You asked, we answered: What are the implications of the VAT reform in China?

7 November, 2025

Summary

- The Ministry of Finance and State Taxation Administration of China recently announced changes to the gold market value-added tax (VAT) policies, effective from 1 November 2025 to 31 December 2027

- Members who buy and sell gold directly on the Shanghai Gold Exchange (SGE) – the so-called “first-tier” supply – remain VAT free, however, members withdrawing gold are now subject to different policies depending on their purpose: investment or non-investment

- Members withdrawing physical gold and re-selling with investment purposes are not impacted as they are still subject to the current VAT charge (at 13%) on the value-added part1, while those with non-investment purposes now face higher costs when they re-distribute

- Clients who are registered with SGE members – also referred to as SGE clients – also face increased tax obligations when they withdraw gold from the SGE.

Impact

- With higher costs, gold jewellery demand in China may face some headwinds; however, it may can also be an additional catalyst for innovation amidst a competitive landscape

- Bar and coin demand is not directly impacted by the policy, but we may see greater concentration of gold buying through SGE members

- In certain instances, some consumers may choose to shift their gold jewellery purchases to investment products to take advantage of the lower tax burden

- Interestingly, the tax increase would widen the differential between the purchase price of a jewellery piece (which will include VAT) and its buy-back price (which excludes VAT); this could in turn have a dimming effect on jewellery recycling

Overview of the gold market tax reform

The Ministry of Finance and State Taxation Administration of China recently issued a few changes in the Chinese gold market tax policies, effective from 1 November 2025 to 31 December 2027. The changes are mainly related to the VAT system that is specific to the gold market. Last time there was a change in VAT that affected the gold market was back in April 2019, when VAT was lowered from 16% to 13% across the board.

The news came shortly after changes to taxation on platinum and diamonds2, which also came into effect on 1 November. But the recent VAT policy change affecting the gold market is different.

What’s the change? A VAT system varied by purpose

To understand the changes, we need to take a step back and review the VAT policy in place until 31st October.

