China gold market update: Wholesale demand rebounded

17 October, 2025

Highlights

- Gold continues to shine. The LBMA Gold Price PM in USD and the Shanghai Benchmark Gold Price PM (SHAUPM) in RMB both soared by 12% last month, extending y-t-d gains to levels unseen for decades

- Gold withdrawals from the Shanghai Gold Exchange (SGE) reached 118t in September, 33t higher m/m and 4t higher y/y; Q3 ended with a total withdrawal of 297t, 9t lower y/y

- Chinese gold ETFs saw inflows in September (RMB4.5bn, US$622mn), narrowing their Q3 losses, and gold futures activity on the Shanghai Futures Exchange (SHFE) improved notably

- The People’s Bank of China (PBoC) reported its 11th consecutive monthly gold purchase, adding 1.2t in September and pushing the Q3 total to 5t.

Looking ahead

- After re-stocking in September, gold jewellery retailers will likely dial back their replenishment in October, following seasonal trends. Furthermore, the gold price rally may continue to weigh on gold jewellery consumption, adding to retailer caution.

- Investment demand for gold may be buoyed by the attractive gold price rally, particularly when the local equity momentum took a hit amid flaring US-China tension.

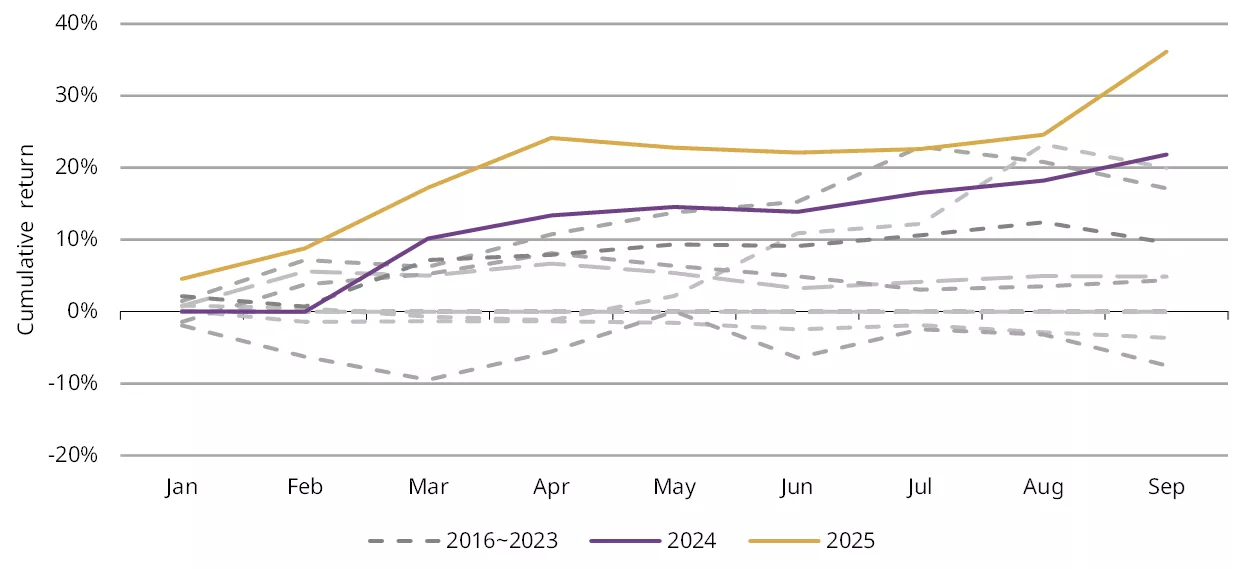

Chart 1: The SHAUPM saw its strongest Q1~Q3 performance since its launch in 2016

Cumulative return of the SHAUPM in RMB between Q1 and Q3*

*Data based on SHAUPM monthly returns between May 2016 and September 2025 as the SHAUPM was launched on 25 April 2016. The dotted grey lines represent cumulative returns between 2017 and 2023.

Source: Shanghai Gold Exchange, World Gold Council

Another record-shattering month

Gold’s strength continued in September. The LBMA Gold Price PM recorded its largest monthly increase since January 2012 and its strongest quarterly performance since Q1 2016. But more notably, the SHAUPM registered its strongest month on record and its second strongest quarter ever with a 14% gain—just behind Q1 2025’s 18% surge.

