Summary

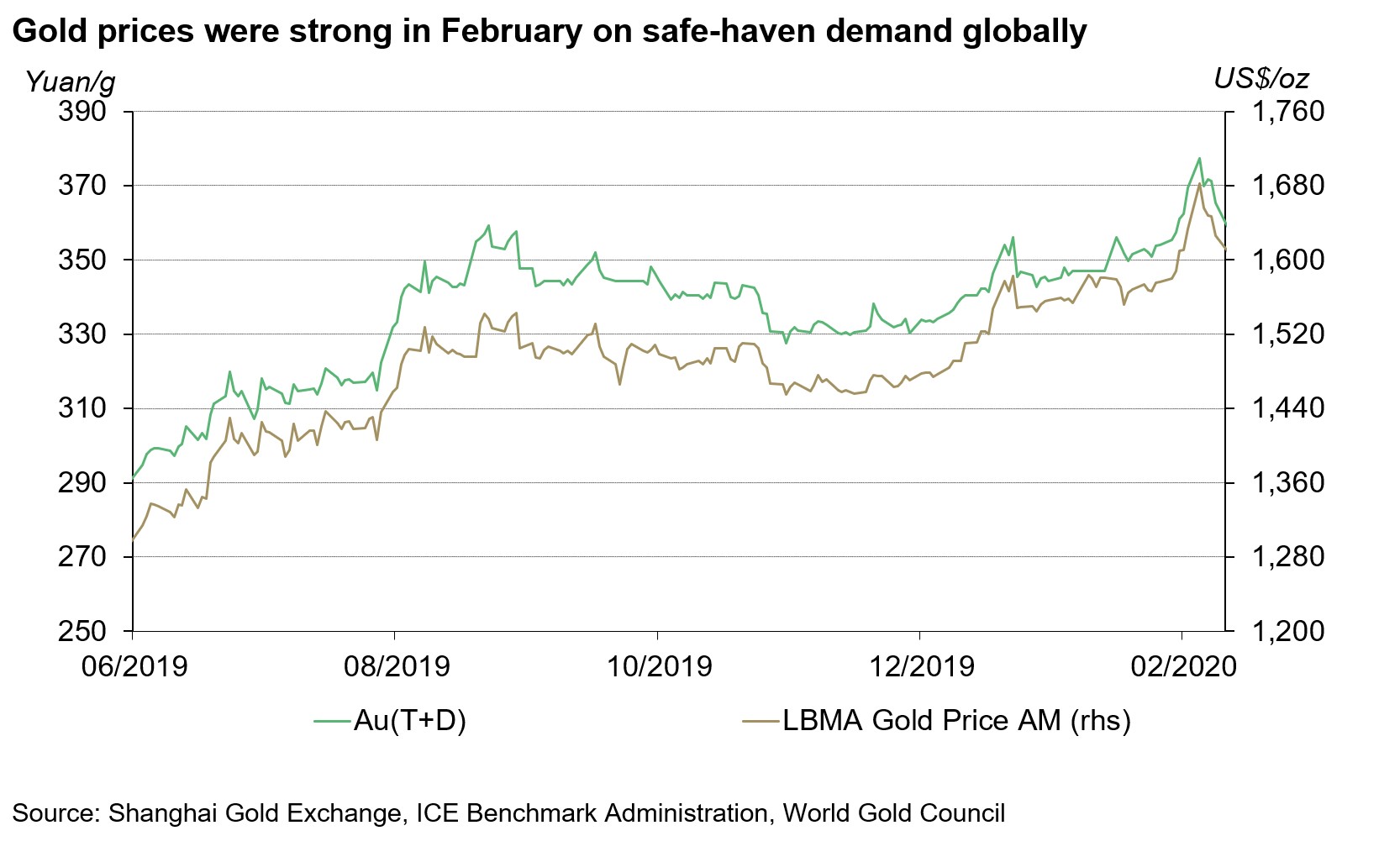

- Last month, the RMB Shanghai Gold Benchmark PM (SHAUPM) increased 5.7% compared to the 3% rise in the USD LBMA Gold Price AM.1

- The coronavirus (COVID-19) outbreak supported demand for gold as a safe-haven asset as stocks and commodities fell sharply, leading to:

