February summary

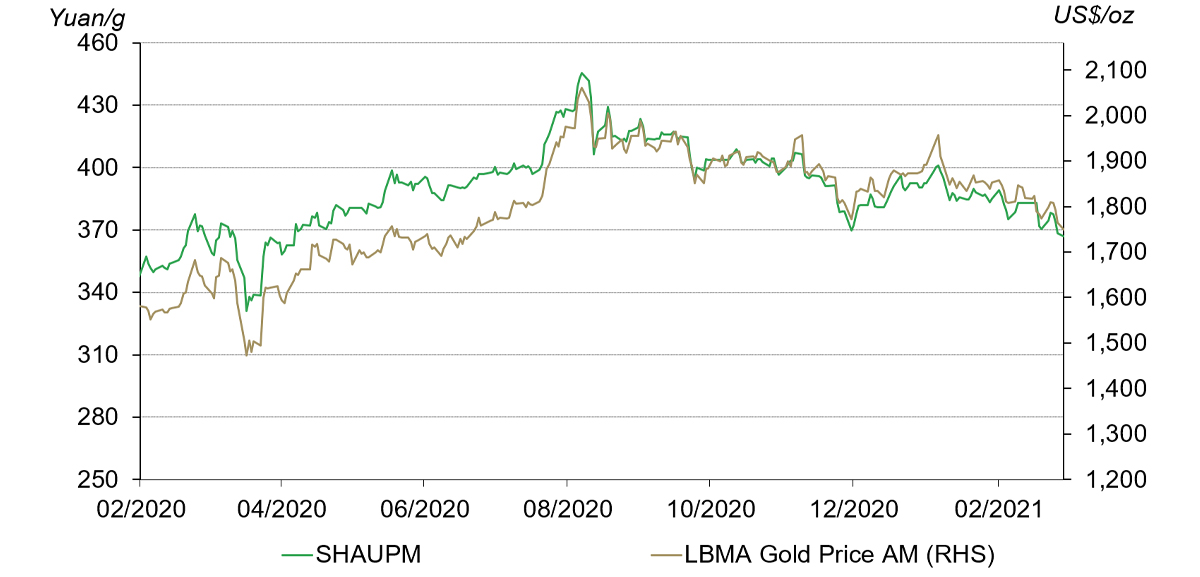

- The LBMA Gold Price AM in US dollars (USD) fell by 4.7% and the Shanghai Gold Benchmark Price PM (SHAUPM) in renminbi (RMB) dropped 4% in the month1

- China’s retail consumption rebounded markedly y-o-y during the Chinese New Year (CNY) holiday2

