Summary

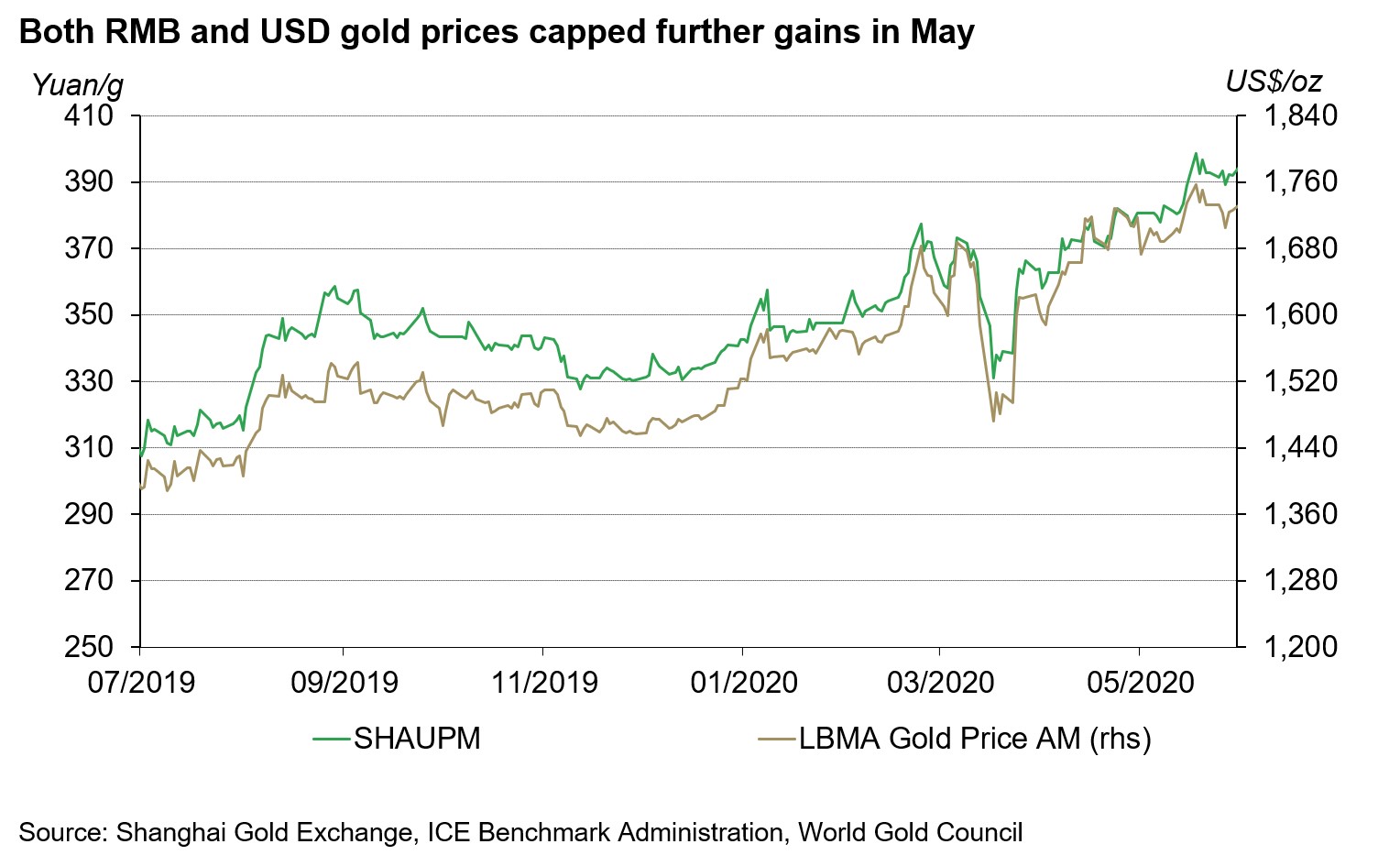

- Gold prices capped further gains in May as rising economic and geopolitical uncertainties lifted investors’ safe-haven demand. The Shanghai Gold Benchmark PM (SHAUPM) in renminbi (RMB) and the LBMA Gold Price AM in US dollars both reached multi-year highs1

