October summary

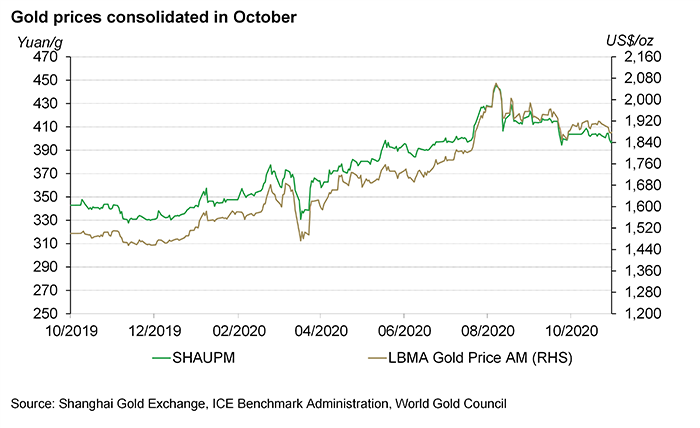

- The LBMA Gold Price AM in US dollars (USD) and the Shanghai Gold Benchmark Price PM (SHAUPM) in renminbi (RMB) dropped slightly1

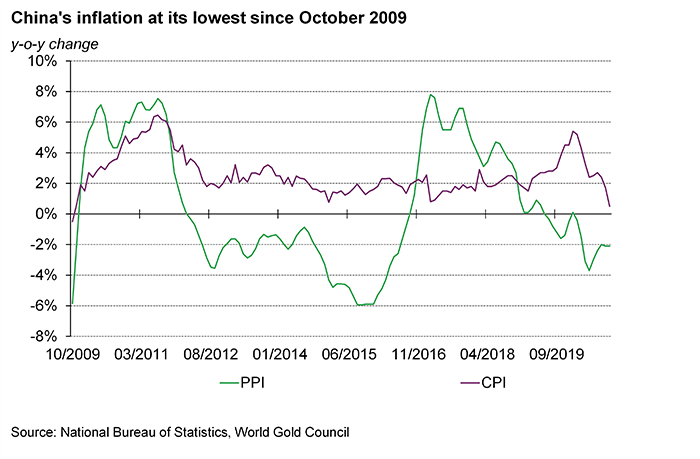

- While the supply side of China’s economy continued to improve, recovery in demand was at a slower pace, leading to a notable decline in inflation