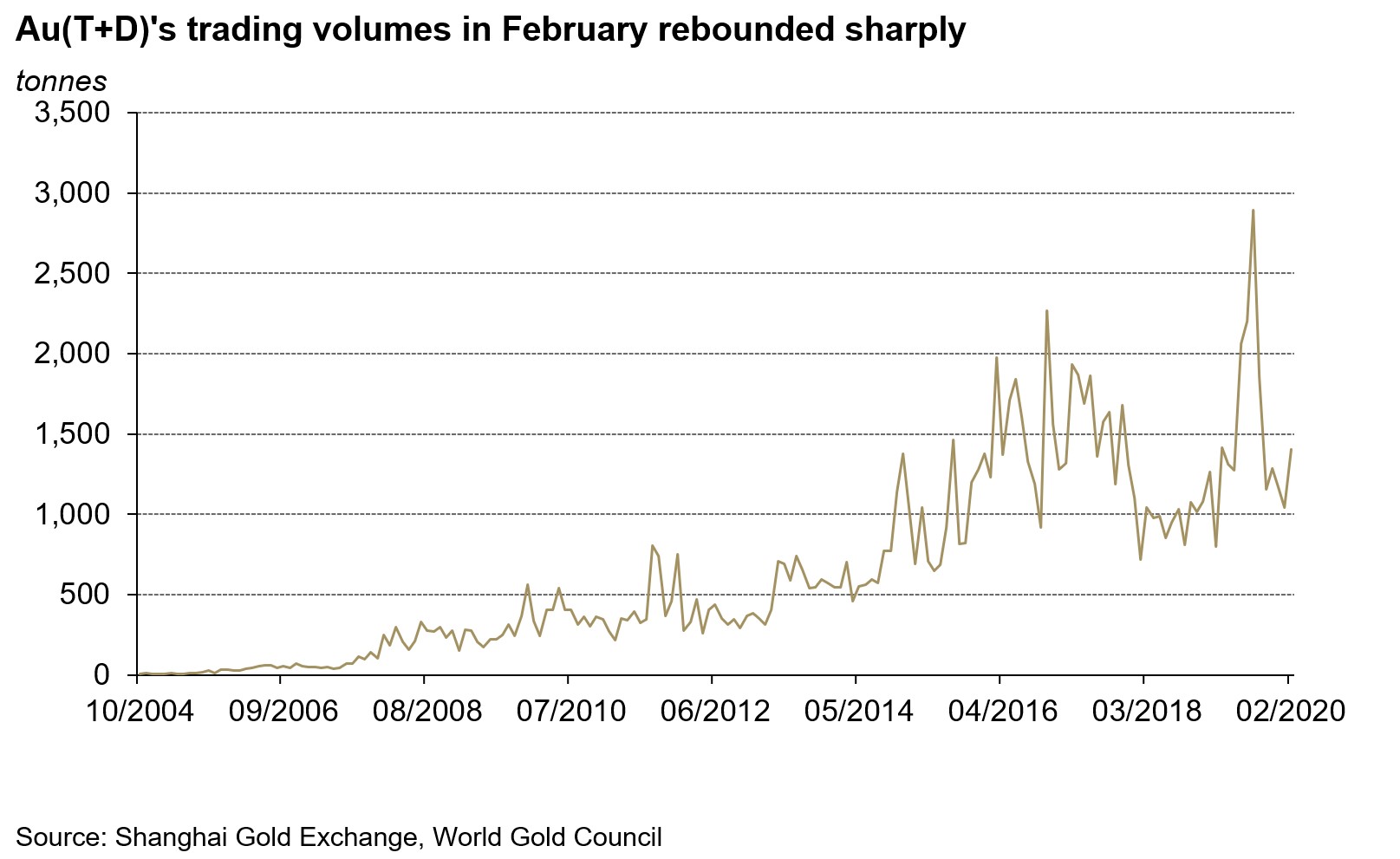

- Au(T+D)’s trading volumes of 70 tonnes (t) per day – the highest level since last September

