Summary

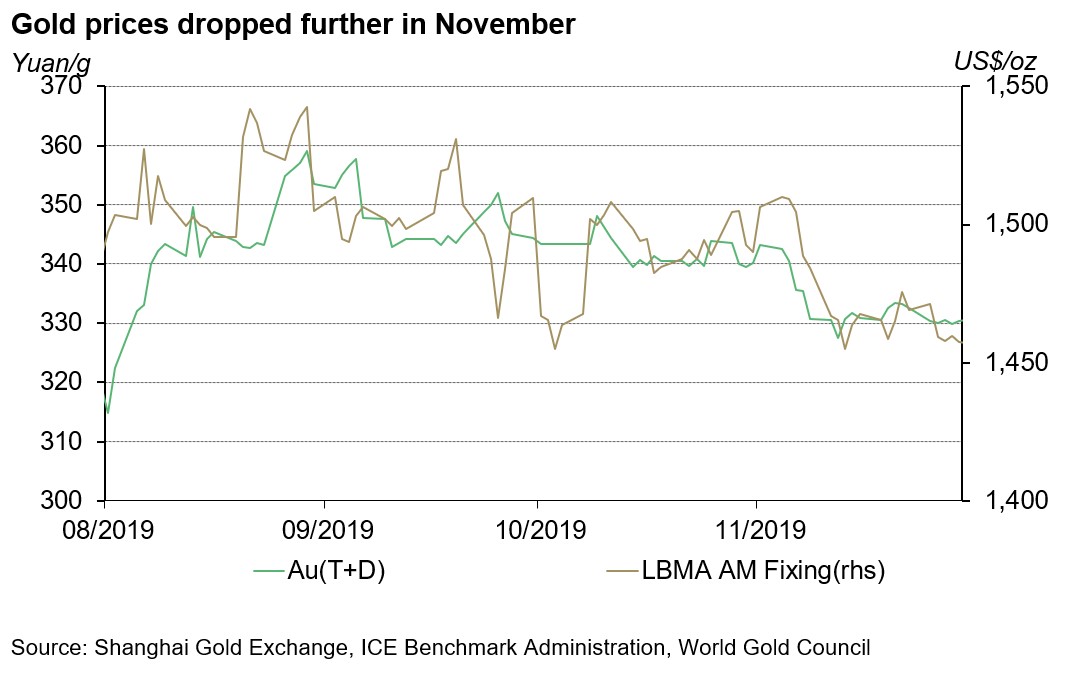

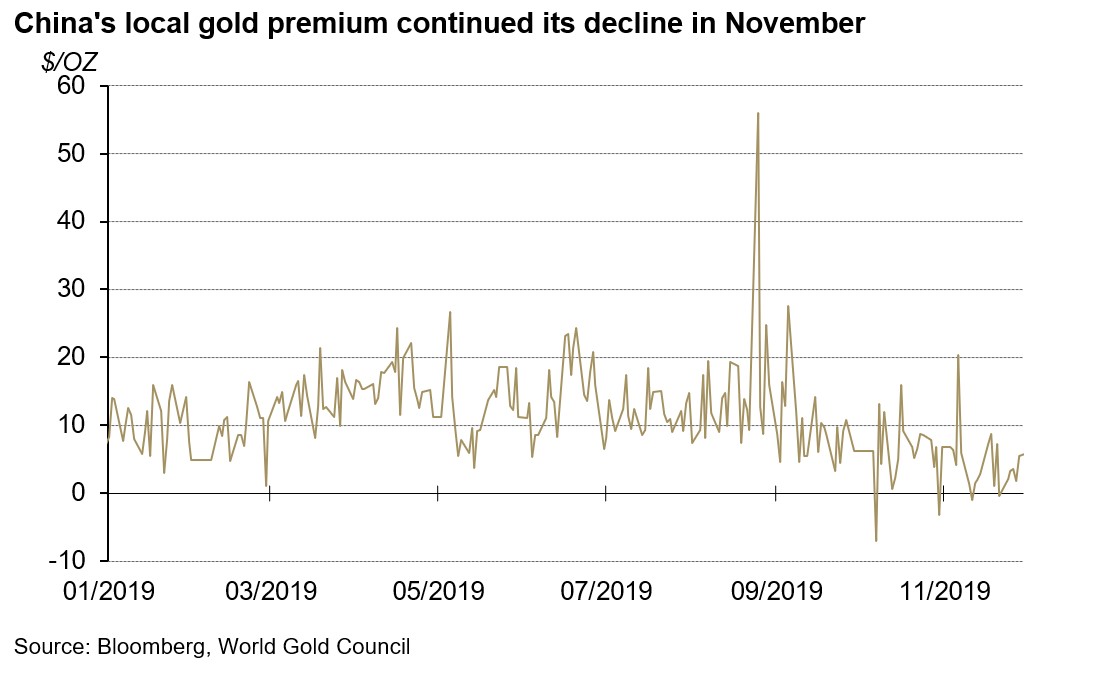

- The Shanghai Gold Benchmark price (PM) extended its decline in November. The appreciating USDCNY has again made CNY-denominated gold prices weaker than the dollar gold price, resulting in another drop in local gold premium last month.