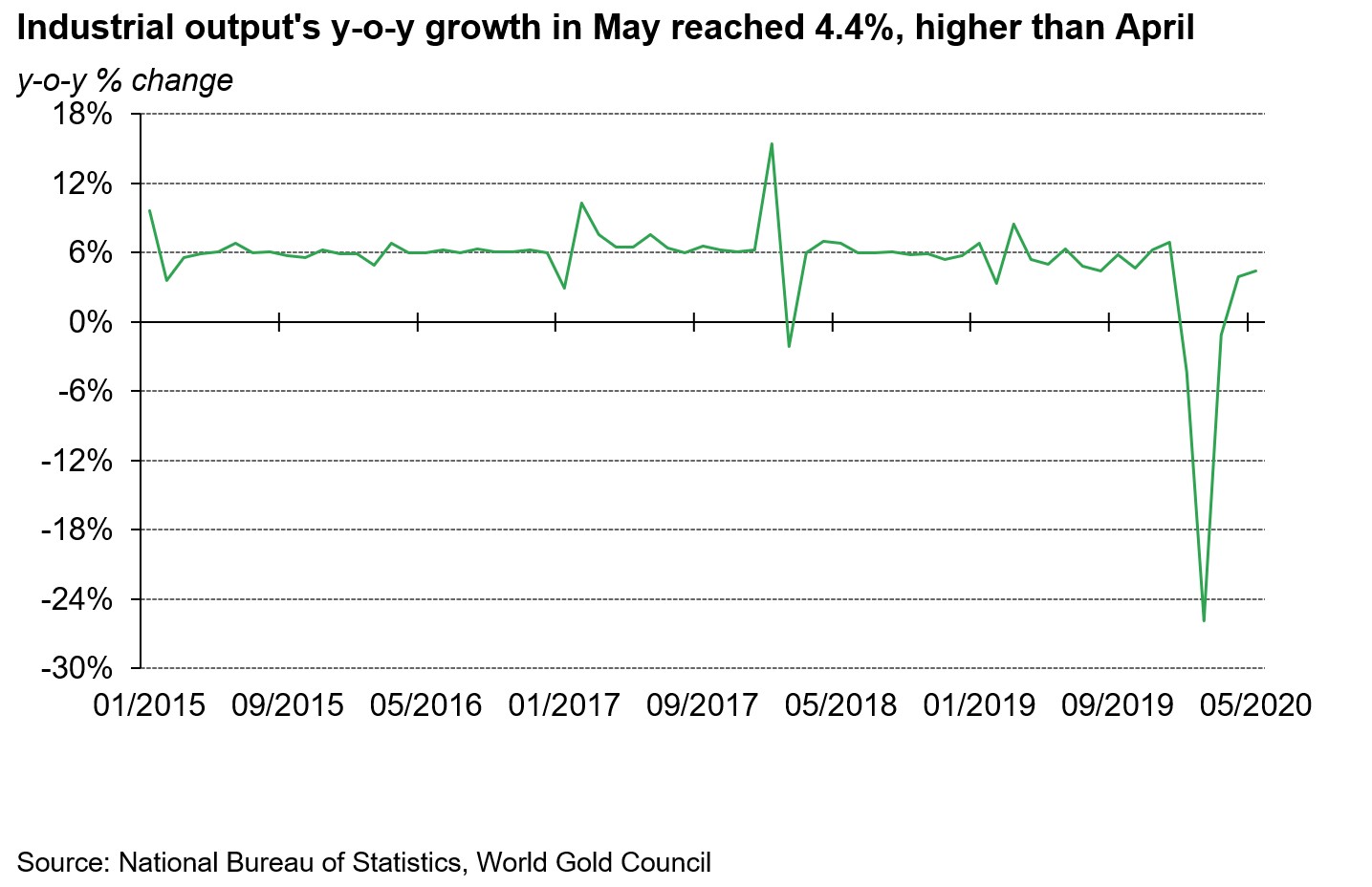

- Benefitting from various accommodative fiscal and monetary policies, China’s economy in May remained stable