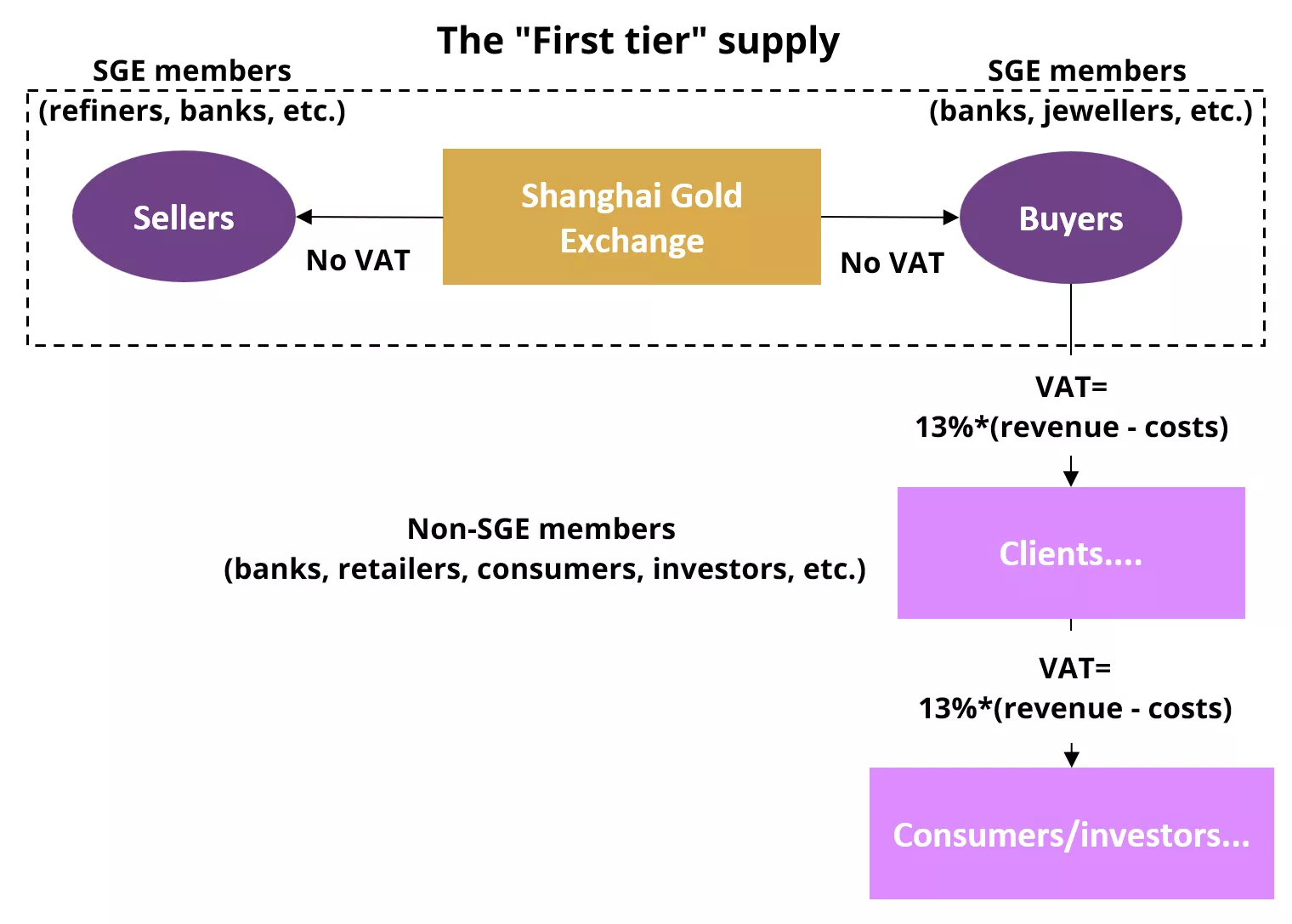

VAT is a circulation tax, meaning it is usually levied on the “value-added” part, or gross margin, at each point in the process of manufacturing, distributing and re-selling (Figure 1). We can break this down tier by tier:

- First tier: when SGE members/clients buy gold at the SGE from sellers, both the SGE and the purchasing members are basically exempt from VAT via the “immediate levy and refund” policy3

- Second tier: when SGE members/clients withdraw gold – to make it into branded investment products, or jewellery items – and re-sell, they pay VAT (at 13%) only on the value-added part (revenue minus costs), which is passed on to their clients

- Third tier or further: when retailers buy these products from SGE members/clients and sell to consumers, they also pay VAT only on their value-added part, which they pass on to their customers.

The value-added part described for the second and third (and beyond) above is usually much smaller for investment products, which have low labour charges, than for jewellery products, where mark-up is determined by craftsmanship.

