Summary

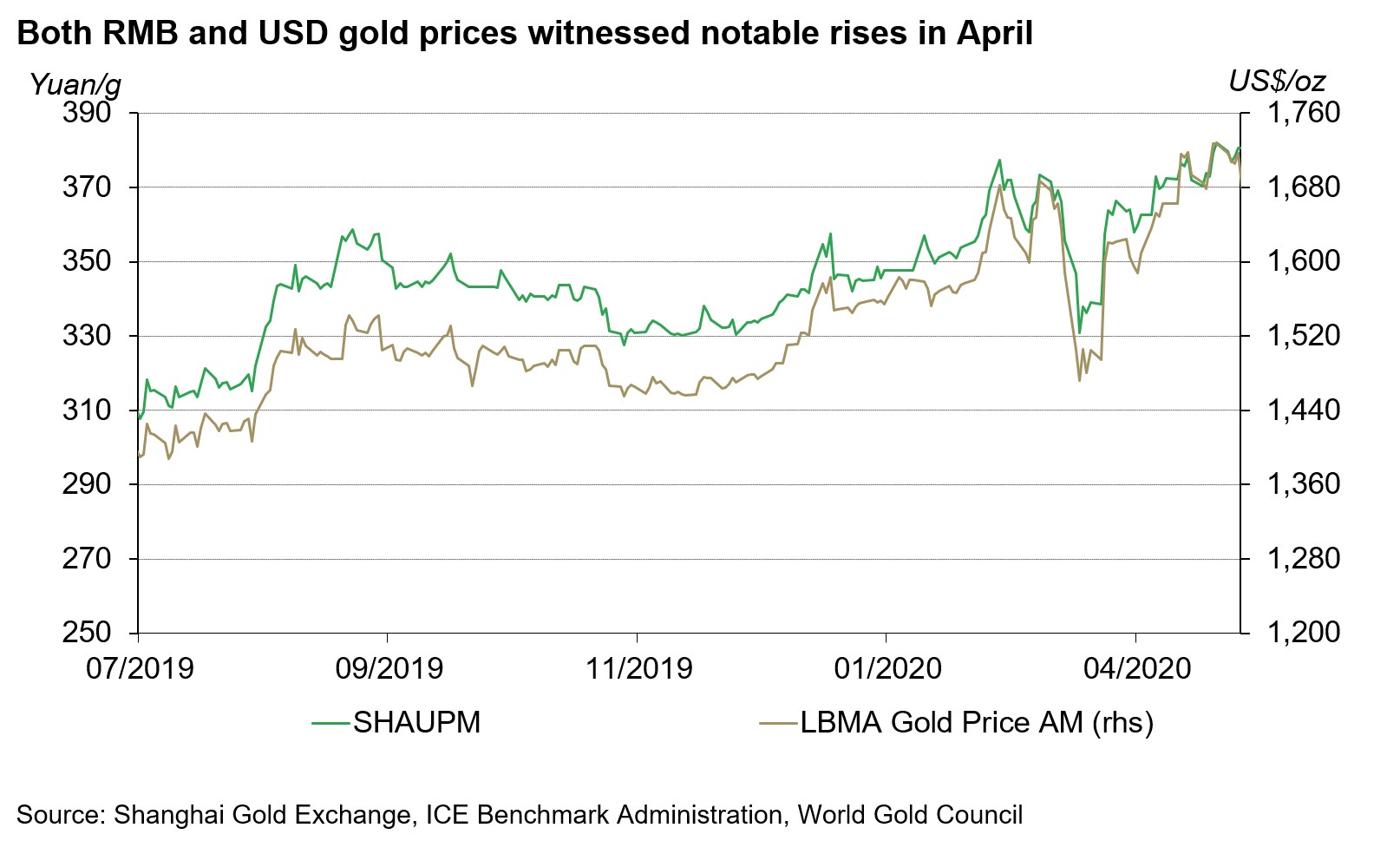

- Gold prices were strong in April: the Shanghai Gold Benchmark PM (SHAUPM) in renminbi (RMB) and the LBMA Gold Price AM in US dollars rose by 5.1% and 7.7% respectively1