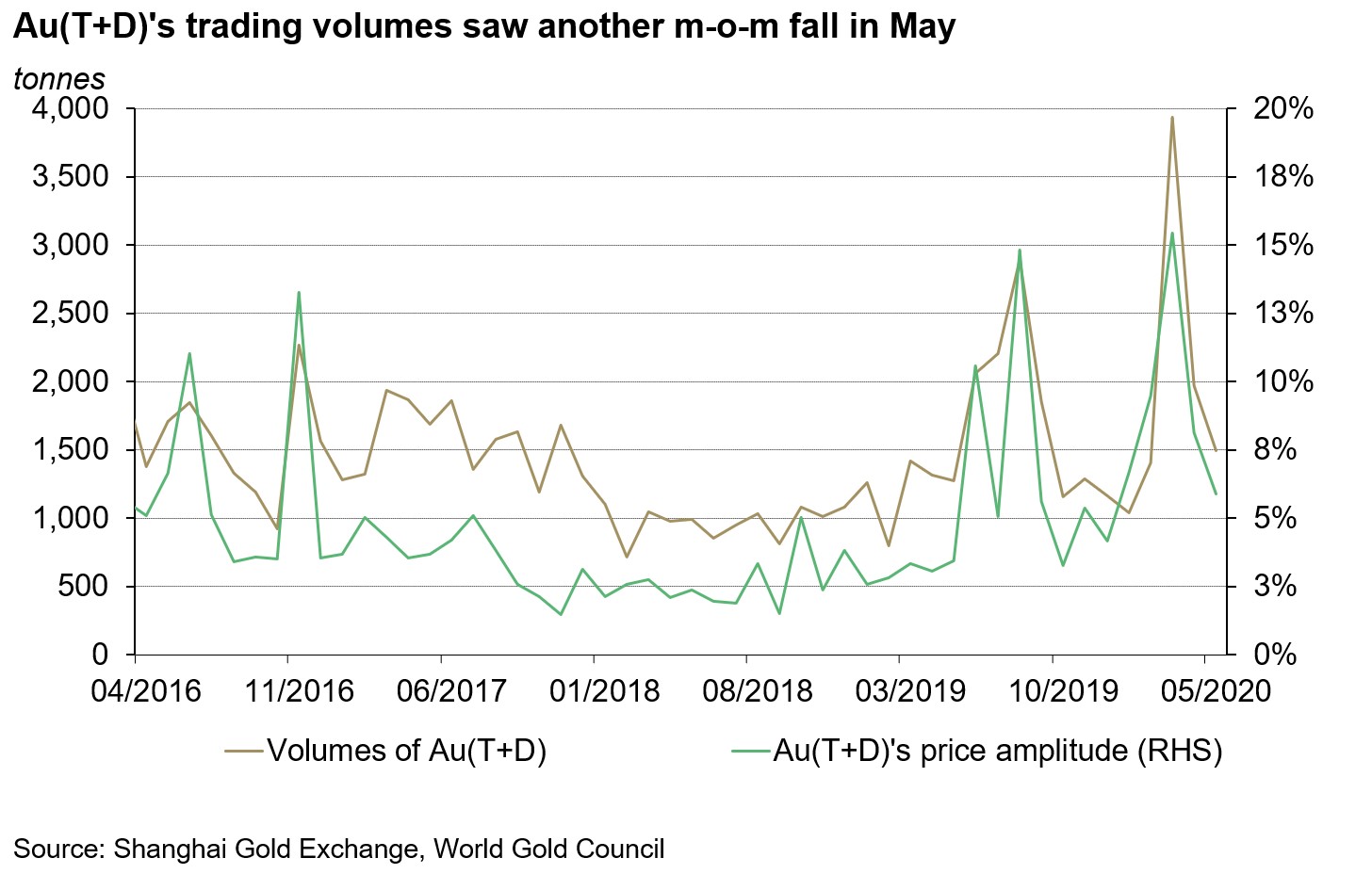

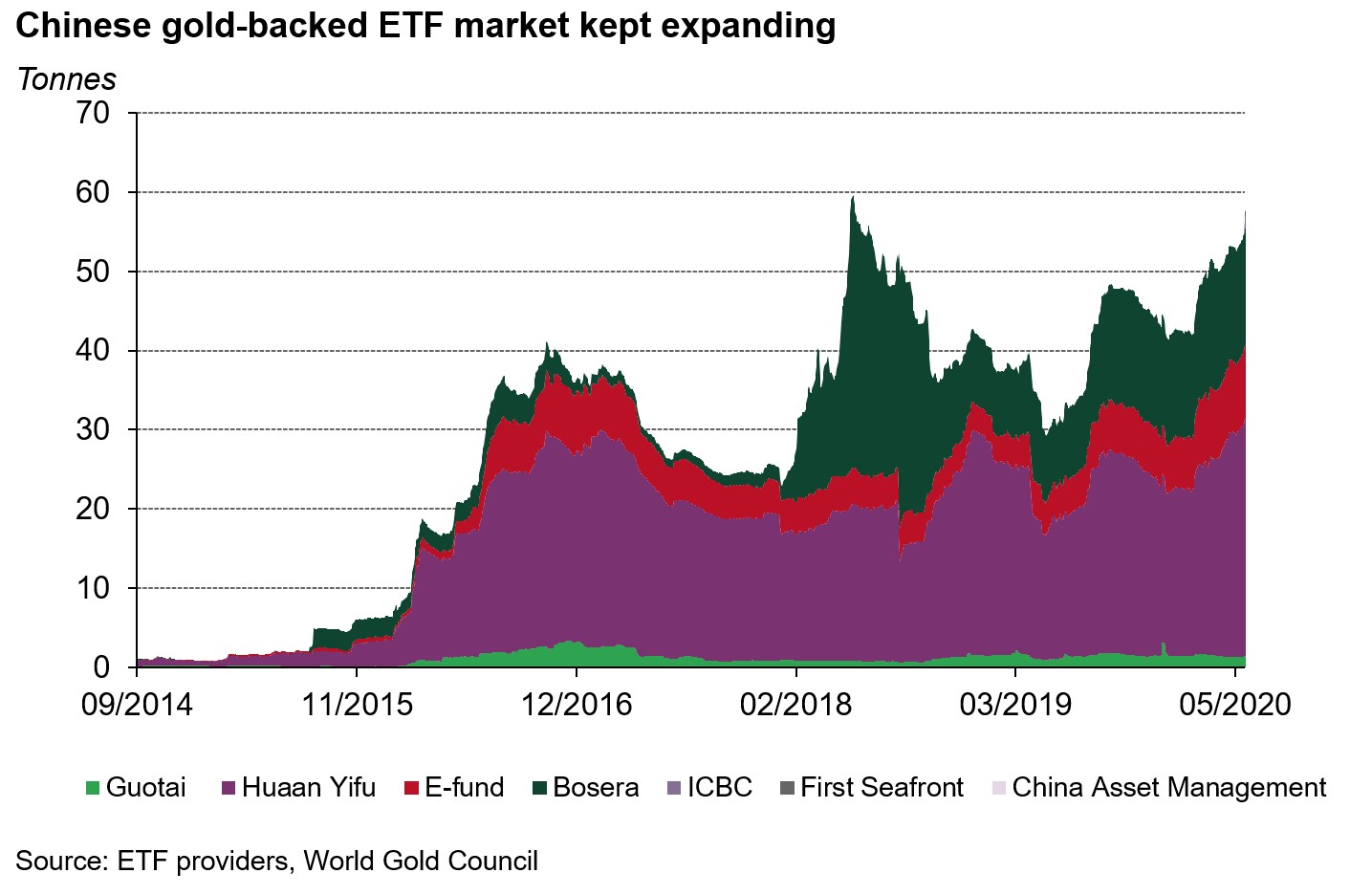

- The bullish gold price momentum and rising safe-haven demand have boosted gold’s popularity among tactical and strategic investors: Au(T+D)’s daily trading volumes y-t-d rose by 61% y-o-y, and Chinese gold-backed ETF holdings have increased by 36% so far this year

