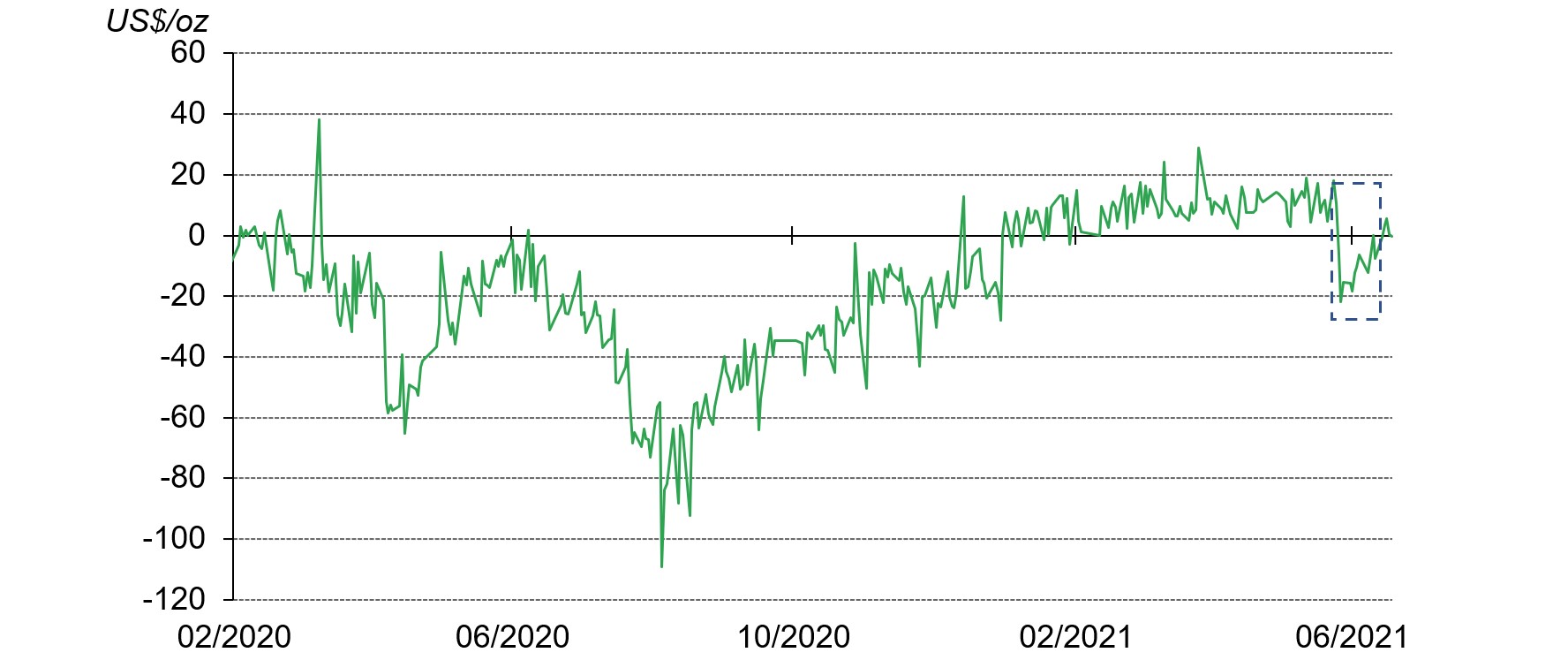

The Shanghai-London gold price spread again turned negative in June after being positive since early 2021,1 falling to -US$6.7/oz on 2 June and remaining negative most days during the month. We believe this is likely driven by:

- the difference between Chinese and Western investors’ risk appetite

- the expectation of tighter regulations in China’s gold market

- the sharp rise in China’s gold imports.