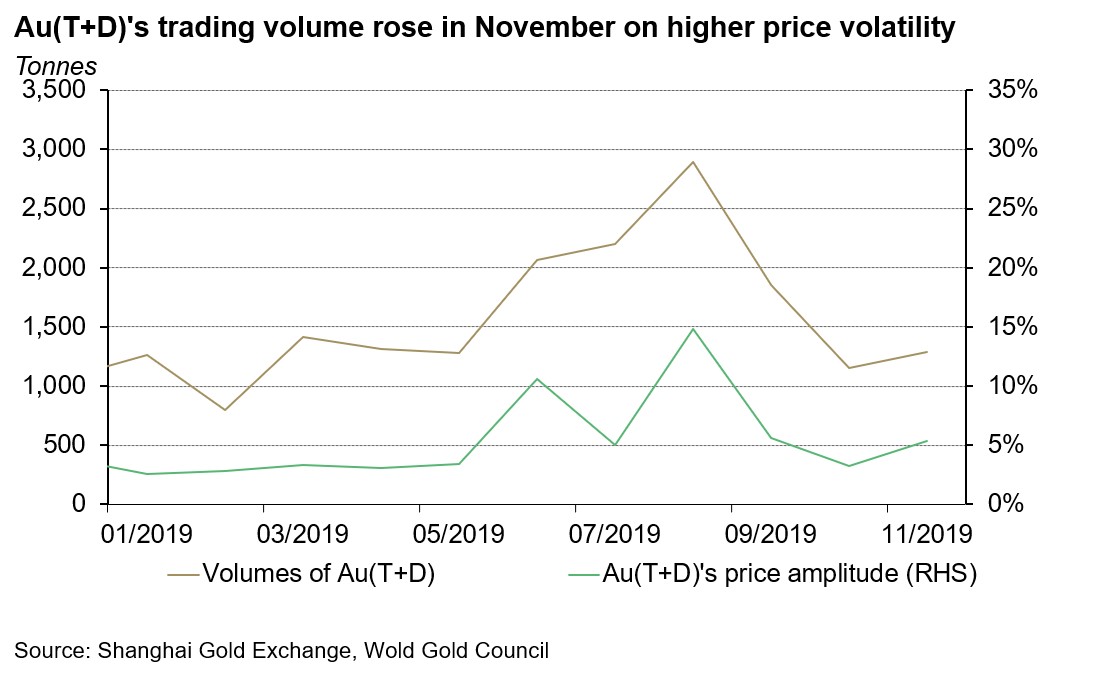

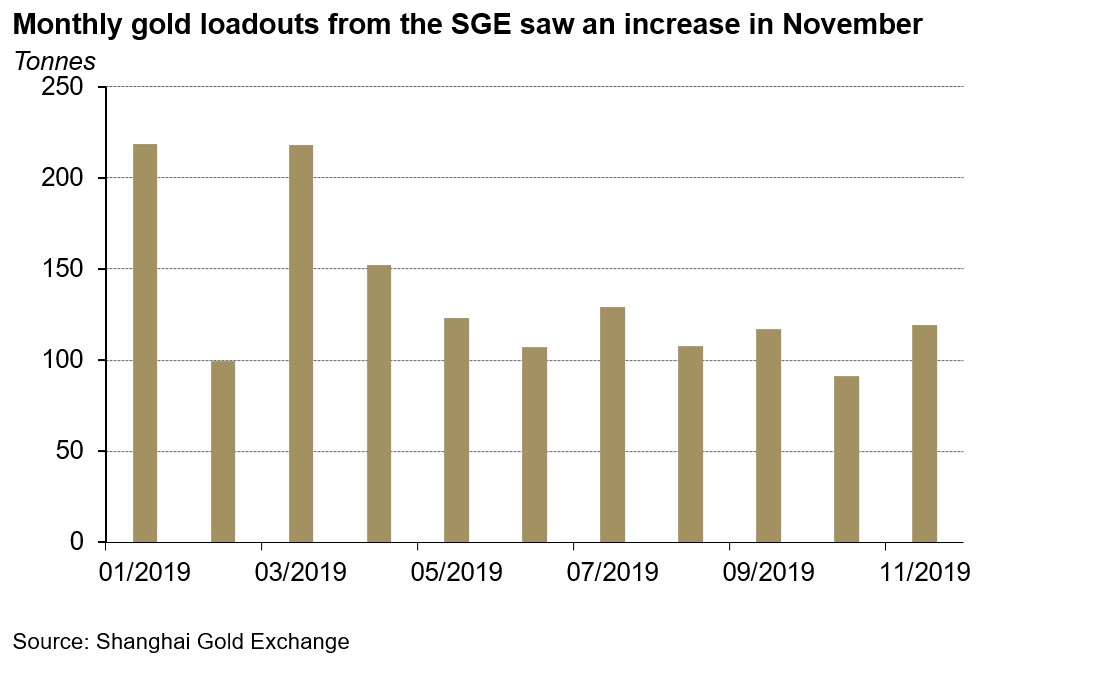

- Driven by elevated price volatility, Au(T+D)’s trading volume was higher m-o-m. Meanwhile, the industry’s stocking ahead of the Chinese New Year’s Festival