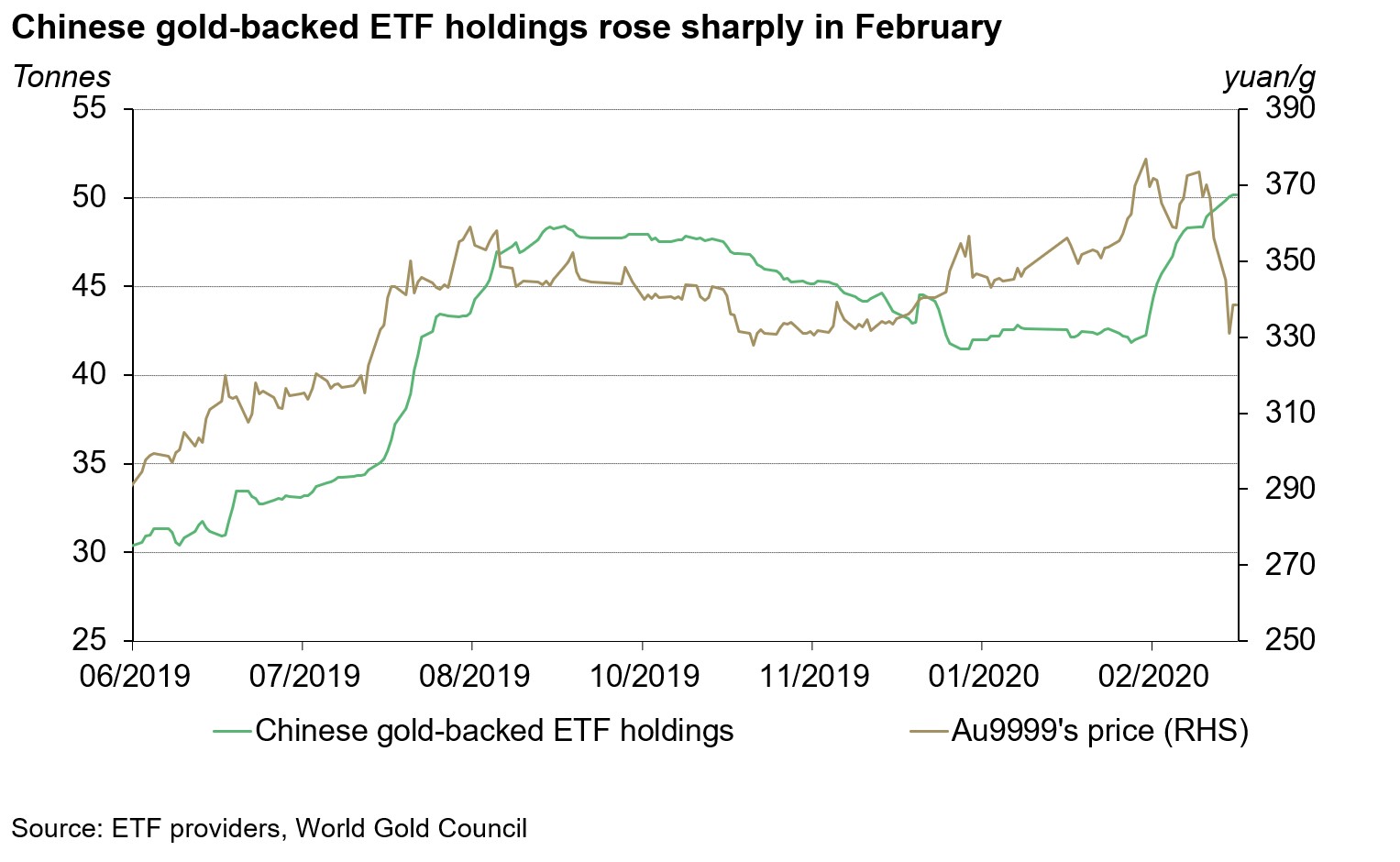

- An increase of more than 3t – or 7% – in holdings of Chinese gold-backed exchange-traded funds (ETFs) during the month.

