Key highlights:

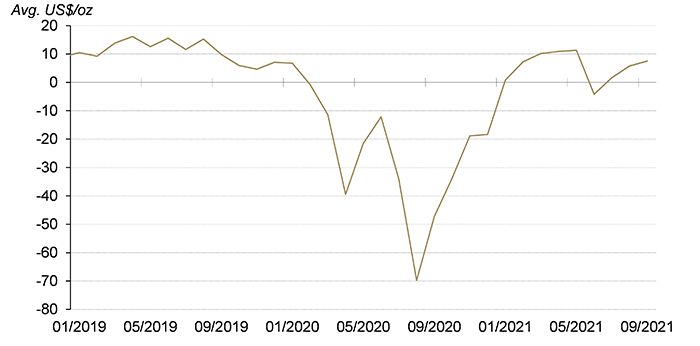

- Both domestic and international gold prices fell in September.1 But the local gold price premium rose further as China’s physical gold demand strengthened, averaging US$7.5/oz in the month2

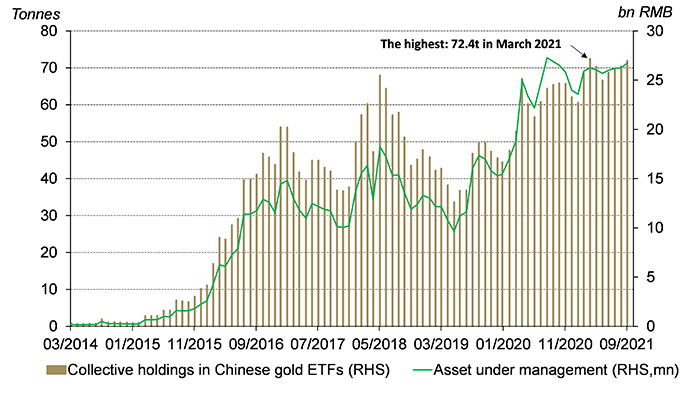

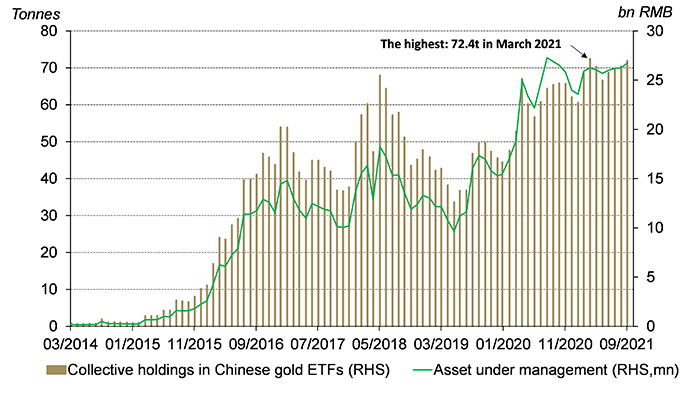

- Chinese gold ETFs witnessed their fourth consecutive monthly inflows amid weakened economic growth and a volatile stock market, reaching 73t (US$4bn, RMB27bn) in September, the second highest on record3