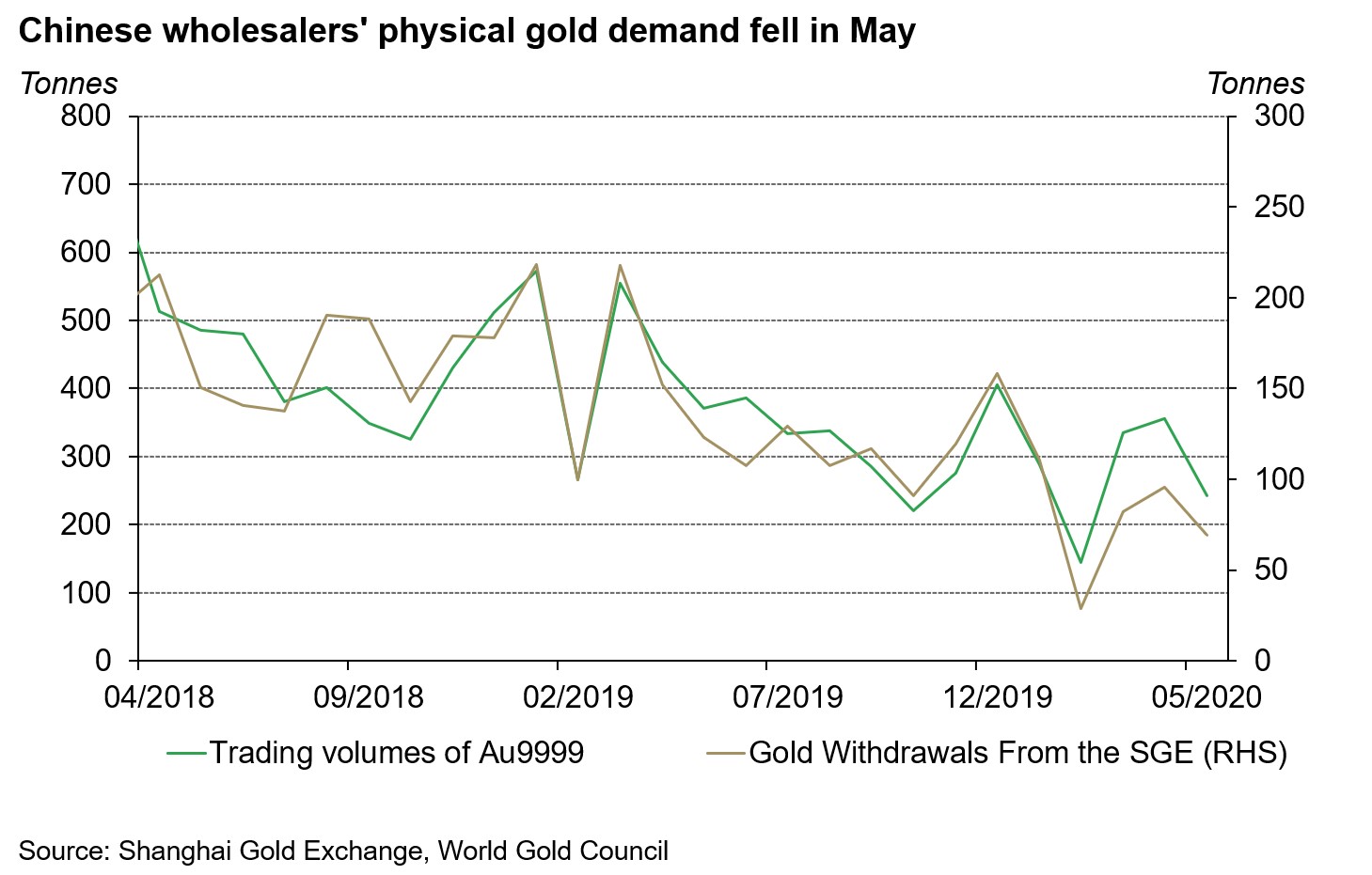

- In May, Au9999’s trading volumes and gold withdrawals from the Shanghai Gold Exchange (SGE) fell; gold retailers’ inventory replenishment ahead of the early May shopping festivals and their expectation of lower sales in June, the traditional off season for jewellery demand, led to the decline in China’s wholesale gold demand last month2