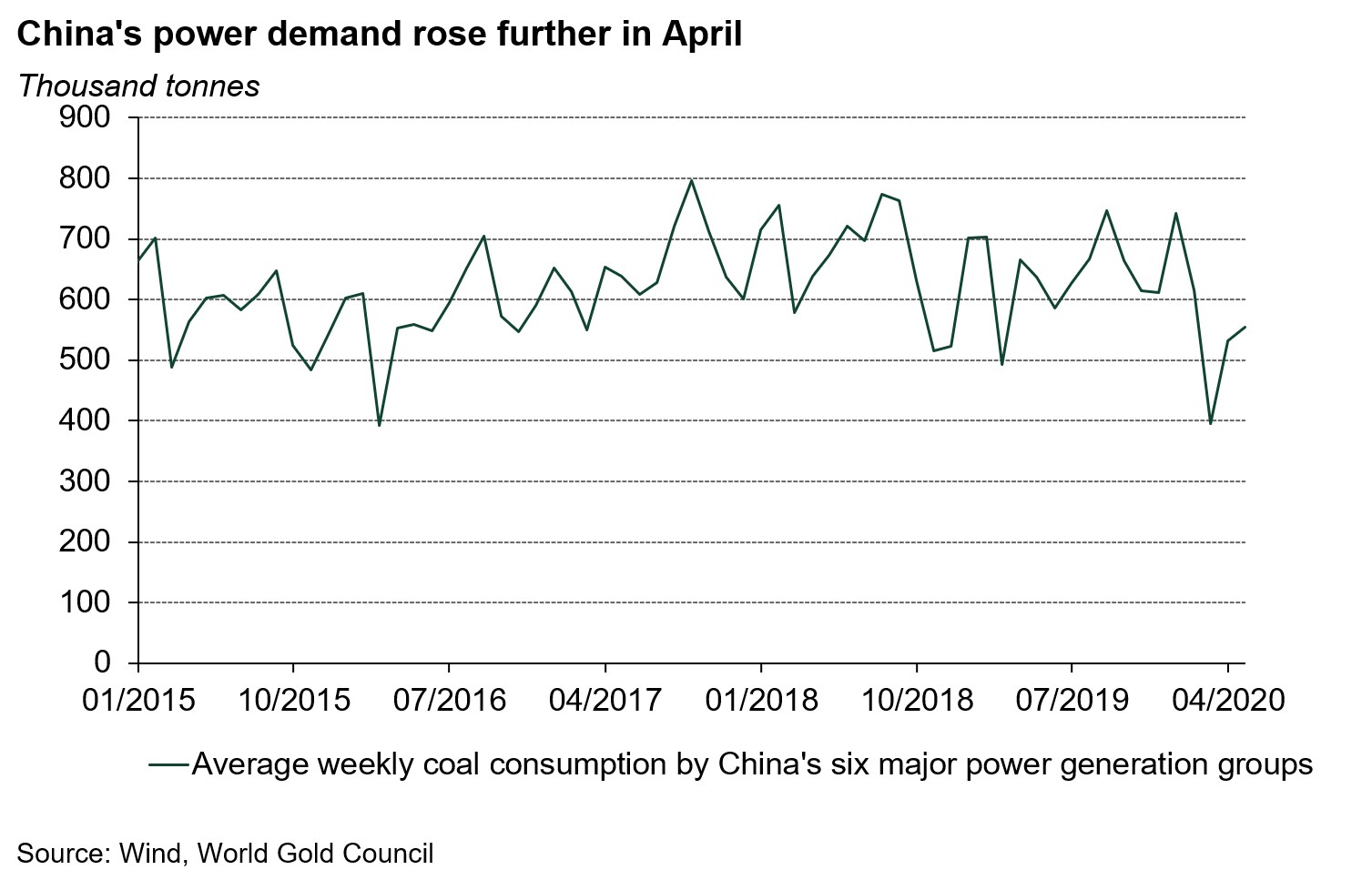

- With the COVID-19 outbreak being effectively contained and accommodative monetary and fiscal policies, China’s economy in April rebounded further

