VAT in China

16 April, 2019

What’s driving this?

Well, first let’s take a step back and answer a different question. How should the amount of gold leaving SGE vaults be interpreted? Some people take it as a proxy for demand. We don’t. Gold leaving SGE vaults doesn’t just capture gold that flows through the supply chain to ultimately reach the end consumer; it also captures gold used in leasing transactions, round-tripping and other activities which are not connected to jewellery, investment or technology demand.

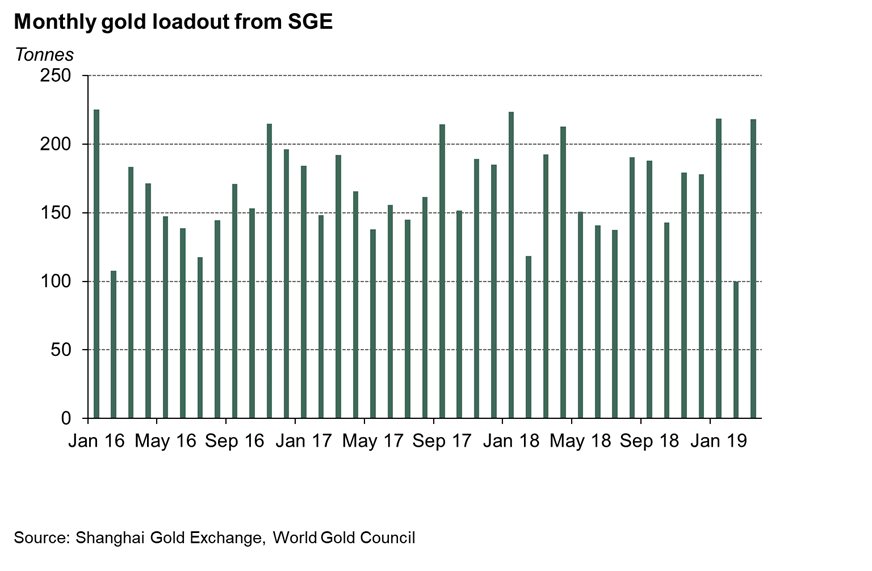

The surge in March is a good example of why the SGE loadout number should be treated with caution.

On 1st April, the Chinese authorities lowered the rate of VAT applied to gold from 16% to 13%. Because of the way tax credits work, businesses taking delivery of gold from the SGE on or before 31st March and selling it on or after 1st April will benefit from paying a lower effective rate of tax. Because of this, businesses - especially jewellers - loaded up on gold as much as possible in the final two weeks of March.

So, the surge in gold leaving SGE vaults in March does not reflect an upsurge in demand. Rather, it reflects businesses trying to minimise their tax burden and to boost margins.