India gold market update: Seasonal strength

21 November, 2025

Highlights

- Gold prices soften from record highs yet remain supported

- Domestic prices slide back into discount

- Gold demand, led by investment buying, strengthened during the festive period, but softened thereafter

- Gold ETFs continue strong momentum in October with record inflows and new investors

- Gold imports soar in October, despite the price rally

Looking ahead

- The busy wedding season over the coming months (November–March), with a high number of anticipated weddings, is expected to support jewellery demand.

- Investment interest in gold is likely to persist amid broadly bullish sentiment around gold.

Prices retreat from peak, but maintain firm trend

International gold price1 recorded a sharp rally in October, hitting its 50th record high of the year during the month. Although price eased by about 7% from the peak, it still ended October 5% higher at US$4,011.5/oz. The momentum carried into November, with price up nearly 3% m-t-d as of 19 November. This sustained performance has lifted gold’s y-t-d gains to 58%.

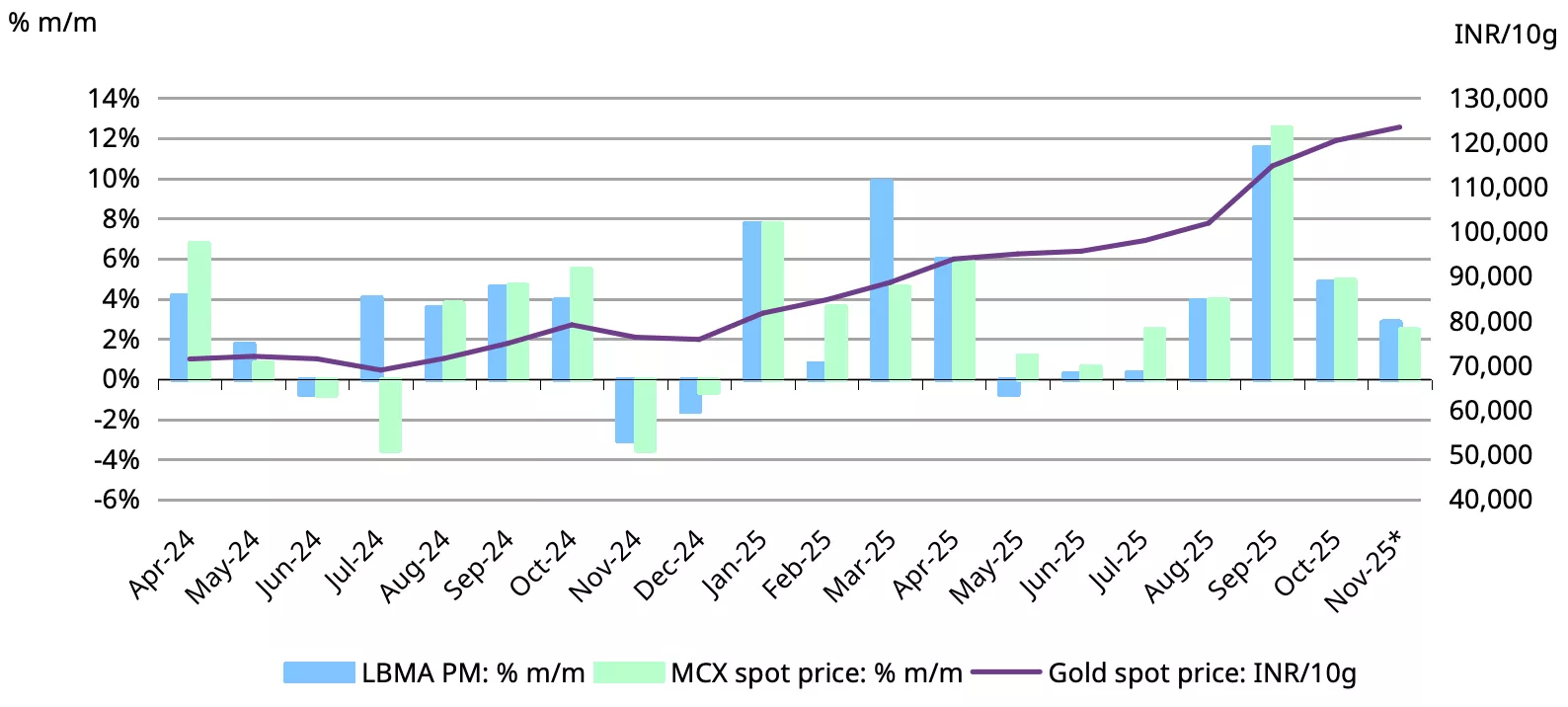

Chart 1: Prices slip from recent peak yet continue to hold up

End of month LBMA Price PM and MCX domestic spot price levels and m/m changes*

*Based on the LBMA Gold Price PM in USD and MCX spot gold price as of 19 November 2025.

Source: Bloomberg, World Gold Council

Our Gold Return Attribution Model (GRAM) suggests that recent movements in international gold prices have been driven by geopolitical risk, higher implied volatility, a stronger US dollar, as well as momentum and evolving interest-rate expectations.

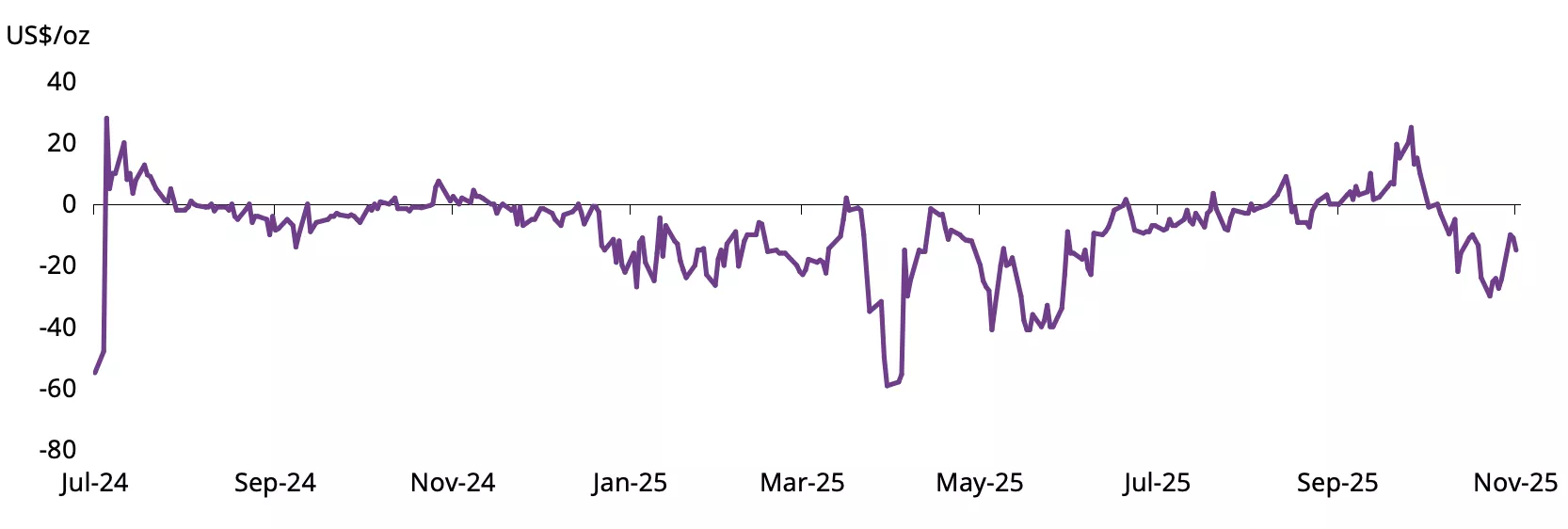

Domestic gold prices have largely tracked the international trend but have delivered even stronger returns, recording 63% y-t-d growth. The higher domestic gains are attributed to the 3.3% depreciation of the Indian rupee. Domestic gold prices, which had mostly traded at par with, or at a premium to, the international price over the past two months, shifted to a discount following the peak festive demand period (Chart 2), with the m-t-d2 discount averaging US$18/oz.