led to a higher Au9999 trading volume and gold withdrawals from the Shanghai Gold Exchange (SGE) in November.

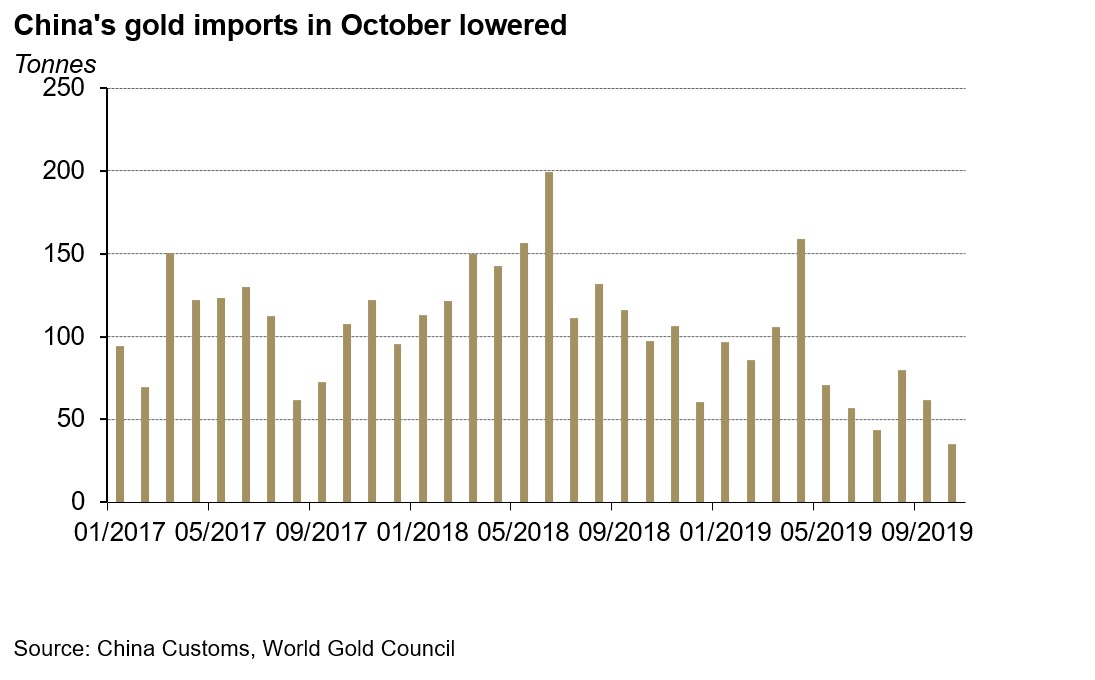

- During the first ten months of 2019, China’s gold imports dropped by 41% y-o-y.