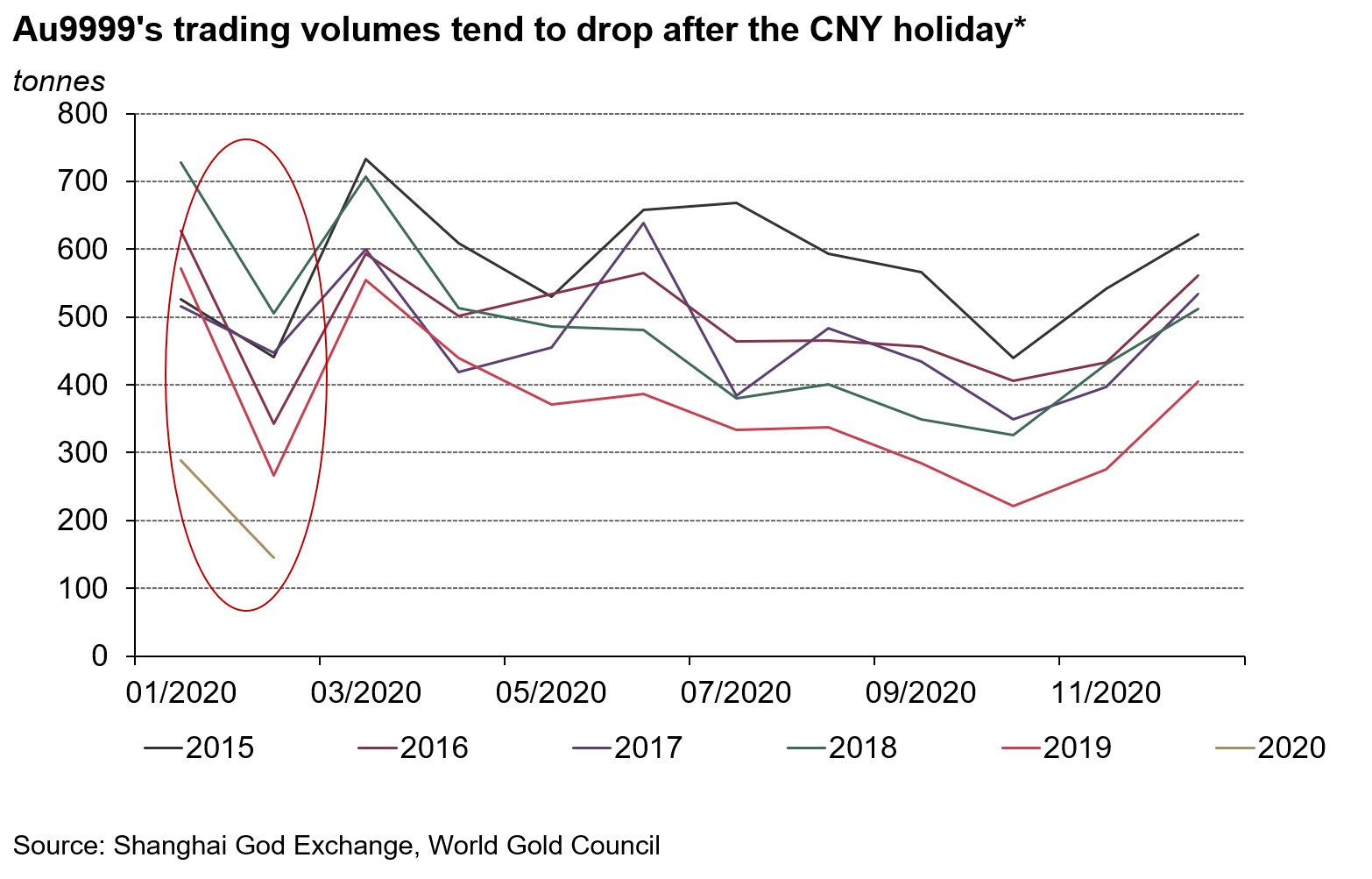

- Au9999’s trading volumes – usually seen as a proxy for physical gold demand – and gold withdrawals from the Shanghai Gold Exchange (SGE) both dropped significantly in February, whereas the Chinese local gold premium turned negative as physical gold demand faltered domestically due to COVID-19 and seasonality factors.2