Chart 2: Domestic gold prices slide to discount

NCDEX gold premium/discount relative to the international price*

*As of 19 November 2025.

Source: NCDEX, World Gold Council

Festive demand shines, tapers after

Festive demand around Diwali and Dhanteras3 – India’s peak gold-buying occasions – was reportedly strong despite record-high prices, according to feedback from industry stakeholders. Market participants consistently highlighted that the strength was driven primarily by investment-oriented buying, particularly bars and coins, with some noting volume nearly doubling from a year ago. E-commerce platforms also saw solid sales,4 and digital gold purchases rose too. Unified Payments Interface (UPI) data shows digital gold purchases increasing 62% m/m to INR22bn (US$259mn) in October.5 In tonnage terms, the volume rose 45% m/m to 1.8t.

Jewellery sales also held up well during the festive period, with retailers reporting healthy sales across both single-store and large multi-store formats, the latter benefitting from brand trust and promotional initiatives. Although jewellery volumes were softer due to elevated prices, the overall value of sales remained healthy, reportedly up by around a quarter y/y for many, reflecting resilient festive buying sentiment.

Post-Diwali, demand has reportedly softened. Industry feedback suggests market activity in November has been subdued, despite the onset of the wedding season. Jewellery buying is largely wedding-driven, while investment demand persists. Supply of old gold into the market has reportedly moderated. Trade participants attribute this to consumers having exhausted surplus gold for immediate needs and now choosing to hold onto jewellery in expectation of further price gains. Jewellers remain cautiously optimistic that the ongoing wedding season (November–March) will boost jewellery sales, given the expected large number of weddings.6

