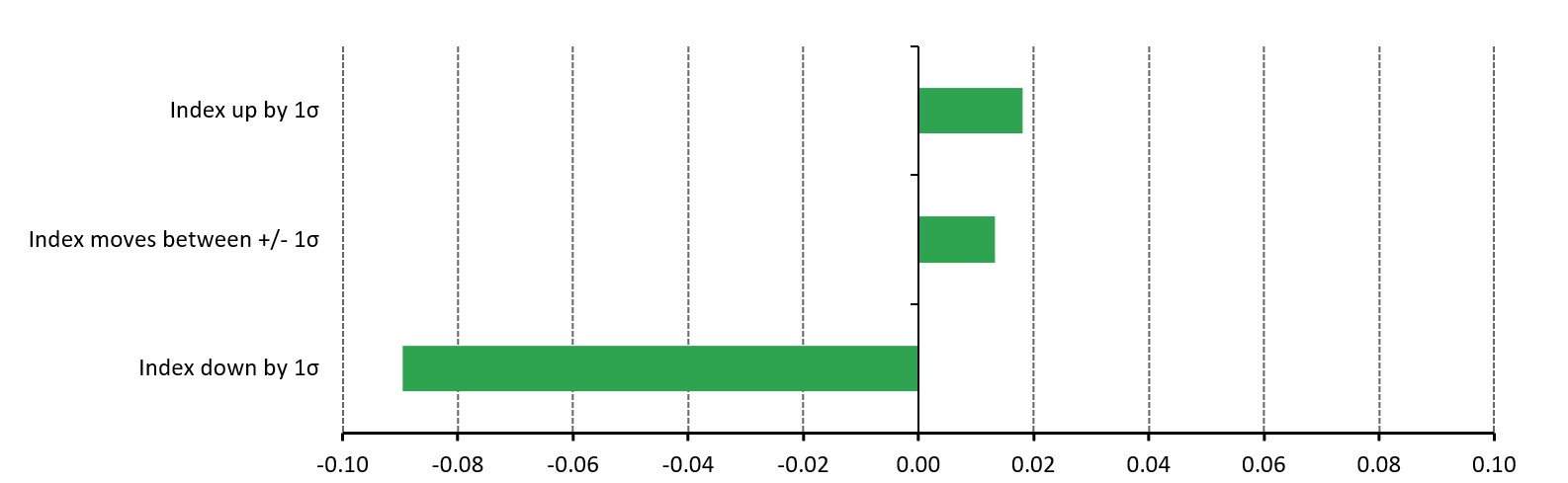

This downward pressure on China’s economy has two major implications. First, a weakening economy could potentially increase equity market risks – which was partially reflected by recent increase in equity market volatility. Gold, with its unique relationship with the Chinese stock market and the independence from China’s economy, could be an effective tool for investors.

Chart 2: gold, an effective equity market risk diversifier

Conditional correlation between Au9999 and CSI stock index during the past decade*

Source: Shanghai Stock Exchange, Shanghai Gold Exchange, Bloomberg, ICE Benchmark Administration

*Based on weekly price changes in CSI300 stock index and Au9999 in RMB between September 2011 and September 2021.

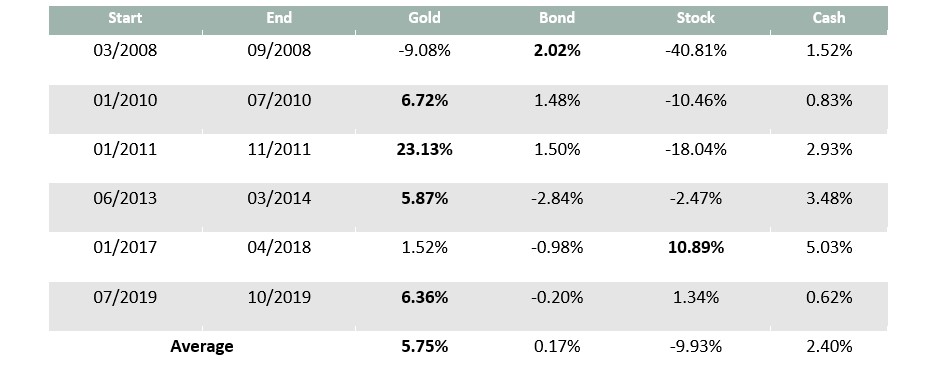

Second, amid supply restrictions, commodity prices might continue to soar, leading to further inflationary pressure at factory gates. Consequently, retail price indices of many categories such as home appliance and transportation rose significantly. But at the same time, demand remains weak. This could signal a potential threat of stagflation. And our research shows that RMB gold tends to outperform other major RMB asset classes during stagflation-alike periods. This, we believe, could make gold a valuable addition to investors’ portfolios.

Table 1: gold has delivered superior returns during stagflation-alike periods in China

Conditional returns of assets under different periods*

Source: Shanghai Gold Exchange, ChinaBond Pricing Centre, China Securities Index Co., Wind, World Gold Council

*Calculation based on daily data of Au9999, CSI300 stock index, ChinaBond New Composite Index and the CSI Money Market Fund index between 2004 and 2020. The division of Chinese economic cycles is based on "The improved investment clock in China: cycle rotation and asset class performance" by Ren Zeping and changes in indicators such as SHIBOR and repo rates.

Looking ahead, many economists are anticipating further stimulus packages to support domestic demand.3 We believe that China is likely to achieve economic stability after short-term shocks fade and stimulating policies are implemented. But for now, the ability to hedge against local stock market volatilities and outperform other assets during stagflation-alike periods in China could make gold shine in investors’ portfolios.