Having reached record highs 36 times during the first three quarters of 2025, the SHAUPM’s y-t-d return extended to 36%, to date the best year on record (Chart 1). The LBMA Gold Price PM jumped 43% between January and September, the best y-t-d performance since 1979. Gold’s relatively weaker return in China was mainly due to a 4% appreciation in the RMB against the dollar during the period.

It is also worth noting that the gold price has carried its bullish momentum into October, with the LBMA Gold Price PM breaching the US$4,000/oz threshold for the first time ever on 8 October and the SHAUPM surging nearly 5% during the month’s first trading day.1

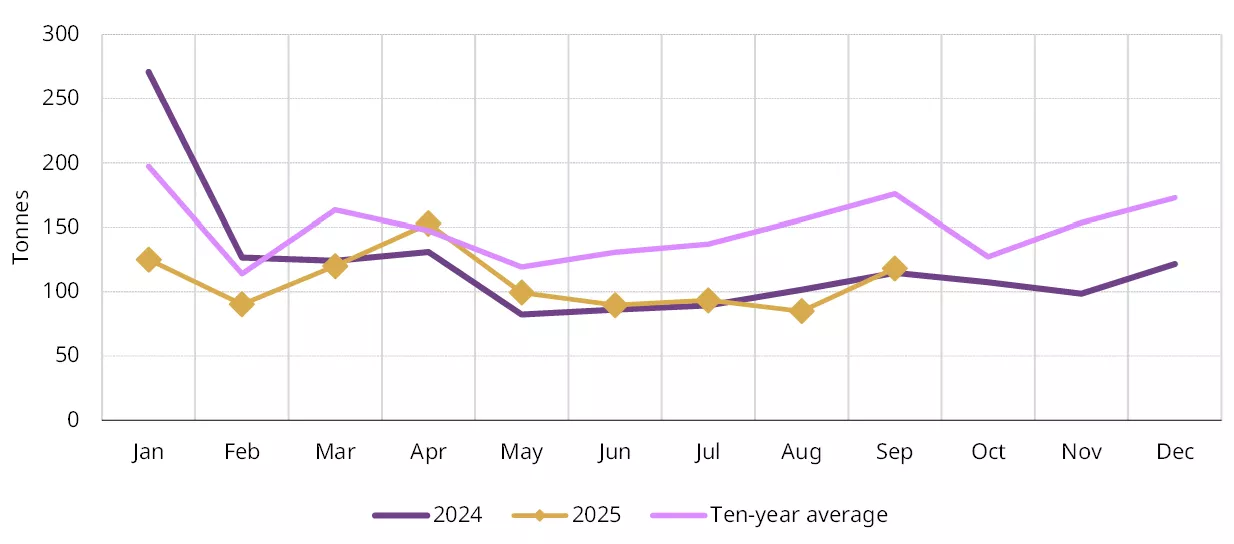

Wholesale demand ended Q3 with an improving September

Wholesale gold demand saw a 33t m/m rebound in September, reaching 118t; 4t higher y/y (Chart 2). Nonetheless, it remained 33% below the long-term average. Our interactions with market participants inform us that as the gold price resumed its uptrend, bar and coin sales improved during the month, supporting wholesale demand. But some investors took the opportunity to book profits by selling their holdings.

September usually brings a seasonal uplift from manufacturers’ new product launches and retailers’ pre-Golden Week holiday restocking. Yet this year, soaring gold prices and doubts about future sales have tempered retailers' restocking enthusiasm.

Chart 2: Wholesale gold demand improved in September

Monthly gold withdrawals from the SGE*

*The 10-year average is based on data between 2015 and 2024.