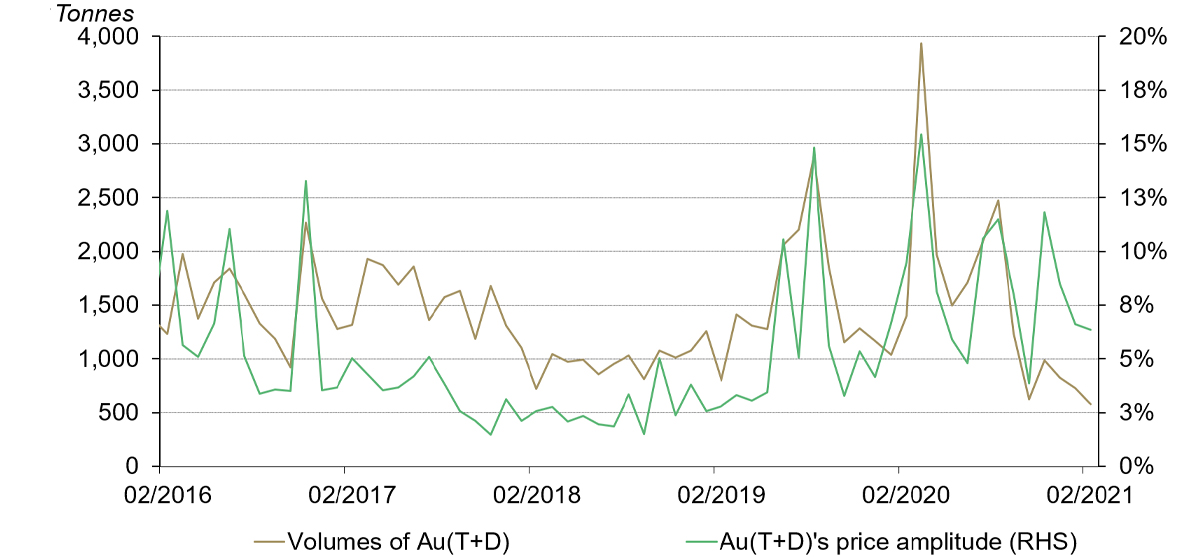

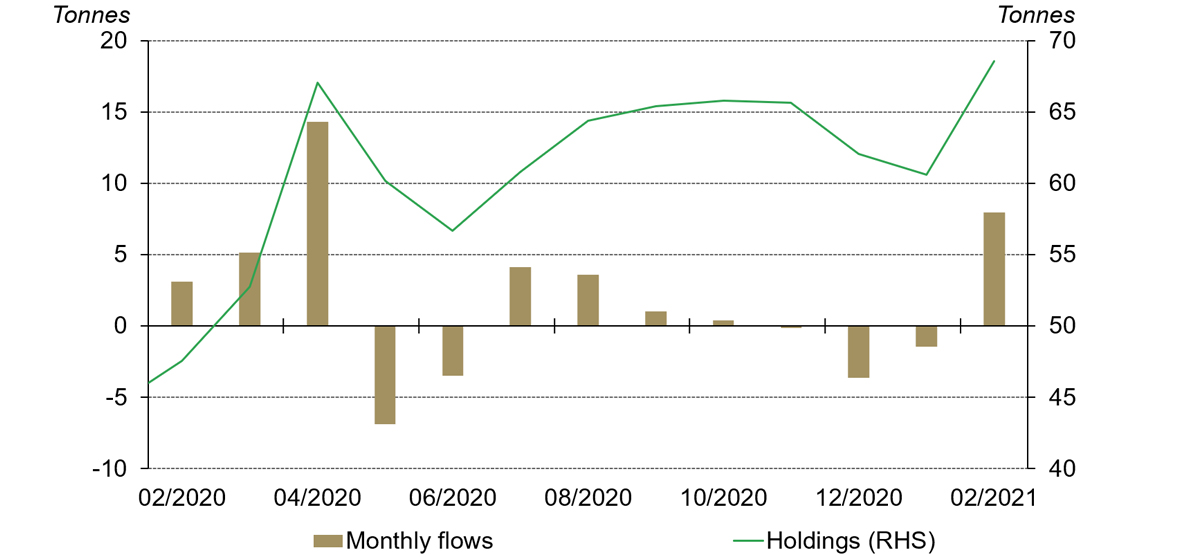

- While Au(T+D)’s trading volumes tumbled, Chinese gold ETFs gained popularity during the month:

- Au(T+D)’s trading volumes totalled 581 tonnes (t), 148t lower m-o-m and 821t lower y-o-y mainly due to fewer trading days in February

- Chinese gold ETF holdings increased by 8t, reaching 68.6t, the highest ever

- Gold withdrawals from the Shanghai Gold Exchange (SGE) fell on a m-o-m basis due to seasonal reasons and fewer trading days in February

- The Shanghai-London gold price spread saw a sizable rise, averaging US$7.3/oz in the month, US$6.5/oz higher than in January3

- China’s wholesale gold demand could rise in March

- The People’s Bank of China gold reserves remained at 1,948t at the end of February, accounting for 3.5% of its total reserves. The Chinese central bank has kept its gold reserves unchanged since September 2019.

Gold prices fell in February

With economic indicators, such as US retail sales, and the COVID-19 vaccine roll-out pointing to recovery in key markets, expectations for the global economic recovery and higher inflation rose. This has led to rapidly climbing government bond yields in many markets, weighing on international gold prices as a result. Both the LBMA Gold Price AM in USD and the SHAUPM in RMB dropped last month.

