Gold demand in China, in particular, investment demand, has benefited from rising concerns for the economy as well as the lowered opportunity cost amid the COVID-19 outbreak and the central bank’s response to it. But with signs of a potential economic recovery emerging, can we expect gold’s attractiveness as a safe haven in China to fade? We believe that the answer is ‘No’.

Gold has been centre-stage in China so far this year

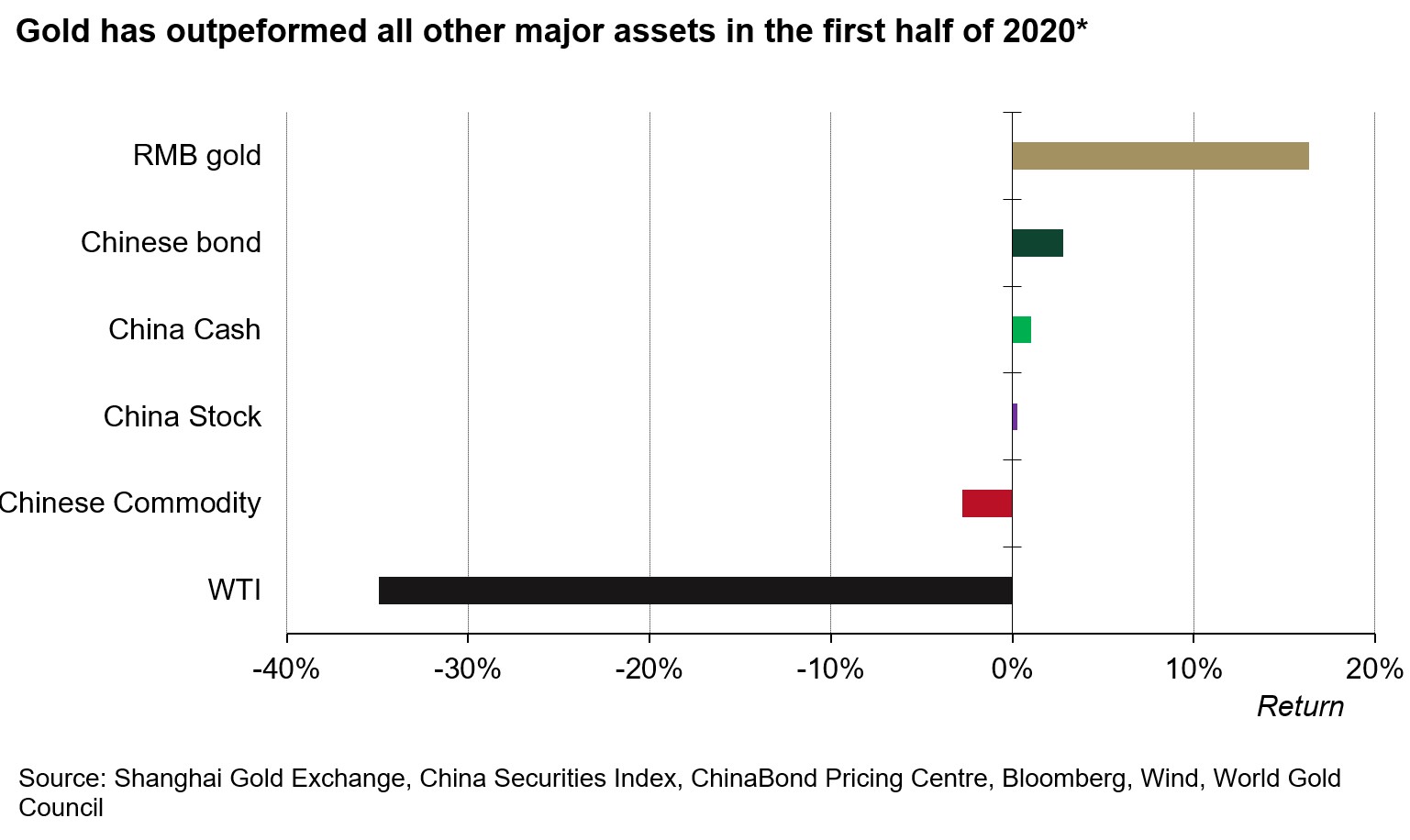

The COVID-19 outbreak has had an unprecedented negative impact on the Chinese economy. City lockdowns and strict travel restrictions to contain the pandemic have led to suspensions in most Chinese industries for the majority of Q1. As a result, China’s GDP in Q1 contracted by 6.8%, the largest drop on record. This unforeseen economic contraction worsened many investors’ already gloomy outlook for China’s growth, lifting their demand for safe-haven assets such as gold. Consequently, gold has outperformed all major Chinese asset classes in the first half of 2020.