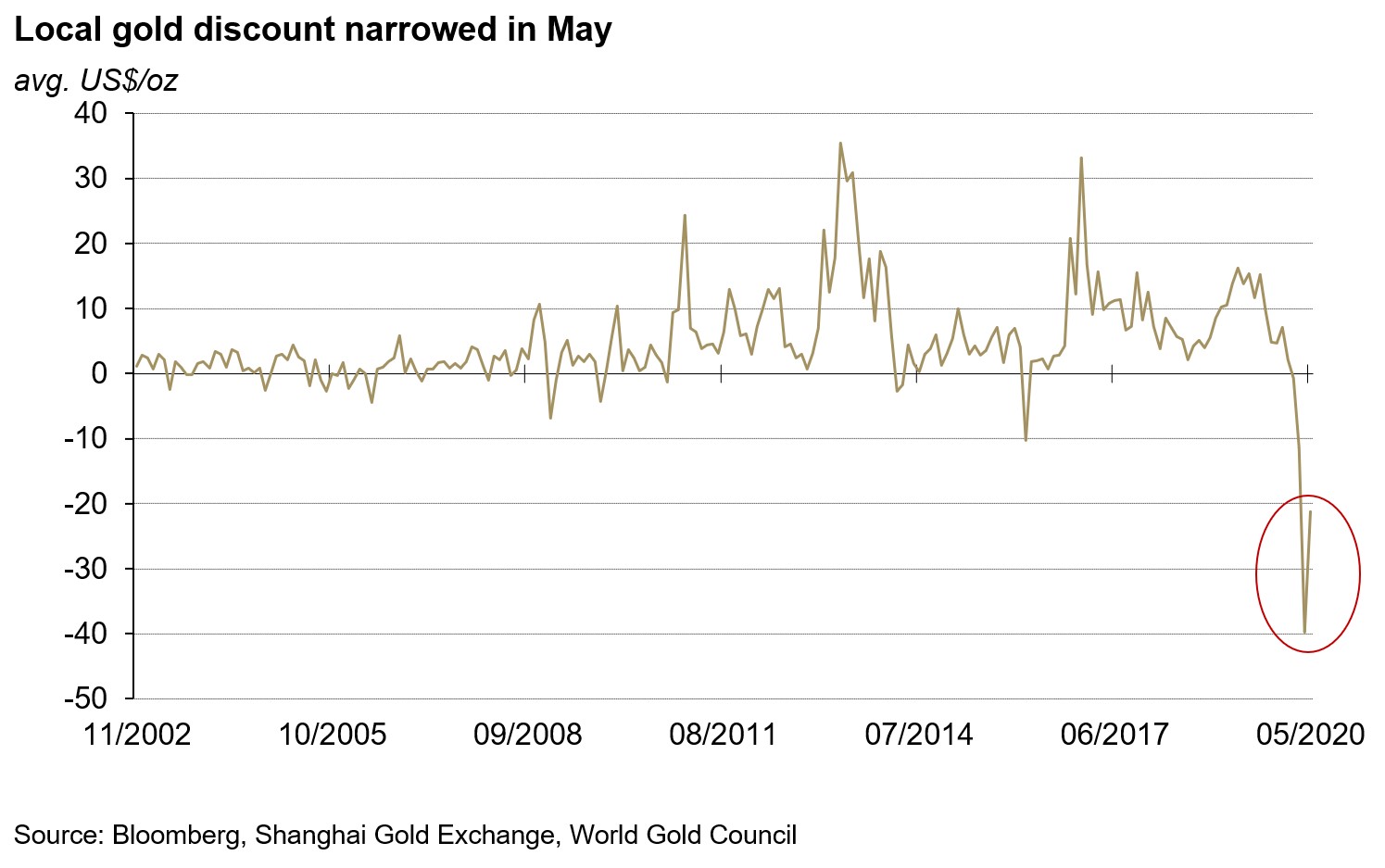

- With gold consumption in China rising notably and supply disruption easing in the Western market in May, Chinese local gold price discount narrowed3