Figure 1: An illustration of the previous VAT policy in China’s gold market

Source: Shanghai Gold Exchange, World Gold Council

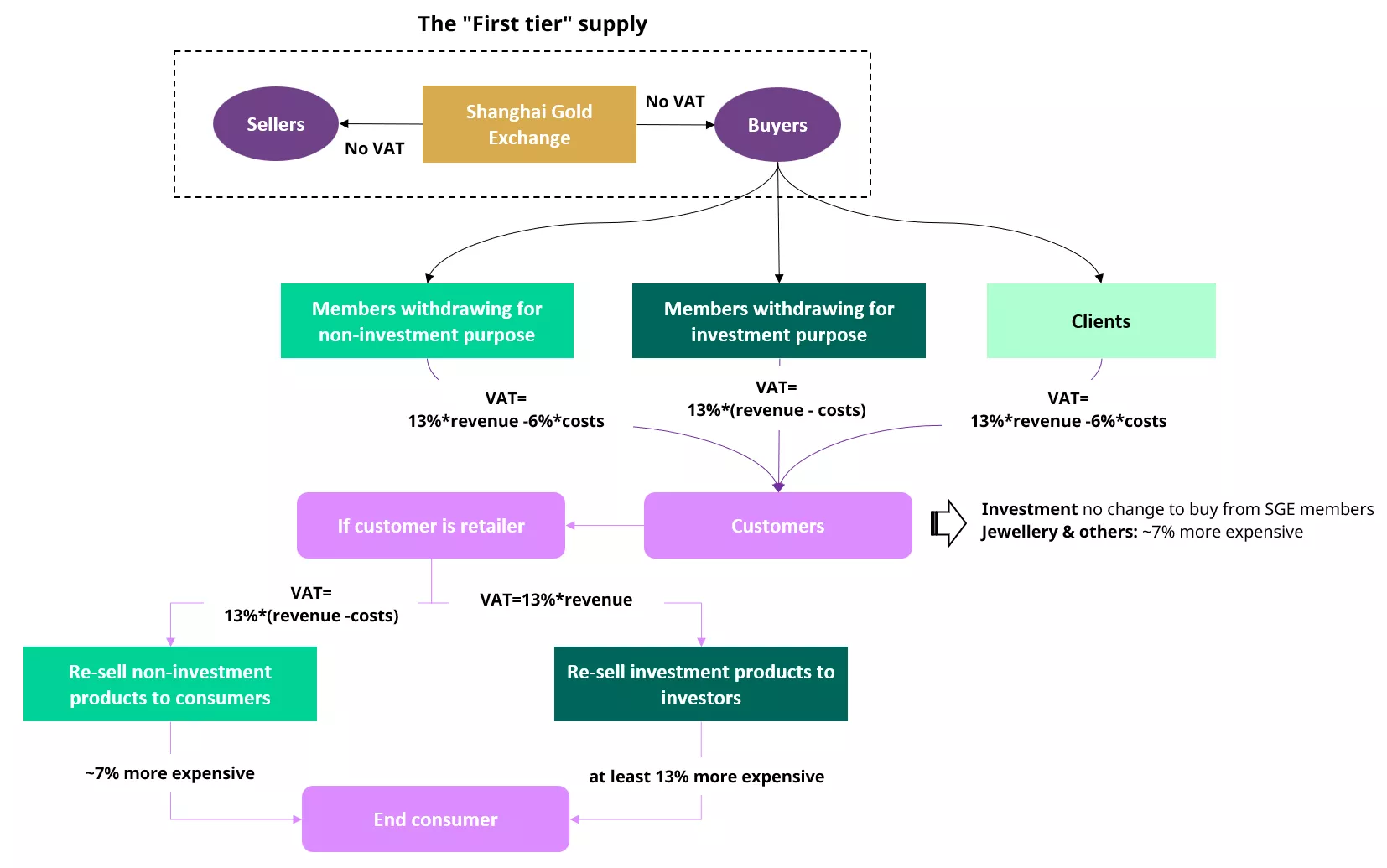

But now it is different. While SGE members that buy and sell gold on SGE in the “first tier” are still VAT exempt, the VAT treatment for members withdrawing gold is different, depending on their purposes. It is perhaps easier if we use hypothetical examples to explain the mechanics, illustrated in Figure 2.

SGE members who withdraw gold for investment purposes:

The VAT treatment of SGE members who withdraw gold and re-sell it for investment purposes hasn’t changed. For example, if Bank A withdraws 1,000 yuan worth of gold from the SGE, which represents its cost, refines it into a branded bar and resells it at 1,050 yuan, which represents the sales price before VAT. In this case the applicable VAT is 13%* (1,050/1.13) – 13%* (1,000/1.13) = 5.8 yuan, raising the sale price after VAT to 1,055.8 yuan.4 This has not changed under the new tax reforms.

However, the input VAT tax deduction ends there. Here is what happens if Bank A sells the same product to a Client at the same price, and the Client sells this to a consumer at 1,100 yuan:

The Client’s tax burden is now 13% * (1,100/1.13) – 0 = 127 yuan, pushing the total sale price after VAT to 1,227 yuan. The new tax rule stipulates that SGE members cannot issue a special VAT invoice when they re-sell their investment products to any client, leaving the client with no “cost credit” to deduct. In this situation, the consumer will most likely choose to buy the same investment product directly form Bank A, which is a SGE member, as it would be cheaper.

SGE members who withdraw gold for non-investment purposes:

SGE members who withdraw gold for non-investment purposes can now only deduct their sales VAT (at 13%) by 6% of their costs, instead of 13% previously. And the SGE issues only ordinary invoices instead of special VAT invoices to these members. For example, let’s assume that Jeweller B withdraws 1,000 yuan worth of gold from the SGE and plans to re-sell the jewellery product made from that SGE gold bar at 1,100 yuan:

- Before: Jeweller B’s VAT burden is 13% * (1,000/1.13) – 13% * (1,100/1.13) = 12 yuan, meaning the final sale price to its client after VAT will be 1,112 yuan

- After: Jeweller B’s VAT burden is now 13% * (1,000/1.13) – 6% * 1,100 = 55 yuan, raising the sale price after VAT to 1,155 yuan, which is 4% more expensive than the previous price of 1,112 yuan

Suppose B’s client, Retailer C, plans to sell the same product for a hypothetical additional 20% profit, at 1,386 yuan (cost at 1,155 yuan), then the total VAT burden passed on to the end consumer will be 13%* (1,155* 1.2/1.13) – 13% * (1,155/1.13) = 27 yuan, meaning that the end consumer in this hypothetical example would pay 1,413 yuan for the product. In general, consumers will now likely pay more for their gold jewellery as the tax is usually passed down from the seller.