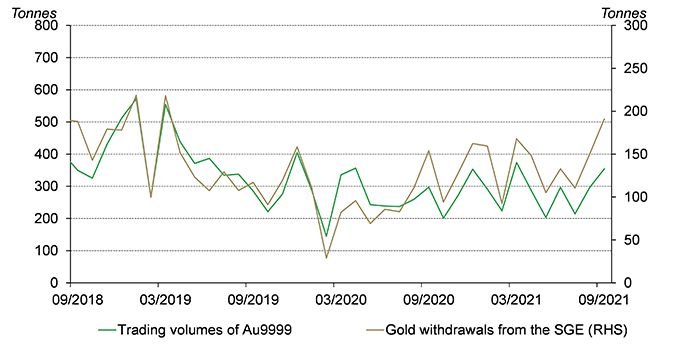

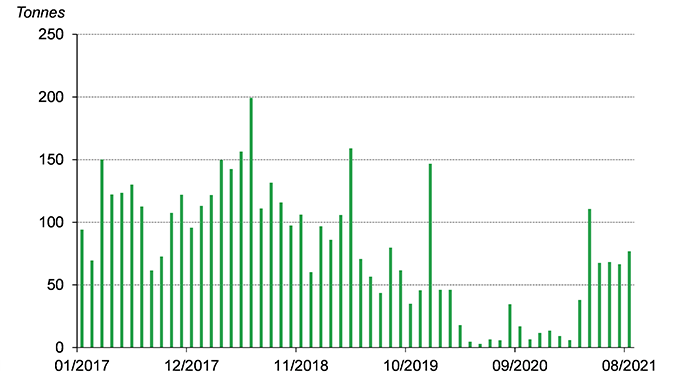

- As the peak season for gold consumption approaches, wholesale physical gold demand rose in China: both gold withdrawals from the Shanghai Gold Exchange (SGE) in September and gold imports in August – according to the latest information available – were higher m-o-m.

Looking ahead:

- As stagflationary pressure intensifies, China’s economic growth faces challenges, potentially supporting local investors’ interests in gold as a key non-RMB asset

- Robust gold jewellery sales during the National Day Holiday in early October kicked off a seasonally strong Q4, but economic uncertainty may be a headwind.

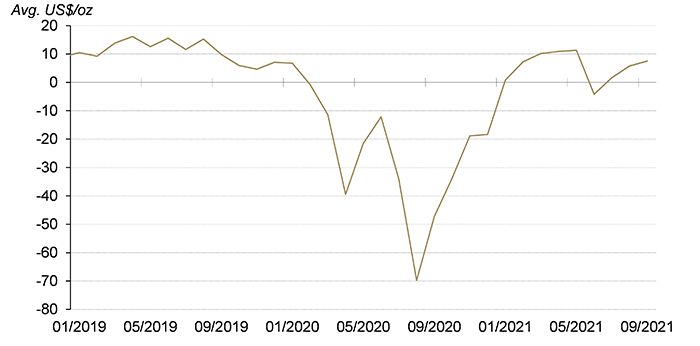

Gold prices down, local premium up

Gold prices fell in September. The LBMA Gold Price AM in USD and the Shanghai Gold Benchmark Price (PM) in CNY declined by 4.6% and 4.3% respectively last month. The rising interest rate, outflows from global gold ETFs, and a stronger dollar all contributed to gold price weaknesses in September.

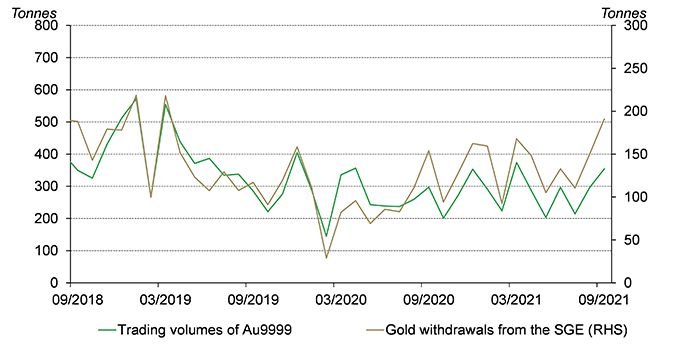

The average monthly Shanghai-London gold price premium reached US$7.5/oz in September, US$1.7/oz higher m-o-m, rising for the third consecutive month. China’s wholesale physical gold demand increased ahead of the traditional National Day Holiday sales boom in October, driving up the local gold premium as a result – you can find more detail in our analysis below.4

The local gold price premium rose further in September

Source: Bloomberg, Shanghai Gold exchange, World Gold Council

SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used.

Click here for more.

A volatile stock market and a lower gold price might have spurred local interest in gold ETFs

Collective holdings in China’s gold ETFs totalled 72t (US$4bn, RMB27bn) as of September, the second highest on record in tonnage terms and 1.5t (US$63mn, RMB 479mn) higher m-o-m. Year-to-date, inflows into Chinese gold ETFs reached 11t.

