Our latest Gold Demand Trends report was released last week, explaining in detail developments in the different elements of global demand in Q1 2021.

Key trends from Q1

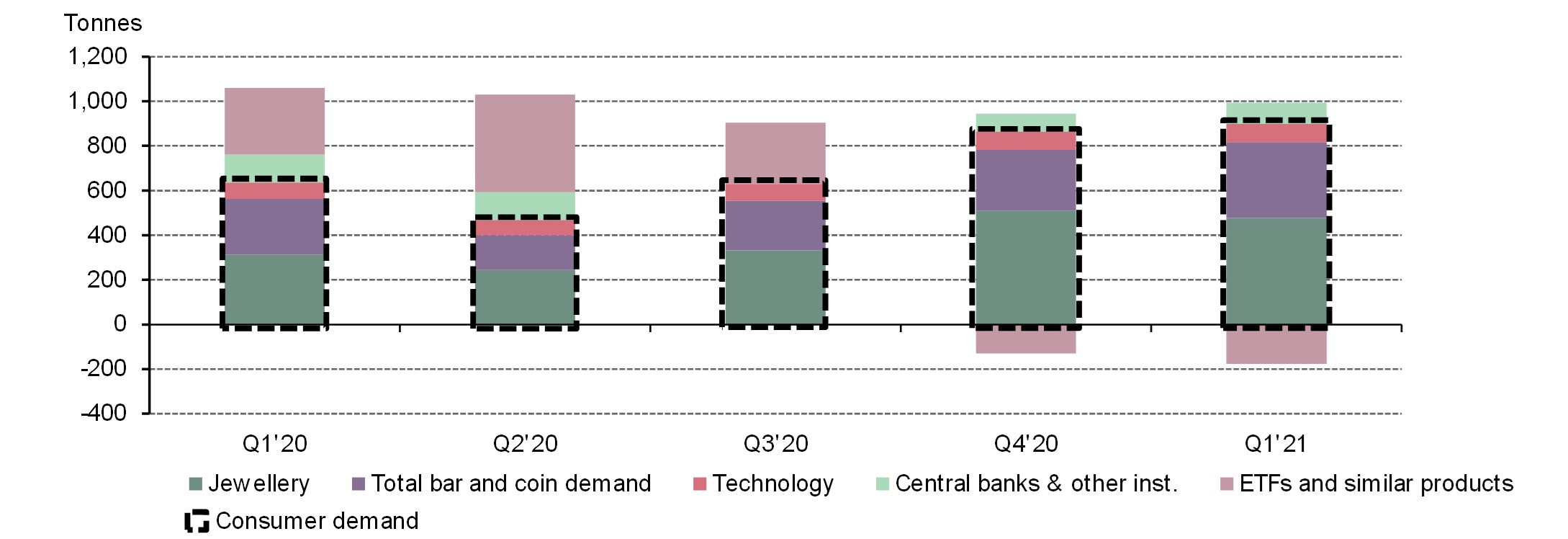

- Gold demand (excluding OTC) was 815.7t, down 23% compared with Q1 2020

- Jewellery demand of 77.4t saw a strong improvement from the historically weak Q1 2020

- Bar and coin investment, at 339.5t, was buoyed by bargain-hunting and growing concern over inflationary pressures

- Gold ETFs1 lost 177.9t, with Western markets driving outflows

- Central banks bought a net 95.5t of gold in Q1.

Amid various reports from across the globe of an ardent appetite for gold jewellery, vibrant investment interest in gold bars and coins, and sustained growth in demand for cars and smartphones, our data confirms a continued recovery in consumer demand from the pandemic-stricken lows of last year.

Gold demand held steady despite ETF outflows

Quarterly demand by sector*