January summary

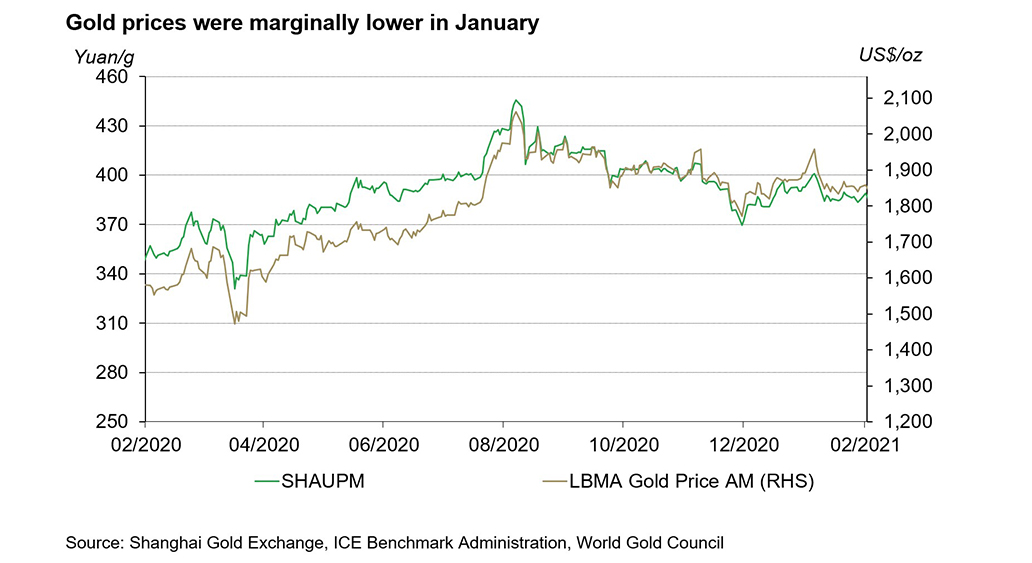

- Both the LBMA Gold Price AM in US dollars (USD) and the Shanghai Gold Benchmark Price PM (SHAUPM) in renminbi (RMB) witnessed slight declines during the first month of 20211