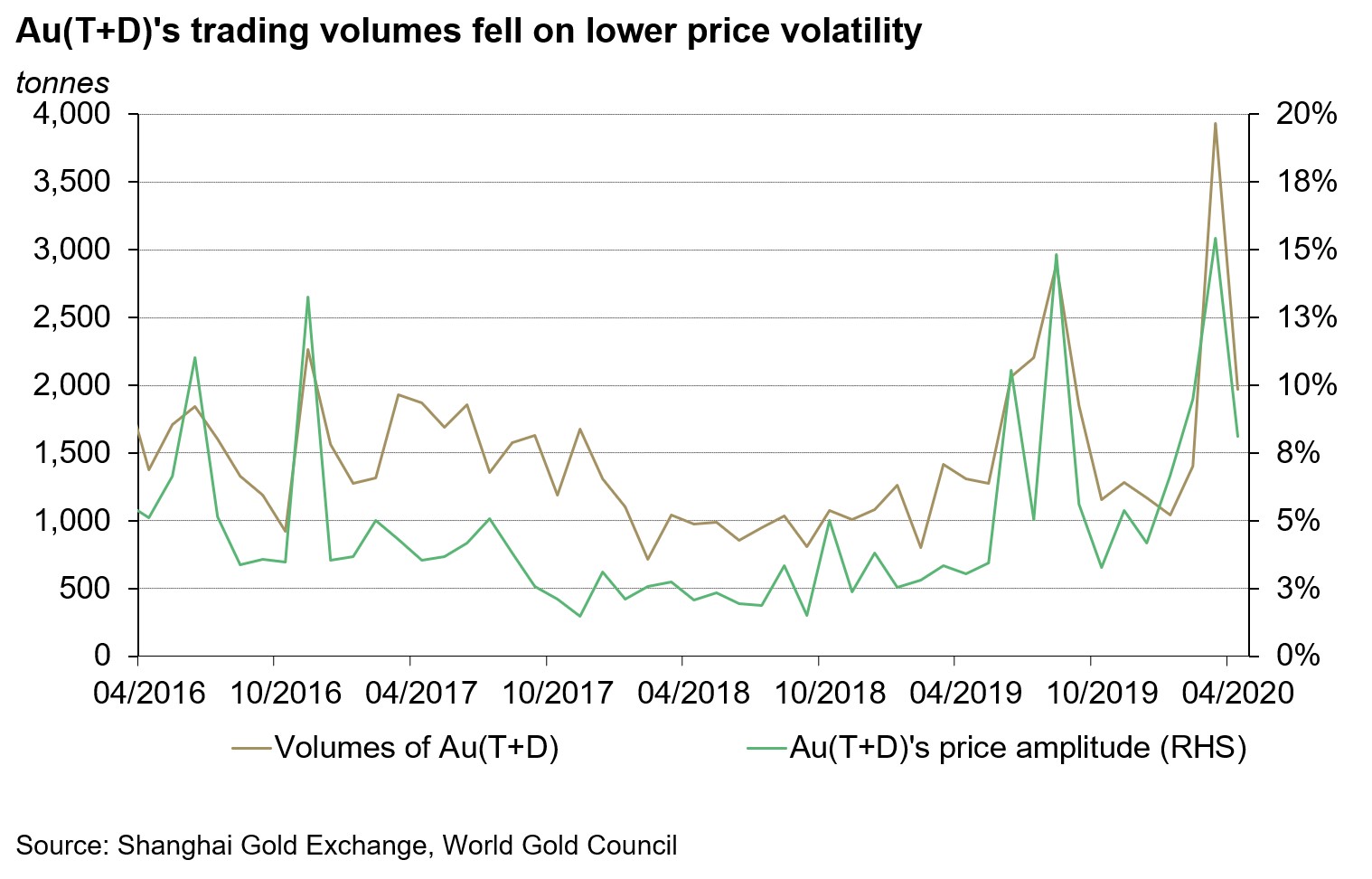

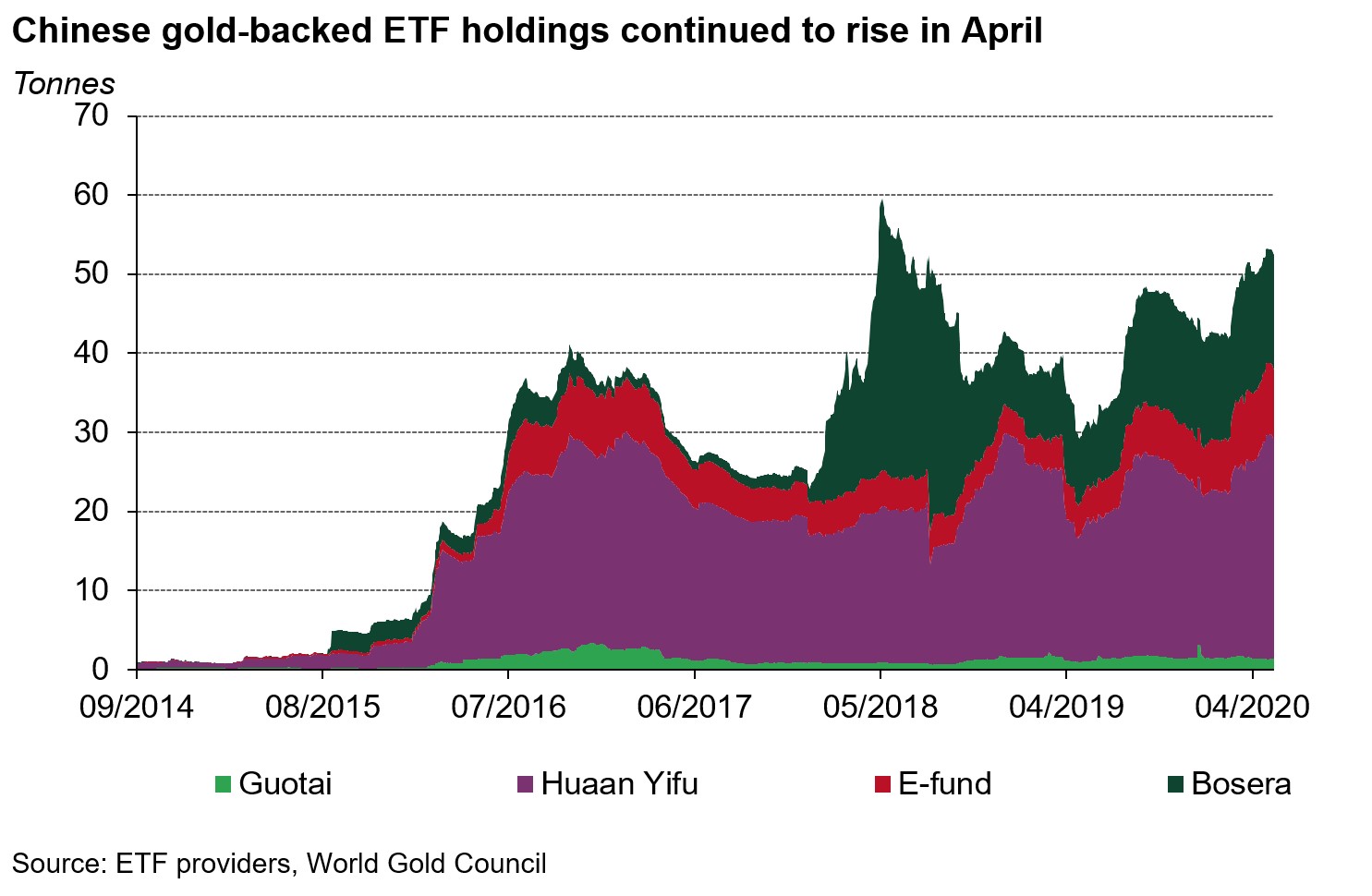

- While Chinese investors’ tactical positioning in Au(T+D) fell due to the lower gold price volatility in April, their allocation to gold ETFs kept increasing on the bullish gold price momentum