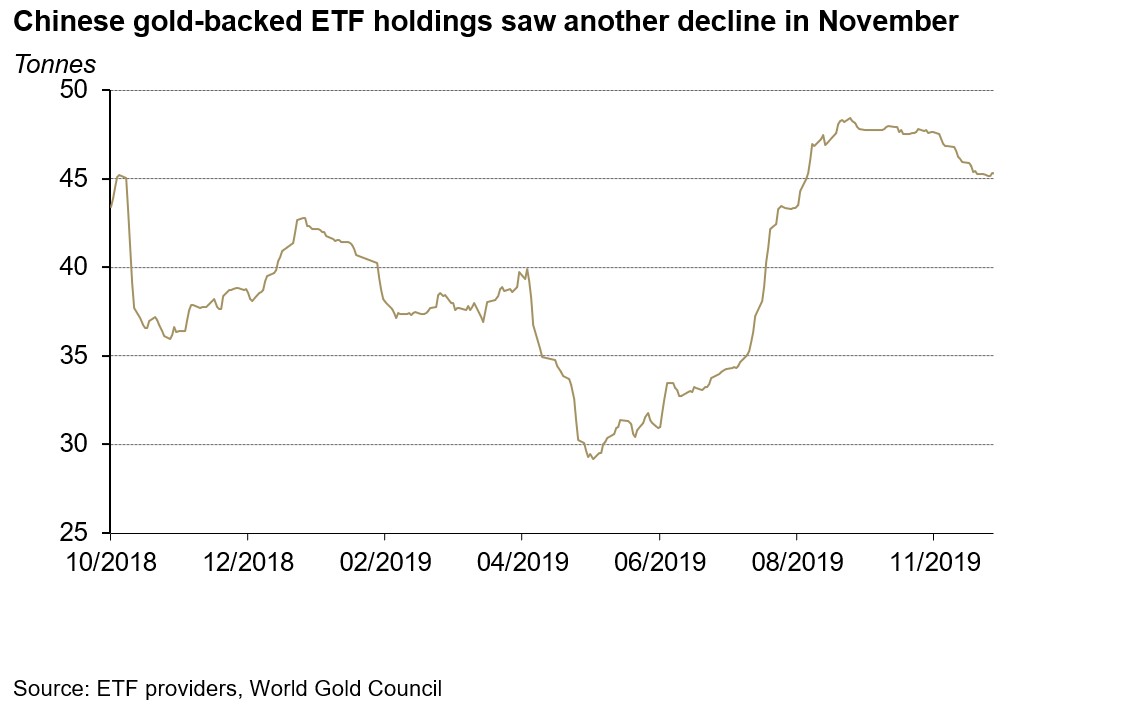

- While some investors have stepped away, Chinese gold ETFs’ gold holdings stabilised around the highest level since last October.

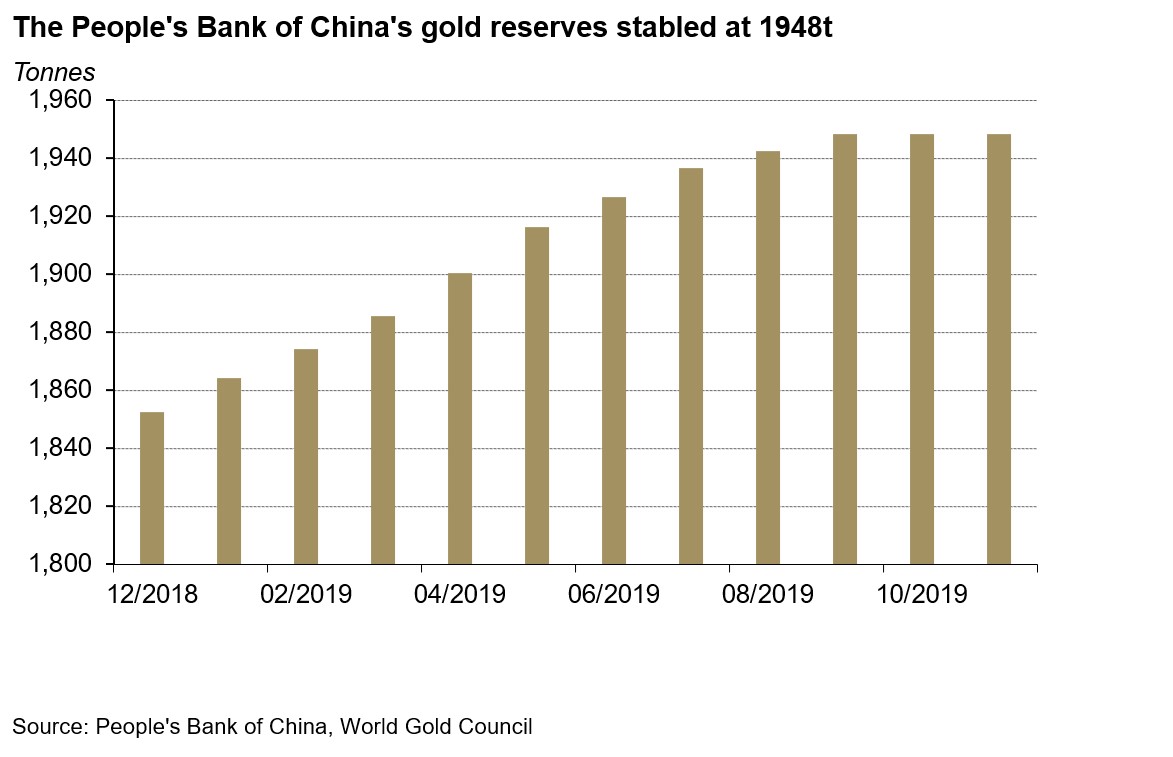

- The People’s Bank of China (PBoC) left its gold reserve unchanged at 1,948t in November.