The Shanghai-London gold price spread turned negative in June*

Source: Shanghai Gold Exchange, ICE Benchmark Administration, World Gold Council

*Data as of 25 June 2021

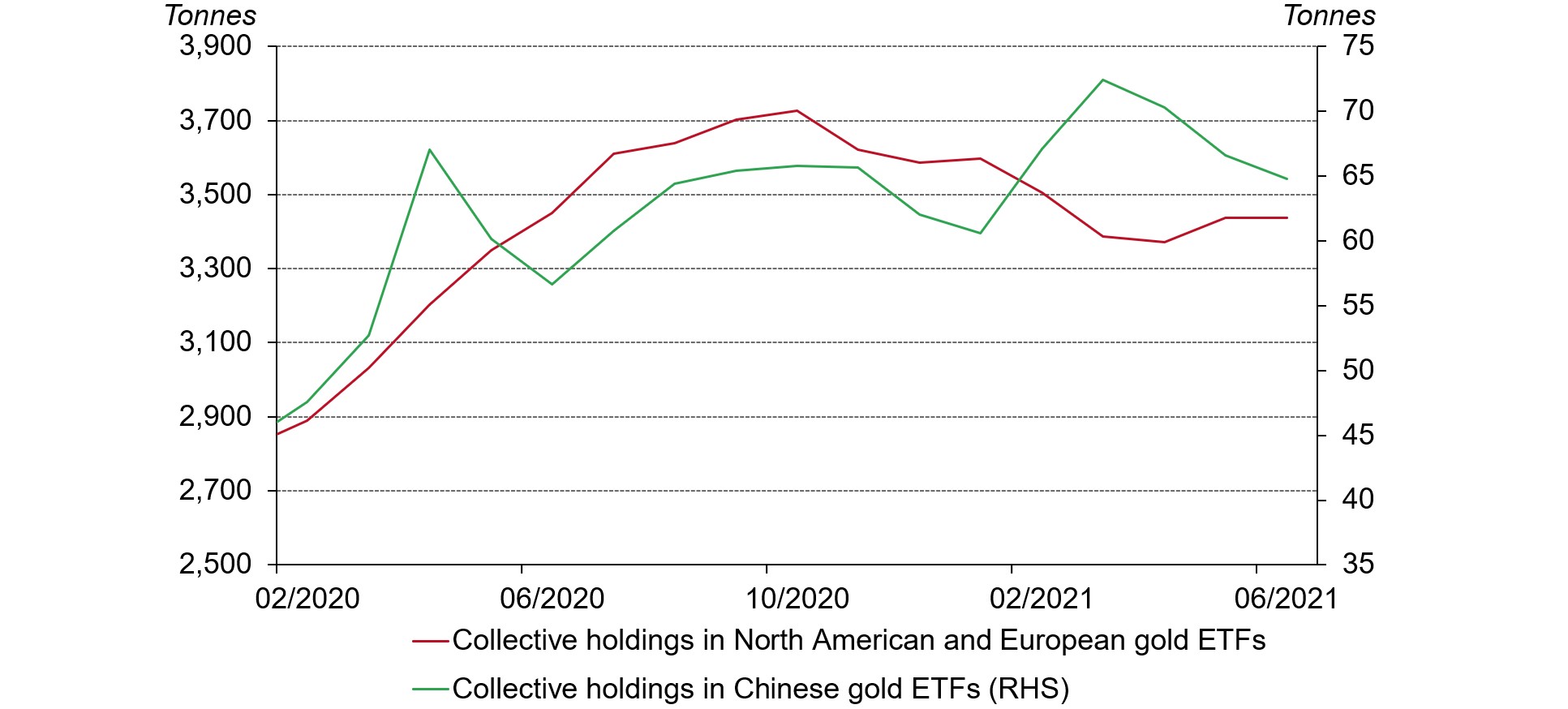

Chinese investors are less risk-averse than Western investors

The attitudes and perspective of Chinese and Western investors can differ. And this has been true for gold in recent months. For example, while there were inflows into Chinese-listed gold ETFs during Q1, Western-listed ETFs saw outflows. Conversely, Chinese gold ETF holdings saw a 3.7t outflow in May and a 1.7t decline during the first half of June, while US-listed funds generally saw inflows.2