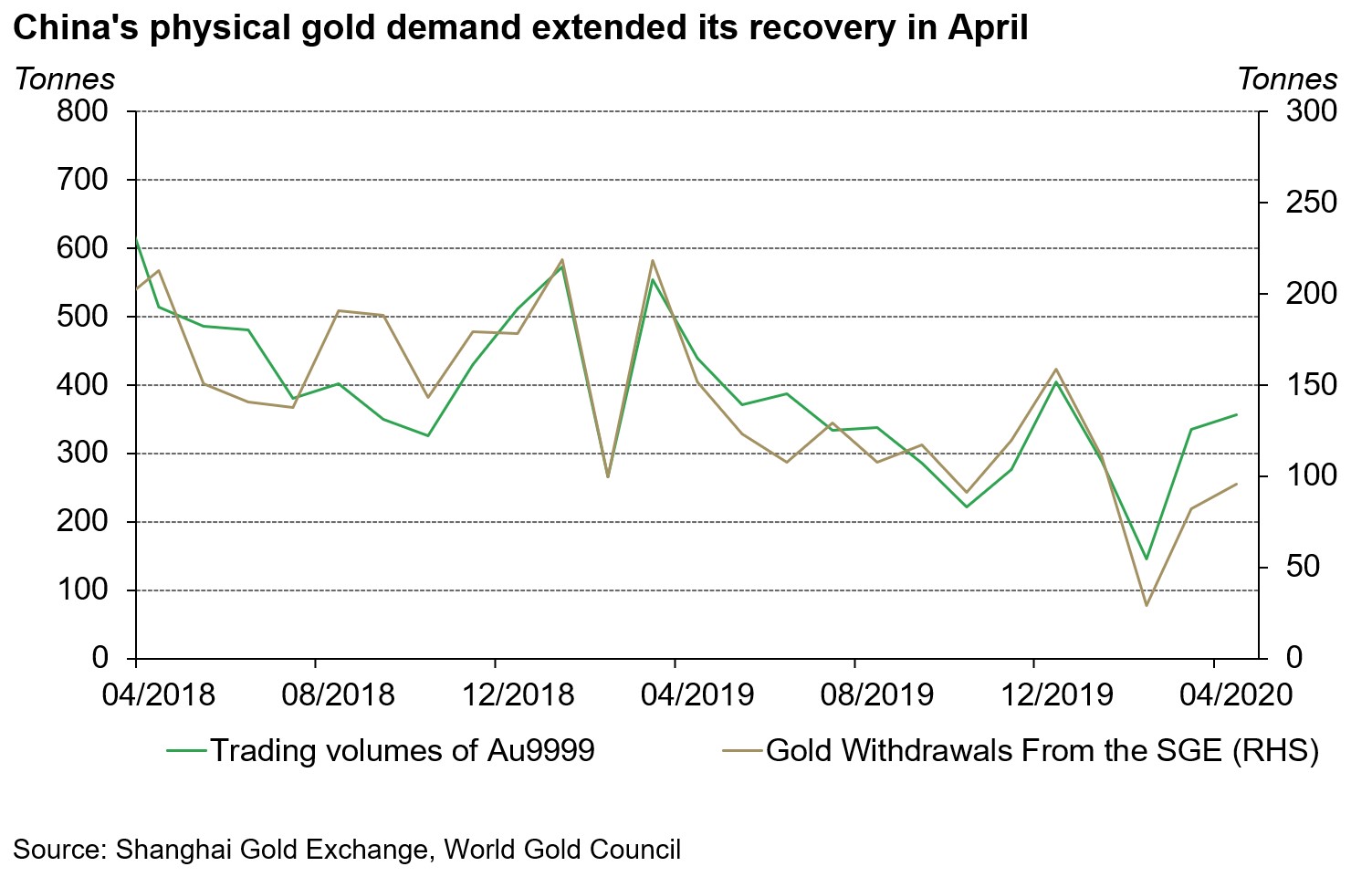

- In April, Au9999’s trading volumes and gold withdrawals from Shanghai Gold Exchange (SGE) rose further; jewellers were actively preparing for the widely expected gold consumption spikes such as the Labour Day Holiday and Mother’s Day in early May