ETFs: persistent strong inflows

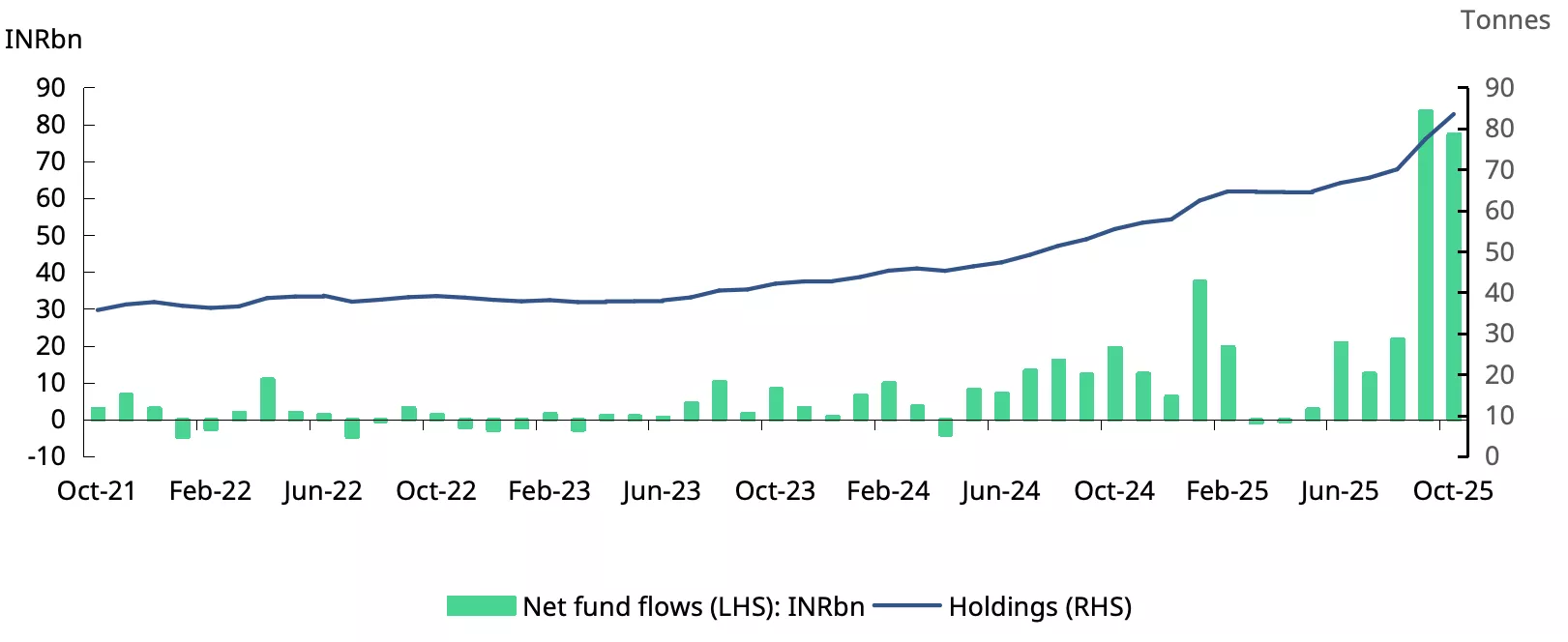

October marked the sixth consecutive month of strong inflows into Indian gold ETFs, emphasising the growing appeal of gold as an investment asset in various forms.

Net inflows for the month were INR77bn (US$876mn), a modest 8% decline from the previous month, largely in line with our estimates.7 Despite this moderation, the figure remained significantly higher than the y-t-d average of INR28bn (US$315mn). The dip was primarily due to a sharp rise in redemptions, which hit a record INR21bn (US$244mn). This surge in redemptions was likely driven by profit-taking following the rally in gold prices. Gross inflows for the month, however, set a record at INR99bn (US$11bn). The exceptional rise in gold prices likely drew investor attention, contributing to the strong inflows, while ongoing safe-haven demand further reinforced this trend. Net inflows have continued into November, reaching INR24bn (US$269mn) during the first 17 days of the month.8

The first 10 months of 2025 have been particularly strong for gold ETFs, with cumulative inflows totalling INR276bn (US$3.1bn) – the highest annual inflows on record. This surpasses the total inflows from March 2020 to December 2024. This unprecedented demand has propelled the assets of these funds to historic levels. As per AMFI data, as of end October, the assets under management (AUM) of gold ETFs climbed to a record INR1,021bn (US$11.5bn) and gold holdings rose to 83.5t,9 nearly a third of which were added in 2025 alone.

The growing interest in gold ETFs was further evidenced by the increase in new investors. In October, a record 911,000 new accounts (folios) were added, bringing the total number of folios to 9.57mn, reflecting a 49% increase y-t-d.

In addition to the strong performance of existing gold ETFs, the market saw the launch of a new gold ETF in October,10 bringing the total number of gold ETFs in India to 23.

Chart 3: Indian gold ETF rally continues

Monthly gold ETF flows in INRbn, and total holdings in tonnes*

*As of end October 2025.

