India gold market update: Price strength fuels demand

17 February, 2026

Highlights

- Gold prices: new highs, then volatility, now in holding pattern

- Firm price trend spurs buying in jewellery and investment products

- Gold ETFs cross key milestones in January: record inflows, holdings and participation

- Digital gold purchases accelerate to record highs

- Slight uptick in RBI gold holdings

- Imports rise, led by investment demand.

Looking ahead

- Price stability may unlock deferred demand, while investment demand persists and wedding-related purchases support jewellery sales.

Records and resilience

The first six weeks of 2026 marked a record-breaking yet turbulent phase for gold. International gold prices scaled 12 all-time highs, breached US$5,400/oz,1 and then corrected sharply at the end of January. Despite the pullback, prices have largely hovered around the US$5,000/oz level,2 signifying resilience.

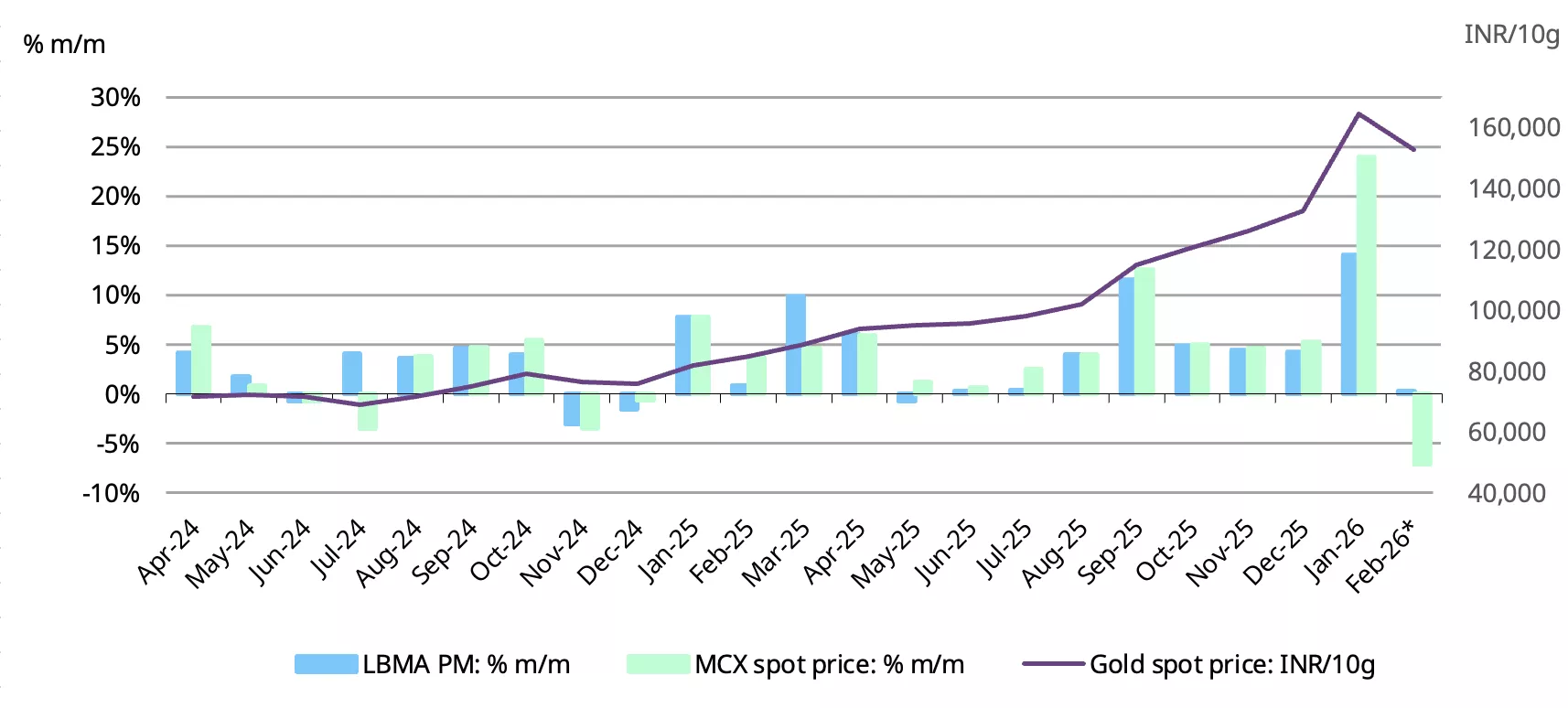

January closed with a 14% gain,3 the eighth consecutive monthly advance, with prices up a further 0.3% as of 13 February (Chart 1). Strong gold ETF inflows, persistent and widening geopolitical risks, and US dollar weakness powered the gains. Domestic gold prices mirrored the move in international prices, rising to a record INR175,231/10g.4 Gains were more pronounced in INR terms, with prices up 24% as of end-January, aided by the depreciation of the INR. Since then, however, prices have eased by 7%,5 in part reflecting the subsequent currency strengthening.