Source: Shanghai Gold Exchange, World Gold Council

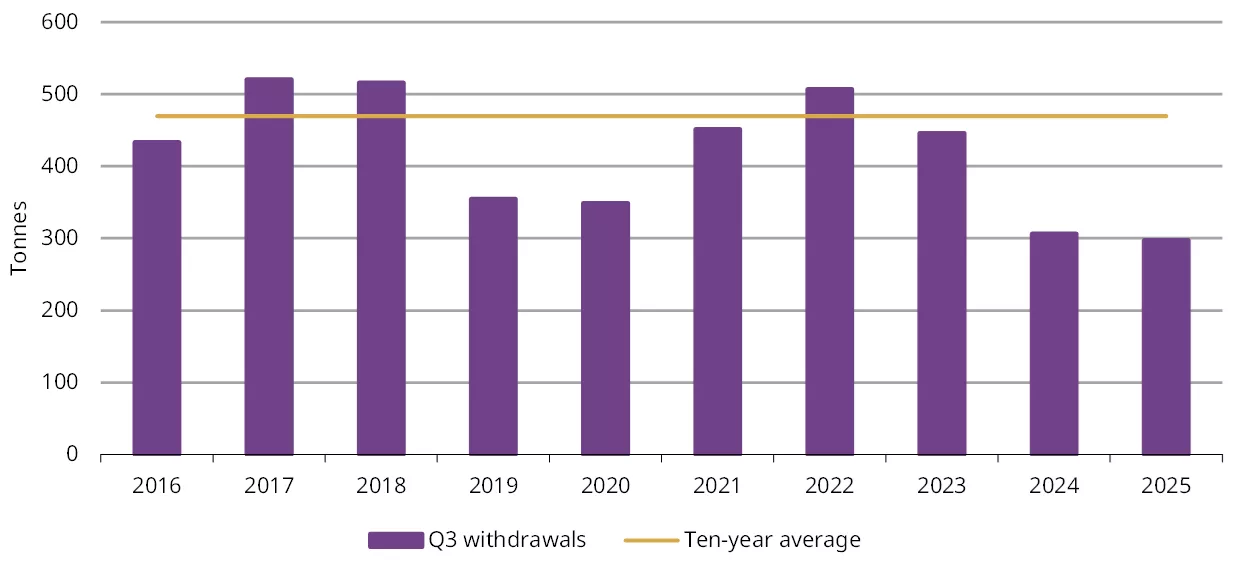

During the first three quarters of 2025 wholesale gold demand reached 297t, a mild 3% y/y fall and 37% below the ten-year average (Chart 3). In this quarter, weakness in the gold jewellery sector outpaced investment strength. For details on gold demand changes in Q3 and our outlook, please stay tuned for our Gold Demand Trends report, which will be released on 30 October.

Chart 3: Gold withdrawals from the SGE remained weak in Q3

Q3 gold withdrawals from the SGE*

*The 10-year average is based on data between 2015 and 2024.

Source: Shanghai Gold Exchange, World Gold Council

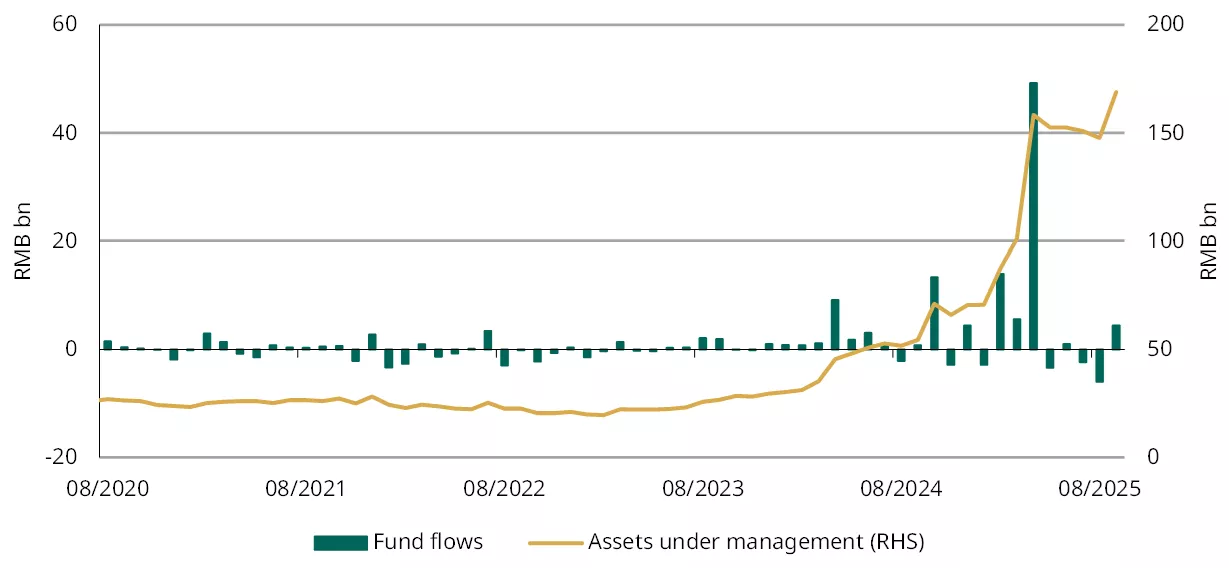

Early Q3 Chinese gold ETF losses partially reversed by a positive September

Chinese gold ETFs finally saw inflows in September, following two consecutive monthly losses (Chart 4). Attracted by the strong gold price performance, Chinese investors bought RMB4.5bn (US$622mn) of local gold ETFs. September’s inflows and the surging price lifted Chinese gold ETFs’ total AUM to another month-end peak of RMB169bn (US$22bn), with holdings rebounding by 4.9t to 194t.