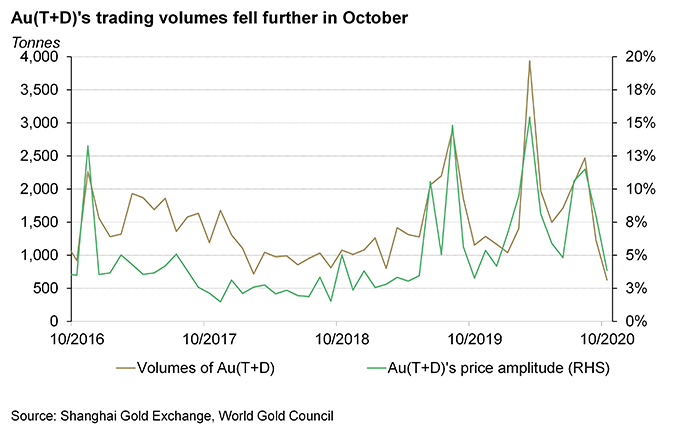

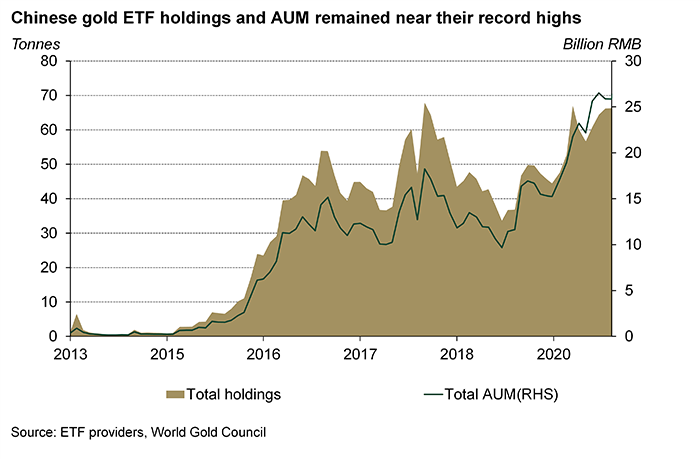

- With fewer trading days and reduced gold price volatility, Au(T+D)’s trading volumes fell further in October. Meanwhile, holdings in Chinese gold ETFs remained at record levels

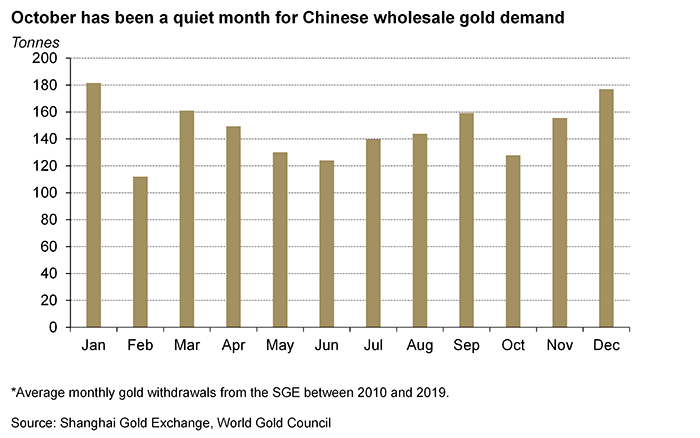

- Wholesale physical gold demand in China fell m-o-m due to seasonal reasons: gold withdrawals from the Shanghai Gold Exchange (SGE) were 94t, 60t lower m-o-m but 3t higher y-o-y

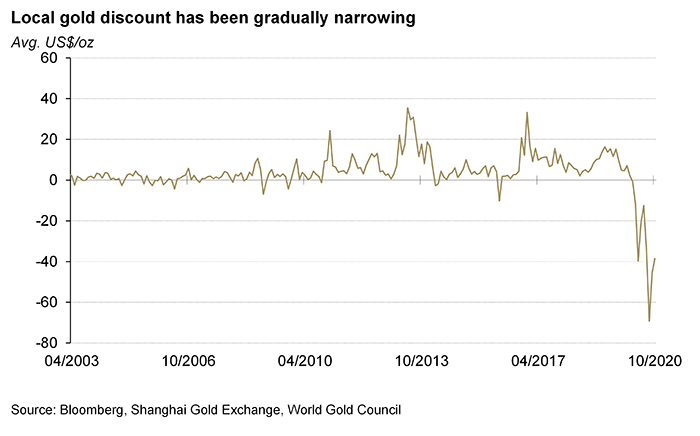

- The Chinese local gold price discount continued to narrow as local gold demand maintained its recovery2

- The People’s Bank of China’s gold reserves remained at 1,948t, accounting for 3.6% of its total reserves.

Gold prices saw marginal declines in October. Even though the US presidential election and a significant rebound in COVID-19 infection cases in many regions kept uncertainty elevated globally, climbing real interest rates in key markets such as the US and China weighed on local gold prices. As a result, the SHAUPM (RMB) and LBMA Gold Price AM (USD) fell by 1.8% and 0.4% respectively in the month.

The continuous appreciation in RMB and a rising real rate in China driven by the nation’s strong economic revival after Q1 could be the main factors contributing to weaker performance in the RMB gold price relative to the USD gold price.

Signals on China’s economic growth last month were mixed. While the manufacturing Purchasing Managers’ Index and the growth in industrial output continued to rise, local inflation – the y-o-y change in Consumer Price Index (CPI) – dropped to 0.5% in October from 1.7% in the previous month – the lowest in 12 years. In the meantime, the Producer Price Index (PPI) remained at its multi-year low.