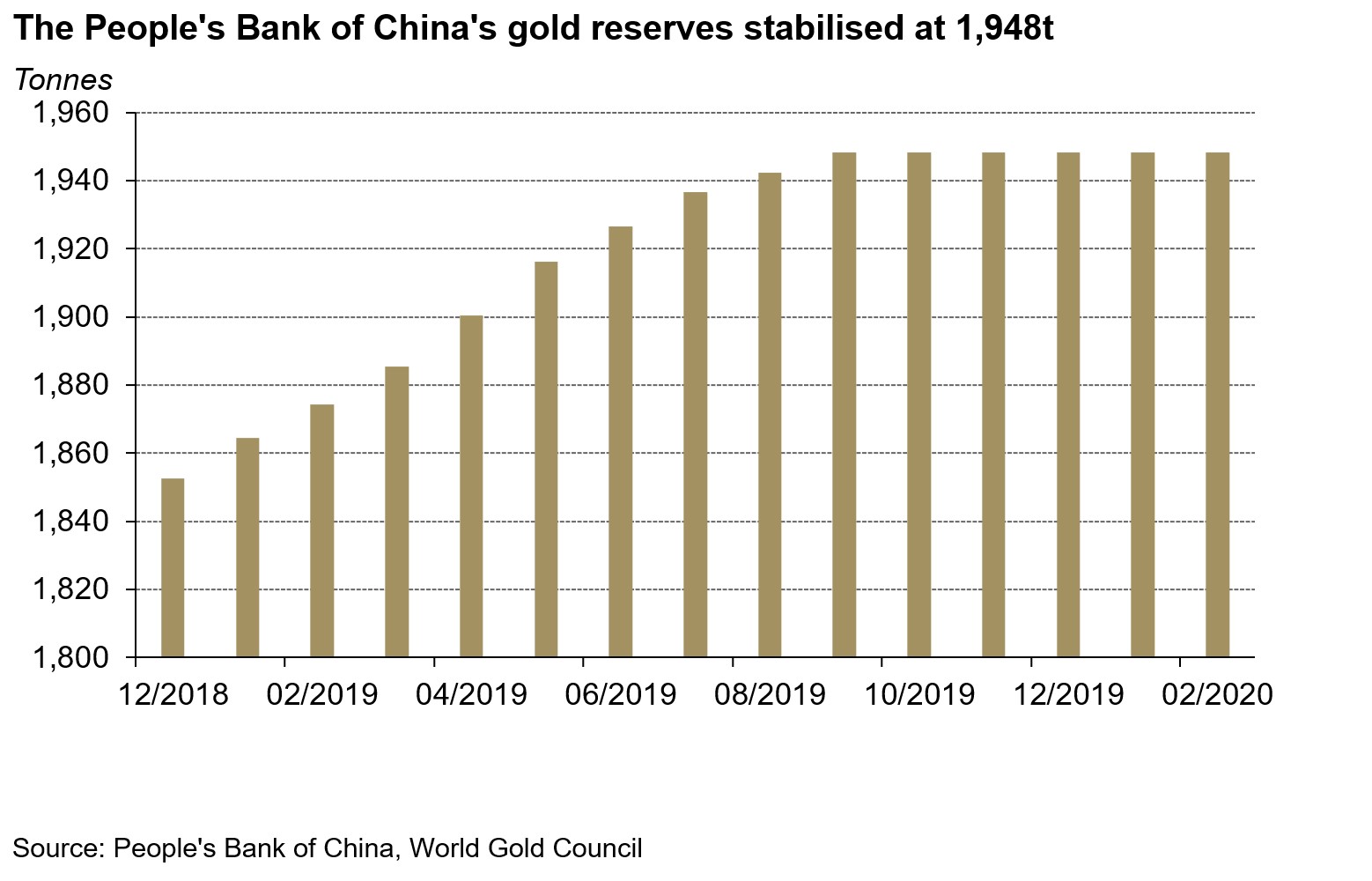

- The People’s Bank of China (PBoC) kept its gold reserves unchanged at 1,948t in February.