Gold prices saw declines in February

Source: Shanghai Gold Exchange, ICE Benchmark Administration, World Gold Council

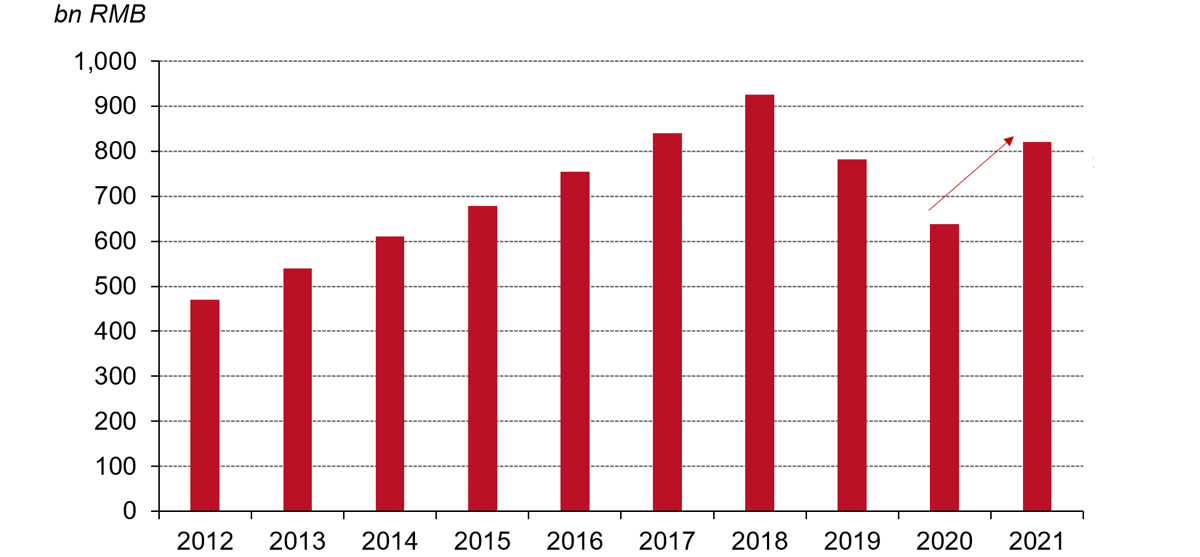

The 2021 CNY holiday witnessed a strong y-o-y rebound in China’s retail consumption

According to the Ministry of Commerce, key retailers and catering revenues in China during the 2021 CNY holiday reached RMB821bn, 28.7% higher y-o-y and 4.9% higher than 2019’s CNY week.4

There was a strong y-o-y rebound in the 2021 CNY holiday consumption

CNY holiday week's key retailers and catering revenues in China

Source: Ministry of Commerce, World Gold Council

While the economic recovery and the containment of the pandemic were key drivers of this retail consumption boom during the festival, the “stay put” initiative was another contributor. As mentioned in my recent blog, the “stay put” drive that encourages migrants in cities to stay for the CNY holiday instead of returning to their hometowns to strengthen the pandemic containment has boosted large cities’ retail consumption.5

Au(T+D)’s trading volumes plummeted last month primarily due to fewer trading days in the month

Nevertheless, the margin-traded contract’s trading volumes in February were the lowest seen during CNY months since 2015. This was because:6

- the local gold price extended its weakness from previous months

- volatility in the local gold price continued to fall as a lower gold price volatility often means fewer short-term profit opportunities.

Au(T+D)'s trading volumes fell

Source: Shanghai Gold Exchange, World Gold Council

Chinese gold ETF total holdings reached 68.6t – the highest on record – as of February, 8t higher m-o-m

First, last month’s turbulent Chinese equity market was a key factor driving local investors’ gold ETF allocation. While the CSI300 stock index dropped by more than 8% after the CNY holiday, the stock market’s volatility also elevated significantly in February.7 Second, the local gold price dip in the month was seen as a better entry point to the market by many retail investors, spurring further interests in Chinese gold ETFs.