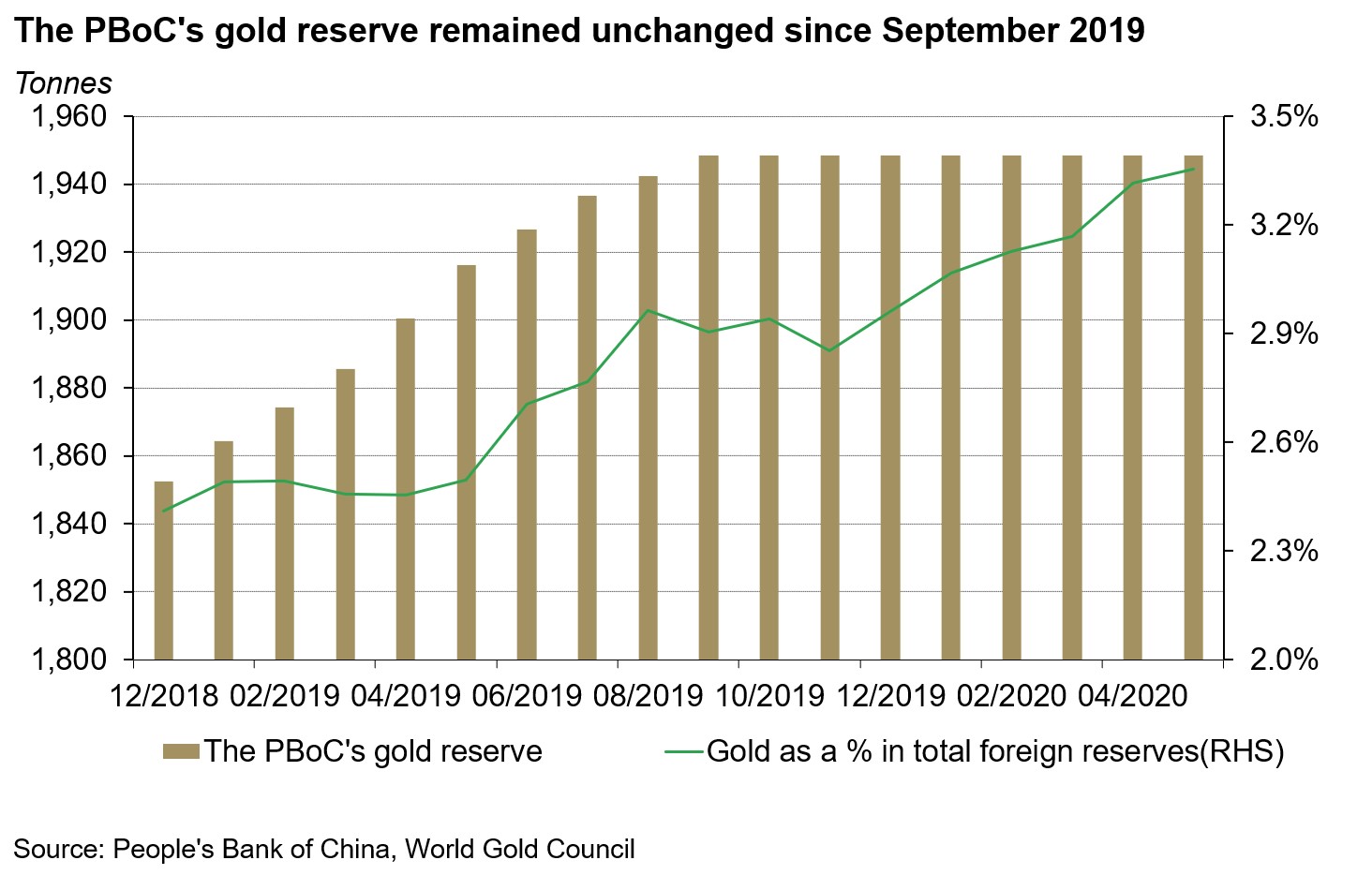

- The Peoples Bank of China (PBoC) kept its gold reserves unchanged at 1,948t in May, accounting for 3.4% of total reserves

Gold prices continued to rise in May amid economic and geopolitical uncertainties. During the month, gold prices continued to respond to persistent economic and geopolitical uncertainties. For instance, the deterioration of US-China relations in May is threatening the phase one trade deal between the two countries.4 Meanwhile, major economies are still facing economic challenges brought about by the COVID-19 pandemic. Driven by higher safe-haven demand, SHAUPM in RMB and the LBMA Gold Price AM in USD were up by 3.03% and 3.43% respectively in the month.

Supported by various policies, China’s economy was stable in May. With almost all companies in China having resumed operations in May, the government is making increasing efforts to cushion the economic shock caused by the COVID-19 outbreak. Fiscal policies such as widening the deficit and special bond issuances, with a total value of US$280bn, were implemented.5 Meanwhile, the PBoC announced 30 supportive measures to guide and encourage the flow of credit to small and medium companies.6

As a result, China’s official manufacturing and non-manufacturing Purchasing Managers’ Indexes (PMI) remained in the expansion area in May. Meanwhile, the y-o-y growth in industrial output accelerated in May.

Au(T+D)’s trading volumes totalled 1,496t in May, 24% lower than April. While fewer trading days in May contributed to the decline,7 the key factor was the drop in volatility during the month. Even so, Au(T+D)’s trading volumes in May were still 17% higher on a y-o-y basis as gold has been receiving increasing attention this year due to its outperformance of other major assets.