Safe-haven demand following the COVID-19 outbreak after the Chinese New Year (CNY) holiday boosted SHAUPM in February.3 An escalation in the coronavirus outbreak hampered high-risk assets as the Shanghai Stock Composite Index and the Wind Commodity Index both fell by over 3% in the month. As equity and commodity markets plunged, safe-haven demand fuelled the 5.7% rise in SHAUPM. The gold price in USD increased by 3% over this period as concerns about the impact of the coronavirus to the global economy grew and central banks around the globe implemented additional monetary policy measures.

The difference between rises in the SHAUPM and the LBMA Gold Price AM during the month can be explained by:

- In February, the CNY depreciated by nearly 1% against the US dollar;

- Chinese financial markets closed during the last week of January for the CNY holiday when the LBMA Gold Price AM rose nearly 2%.

The COVID-19 outbreak clouded China’s economy.4 As the outbreak started to accelerate, China took strict containment measures, including sealing off cities, imposing travel restrictions and delaying the return to work following the CNY holiday.5 With most industries pausing and the public confined to their homes, key economic indicators such as manufacturing and service Purchasing Managers’ Indexes (PMIs), imports and exports were significantly weakened in February. And according to the National Bureau of Statistics, China’s overall retail sales dropped by 21% during the first two months of the year, whereas gold, sliver and gem jewellery sales plunged by 41%.6 The containment measures also caused a shortage in consumer staples, keeping China’s Consumer Price Index (CPI) above 5%, the highest level since 2011.

Investors’ interest in Au(T+D) ran high after the CNY holiday. Au(T+D)’s trading volumes in February totalled 1,402t, or US$3.6bn per day, the highest in five months. Safe-haven demand pushed up Chinese investors’ tactical positioning in February. And this trend has continued in March: investors’ interest in Au(T+D) averaged 198t per day, 1.8 times greater than in February.7

Chinese gold-backed ETF holdings increased by more than 3t in February on rising safe-haven demand, totalling 46t as of 28 February 2020.8 The plunge in equity and commodity markets after the CNY holiday prompted gold’s investment demand, leading not only to higher Au(T+D) trading volumes which tend to be tactical moves, but also to increased strategic allocation to gold ETFs. And Chinese gold-backed ETF holdings have already seen a 3.5t inflow in the first 18 days of March.