*As of June 30th, Shanghai Gold Exchange’s Au9999, ChinaBond New Composite Index – Total Return, CSI Money Market Fund Index, CSI 300 Stock Index and Wind Chinese Commodity Index were used for calculation.

Chinese investors’ appetite for gold has improved significantly in the first half of 2020. To cushion the pandemic’s economic shock, the People’s Bank of China and the Treasury Department have introduced various accommodative policies, resulting in a lower benchmark policy rate and a higher M2 money supply. The reduction in the opportunity cost for holding gold combined with concerns of currency devaluation has pushed up Chinese investors’ allocation to gold; for example, Chinese gold ETFs’ total holdings have increased by 11.6t (RMB4.6 billion; US$647million) in H1 2020.

Meanwhile, gold’s outperformance compared to other major assets also lured many shorter-term tactical investors. The average daily trading volumes of Au(T+D), a proxy for Chinese gold investors’ tactical demand, in the first half of 2020 reached US$5bn, 45% higher than 2019’s average.

China’s economy is rebounding

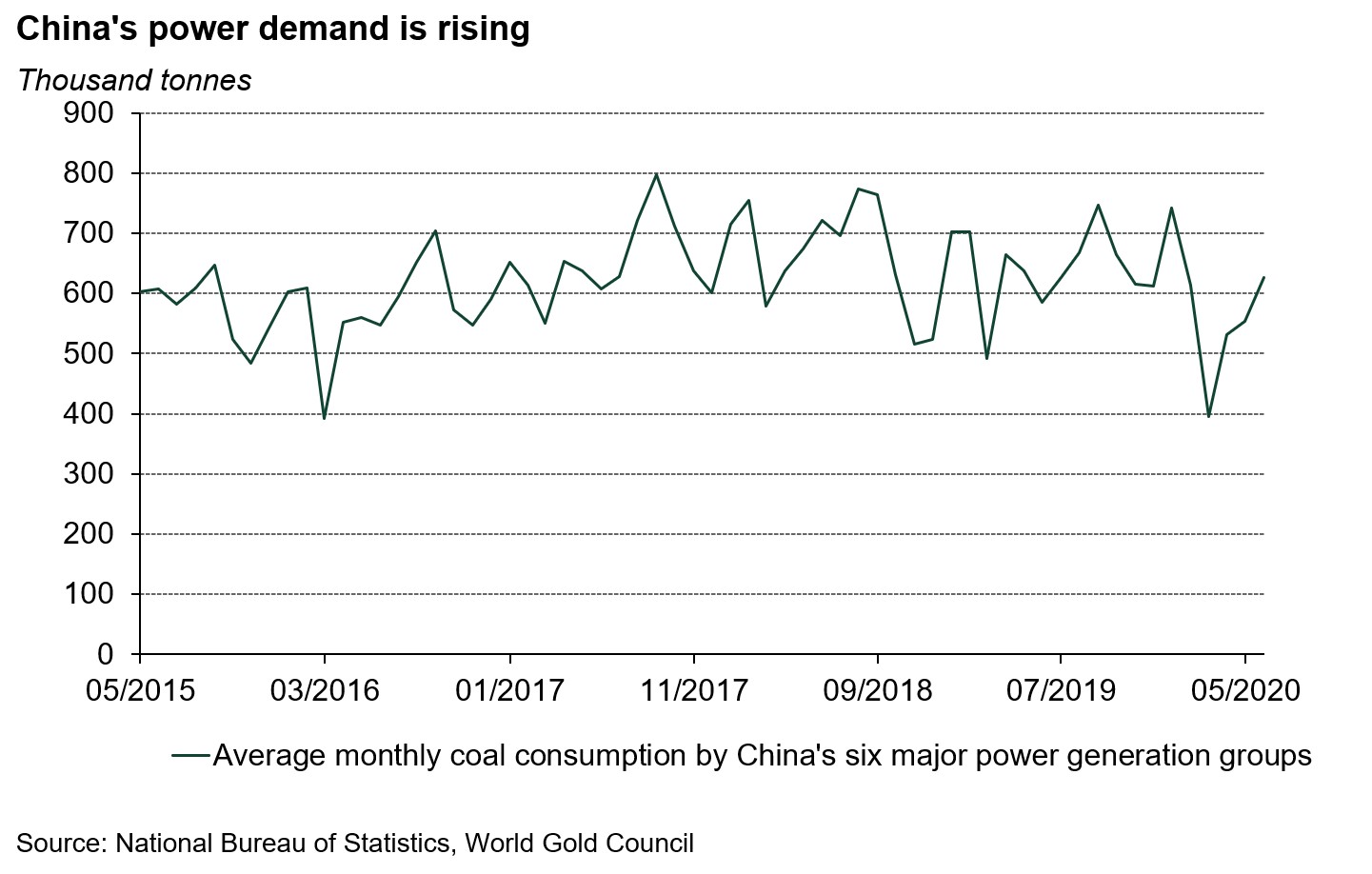