Chinese gold-backed ETF holdings stood at 57.7t as of May, increasing by 4.5t in the month.8 First, the bullish gold price momentum, as well as the escalating economic and geopolitical uncertainties, continued to lure strategic investors to gold ETFs. Second, ICBC Gold ETF and First Seafront Gold ETF were listed on Shanghai Stock Exchange (SSE) and Shenzhen Stock Exchange in May, adding another 2.2t to China’s gold ETFs’ total holdings. On June 5th, China AMC Gold ETF was also listed at the SSE, expanding Chinese gold ETF investors’ choices to seven funds.

Gold’s wholesale demand in China fell in May. Au9999’s trading volumes and gold withdrawals from the SGE were 243t and 69t respectively last month, 28% and 32% lower than April. Retailers’ inventory replenishment, ahead of the anticipated early May sales boom, in April, and the fact that June is the traditional weak season for China’s gold consumption, led to a lower wholesale gold demand in May.

From discussion with local jewellery manufacturers we learnt that even though shopping festivals and promotions could last for serval months, the pandemic’s impact on consumers’ wallets lingers, lowering retailers’ sales expectation in June, the traditional off season, further. Meanwhile, most retailers are still digesting stocks they replenished before the COVID-19 outbreak. As such, the combination of lower sales expectation in June and still ample inventories have led to jewellery retailers’ cautious replenishing activities, clamping down on the wholesale gold demand in May.

Holiday shopping festivals held by major cities were key to Chinese consumer gold demand’s revival in May. As I mentioned in my previous blog, major Chinese cities launched various shopping festivals in early May to boost retail consumption that are expected to last for several months. Gold jewellery retailers actively participated. For instance, China Gold Jewellery’s Shanghai stores offered discounts of up to 20% on 24K gold products. And according to the Bureau of Statistics, the y-o-y decline in gold, silver, diamond and gem jewellery retail sales in May narrowed to -3.9% from -12% in April.9

Chinese local gold price discount narrowed in May after reaching the widest level ever in April. On average, the SHAUPM was US$21/oz cheaper than LBMA Gold Price AM last month, a US$19/oz m-o-m contraction in the discount. China’s gold consumption in May experienced a markedly m-o-m rise whilst the nation’s gold supply remained stable, leading to a narrower local gold price discount. Meanwhile, companies in the gold supply chain outside of China reopened as COVID-19 lockdown measures eased, relieving the supply pressure in the Western market to some extent and contributing to Chinese local gold price discount’s contraction.10

Note: SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used

There was no change in the PBoC’s gold reserves in May. The PBoC’s foreign reserves stood at US$3,102bn at the end of May, a 0.3% rise m-o-m, according to the State Administration of Foreign Exchange. Similar to the m-o-m rise in April, a weaker US dollar and stronger asset performance in major economies were key to the US$10.2bn increase. The PBoC’s gold reserve has remained unchanged at 1,948t since September 2019 and currently make up 3.4% of total reserves.

Footnotes

1 We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit en.sge.com.cn/data_BenchmarkPrice.

2 For more information about the May shopping festivals, please visit: www.chinadaily.com.cn/a/202005/07/WS5eb37109a310a8b241153e08.html

3 For more information about premium calculation, please visit www.gold.org/goldhub/data/local-gold-price-premiumdiscount.

4 For more information, please visit www.edition.cnn.com/2020/05/29/politics/trump-china-announcement/index.html

5 Please visit english.www.gov.cn/premier/news/202005/29/content_WS5ed0c79fc6d0b3f0e949905a.html for more.

6 Please visit https://global.chinadaily.com.cn/a/202006/09/WS5edecebaa310834817251a56.html for more.

7 There were only 18 trading days in May due to the Labour Day Holiday. In April, there were 21 days.

8 Including the newly listed ICBC and First Seafront gold ETFs, Excluding Bosera’s I & D shares as they only provide updates at the end of each quarter.

9 For more information, please visit: www.stats.gov.cn/english/PressRelease/202006/t20200616_1760480.html

10 Please visit https://www.reuters.com/article/us-gold-refining-switzerland-idUSKBN22G0UP for more.