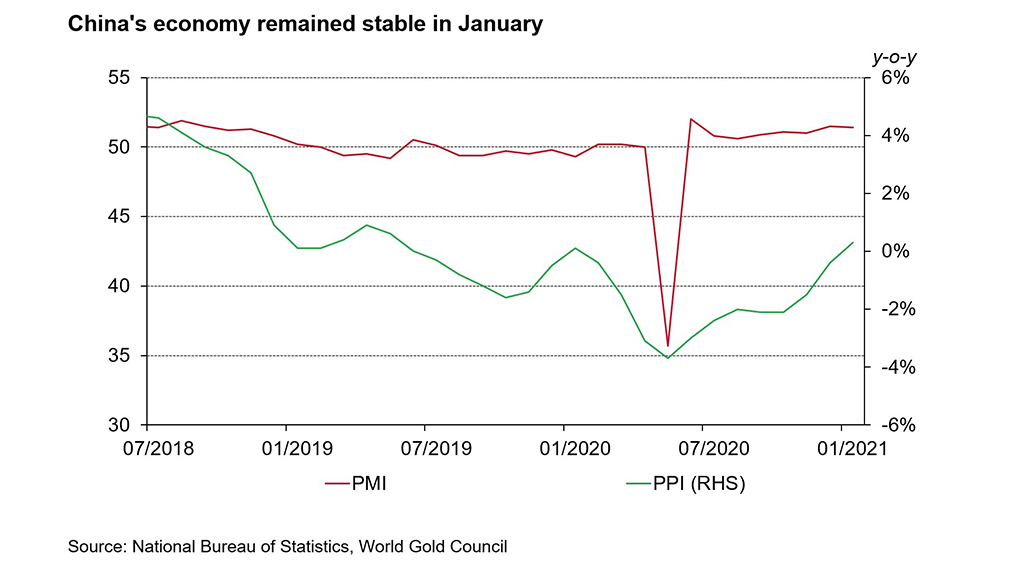

- China’s economy continued to show signs of stabilisation in January

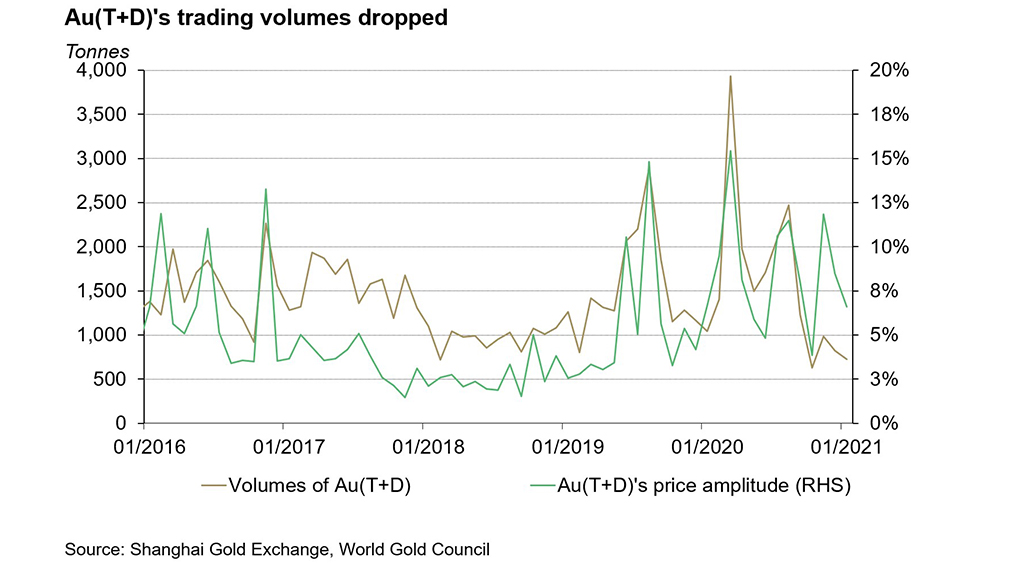

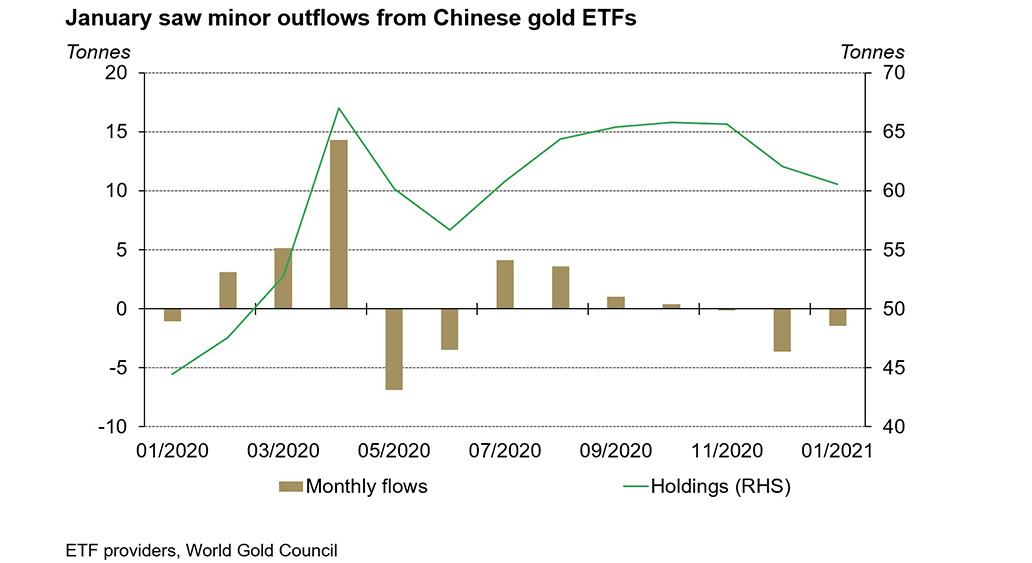

- Local investor interests in Au(T+D) and gold ETFs diminished:

- Au(T+D) trading volumes were 11% lower m-o-m and 30% lower y-o-y

- Total gold holdings under Chinese gold-backed ETFs decreased by 1.5t in the month

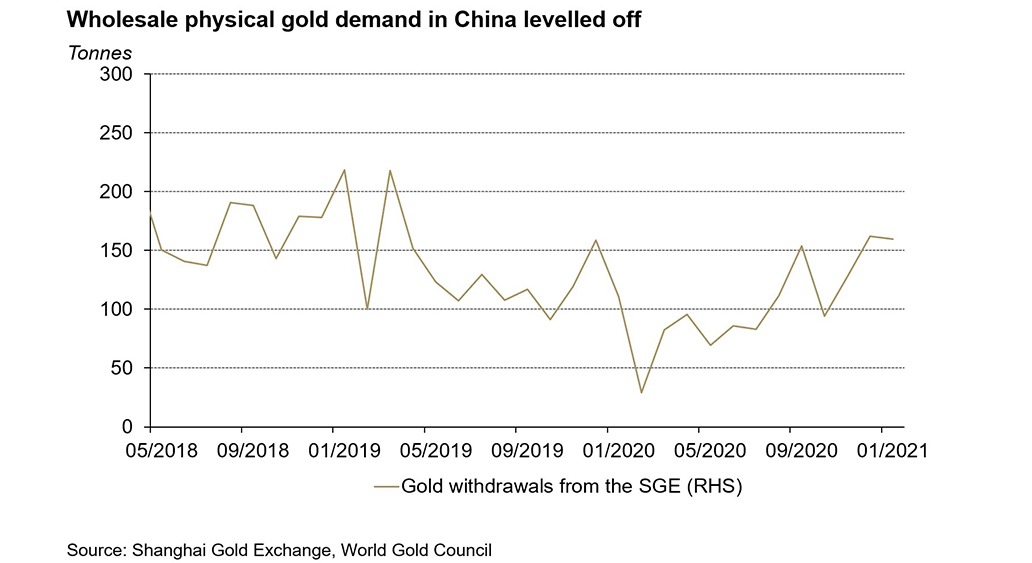

- Gold withdrawals from the Shanghai Gold Exchange (SGE) levelled off at 159t last month – compared to 162t in December – as gold sales remained buoyant ahead of the Chinese New Year (CNY) holiday.