Chart 1: Momentum cools, strength holds

End-of-month LBMA Gold Price PM and MCX domestic spot price m/m changes and price level*

*Based on the LBMA Gold Price PM in US$ and MCX spot gold price as of 13 February 2026.

Source: Bloomberg, World Gold Council

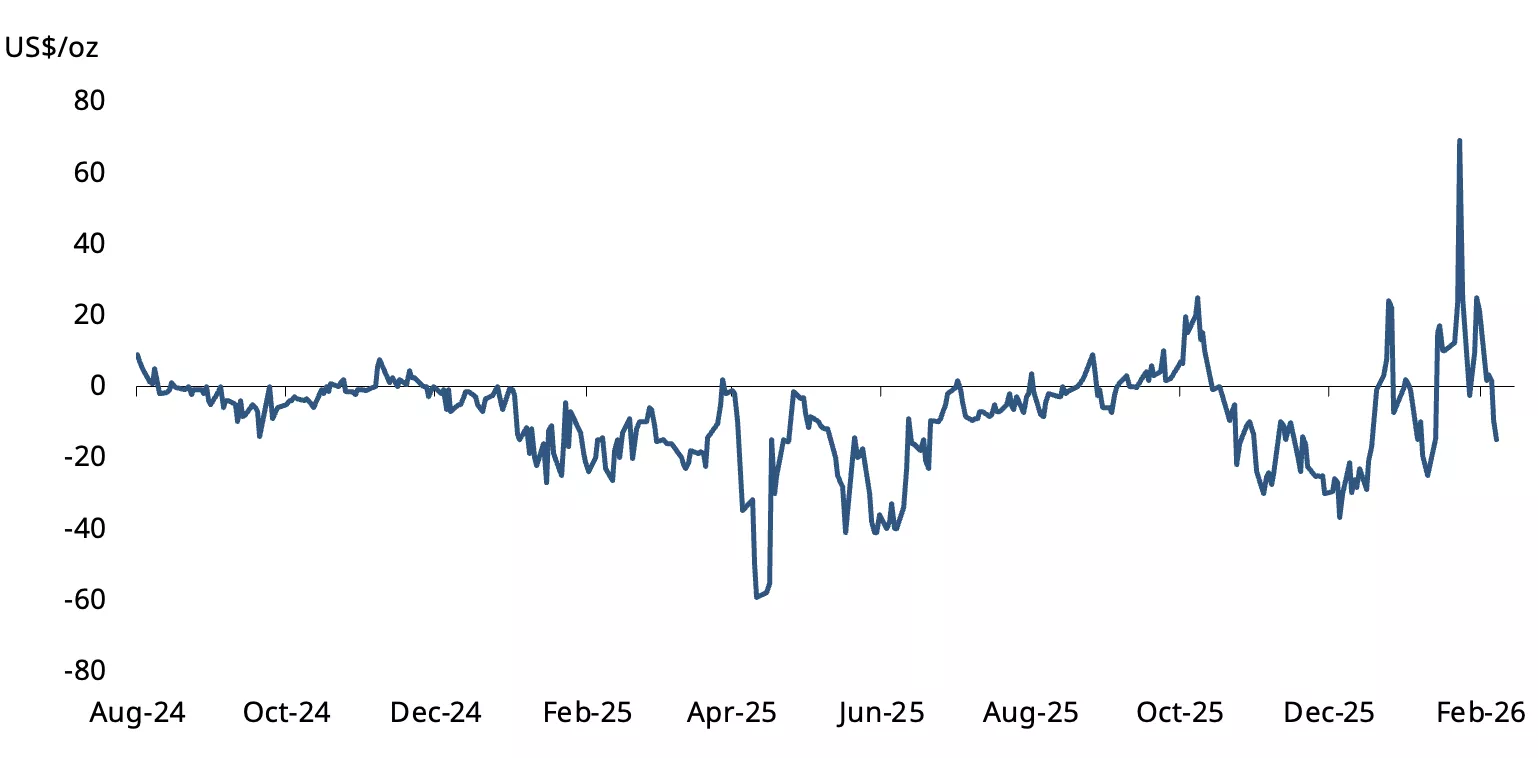

Domestic gold prices traded at a premium to international benchmarks during the latter half of January in the run-up to the Union Budget announced on 1 February. Multiple upward revisions in customs tariff value,6 expectations of a potential increase in import duty (up from 6%), and healthy underlying demand pushed domestic prices to a premium of US$10/oz - US$70/oz over international prices (Chart 2). This premium persisted until 11 February, after which domestic prices shifted to a discount, likely due to fewer revisions in customs tariff value and an increase in supply.

Chart 2: Premiums spike, then ease

NCDEX gold premium/discount relative to the international price*

*As of 13 February 2026.

Source: NCDEX, World Gold Council

Buying on strength and on dips

Feedback from physical market participants suggests that consumer demand has remained resilient following the inauspicious period (mid-December to mid-January), despite record-high gold prices and elevated volatility, with buying skewed towards investment products. Sharp price gains have reinforced bullish sentiment towards gold, with limited expectations of a meaningful correction. The rally has also attracted new buyers across age groups, and price dips have triggered purchases.

Jewellery buying has reportedly become measured, with consumers preferring staggered accumulation over lump-sum purchases, even for weddings. While jewellery demand volumes are estimated to be lower by ~20% y/y, in value terms sales growth has been up by ~25–30%, supported by elevated prices. Purchases through exchange of old gold remain high, accounting for ~40–70% of transactions in some markets. Investment demand for bars and coins continues to hold firm, with some participants indicating a potential shift in allocation from capital markets to gold. Meanwhile, liquidation activity remains limited, reflecting confidence among holders that prices are unlikely to see a sharp correction.