Chinese gold ETFs: outflows, Western gold ETFs: inflows*

Source: ETF providers, World Gold Council

*Data as of 18 June 2021

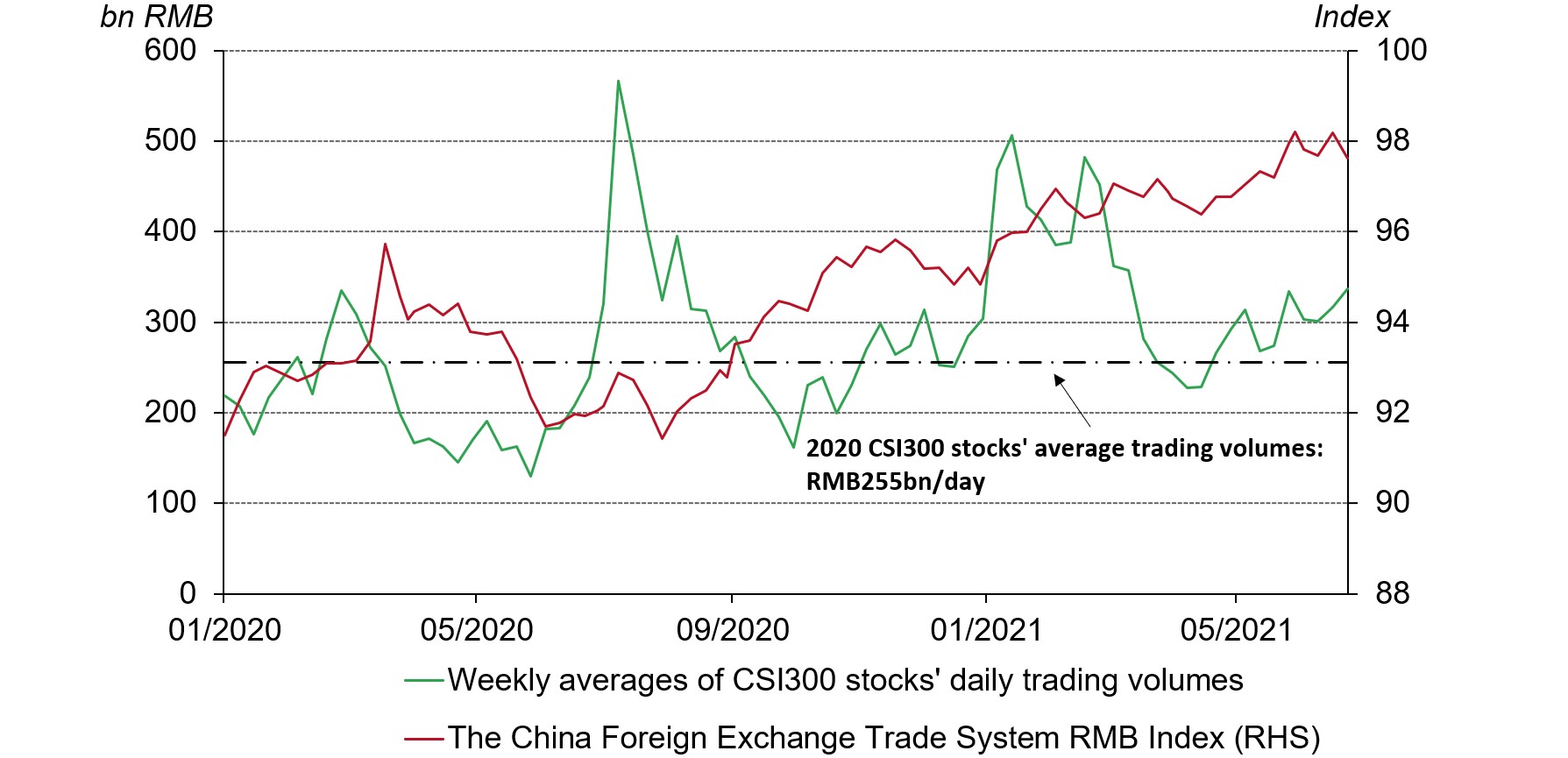

Such divergence could be a result of a higher risk appetite among Chinese investors than their Western counterparts. First, the Chinese renminbi index – an index developed by the China Foreign Exchange Trade System to reflect the RMB’s strength against a basket of currencies – has climbed rapidly recently. A strong local currency usually results in a higher risk tolerance from local investors as it often indicates a strengthening in the local economy. This has, in turn, pushed up trading volumes on the local stock market and lowered Chinese investors’ interest in safe-haven assets such as gold.

The strengthening RMB has lifted local investors' risk appetite

Source: Wind, China Foreign Exchange Trade System, World Gold Council

*Data as of 25 June 2021, based on weekly averages.

