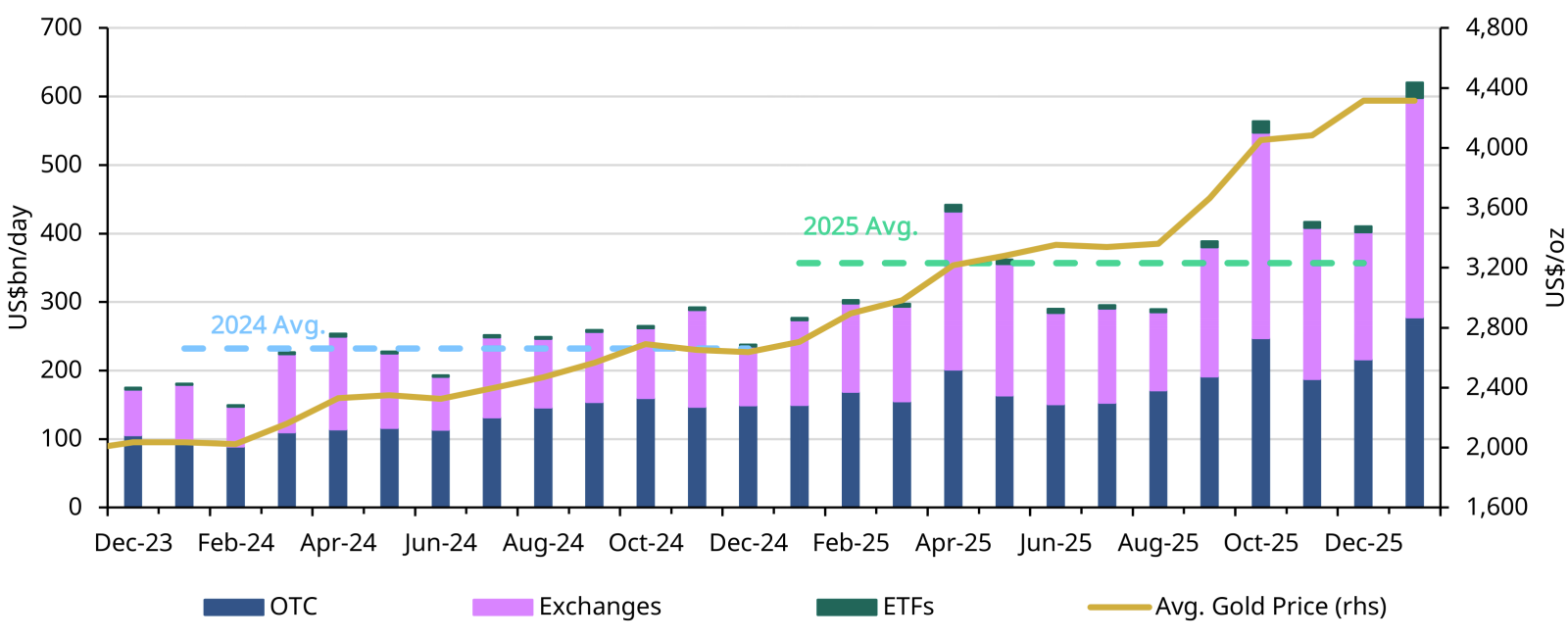

Volumes spike with volatility

Global gold market trading volumes6 surged to an average of US$623bn/day in January, marking a 52% m/m increase and standing 72% above the 2025 average.7 This rise occurred predominately in the final week of the month, when heightened volatility pushed activity to an average of US$963bn/day (Chart 2).

Over-the-counter (OTC) activity strengthened, with volumes rising to US$280bn/day (+29% m/m) on the back of increased LBMA trading. Meanwhile, elevated price volatility supported a sharp pick-up in derivatives trading across major exchanges, where volumes climbed to US$320bn/day (+73% m/m). Trading in global gold ETFs also rose meaningfully to US$23bn/day (+160% m/m), driven largely by a near 200% increase in North American ETF activity, partly due to options expiry and month‑end volatility.

Volume in tonnage terms moved in tandem, averaging 3,998t/day in January, up 35% m/m and well above the 2025 average of 3,247t/day. This represents the strongest month of trading activity since October of last year.

Positioning data showed a moderation: total COMEX net longs fell 6% during the month to 642t.8 This decline, however, does not capture the final days of elevated volatility. Money manager net longs slipped 4% to 378t, while Other net longs declined 8% to 264t, likely reflecting profit‑taking after steady net‑long buildup earlier in the month.

Chart 2: Gold volumes record strongest month on record in January

Average daily trading volumes by segment*

*Data as of 31 January 2026. Gold price based on the monthly average LBMA gold price PM USD.

For more information on trading volumes please visit our Trading Volumes page on Goldhub: Gold Trading Volume | Gold Daily Volume | World Gold Council.

Source: Bloomberg, Nasdaq, COMEX, ICE Benchmark Administration, Shanghai Gold Exchange, Shanghai Futures Exchange, ETF providers, Multi Commodity Exchange of India, Dubai Gold & Commodities Exchange, Japan Exchange Group, Thailand Futures Exchange, Borsa Istanbul, Bursa Malaysia, Korea Exchange, World Gold Council