China’s economy has witnessed a gradual recovery in the past few months. As of May, over 90% of all Chinese companies have returned to work, according to the Ministry of Science and Technology. Owing to higher work resumption, China’s key economic indicators such as Purchasing Managers’ Indexes (PMIs) and industrial output picked up steam after reaching historical lows in February when strict lockdown measures to contain the pandemic were in place.

Accommodative fiscal and monetary policies underpinned such recovery. In addition to injecting liquidity to financial and banking systems directly through various lending facilities, the People’s Bank of China (PBoC) has also made a 30-basis point cut in the one-year loan prime rate since the COVID-19 outbreak late January. Furthermore, widening 2020’s fiscal budget deficit and issuing special COVID-19 bonds, worth trillions of RMB, were listed in the government’s fiscal policy direction to shore up the economic growth this year.1

Why gold demand may remain supported as the economy rebounds

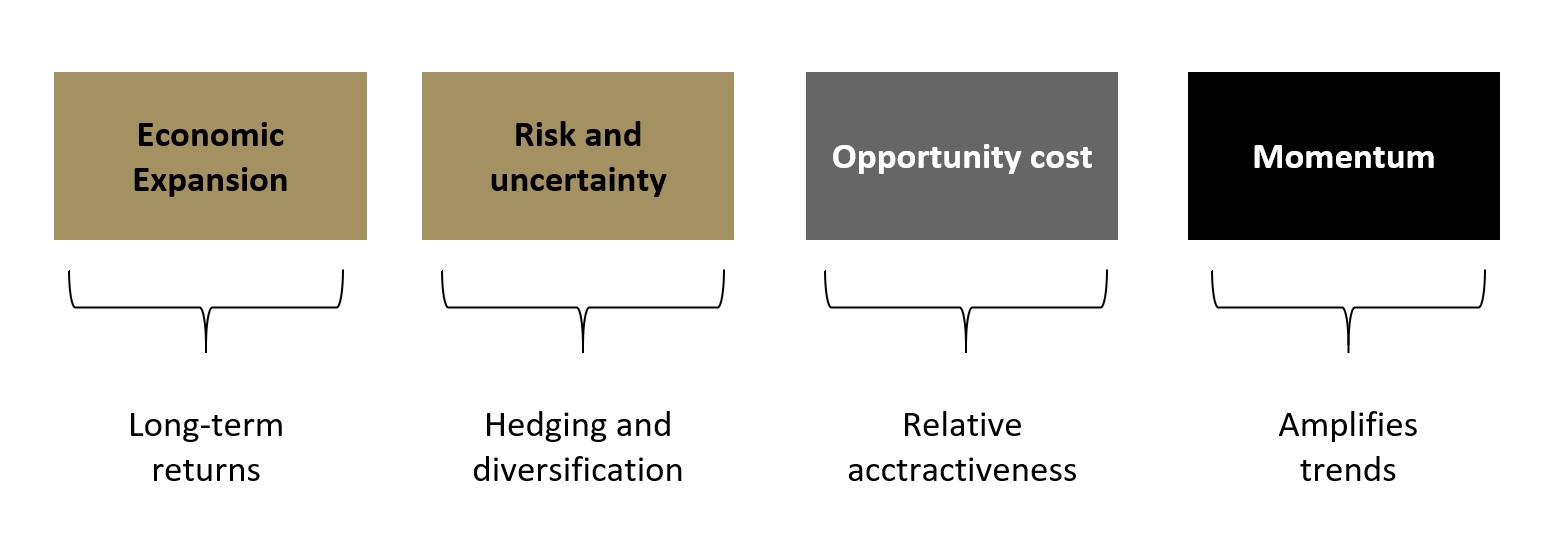

To examine the potential impact of an economic recovery, we first need to revisit the four drivers of gold demand. Namely:

Among the four main drivers for gold demand, rising risk and uncertainty and diminishing opportunity cost for holding gold have been supporting Chinese investors’ demand for gold, whereas the positive gold price momentum amplified such demand.