Note that for illustrative purposes, we have only considered VAT in the above examples and have excluded all other taxes, such as stamp duty, city construction tax, education tax, etc.

SGE non-member clients who withdraw gold:

SGE non-member clients who open accounts via SGE members, are treated the same as SGE members who withdraw gold for non-investment purposes. They will need to sell their products at higher prices as they can only deduct their VAT at 6% of costs, rather than 13% as previously.

Figure 2: A stylised illustration of the new VAT policy’s impact on China’s gold market

Source: Shanghai Gold Exchange, World Gold Council

What’s the impact: pain or gain?

It is obvious from the above analysis that the new VAT policy will impact investment demand and jewellery consumption differently. In the investment sector:

- Bar and coin investors won’t see any change as long as they buy gold investment products directly from SGE members

- In addition, there is no impact on the buying and/or selling of gold ETFs and gold accumulation plans (GAP)

- However, the dominance of SGE members in China’s investment sector is likely to increase due to their VAT advantages compare to industry participants further down the chain, as shown in Figure 2

- Gold bar sales may further pick up: while various risks, expectations of lower yields, and anticipation of further gold price strength could provide continued support for investment, gold jewellery consumers may be tempted to buy gold bars and send to jewellery shops or craftsmen for processing in order to avoid the additional VAT on direct gold jewellery purchase

But the implication is different for gold jewellery consumption:

- Gold jewellery products will likely be more expensive as they now reflect the additional tax passed to consumers

- Due to its negative correlation with the gold price, China’s gold jewellery demand is likely to face headwinds. Our annual gold jewellery demand model shows that, keeping other factors constant, for every 1% increase in the gold price, demand could be reduced, in tonnage terms, by 0.7% in the same year

- Yet looking at the dynamic correlation between changes in Chinese gold jewellery demand and the gold price we found that as the price increases, the elasticity of demand reduces, suggesting that demand may become less sensitive to further cost rises as the gold price has already surged to its record high

- The ongoing consolidation of gold jewellery retailers may accelerate, potentially persuading jewellers to further shift their focus from price competition to innovative design and craftmanship in order to attract consumers

- Gold jewellery sales performance may diverge between mainland China, Hong Kong SAR and Macau SAR as the latter two are not impacted by the new VAT policy changes and could, therefore, offer cheaper prices.

Conclusion

The new VAT policy will have implications across China’s gold market, particularly in the jewellery sector. Based on our recent field trip in Shenzhen, China’s gold jewellery manufacturing and wholesale hub, we observed:

- Gold jewellery prices at manufacturers and wholesalers’ showrooms in Shenzhen have already increased, reflecting their additional VAT burdens; meanwhile, retail prices at jewellery retailer shops across the country have also risen since 3 November

- Higher costs have weighed on retailers’ restocking activities further: tepid National Day Holiday sales and a later-than-usual 2026 Chinese New Year’s holiday, a traditional gold jewellery sales boost, have already dashed their replenishment enthusiasm in Q4

- Activities of “buying bars from SGE members and sending for gold jewellery re-making” might begin to intensify.

Meanwhile, gold investment products sold via SGE members’ channels, i.e. major commercial banks and direct sales stores of gold jewellery brands who are also SGE members, are not impacted. But non-member clients such as small regional banks, independent jewellery shops and franchises of major gold jewellery brands, have already raised their gold bar prices by around 13%.

Gold jewellery recycling activity is also likely to be impacted. Retail prices have climbed while recycling prices have remained close to the SGE benchmark (usually marginally lower than SGE prices), leading to a widening price gap and a perceived loss for consumers, which may suppress household recycling interest.

Looking ahead, we expect this VAT adjustment to have a more pronounced effect on China’s gold jewellery industry by raising costs for consumers. It also reinforces an existing challenge for jewellers: how to attract buyers in a high-gold-price environment. As we have noted in the past, contributions from Hard Pure gold jewellery products as well as pure gold + other materials have risen due to their better affordability and innovative designs. We believe this could continue to help retail jewellers’ sales and profits in the future.

With the real estate sector weakening, growth uncertainty remaining, yields potentially declining and household willingness to save hovering around the record high, we see continued strength in China’s gold investment demand.

Footnotes

1See: Value Added Tax in China - China Guide | Doing Business in China

2See: China withdraws tax exemptions on platinum and diamonds.

3This is a tax benefit where sellers and buyers – SGE members – are allowed to pay VAT first then get the refund.

4Note that for illustrative purposes, we have only considered VAT in all examples here and have excluded all other taxes, such as stamp duty, city construction tax, education tax, etc.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.