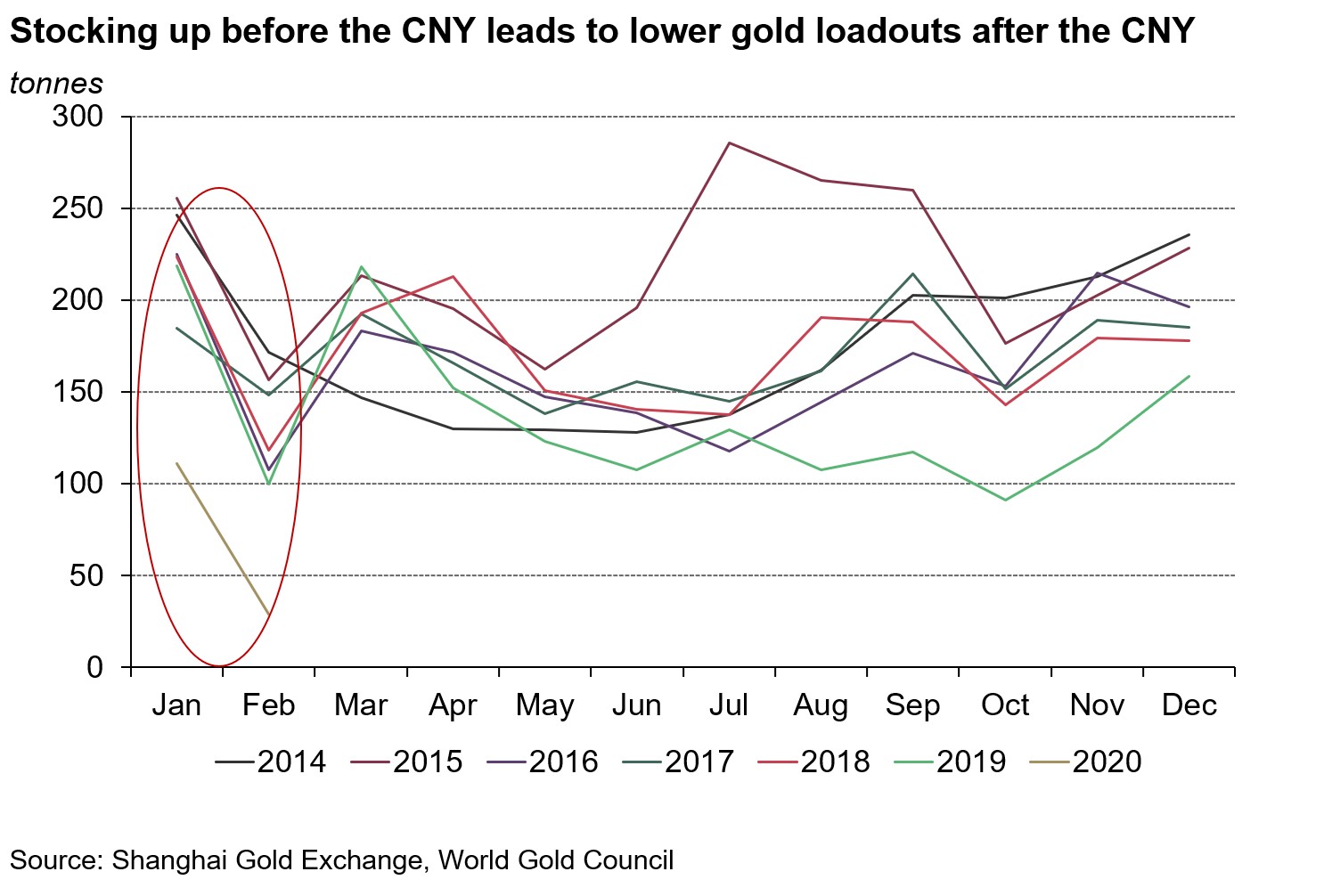

Trading activities of Au9999, a proxy for China’s physical gold demand, fell significantly last month.9 Trading volumes in February stood at 145t, 71% lower than February 2019, which also had fewer trading days.10 While this drop should be partially attributed to the sharp fall in gold retail sales as mentioned above, lower sales mean lower replenishment demand from the supply chain. The tradition of stocking up before the CNY holiday for the following month left retailers with ample inventories especially when the streets were emptied by the COVID-19 outbreak.

*The CNY holiday always occurs between mid-January and early February.

But there are signs of a rebound in Au9999’s trading volumes. So far in March, Au9999’s average daily trading volumes have amounted to 12t, 61% higher than February’s mean. As the virus is being effectively contained in China, more and more companies in the country’s gold industry are resuming normal operation, slowly improving the physical gold demand.

For the same factors suppressing Au9999’s trading volumes, gold withdrawals from the SGE only totalled 29t in February, 82t lower m-o-m and 89t lower y-o-y.