Source: AMFI, ICRA Analytics, CMIE, World Gold Council

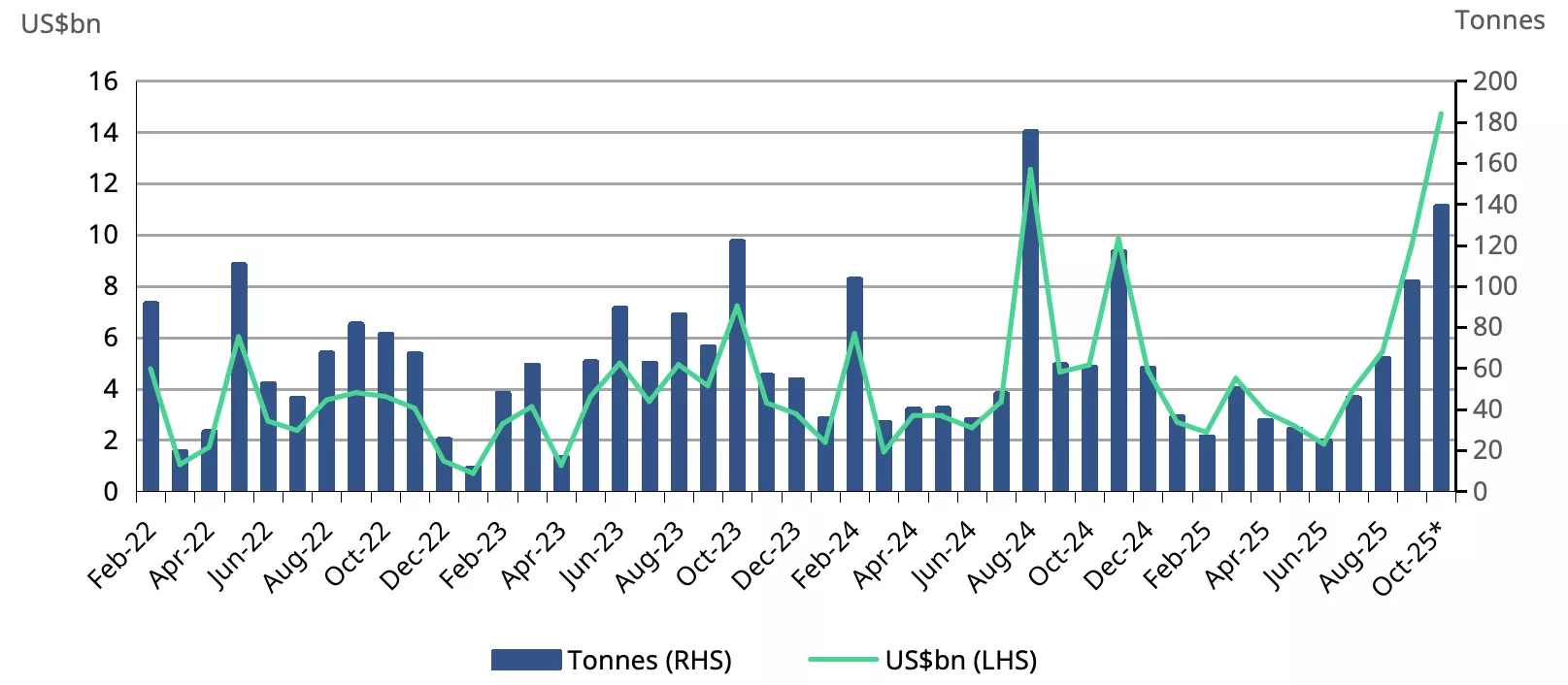

Imports surge to new peak in October despite price rally

Gold imports registered a sharp surge in October, marking the fourth consecutive month of growth in both value and volume terms. Notably, the increase occurred despite domestic gold prices touching record highs – rising 60% y/y and 11% m/m11 – indicating resilient domestic demand. In value terms, imports climbed to US$14.7bn, the highest on record, translating into a ~200% y/y and 53% m/m increase. Import volumes also rose substantially, with inflows estimated at 137–142t, compared with 102t in September and 61t a year earlier. The October surge was largely driven by seasonal factors, i.e. the Diwali festivities and the onset of the wedding season.

On a y-t-d basis, gold imports have totalled US$51bn, an increase of 16% y/y. In contrast, the import volumes, estimated at around 559t, are down 12% from a year ago, reflecting the impact of elevated gold prices.

Chart 4: Seasonal boost lifts gold imports

Monthly gold imports in tonnes and US$bn*

*Includes World Gold Council estimates on volume of imports.

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Footnotes

1LBMA Gold Price PM

21-19 November 2025.

318–21 October 2025.

4Quick delivery of gold, silver coins on the rise this Dhanteras, Economic Times, 18 October 2025.

5National payments corporation of India monthly statistics.

6Wedding season to generate INR6.5 lakh crore, NDTV, 30 October 2025.

7WGC’s preliminary estimate, based on partial data, indicated net fund inflows of US$850mn.

8Based on World Gold Council’s estimates of fund-wise net inflows from 1 to 17 November 2025.

9Based on the portfolio disclosures of the various gold ETFs for October 2025.

10Choice gold ETF was launched in October 2025.

11The average landed gold price which is the LBMA Gold Price AM adjusted for import taxes and exchange rate.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.