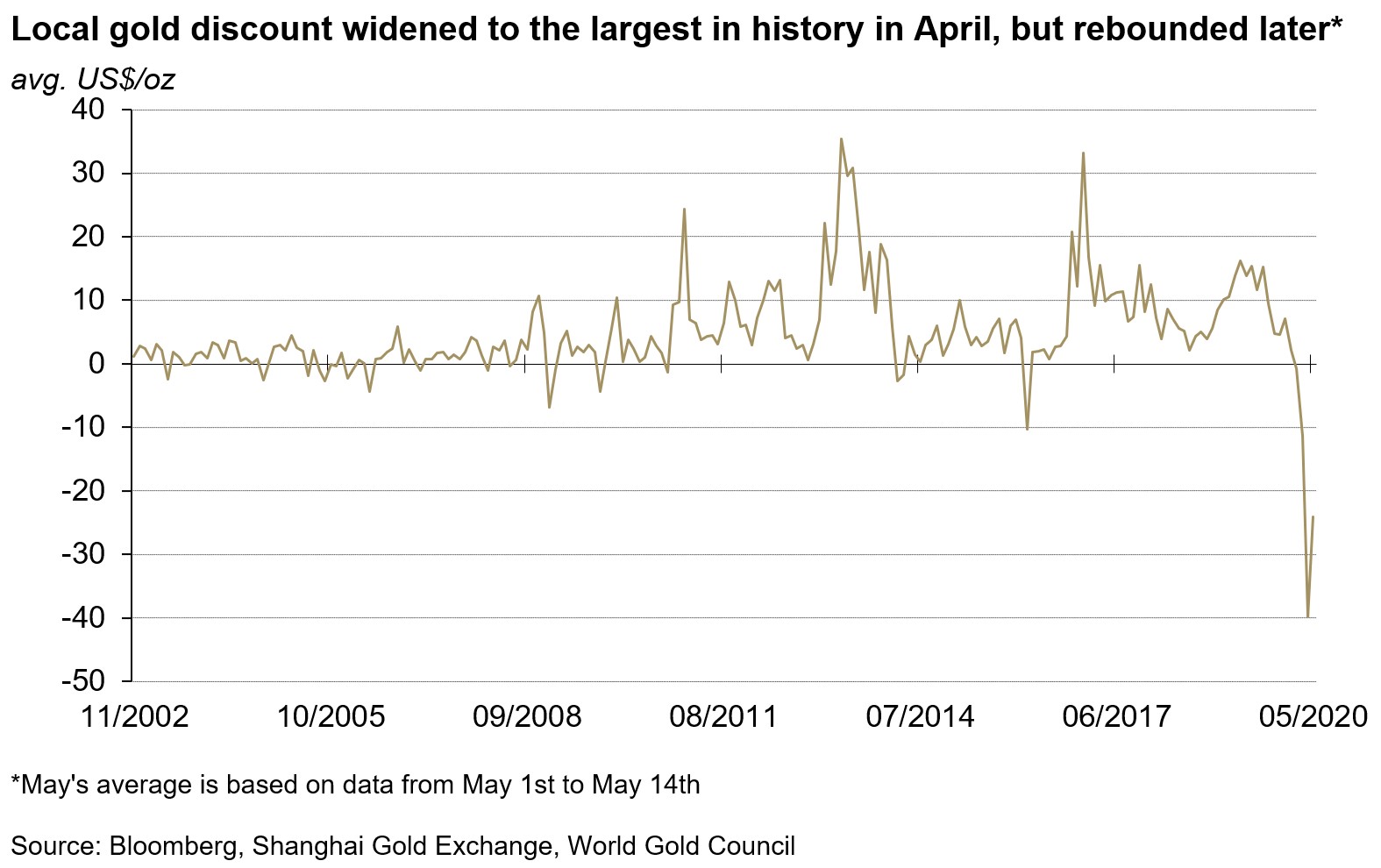

- Higher retail gold bullion sales, disruptions in gold supply chains in Western markets, as well as still soft Chinese consumer demand led to the widest local gold price discount since 2002 – when the SGE was established – in April2