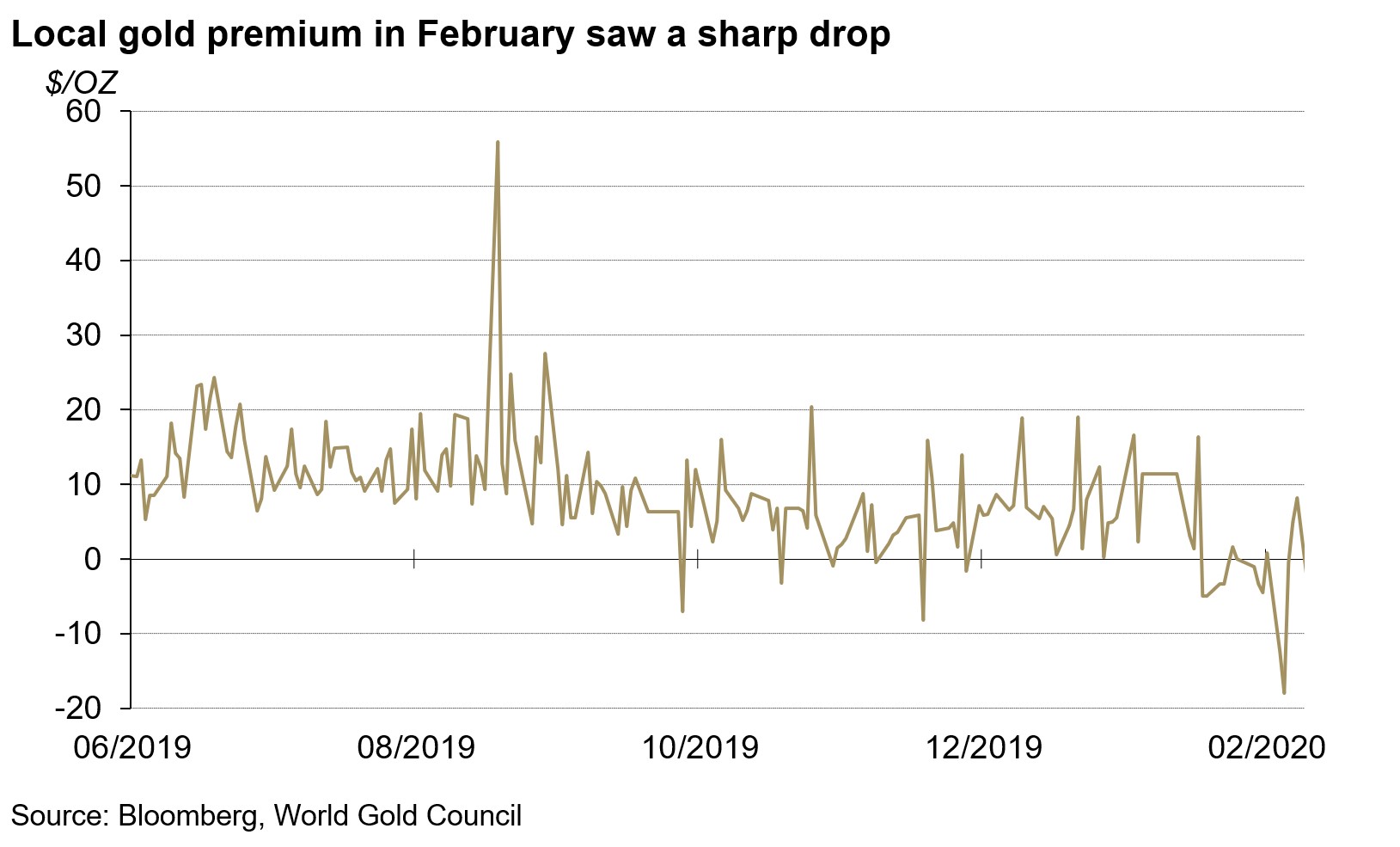

The Chinese local gold premium dropped sharply in February. Last month, SHAUPM was US$1/oz cheaper than LBMA Gold Price AM on average, the narrowest differential since May 2014. The severely hampered physical gold demand in China during the month was the fundamental factor leading to the local gold-price discount.

Note: SHAUPM vs LBMA Gold Price AM after April 2014; before that, it was Au9999 vs LBMA Gold Price AM.

There was no change in the PBoC’s gold reserve in February. While there was a US$88mn decline in China’s total foreign exchange reserves, the gold reserve has remained at 1,948t (3.2% of total reserves) since September 2019.

Footnotes

1 We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit en.sge.com.cn/data_BenchmarkPrice

2 For more information about premium calculation, please visit www.gold.org/goldhub/data/local-gold-price-premiumdiscount

3 The CNY holiday occurred between 24 January and 2 February 2020.

4 Please visit www.chinadaily.com.cn/a/202001/27/WS5e2a95d9a310128217273202.html for more.

5 The 2020 CNY holiday should have ended on 3 February 2020, but due to virus containment measures, governments extended the holiday and most people chose to work from home. At the time of writing All industries in China are still not in full capacity yet and all schools are closed.

6 Please visit www.stats.gov.cn/english/PressRelease/202003/t20200317_1732694.html for the full retail sales data report.

7 As of 18 March 2020.

8 Excluding Bosera’s I & D shares as it only provides updates at the end of each quarter.

9 For the difference between Au(T+D) and Au9999, please visit www.gold.org/goldhub/gold-focus/2019/06/tale-two-contracts-speculative-investment-physical-demand-down

10 China’s financial markets were closed for the CNY holiday from 4 to 8 February 2019.