Chart 4: Chinese gold ETFs saw inflows in September

Monthly Chinese gold ETF flows and month-end AUM*

*Data to 30 September 2025.

Source: Company filings, World Gold Council

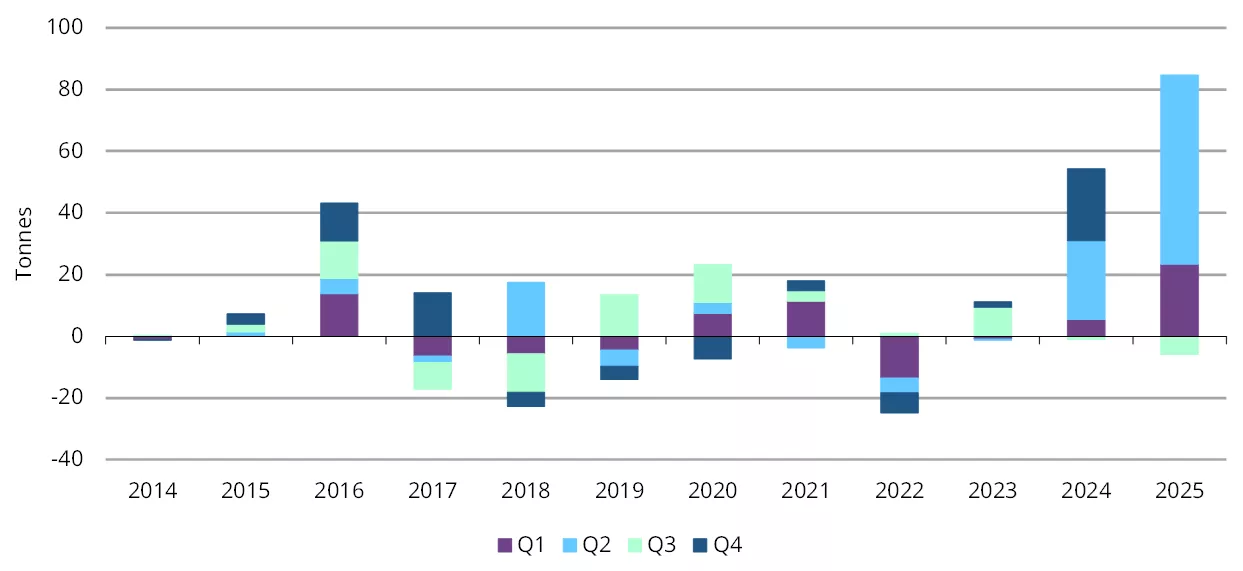

But September’s inflows were not sufficient to reverse earlier losses, resulting in Q3 net outflows of RMB3.8bn (US$537mn) (Chart 5) and collective holdings reduced by 5.8t during the period. As previously noted, Chinese investor risk appetite improved as the need for safe-haven assets declined: July and August saw better growth expectations on the back of strong Q2 economic data and a reducing US-China tariff risk. This sentiment was reflected in the strong CSI300 Stock Index rally, which surged 18% during Q3, the strongest quarter since Q1 2019. Meanwhile, rising government bond yields – as the market priced in fewer rate cuts by the PBoC – increased opportunity costs of holding gold.

Nonetheless, helped by various uncertainties, the strong price performance, a lack of alternative investment options, and encouragement from the central bank’s non-stop gold buying, Chinese gold ETF inflows during the first three quarters remain the largest ever. In fact, the cumulative inflows of RMB59bn (US$8.2bn, 79t) between Q1 and Q3 have surpassed all previous annual records (Chart 5).

Chart 5: Q3 outflows have little impact on y-t-d strength

Quarterly gold ETF tonnage demand*

*As of September 2025.