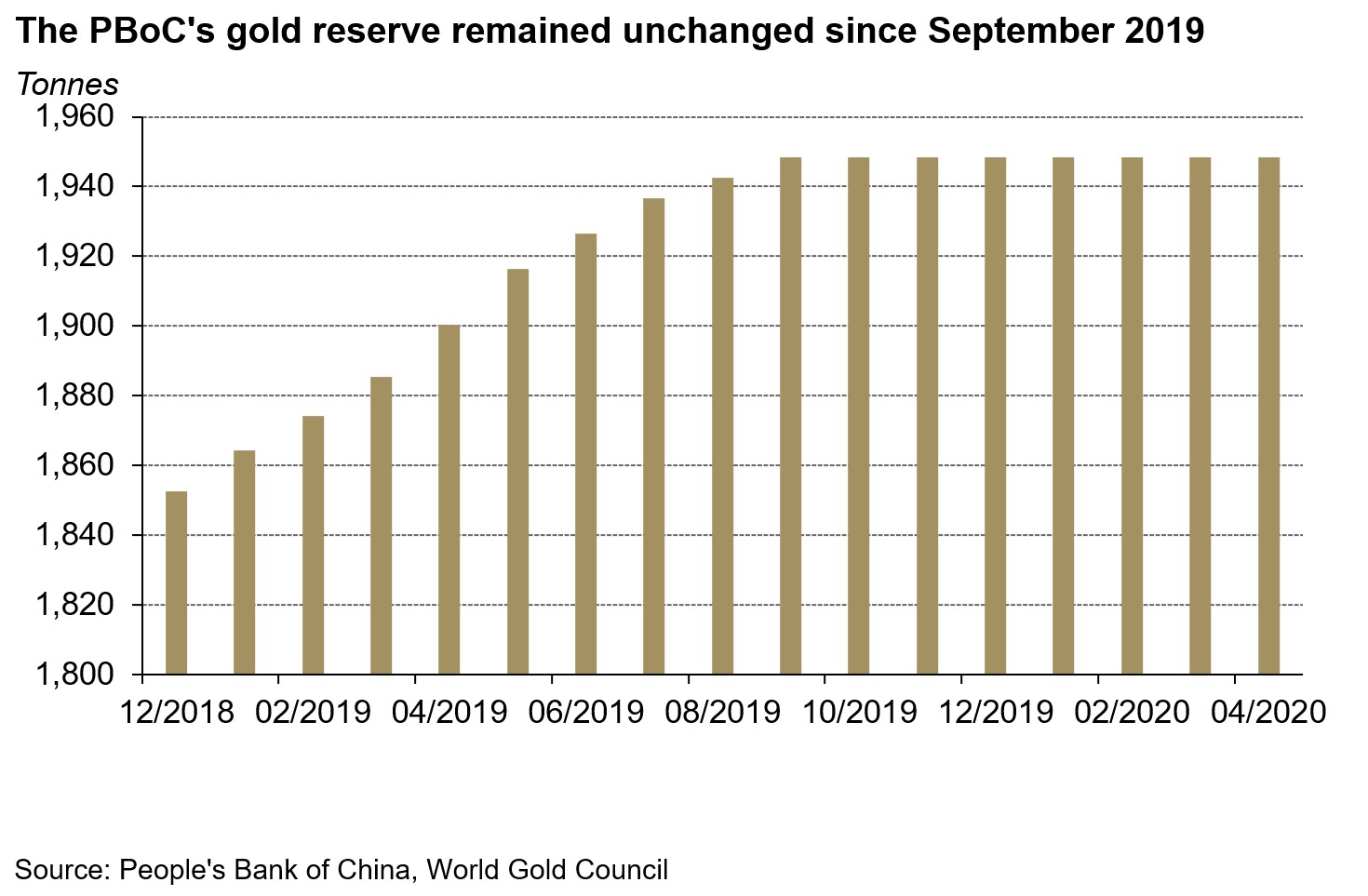

- The People’s Bank of China (PBoC) kept its gold reserves unchanged at 1,948t in April, accounting for 3.5% of total reserves.

