India gold market update: Encouraging start to seasonal demand

17 September, 2025

Highlights

- Gold regains momentum, hits new records; discounts narrow in India

- Investment demand steers festive gold buying revival

- Momentum builds in gold ETFs with strong inflows and lower redemptions

- RBI maintains pause on gold purchases

- Gold imports hit 9-month high in August, reflecting festive demand momentum.

Looking ahead

- Gold demand could strengthen during the peak festive period (October – December), aided by sustained investment interest, wedding and occasions-related jewellery purchases, and a potential boost from consumption tax cuts. However, elevated prices — and any renewed surge — may curb overall demand.

Gold resumes climb

Gold prices saw a sharp upswing in late August, with the rally accelerating through the first half of September to hit fresh all-time highs, pushing year-to-date gains to 40%.1 International gold prices climbed 4% in August and added another 6.7% in early September2 as bullish sentiment deepened. Our Gold Return Attribution Model (GRAM) attributes August's gains to a weaker US dollar, elevated geopolitical tensions, and strong inflows into global gold ETFs. The continued momentum in September was supported by positive investor positioning – evidenced by rising futures net longs and sustained ETF inflows. Lower US Treasury yields, amid growing expectations of a Fed rate cut and concerns around the Fed’s independence, have provided additional tailwinds.

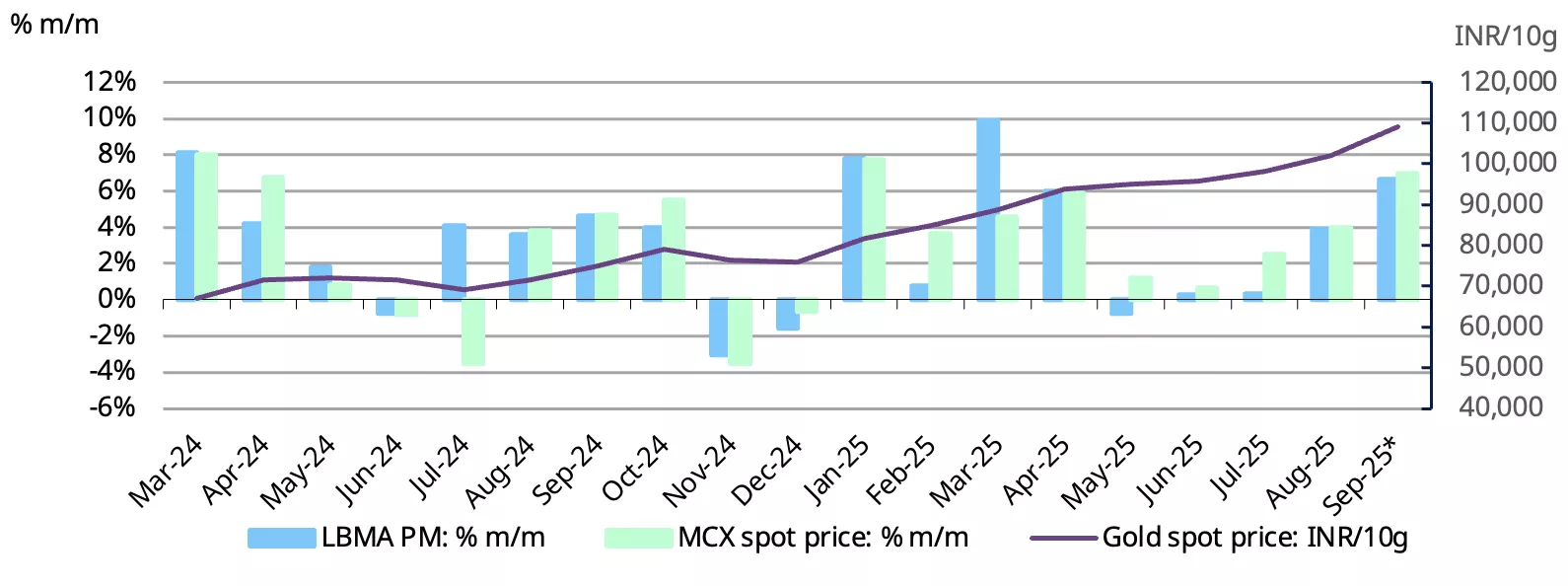

Chart 1: Sharp rally in gold prices

End of month LBMA Price PM and domestic spot price changes and movement*

*Based on the LBMA Gold Price PM in USD and MCX spot gold price as of 15 September 2025.