Inflows into Chinese gold ETFs were the highest since last April

Source: ETF providers, World Gold Council

Gold shipped out of the SGE in February totalled 92t, 67t lower m-o-m

This was mainly a result of the seasonal patterns in China’s wholesale gold demand around the CNY holiday:

- CNY months usually have fewer working days due to the holiday

- the Chinese gold market supply chain tends to stock up ahead of the CNY month, reducing the wholesale gold demand in the following month

- some gold products manufacturers do not resume production until after the Spring Lantern Festival8

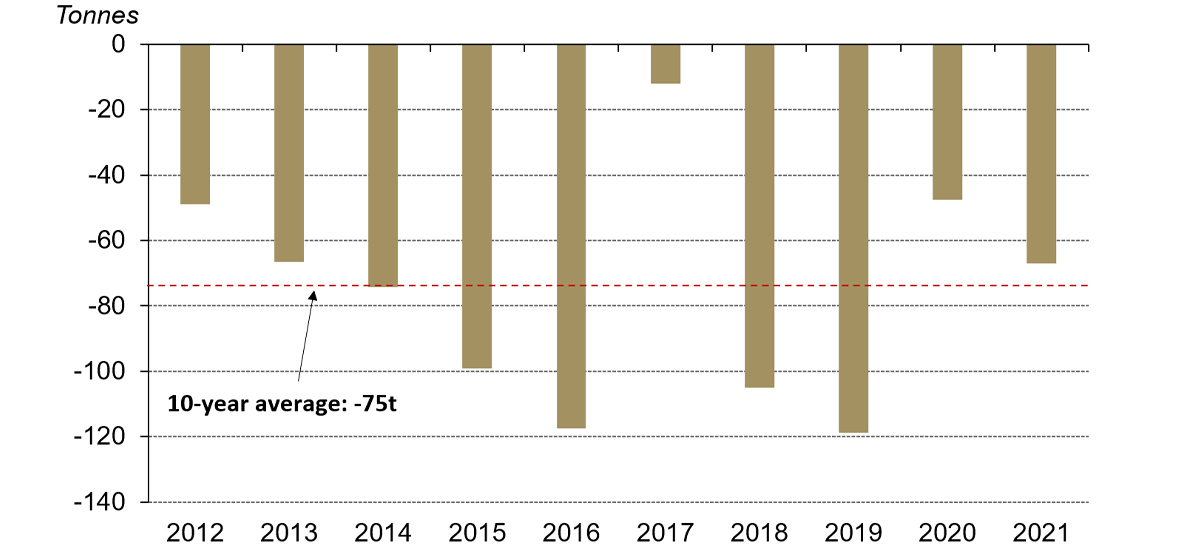

China's wholesale gold demand tends to fall in months CNY holidays occur*

M-o-m changes in the SGE's gold withdrawals between CNY months and previous months

Source: Shanghai Gold Exchange, World Gold Council

*M-o-m changes based on gold withdrawals from the SGE in the month the CNY holiday occurred and the previous month between 2011 and 2021. For instance, the 2021 data was based on the m-o-m change in gold withdrawals between February and January as the 2021 CNY holiday was between 11 February and 17 February. The 10-year average is based on data between 2011 and 2020. For detailed information of past CNY holiday dates, please click here.

