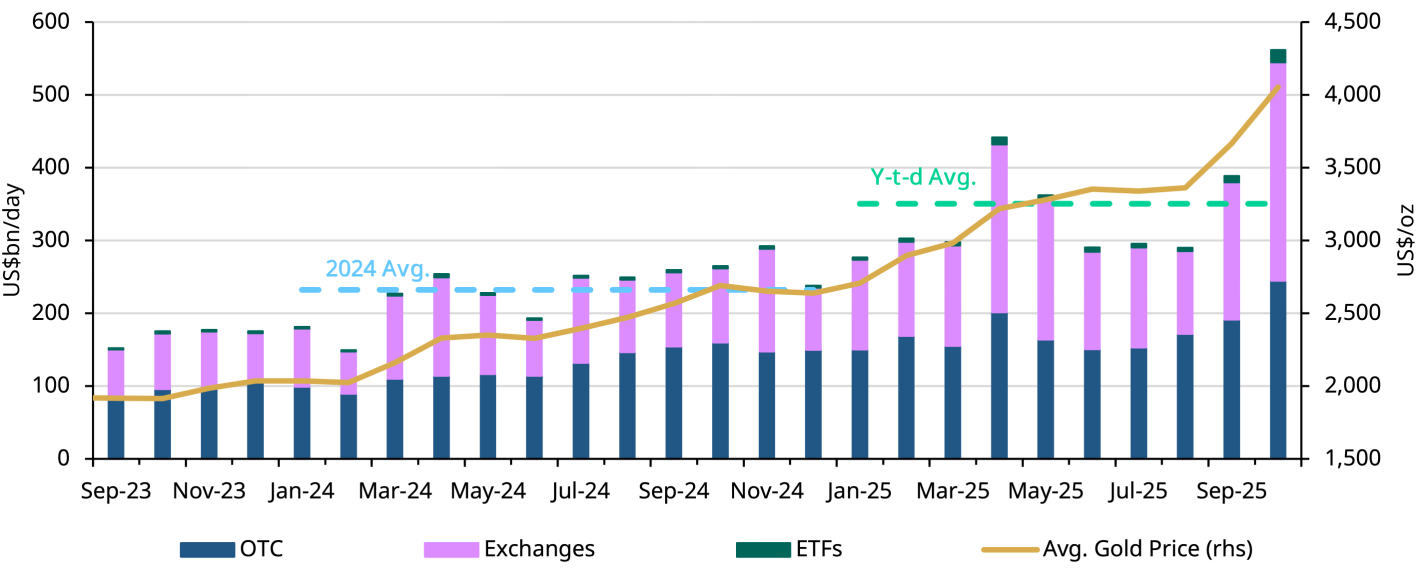

Volumes rise with volatility

Gold market trading volumes surged in October to a record high of US$561bn per day – increasing 45% m/m.3 Volumes jumped alongside as traders piled into gold when prices hit record highs before pulling back 8% into month-end. As a result, all trading segments saw higher activity m/m.4

Exchange-traded volume rose 59% m/m to an average of US$300bn/day, driven by strong activity on both COMEX (+49%) and the Shanghai Futures Exchange (+86%).

OTC trading increased 28% m/m to US$245bn/day – 92% higher than the 2024 average of US$128bn/day.

Gold ETF trading volumes surged to a record US$17bn/day (+100% m/m), led primarily by North American funds, which averaged US$12.5bn/day (+93% m/m) and accounted for roughly 75% of global physically backed ETF trading.

Trading volume in tonnage terms was equally impressive, rising 31% m/m to 4,287t per day, just 1% shy of the record set in April (4,251t/day).

The increase was largely driven by higher activity in LBMA OTC and COMEX markets, which averaged 1,725t (+16% m/m) and 1,492t (+36% m/m) per day, respectively. While smaller in size, gold ETF trading also grew sharply, up 80% m/m to 125t per day, led by North America (95t/day, +73% m/m) and Asia (22t/day, +109% m/m).

Lastly, with the government shutdown preventing updates to net long positioning, futures open interest fell 4% m/m to US$235bn at month-end, suggesting a decline in long positions.5 Notably, open interest had reached its highest level since 2013 – US$261bn –during the week ending 17 October.

Chart 3: Gold volumes surged recording their strongest month in 2025

Average daily trading volumes by segment*

*Data as of 31 October 2025. Gold price based on the monthly average LBMA gold price PM USD.

For more information on trading volumes please visit our Trading Volumes page on Goldhub: Gold Trading Volume | Gold Daily Volume | World Gold Council.

Source: Bloomberg, Nasdaq, COMEX, ICE Benchmark Administration, Shanghai Gold Exchange, Shanghai Futures Exchange, ETF providers, Multi Commodity Exchange of India, Dubai Gold & Commodities Exchange, Japan Exchange Group, Thailand Futures Exchange, Borsa Istanbul, Bursa Malaysia, Korea Exchange, World Gold Council