Gold ETFs scale new highs, outpacing equity flows

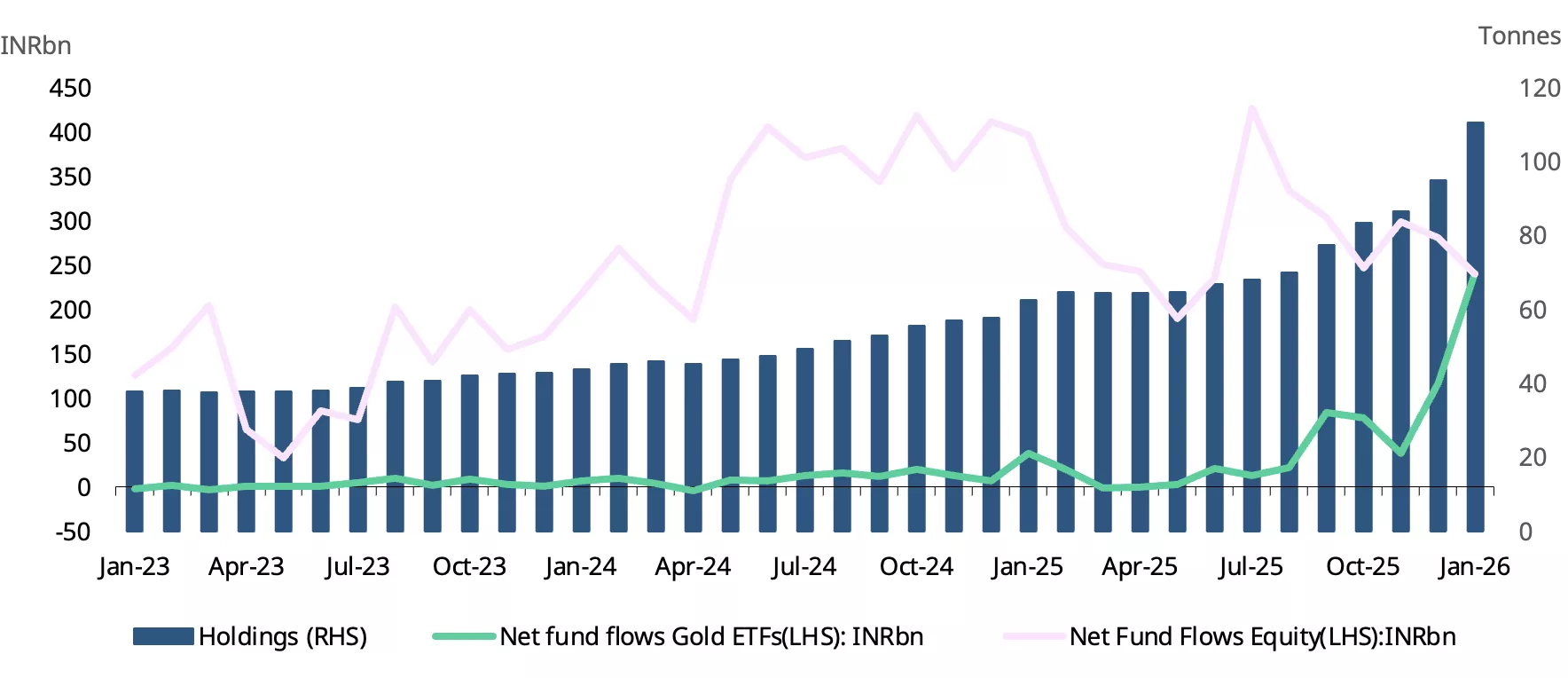

January marked a historic month for Indian gold ETFs, with record-breaking inflows, holdings, assets under management (AUM), and investor participation.

Indian gold ETFs recorded their ninth consecutive month of net inflows, reaching a record INR240bn (US$2.5bn), in line with our estimates. This was the third highest globally, after the US and China. Notably, inflows into gold ETFs surpassed those into equity funds7 for the first time, which could be indicative of evolving preference in investor asset allocation. The strong demand was underpinned by sustained momentum in the gold price and a likely shift towards diversification amid subdued performance in domestic equity markets.

The surge in inflows, along with elevated gold prices, led to a sharp increase in AUM, which climbed to INR1,842bn (US$20bn) by end January, a more than a threefold increase on a y/y basis. Furthermore, cumulative holdings across the 25 gold ETFs crossed the 100t milestone for the first time, with a record monthly addition of 15.5t taking total holdings to 110t. The momentum extended into February, with net inflows between 1 and 12 February estimated at INR46bn (US$501mn), translating into an additional 3t to cumulative holdings. This sustained trend highlights the resilience of investor interest in the asset class. Gold ETFs now account for 2.3% of the total mutual fund industry AUM, the highest share on record and a notable increase from 0.8% a year ago

Investor participation also increased markedly during the month, with 1.2mn new accounts (folios) added, bringing the total number of gold ETF accounts to 11.44mn. The persistence of inflows coupled with rising investor participation underscores the growing prominence of gold ETFs within investor portfolios.

Chart 3: All-time highs in investment flows and holdings

Gold ETF flows and equity flows in INRbn, and total holdings in tonnes*

*As of end January 2026.