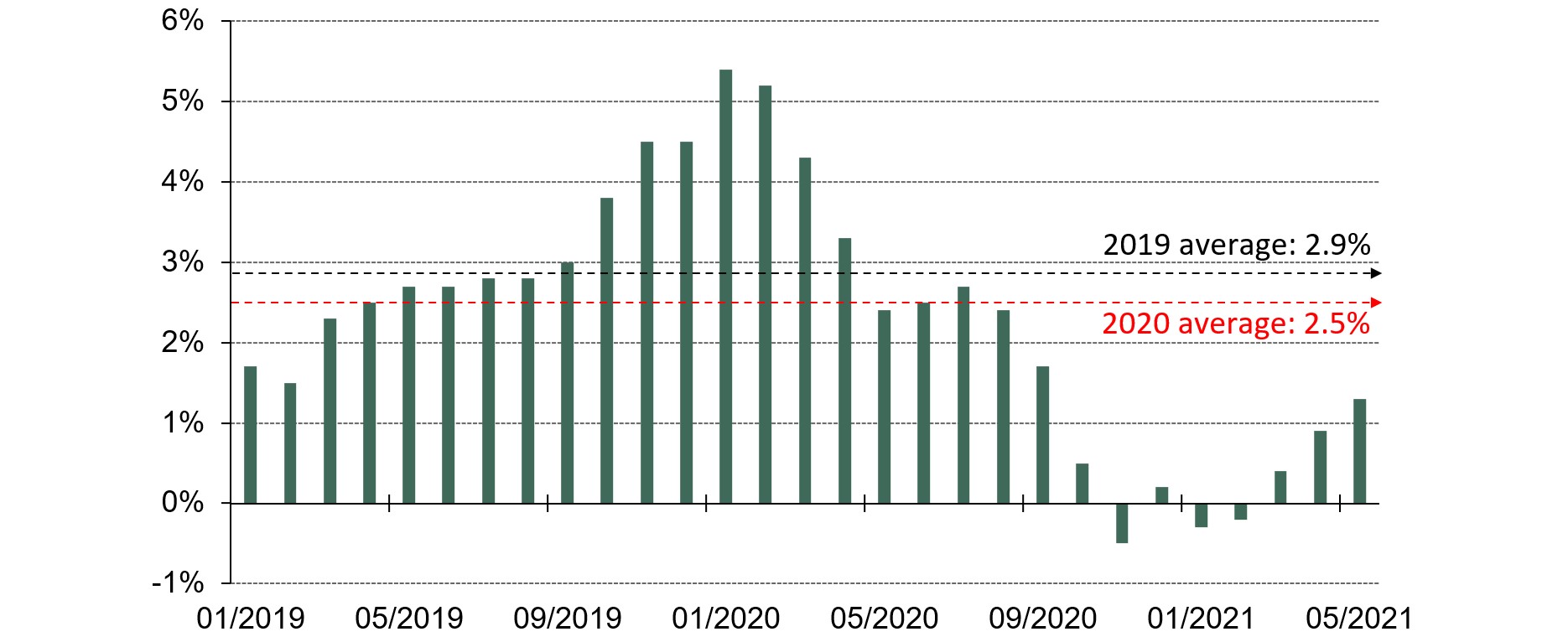

Also, Chinese investors have had less rising inflationary concerns so far in 2021 than investors in the West. With commodity prices rocketing, China’s Producers Price Index (PPI) rose rapidly in 2021. But the country’s Consumer Price Index (CPI) has remained subdued, chiefly due to lower food prices and a relatively gradual recovery in the demand side of the economy so far in 2021. As a result, the demand for gold as a hedge against inflation has reduced.3

Inflation in China has been subdued so far in 2021

y-o-y changes in Chinese CPI

Source: National Bureau of Statistics, World Gold Council

The expectation for tighter regulation in the local gold market

On 1 June an announcement was made by the People’s Bank of China’s (PBoC) that the scope of the anti-money laundering law has extended to gold spot exchanges and dealers – leading to the expectation of tighter regulation in physical gold trading. This further weighed on the mood of Chinese gold traders and drove the Shanghai-London spread down sharply. And traders betting on the Shanghai-London gold price spread widening had to close their positions by selling RMB gold contracts and buying USD gold contracts to limit their losses, accelerating the spread’s plunge.