Source: Company filings, World Gold Council

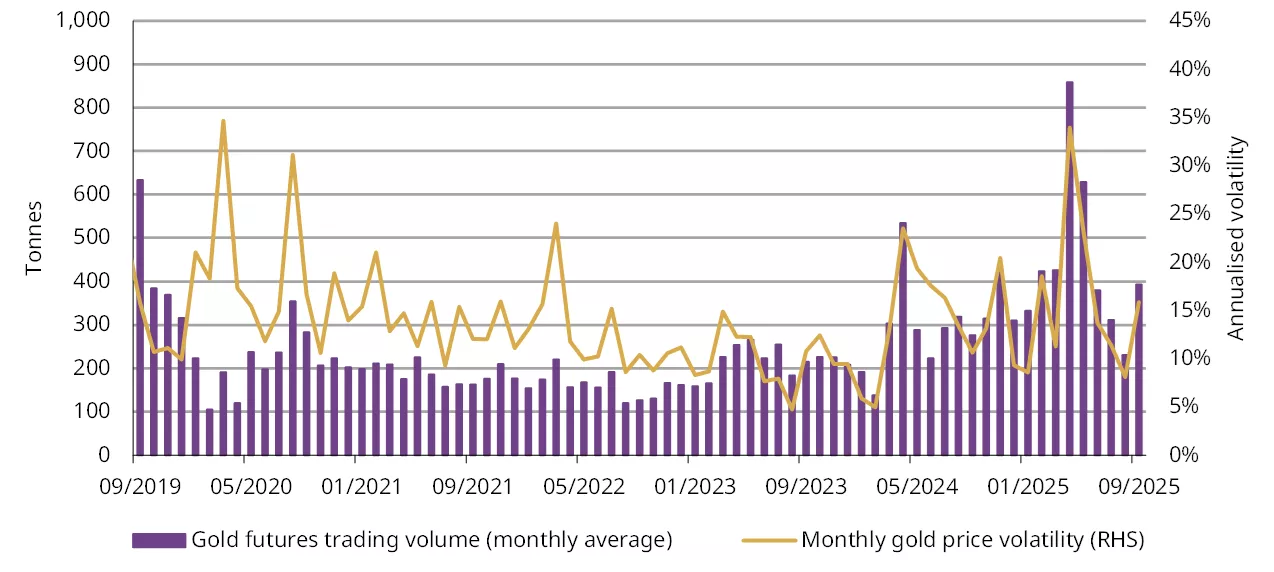

Gold futures investor activity also improved (Chart 6). The average trading volumes of gold futures at the SHFE jumped 70% m/m to 394t/day in September; 82% higher than the five-year average. The strong gold price performance and rising volatility attracted attention from tactical investors. Yet Q3 volumes fell 49% q/q to 312t/day despite the gold price rally proving stronger than the previous quarter – Q2 gold price volatility climbed to the highest in decades, a key factor luring interest from futures traders.

Chart 6: Trading volumes of gold futures rebounded in September

Daily average trading volumes of SHFE gold futures and monthly gold price volatility*

*As of 30 September 2025. The monthly gold price volatility is based on daily gold price change in the active SHFE gold futures.