Source: AMFI, ICRA Analytics, CMIE, World Gold Council

Strong uptick in digital gold buying

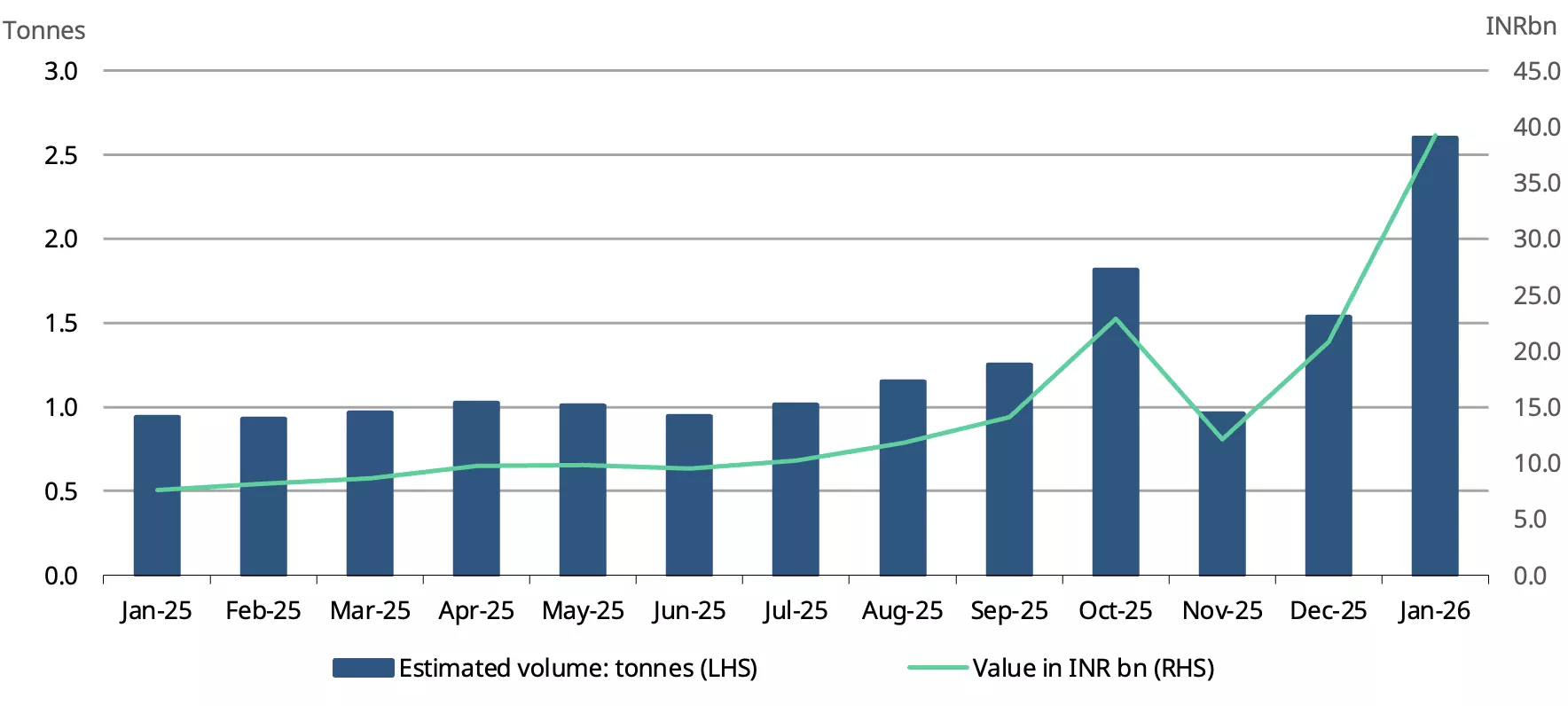

Buying interest in digital gold strengthened further in January, with activity reaching its highest level in the published data series dating back to January 2025 (Chart 4).

Purchases via the Unified Payments Interface (UPI)8 totalled INR39bn (US$432mn), representing a nearly 90% m/m increase and more than a fourfold y/y rise. In volume terms, an estimated 2.6t was purchased through this channel, marking a 70% m/m increase. The surge in buying activity appears to reflect momentum-driven demand, as both domestic and international gold prices breached multiple all-time highs during the month. In addition, the ease of transaction and low minimum investment requirement have continued to attract retail participation. Although digital gold products remain unregulated, they are increasingly gaining consumer attention, underscoring a growing need for comprehensive regulatory oversight.

Chart 4: Digital gold on an upswing

Purchase of digital gold, by value and estimated volume

Source: NPCI, World Gold Council

Marginal addition to RBI gold reserves

The Reserve Bank of India’s (RBI) gold reserves registered a marginal increase of 0.13t in January, marking the first monthly increase in four months and lifting total holdings to a record high of 880.3t. As of early February, gold accounted for 17.2% of the country’s foreign exchange reserves – the highest proportion on record. This marks an increase of nearly 6% compared to a year ago, attributable to the sharp appreciation in gold prices, which have risen by more than 70% during the period. In contrast, the RBI’s physical gold holdings expanded by just 1.3t, or 0.15%, over the same timeframe, suggesting that the increase in gold’s share of reserves has been primarily valuation driven rather than by net purchases.