Economic uncertainty and lowered opportunity cost of holding gold lifted gold prices in April. As the COVID-19 outbreak continued last month, economic pressure in major economies and central banks’ monetary policy stance in response pushed international gold prices up by almost 8%. But the reviving Chinese economy and an appreciating CNY against the US dollar have led to a relatively weaker RMB gold price performance – 5% – by comparison

China’s economy saw further improvements after Q1.3 With the number of new COVID-19 cases remaining near zero, around 99% of large-scale enterprises and 84% of small- and medium-sized companies resumed operation in April.4 And China’s key economic indicators, such as PMIs and retail sales, saw further improvement last month. As well as progress with virus containment, the PBoC’s 20 basis point cut in the benchmark loan prime rate in April, and the other supportive monetary and fiscal policies introduced so far, were also key to the continued economic recovery.5

In April, Au(T+D)’s trading volumes fell by 50% m-o-m, totaling 1,972t. Lower gold price volatility in April compared to March reduced the contract’s popularity among tactical investors, leading to the m-o-m drop in its trading activities. Nonetheless, Au(T+D)’s trading volumes in April averaged US$5bn per day, 89% higher y-o-y. Financial and economic uncertainties driven by the pandemic were the major reason for the y-o-y surge in Au(T+D)’s trading volumes.

Chinese gold-backed ETF holdings continued to grow.6 Chinese gold ETFs’ holdings rose 2.2t in April, reaching 53.2t. As one of the best performing assets in 2020, gold has grabbed many Chinese investors’ attention. With the gold price rising and other major Chinese assets stagnant in April, local investors increased their strategic allocation to gold ETFs.

China’s physical gold demand rebounded further in April. Au9999’s trading volumes and gold withdrawals from the SGE were 356t and 96t respectively last month, 14t and 21t higher m-o-m. Our trade partners in the industry told us many jewellery manufactures have been preparing for the widely expected Labor Day Holiday and Mother’s Day sales spike in early May, lifting China’s physical gold demand in April as a result.

Further consumption stimuli after Q1 underpinned the recovery in China’s physical gold demand. The Shanghai municipal government, for example, teamed up with local malls to launch a '5 May Shopping Festival' online and offline, lasting through to June, which offers attractive discounts on a wide range of consumer products including gold jewellery.7 And according to China Gold Association, online jewellery sales during 2020’s Labour Day Holiday were 153% higher y-o-y. Moreover, offline gold jewellery sales were 22% higher y-o-y8 during the Mother’s Day week in Shanghai, according to Shanghai Commercial Development and Research Centre.9

Jewellery wholesalers showrooms were getting busy again in April

Source: Ganlu Jewellery

Chinese local gold price discount in April surpassed March’s record, as the SHAUPM was US$40/oz less than LBMA Gold Price AM on average. A combination of surging gold coins sales and supply disruptions in western markets, along with China’s still tepid gold demand and its recovering supply, led to the unprecedented discount in the Chinese local gold price in April, as I mentioned in my previous blog.10

But as western retail gold demand cooled and China’s retail gold sales gathered steam, the local gold price premium showed a notable bounce in early May.11

Note: SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used.

There was no change in the PBoC’s gold reserves in April. According to the State Ministry of Foreign Exchange (SAFE), the PBoC’s foreign reserves totalled US$3,091bn as of April, rising 1% m-o-m. A weaker US dollar and stronger asset performance in major economies during April contributed to the US$31bn m-o-m rise in total foreign reserves. Meanwhile, the PBoC’s gold reserve has held steady at 1,948t (3.5% of total reserves) since September 2019.

Footnotes

1 We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit en.sge.com.cn/data_BenchmarkPrice

2 For more information about premium calculation, please visit www.gold.org/goldhub/data/local-gold-price-premiumdiscount

3 For more information, please visit https://coronavirus.jhu.edu/data/new-cases for more.

4 According to the Ministry of Industry and Information Technology’s news release mid-April

5 For more information, please visit: www.nasdaq.com/articles/china-cuts-benchmark-lending-rate-for-second-time-since-virus-outbreak-2020-04-20

6 Excluding Bosera’s I & D shares as they only provide updates at the end of each quarter.

7 For more information, please visit: www.chinadaily.com.cn/a/202005/06/WS5eb1fd45a310a8b2411537cf.html

8 2020’s Labor Day Holiday was from 1 May to 5 May, one day more than 2019’s.

9 Shanghai Commercial Development and Research Centre surveyed major jewellery retailers in Shanghai from 6 May to 10 May.

10 For more information, please visit: www.bloomberg.com/news/articles/2020-04-15/u-s-mint-halts-coin-output-just-as-investors-are-demanding-more

11 For more information, please visit: www.usmint.gov/about/production-sales-figures