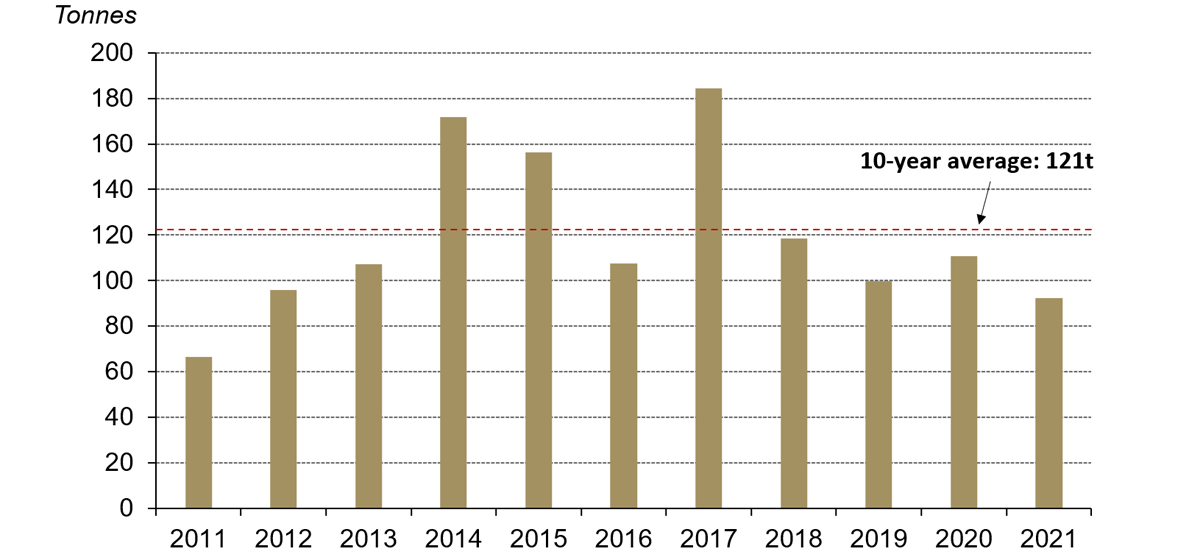

China’s wholesale gold demand in February was still 18t below 2020’s CNY month and 30t lower than the 10-year average

Severely affected by the COVID-19 pandemic, China’s gold consumption was hampered in 2020. Although the Chinese gold demand witnessed rapid recoveries last year amid the economic improvement, it has not returned to its pre-COVID level. But with the economy continuing to show strength, China’s gold demand could rise further.

2021's CNY month gold withdrawals were lower than the long-term average*

Gold withdrawals from the SGE in CNY months between 2011 and 2021

Source: Shanghai Gold Exchange, World Gold Council

*CNY months refer to the months when the CNY holiday occurred. The 10-year average volume is calculated based on data between 2011 and 2020. For detailed information of past CNY holiday dates, please click here.

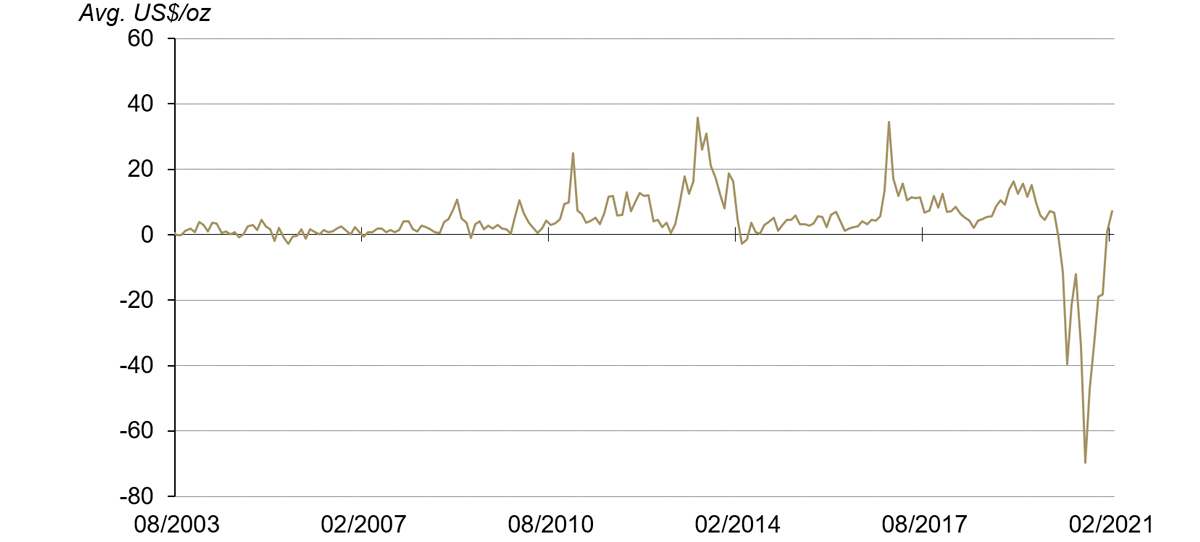

The Shanghai-London gold price spread climbed rapidly in February amid improved gold consumption

The monthly average of US$7.3/oz in February was significantly higher than January and edged closer to the 2019 annual average – before the spread turned negative amid the COVID-19 pandemic in 2020. This was primarily the result of significantly improved gold consumption in the month around the CNY holiday week.9 Our recent analysis showed that local gold demand has historically played the key role in driving the spread.