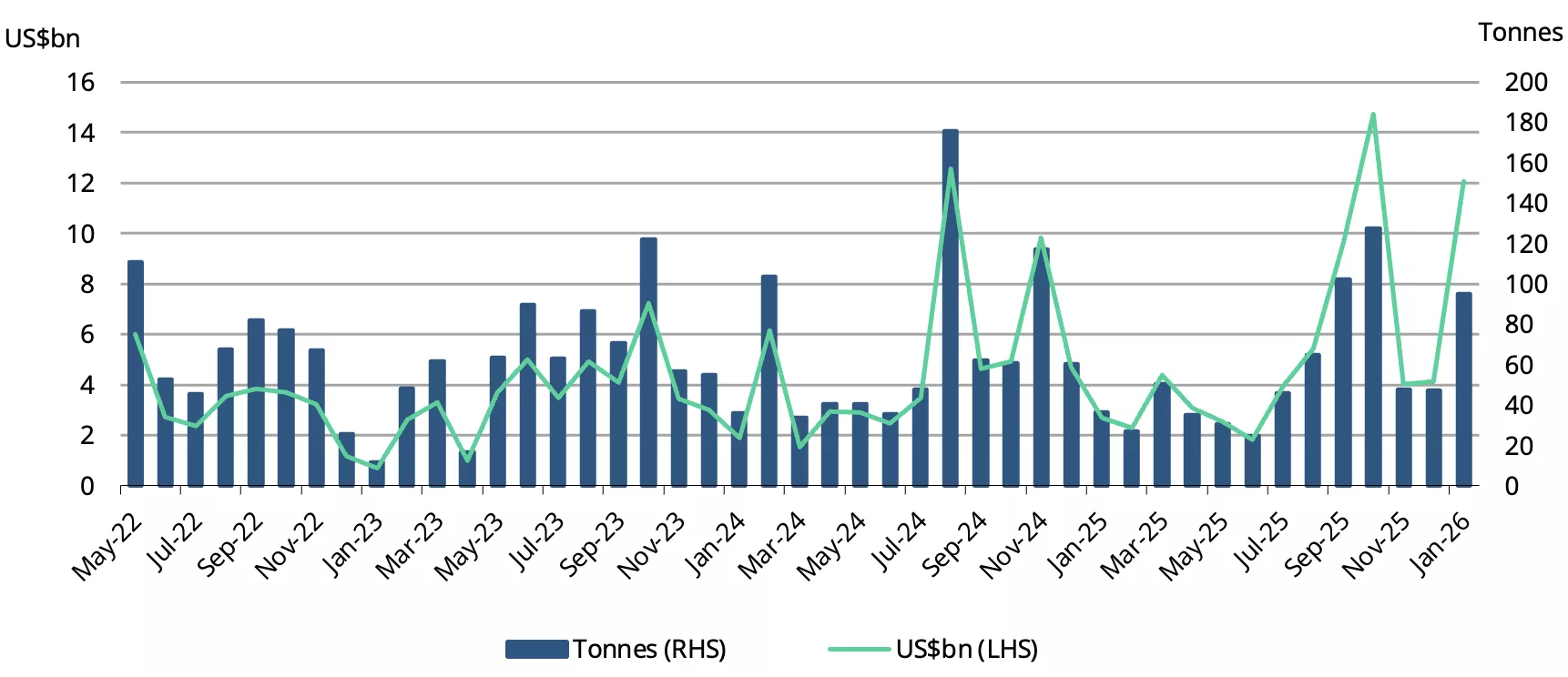

Imports climb

India’s gold imports rose to a three-month high in January, likely driven by strong investment demand across both gold ETFs and physical gold. Also, anticipation of a potential upward revision in import duty in the Union Budget may have prompted front-loaded shipments. Additionally, the surge in gold prices to record highs has pushed up the import bill. In value terms, gold imports stood at US$12.1bn, up 192% m/m. In volume terms, imports are estimated to be in the range of 95t to 100t.

Chart 5: Sharp pick-up in gold imports

Monthly gold imports in tonnes and US$bn*

*Includes World Gold Council estimates on volume of imports.

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Footnotes

1LBMA Gold Price PM on 29 January, 2026.

2As of 17 February 2026.

3Based on LBMA Gold Price PM.

4MCX spot gold price as on 29 January 2026.

5As of 13 February, based on MCX spot gold price.

6Customs duty on gold imports is levied on a notified value fixed by the Central Board of Indirect Taxes and Customs, rather than solely on invoice prices. There is no fixed schedule for revising the notified value. It is typically updated every few weeks and more frequently during periods when price volatility is high.

7A first: Gold ETFs knocked equity funds off the flow podium in January, Business Standard, 15 February 2026.

8Digital gold is a physical gold product that is purchased electronically by customers and held in professionally managed vaults until the customer chooses to sell the gold or take physical delivery. Providers of digital gold include payment application, jewellers and online investment platforms.

Disclaimer

Important information and disclaimers

© 2026 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.