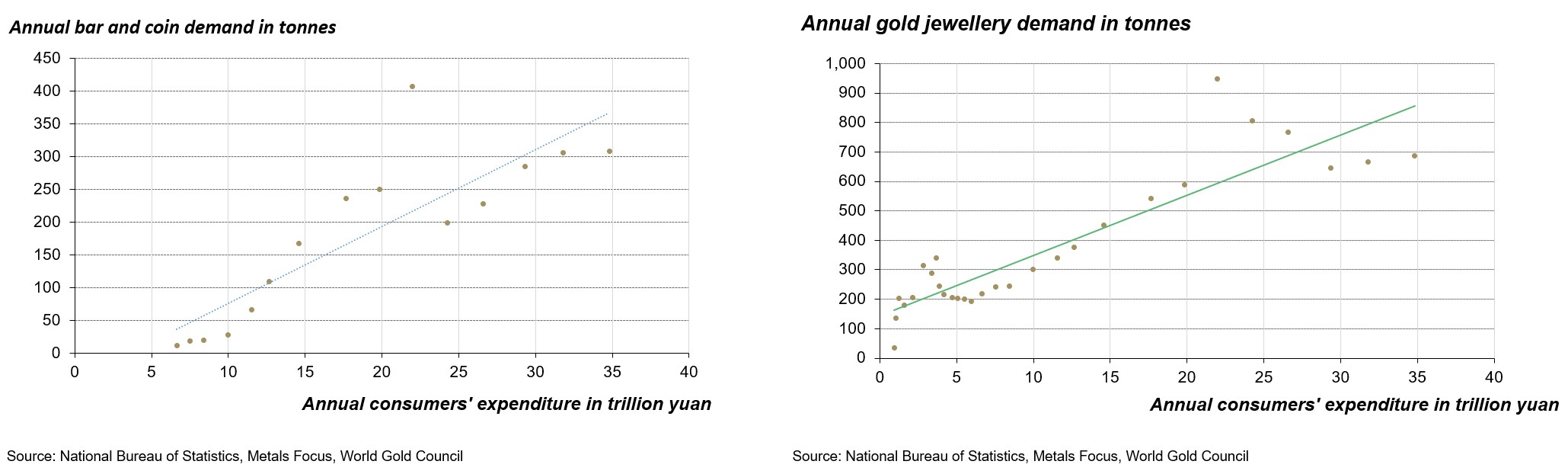

While an economic recovery may improve investor sentiment and potentially reduce gold’s appeal, such recovery could also potentially lead to a rise in consumers’ wealth. Our analysis suggest that the rising consumer expenditure is positively correlated to gold jewellery and bar and coin sales in China. This, in turn, could provide some support for gold’s performance and offset some of the headwinds from lower investment demand.

China’s gold jewellery and bar and coin demand are positively correlated to consumer expenditure

However, we don’t expect that gold’s appeal as a hedge in the current environment will fade:

- China’s economy recovery is fragile as many key demand indicators such as retail consumption remain weak.

- it is too early to rule out further possible recurrence of COVID-19 and the damages it could bring on the vulnerable economy.

- accommodative monetary and fiscal policies are likely to remain in place in consideration of the above-mentioned factors. And as stated in the Government Work Report late May, China is aiming at accelerating the growth in M2 money supply and aggregate financing all year. As such, a lowered opportunity cost and concerns for the currency devaluation might remain in the driving seat for gold’s investment demand in China for longer than expected.

Conclusion

It is important to recognise the diversity in gold demand. In tested times, gold’s role as a strategic asset allocation becomes more relevant for investors searching for safe-haven assets. In fact, the strong investment demand was the main contributor to the overall 1% y-o-y rise in the global gold demand in Q1 despite the negative effect that the COVID-19 outbreak’s had on other gold demand sectors such as jewellery and technology.

However, a revival of China’s economy should support an improvement to gold jewellery sales, gold used in the technology sector and long-term saving demand. While gold could remain a relevant asset in the current environment, such strength in consumer demand could partially offset the deceleration that improved financial market sentiment may have on gold’s alure as a hedge.

Gold’s diverse sources of demand contribute primarily to its effectiveness as a diversifier and help its performance over the long run. According to our recent report on the relevance of gold as a strategic asset, gold in RMB has delivered returns comparable to Chinese stocks and higher than Chinese bonds and commodities in the long term.

Footnotes

1 Please visit www.chinadaily.com.cn/a/202005/22/WS5ec7c1e3a310a8b241157b38.html for more.

2 RMB gold has outperformed Chinese bond and commodities during the past 15 years (2004/12~2019/12), past 10 years (2009/12~2019/12) and past 5 years (2014/12~2019/12), for more information, please visit www.gold.org/goldhub/research/relevance-of-gold-as-a-strategic-asset-2020-china-edition