Source: Shanghai Futures Exchange, World Gold Council

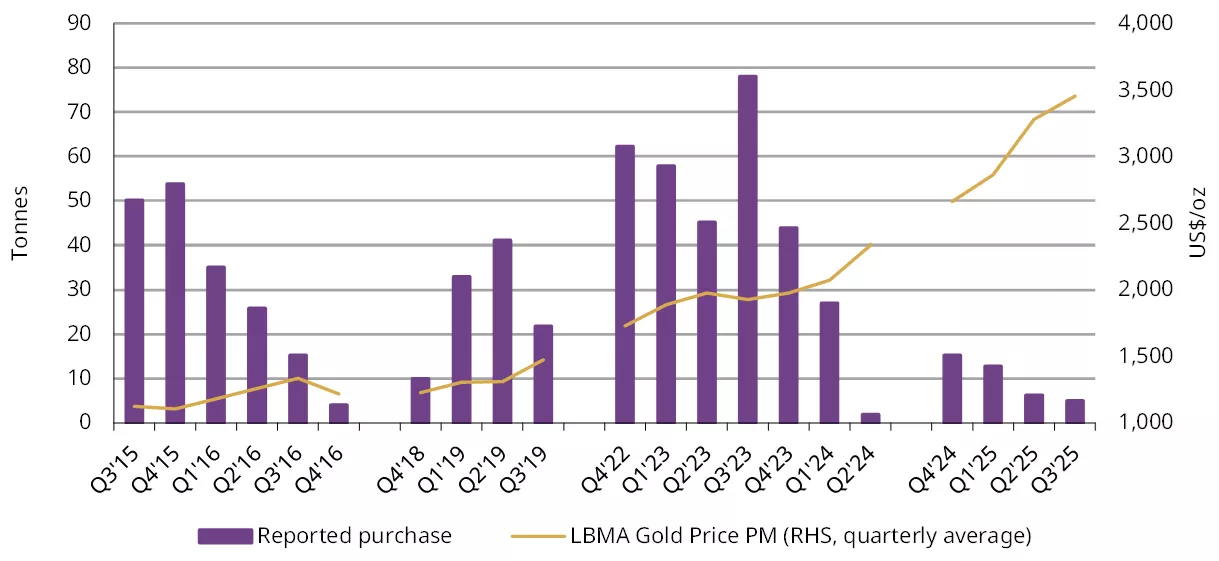

The PBoC reported its 11th consecutive monthly gold purchase

In September the PBoC announced a 1.2t gold purchase, its 11th non-stop addition. By the end of Q3 China’s official gold holdings stood at 2,303t, 7.7% of total foreign reserves.

China’s gold reserves increased by 5t, a slower pace than in previous quarters (Chart 7). This is perhaps not surprising: as the gold price surges central banks may dial back the amount of gold buying for tactical reasons. Yet judging from the PBoC’s four-quarter non-stop gold purchases, we believe gold remains a key strategic asset to central banks looking to diversify assets in a fragmented and uncertain world.

Chart 7: Four quarters of non-stop PBoC gold purchasing announcements

Reported official gold holdings and the quarterly average LBMA Gold Price PM*

*As of September 2025. The gaps indicate quarters where the PBoC did not announce gold purchases.

Source: State Administration of Foreign Exchange, World Gold Council

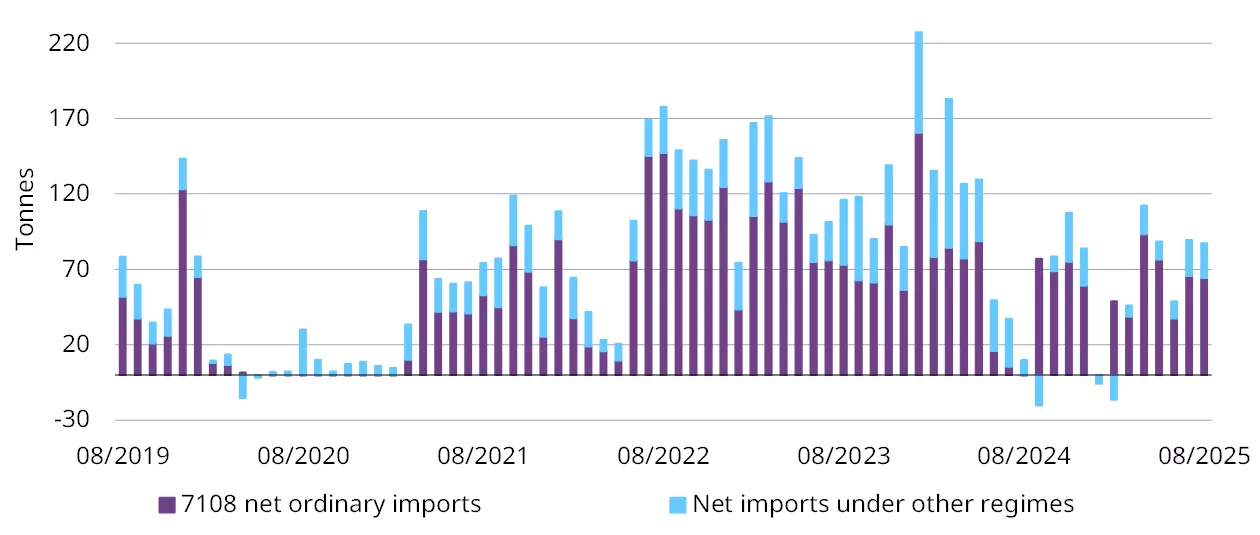

Imports stable in August

China imported a net 87t of gold in August, based on the latest information, a mild 2t m/m fall (Chart 8). Imports remained broadly stable as the average local gold price premium fell only slightly in the month (US$7.6/oz in August vs US$8/oz in July); the upcoming peak season for gold also limited the m/m weakness.

Chart 8: August gold imports remained relatively stable

Net 7108 gold imports under various regimes*

*Based on the latest data available. Data to August 2025.

Source: China Customs, World Gold Council

Footnotes:

1Chinese markets were closed between 1 and 8 October due to the National Day Holiday and the Mid-Autumn Day.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.