While we remain optimistic around the longer-term outlook of the demand side of the Chinese economy, the possibility of a deflationary scenario in the near term could be rising. And historical data shows that not only has RMB gold performed well during periods with high inflation, it has also delivered considerable returns in deflationary scenarios as local investors view gold as a store of value during uncertain times.3

Au(T+D)’s trading volumes in October totalled 626t, 50% lower m-o-m and 46% lower y-o-y. We believe that fewer trading days in October due to holidays occurring early in the month and reduced volatility in the gold price, which limited short-term traders’ profiting opportunities, could be the main contributors to the significant drop in the contract’s trading volumes.4

Total gold holdings in Chinese gold-backed ETFs saw a marginal inflow of 0.1t last month, reaching 66.3t as of October. Meanwhile, the total asset under management of the 11 Chinese funds totalled RMB25.9bn, or US$3.9bn, hovering around the highest level on record.5 With the local equity market stabilising and RMB strengthening, the pace of growth in Chinese investors’ strategic allocation to gold ETFs slowed in October.

While there was a marginal y-o-y uptick in China’s wholesale physical gold demand in October, it was seasonally lower than the previous month. Historically, wholesale physical gold demand tends to be relatively lower in October than in September. First, after stocking up in September for the long-anticipated “Golden Week” holiday jewellery sales boom – which helped lift October’s jewellery sales by 17% y-o-y according to the National Bureau of Statistics – as my last blog mentioned, jewellery manufacturers’ gold supplies became relatively ample.6

Second, without major gold-related purchasing occasions and festivals, November’s gold retail sales tend to be weaker m-o-m, leading to lower wholesale gold demand in October than in September.7

The Chinese local gold price discount continued to narrow in October. The discount in SHAUPM relative to the LBMA Gold Price AM averaged US$39/oz last month, remaining around record levels. Primarily, a significantly weakened gold demand in China – gold consumption was 37% lower y-o-y in the first three quarters in 2020 – could be the fundamental driver of the record-level local gold price discounts. Meanwhile, reduced uncertainties amid the swift revival in the nation’s economic growth after the containment of COVID-19 in Q1 – the CNY has appreciated by 6% between March and October – also contributed.

With local gold demand recovering, the discount has been narrowing gradually. For instance, having narrowed by US$23/oz in September, October’s Chinese local gold price discount contracted further by US$7/oz. As noted in our recent Gold Demand Trends, while China’s gold consumption demand in the first three quarters was 37% lower y-o-y, there have been notable q-o-q rebounds in recent quarters. And as previously mentioned, gold, silver, jade and gem jewellery sales in October continued to improve, contributing to the m-o-m local gold price discount contraction.

Note: SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used.

Click here for more.

We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit

https://en.sge.com.cn/data_BenchmarkPrice.

For more information about premium calculation, please visit www.gold.org/goldhub/data/local-gold-price-premiumdiscount.

Au9999’s average annualised monthly return reached around 10% during periods with negative inflation between October 2002 and October 2020.

Due to the National Day Holiday and Mid-Autumn Festival in early October, there were only 16 trading days last month.

Please note that Bosera’s I & D shares only provide updates at the end of each quarter. As a result of these funds’ most recent quarterly reports, we made some adjustments to accurately reflect their sizes.

2020’s Golden Week holiday includes the National Day Holiday and Mid-Autumn Day holiday; it lasted from 1 October to 8 October. Jewellery sales include gold, silver, jade and gem jewellery products.

While the 11 November (double 11) online shopping carnival initiated by major online shopping platforms in China provides notable boosts for online retail sales of many consumer goods, its contribution to the overall sales of gold products could be very limited as the majority of Chinese consumers tend to buy gold products offline, according to our most recent retail insights for the Chinese jewellery market.