The The Shanghai-London gold price spread rose sharply last month*

Source: Bloomberg, Shanghai Gold Exchange, World Gold Council

*SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used. Click here for more.

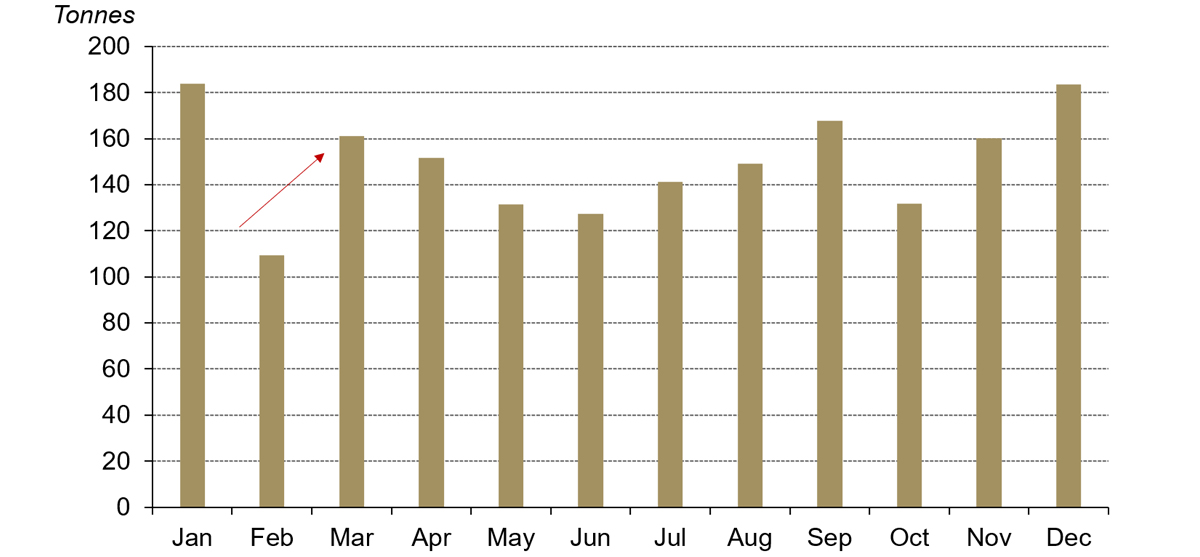

China’s wholesale gold demand is likely to rise in March

With retail gold consumption booming in February, gold retailers replenishing need rises. This, in turn, could lead to gold manufacturers withdrawing more gold from the SGE to fulfill retailers’ stock demand. In addition, historical data also suggests that gold withdrawals from the SGE tend to rise in March. Given the possibility of an increase in Chinese wholesale gold demand, the Shanghai-London gold price spread could remain elevated in the next month.

Chinese wholesale gold demand tends to rise after the CNY holiday*

Average monthly gold withdrawals from the SGE between 2011 and 2020

Source: Shanghai Gold Exchange, World Gold Council

*Chinese New Year often occurs in late January or early February

Footnotes

We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit Shanghai Gold Exchange

The 2021 Chinese New Year holiday began on 11 February and ended on 17 February.

For more information about premium calculation, please visit our local gold price premium/discount page.

For more information, please click here.

Chinese provincial-capital cities and other tier-1 cities’ retail sales accounted for 40% of the total in 2019 according to available data from the Bureau of Statistics.

CNY months refer to the months when the CNY holiday occurs. For instance, the 2021 CNY month was February as the holiday started on 11 February.

Calculation based on the CSI300 stock index’s close on 10 February 2021 and 26 February 2021. The 2021 CNY holiday began on 11 February and ended on 17 February.

The Spring Lantern Festival occurs on the 15th day after the CNY holiday. In 2021, the Spring Lantern Festival occurred on 26 February.

The 2021 CNY holiday began on 11 February and ended on 17 February.