Chinese gold ETF holdings reached the second highest in history

Source: ETF providers, Shanghai Gold Exchange, World Gold Council

Turbulence in the local stock market might be a key factor broadening gold ETFs’ appeal in September. Delta variant outbreaks in various cities, power rationing, and weakened economic growth all led to a volatile stock market: the 4% decline in the Shanghai Composite Stock Index during the second half of the month almost wiped out its early gains. In the meantime, we believe the 4% retreat in the local gold price also prompted some investors either to enter the market or to increase their strategic gold ETF exposure.

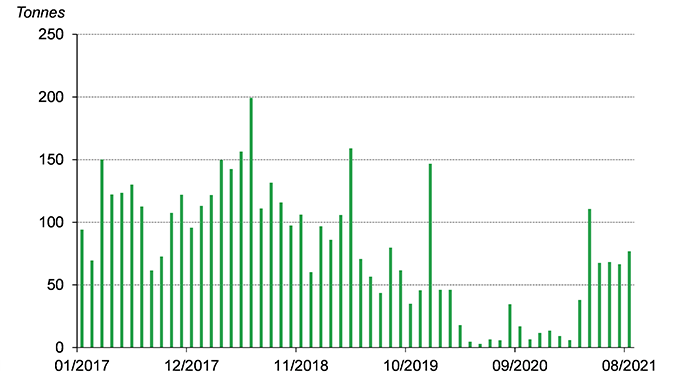

Wholesale physical gold demand increased ahead of the traditional sales boom

Gold withdrawals from the SGE rose to 191t in September, 27% higher m-o-m and 63% higher than 2019. First, the seven-day National Day Holiday in early October has been a major sales focus for Chinese jewellery retailers, leading to higher replenishing volumes and wholesale demand in September. Second, more and more jewellery manufacturers choose to showcase their new products or offer attractive deals around mid-September at Shenzhen Jewellery Fair or their own tradeshows. And these promotional efforts usually attract retailers nationwide, driving up physical gold demand in the upstream as a result.

China's wholesale physical gold demand continued to rise

Source: Shanghai Gold Exchange, World Gold Council

China’s gold imports in August amounted to 76.9t, 10.3t higher m-o-m, in line with the August 2019 level. After a seasonally weak Q2, China’s gold demand tends to pick up, resulting in a higher appetite for gold imports. This trend is especially evident in August and September, for the reasons stated above.

China's gold imports saw a notable rise in August

China's gold imports under HS code 7108

Source: China Customs, World Gold Council

Looking ahead

Investment demand for gold might find some support from weaker economic indicators

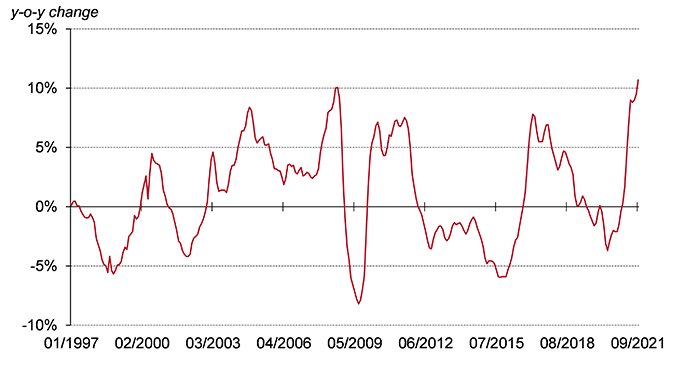

Slowing economic growth might be supportive for gold’s investment demand in China. Amid factors such as power cuts and outbreaks of the Delta variant , the manufacturing Purchasing Managers’ Index (PMI) dropped to 49.6 in September, falling below 50 for the first time since March 2020. Meanwhile, the Producer Price Index (PPI) continued to surge in September, recording its largest y-o-y gain on record. Also, growth in retail sales kept slowing in recent months. With China’s supply side being restricted and demand facing challenges, stagflationary pressure might surface.

