Central bank buying and ETF inflows boosted H1 demand

Gold demand was 1,123t in Q2, up 8% y-o-y. H1 demand jumped to a three-year high of 2,181.7t, largely due to record-breaking central bank purchases.

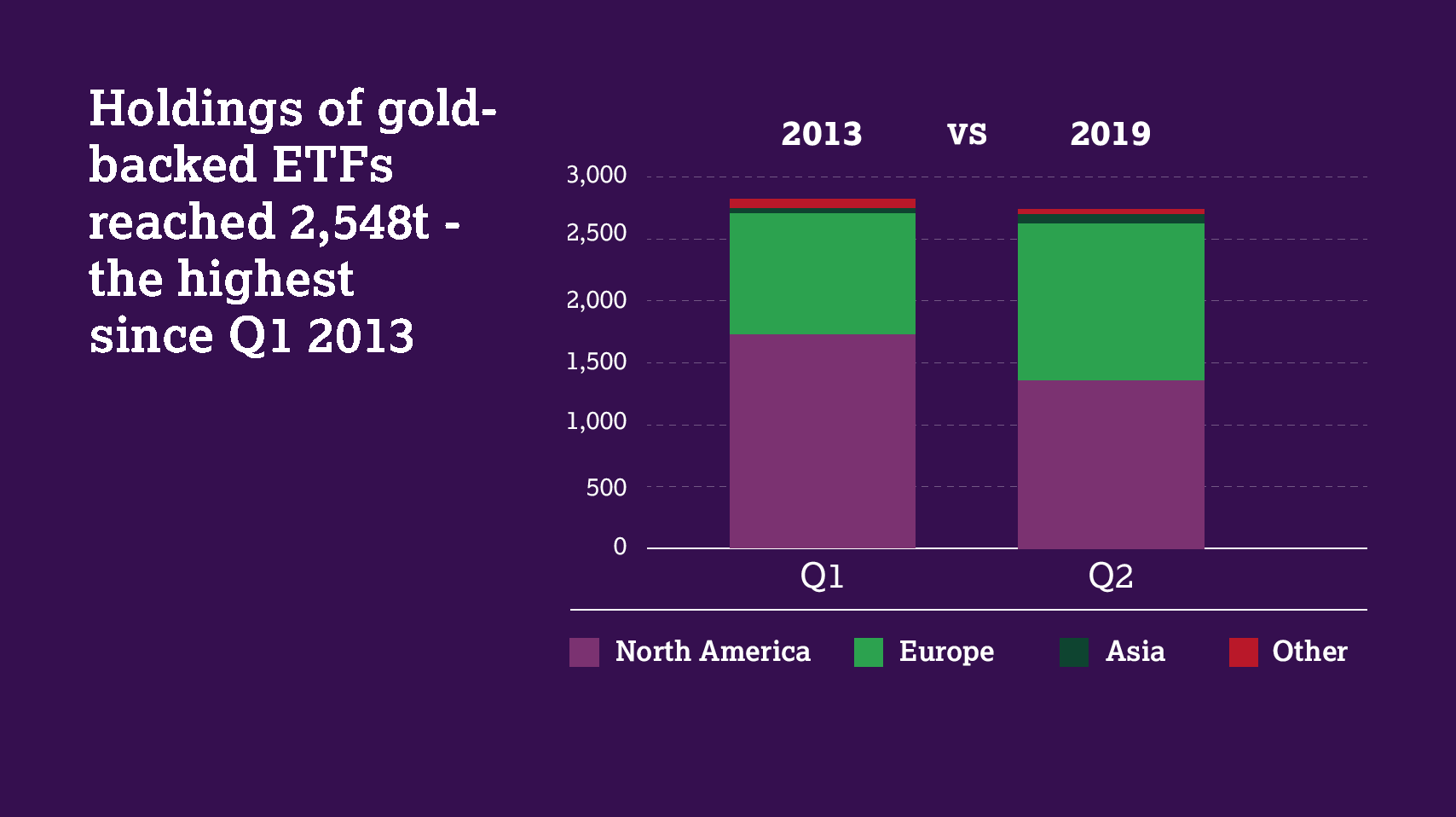

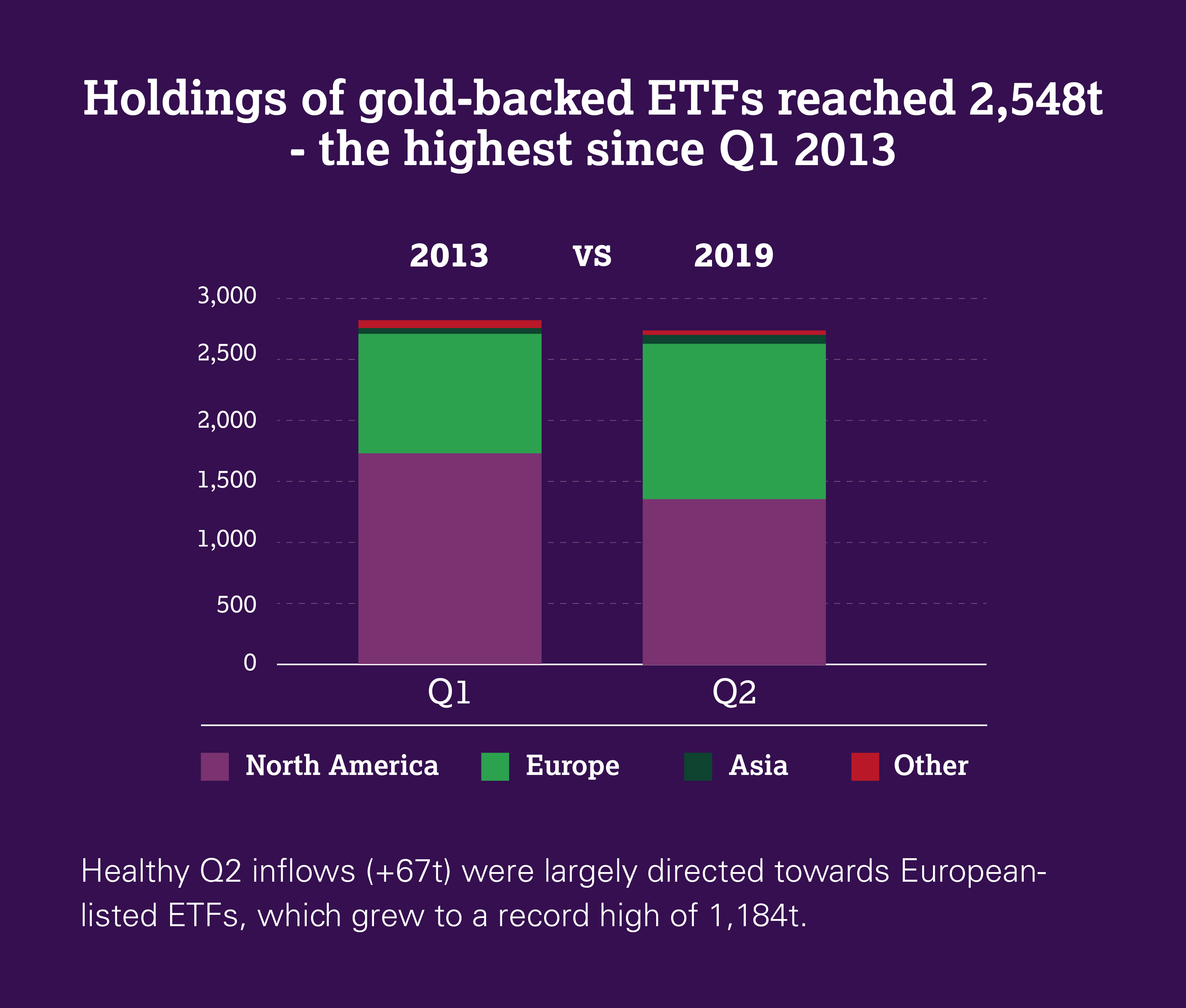

Central bank buying and healthy ETF inflows were the driving forces behind gold demand throughout the first half of 2019. Growth in H1 jewellery demand was largely the product of a more positive environment for Indian consumers. Shifts in bar and coin investment were very much price-related: as the gold price powered its way to multi-year highs, profit-taking kicked in and retail investment all but dried up. The technology sector reduced its usage of gold due to challenging global conditions, although the outlook is for this element of demand to establish something of a floor over coming quarters. Solid growth in both mine production and recycling fed into a 2% increase in total H1 gold supply.