Gold prices experienced further pull-backs last month. The Shanghai Gold Benchmark (PM) and Au(T+D)’s prices both witnessed declines of 3.7% in November, weaker than the LBMA Gold fixing AM which dropped by 3.2%. The expectation of the Federal Reserve halting any further rate cuts and positive signals for a China-US trade deal were the main factors weighing on gold in November.1

There were a few bright spots in China’s economy in November. Growth in social financing, retail sales, industry-added value, PMI and infrastructure investments all saw improvements last month. And as China and US reached a phase one deal removing some existing tariffs in December, confidence in China’s economic growth could improve. But driven by the surging pork price which jumped by 110% y-o-y in November, China’s Consumer Price Index (CPI) increased by 4.5% y-o-y, the highest in eight years.

Both Au(T+D) and Au9999’s trading volumes were higher in November on a m-o-m basis. Au(T+D)’s trading volume reached 1,285t last month, 11% higher m-o-m. Dominated by shorter-term investment demand, higher gold price volatility boosted Au(T+D)’s trading volume due to speculators searching for profiting opportunities.

As a result of the industry’s stocking ahead of the Chinese New Year’s Festival, Au9999 saw a 25% rise m-o-m in its trading volume in November, totaling 275t.2 However, weaker physical demand – as noted in Gold Demand Trends –has led to a 24% decline y-o-y in Au9999’s trading volume so far in 2019.

Note: the price amplitude during the period = (the highest price– the lowest price) / the lowest price

The local gold premium continued to narrow. Chinese local gold premium dropped to US$4.6/oz in November on average, the third consecutive monthly decline since August. Primarily, the 0.74% appreciation in USDCNY caused such drop in local gold premium as CNY gold prices were weaker than the dollar gold price in November.

Note: SHAU PM VS. LBMA Fixing AM

China’s gold imports fell to 35t in October, 27t lower m-o-m.3 China has imported 795t of gold as of October in 2019, 41% lower y-o-y

Gold withdrawals from the SGE reached 119t in November, a 28t increase from the previous month. This rise was pushed by the same reason boosting Au9999’s trading volume – the industry’s stocking up before Chinese New Year in January.

While there could be the traditional sales boost for retail physical gold demand as Chinese New Year’s Festival approaches, our trade partners in the industry are still pessimistic on overall demand in 2019 as a result of the slowing economic growth and a higher gold price. And y-t-d, gold loadouts from the SGE are 21% lower y-o-y.

Chinese gold ETF holdings lost 2.4t in November. Holdings in these products totalled 45.3t at the end of November (5% lower m-o-m).4 To some extent, reduced China-US trade uncertainties and the sliding local gold price have shaken some local gold ETF investors’ bullish gold price expectations. Despite the marginal loss, Chinese gold ETF holdings have stabilised near the highest level since last October.

Chinese investors will have a wider range of gold-backed ETF products soon. The China Securities Regulatory Commission (CSRC) approved three new gold-backed exchange-traded funds late October, raising the number of Chinese gold-backed ETFs to seven. These new ETFs, fully backed by physical gold, will be provided by ICBC Credit Suisse Asset Management, China Asset Management and the First Seafront Fund Management and listed within the next nine months.5

There was no change in the PBoC’s gold reserve in November. After nine consecutive months of gold purchases, the PBoC’s gold reserve has remained at 1,948t (2% of total reserves) since September. China has added 95.8t of gold to its reserves y-t-d.

Footnotes

1 Please visit: https://www.cnbc.com/2019/08/01/bond-market-fights-fed-interest-rates-drop-sharply-in-blowout-move.html?&qsearchterm=blowout%20jobs%20report for more details.

2Chinese New Year will occur on 25 Jan, 2020.

3 Please refer to gold imports under HS code 7108 which includes gold (Including Gold Plated with Platinum), unwrought or In semi-manufactured forms, or In powder form.

4 Excluding Bosera’s I & D shares as they only provide updates at the end of each quarter.

5 According to the CSRC, these fund companies have no more than nine months between the approval and the products’ listing.