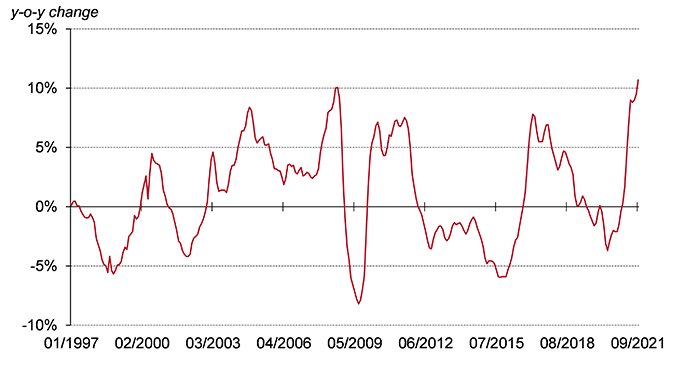

In September, China's PPI saw its largest y-o-y increase on record

Source: National Bureau of Statistics, World Gold Council

Being a key non-RMB asset, gold’s relative independence from China’s economic changes and its strong performances during stagflationary periods in China might attract more local investors.

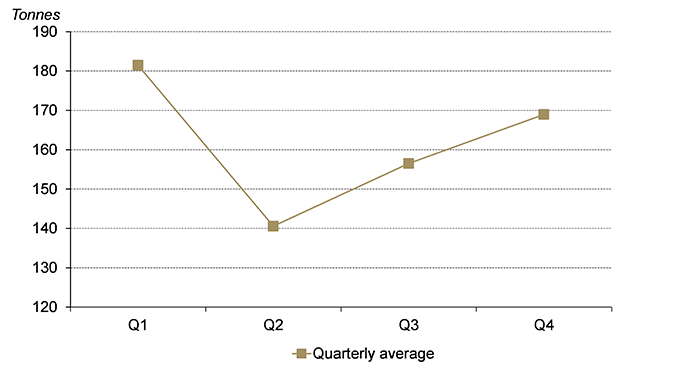

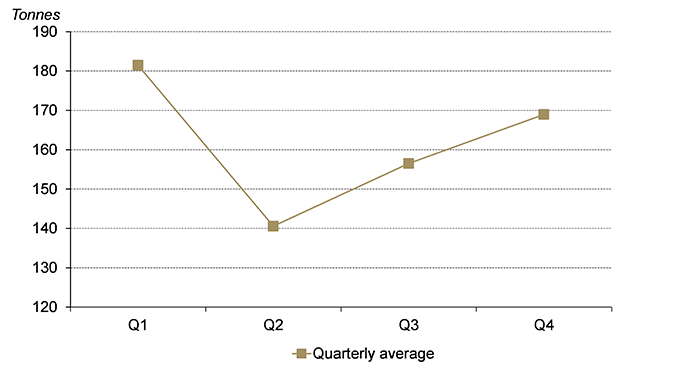

Uncertainties remain for gold jewellery consumption as the peak season starts

The National Day Holiday kicked off Q4 to a strong start for China’s gold jewellery demand. According to the Shanghai Gold Jewellery Assocation, consumers bought gold jewellery worth a total of RMB938mn in Shanghai between 1 and 7 October, 65% higher y-o-y and above the 2019 level. A lower yet stable gold price, the surging popularity of Heritage gold jewellery, and the reallocation of travel budgets amid strict border controls all contributed to the gold jewellery sales boom.

Even while the traditional peak season for gold jewellery sales unfolds, risks remain. Primarily, uncertainties in China’s economic growth could become a key challenge facing China’s gold jewellery consumption as it is highly correlated with consumers’ disposable income. Also, if power rationing, which has already mildly impacted jewellery manufacturers’ outputs since late September, continues, this may create bottlenecks for manufacturers. In view of this, we remain cautiously optimistic about China’s gold jewellery sales in coming months.

China's gold jewellery demand in Q4 is usually higher than Q3

Source: Metal Focus, World Gold Council

Based on quarterly averages of China's gold jewellery demand between 2010 and 2019; 2013 excluded as seasonality was distorted.

Footnotes

We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit Shanghai Gold Exchange.

For more information about premium calculation, please visit our local gold price premium/discount page. The y-t-d average refers to the average daily local gold price spread between January and July.

Please note that the inflow/outflow value term calculation is based on the end of period Au9999 prices in RMB and the USD/CNY rate.

The 2021 National Day Holiday started on 1st October and ended on 7th October.