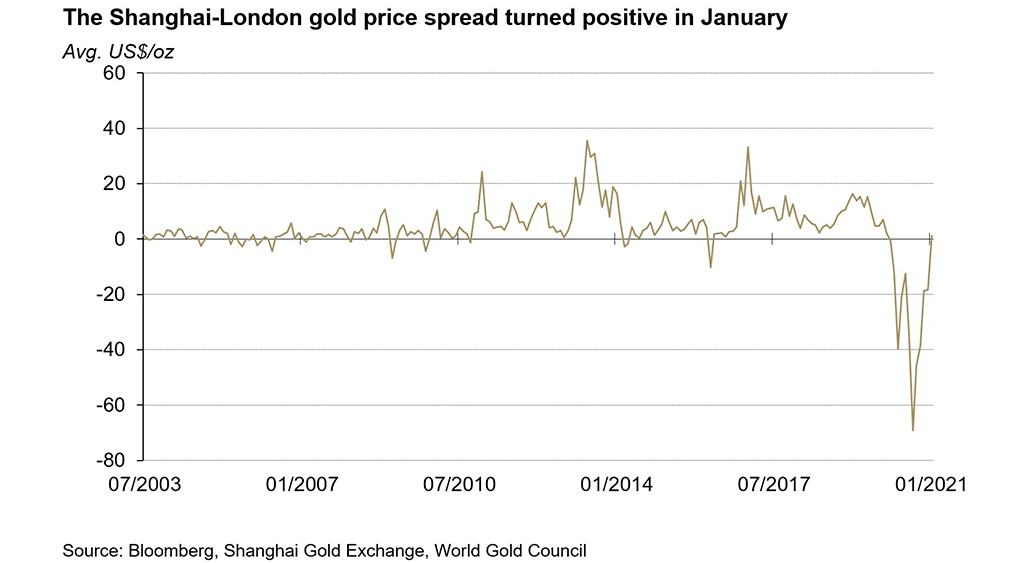

- The monthly average Shanghai-London gold price spread turned positive for the first time in 11 months, averaging US$1.1/oz2

- The People’s Bank of China gold reserves remained at 1,948t at the end of January, accounting for 3.5% of its total reserves. The Chinese central bank has kept its gold reserves unchanged since September 2019.

Gold prices fell slightly in January

In general, the appreciating US dollar, strong equity markets around the globe, and rising US Treasury yields weighed on gold prices during the month. While the LBMA Gold Price AM in USD declined by 1.8%, the SHAUPM in RMB saw a relatively narrower price decrease of 0.9% in January.

China’s economy maintained stability

As the demand side of China’s economy continued to revive, the y-o-y growth in the country’s Producers Price Index (PPI) reached the highest since May 2019. Moreover, the Manufacturers Purchasing Managers Index (PMI) in China remained at a multi-year high.3 January’s negative y-o-y change in China’s Consumers Price Index (CPI) is likely to be temporary, as it was due mainly to the high-base impact: there was a spike in the CPI in January 2020 driven by a retail sales boom ahead of the 2020 Chinese New Year holiday.4

Au(T+D)’s trading volumes totalled 729t in January, the second consecutive monthly decline

Investor sentiment towards gold continued to shift, primarily due to three key factors:

- the bullish momentum in the gold price stalled last month

- the strong equity market continued to headline local news: the CSI300 index witnessed its fifth consecutive monthly rise

- volatility in the local gold price fell further; a lower gold price volatility often means less short-term profit opportunities.

Chinese gold ETF total holdings stood at 60.6t at the end of January, following a 1.5t net outflow during the month

As previously mentioned, the strong equity market, a softer gold price and the continuing economic revival in China have persuaded local investors to increase their risk appetite and reduce their allocation to gold ETFs.

China’s wholesale physical gold demand in January held close to December’s level

Chinese gold retailers continued to actively prepare for the traditional gold sales boom ahead of the CNY holiday in mid-February5 and this elevated wholesale physical gold demand from gold manufacturers through December and January. In addition, it is not uncommon for gold retailers to stock up before CNY as some manufacturers suspend production beyond the end of the holiday.

As China’s physical gold demand kept improving, the Shanghai-London gold price spread returned to positive territory for the first time since February 2020, on a monthly average basis

Our recent analysis showed that significantly weakened gold demand and relatively ample gold supply in China were the main contributors to the Shanghai-London gold price discount in 2020. A revival in Chinese gold consumption amid a recovering economy has narrowed the spread since Q3 last year. The economic improvement in China will remain a key factor throughout 2021.

Note: SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used. Click here for more.

Footnotes

1 We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit Shanghai Gold Exchange.

2 For more information about premium calculation, please visit our local gold price premium/discount page.

3 For definitions of the PPI, PMI and CPI, please click here.

4 In 2020 and 2021, the Chinese New Year’s holiday started on 24th January and 11th February.

5 The 2021 Chinese New Year holiday began on 11 February and ended on 17 February.