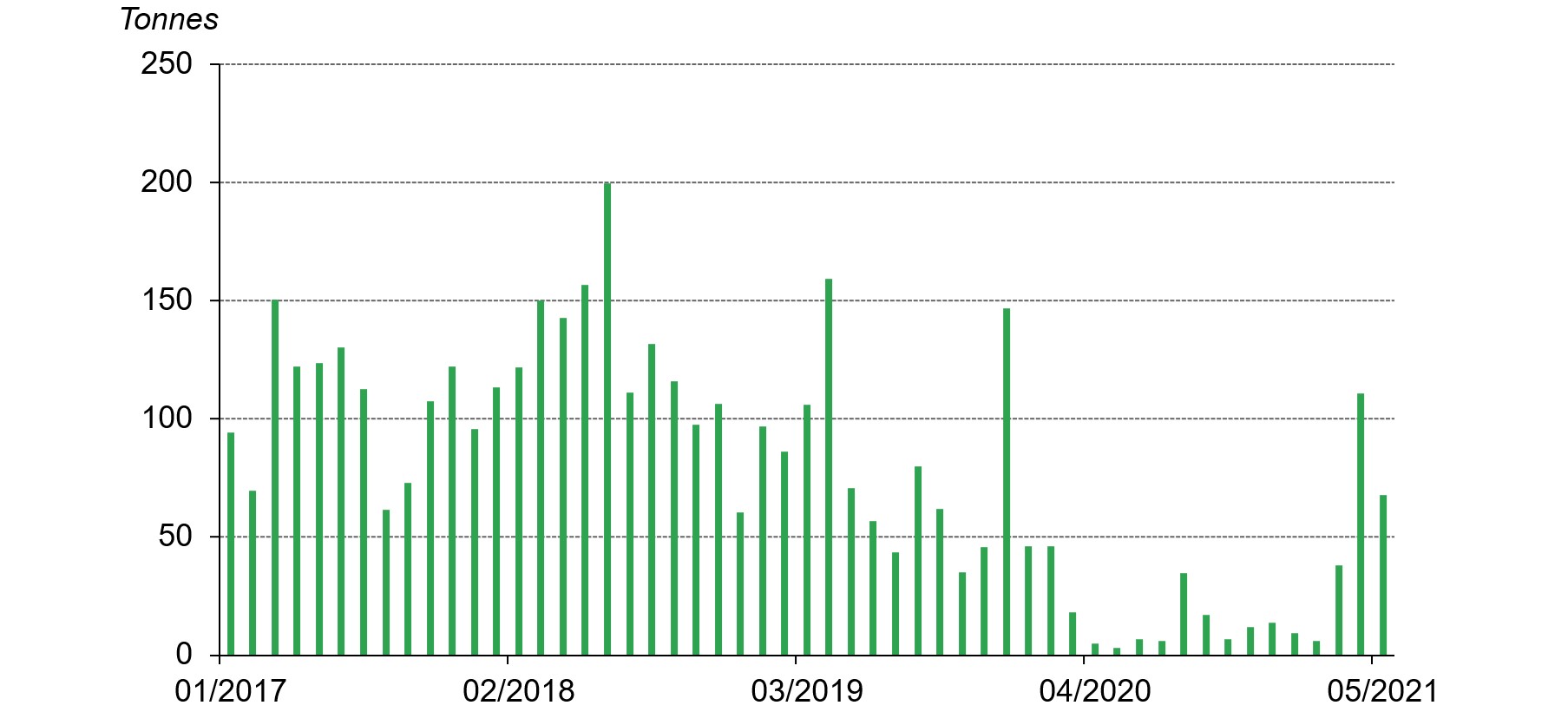

A significant rise in China’s recent gold imports

Recent jumps in China’s gold imports have also lowered the local gold price spread. The authorities’ restrictive controls on gold import quotas have, on most days, contributed to a premium in the Chinese local gold price (except during 2020 when local gold demand was severely hampered).4 After remaining subdued in 2020 and early 2021 amid the COVID-19 pandemic, China’s gold imports rose rapidly – 54t in Q1 2021 and a total of 178t in April and May – primarily driven by rising gold consumption and an easing of restrictions on gold inflows. This increase in gold import quotas has also played a role in driving down the local gold price spread in recent months as there is an expectation that China’s gold imports will increase further in the coming months, thus reducing the “scarcity” of gold in China – a factor that may have been exacerbated by lower than expected investor demand for the reasons explained above.5

Recent uptick in China's gold imports further weighed on local gold price spread

Source: China Customs, World Gold Council

Outlook

In summary, the higher risk appetite among Chinese gold investors than those in the West – where inflationary concerns continue to intensify – combined with the expectation of tighter regulatory controls in China’s physical gold market and a significant jump in its gold imports, have led to a weaker performance in the RMB gold price than in the USD gold price over recent months and a negative Shanghai-London gold price spread.

But the outlook for gold demand – the fundamental driver of the local gold price spread – suggests that the negative spread will not last. With commodity prices remaining stubbornly high and a continuous recovery in the demand side of the economy, China’s inflationary pressures could start to rise, potentially increasing Chinese investors’ demand for gold as an inflation hedge. And as we enter Q3, gold jewellery consumption is likely to pick up due to the seasonal pattern, a stable economic growth and the holiday-related gold consumption boom.