Source: Bloomberg, World Gold Council

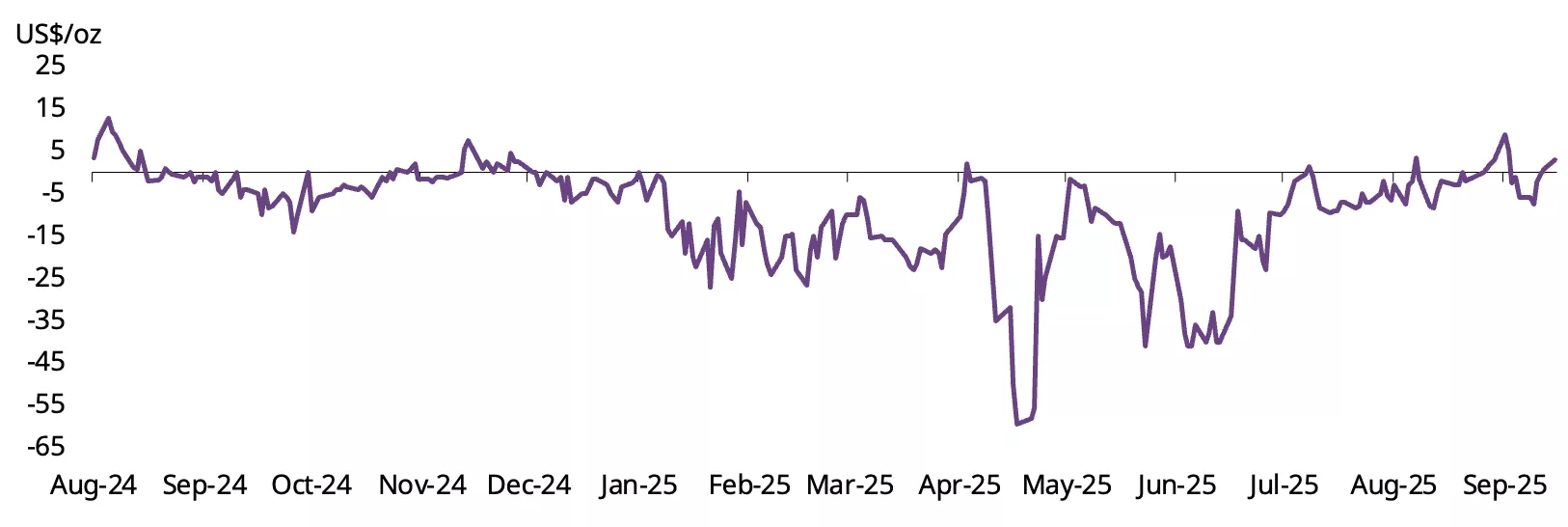

Gold prices in India have closely mirrored international movements, with a weaker rupee (down 3% y-t-d) magnifying domestic price gains. As of mid-September, prices had risen 7.0% month-to-date3 to INR 106,863/10g, bringing the y-t-d increase to 44%. Notably, signs of demand interest have helped narrow domestic price discounts,4 which briefly flipped to a marginal premium in late August and again in mid-September. This marks a noteworthy change, as domestic gold prices had been trading at a near-sustained discount since December (Chart 2).

Chart 2: Domestic gold price discount narrows

NCDEX gold premium/discount relative to the international price*

*As of 15 September 2025

Source: NCDEX, World Gold Council

Festive gold demand emerges, led by investment buying

Gold demand in India is showing signs of a pickup with the onset of the festive season, led primarily by a surge in physical investment demand for bars and coins, according to market reports and anecdotal evidence from trade channels. Investment interest is reportedly outpacing jewellery purchases, as consumers are drawn in by the renewed uptrend in prices and expectations of further increases.

Conversations with jewellery manufacturers and retailers suggest that jewellery demand, while present, remains uneven. High-value, wedding-related purchases have begun and are holding steady, while high prices have dampened lower-ticket daily-wear and discretionary buying, prompting a shift to lower carat products. Large retailers are reporting higher footfalls, supported by aggressive marketing and promotional campaigns,5 along with plans for new store openings. Smaller retailers, in contrast, continue to face muted demand. Robust exchange activity, where old gold jewellery is traded in for new, has also been a key contributor to overall sales. While volumes remain lower y/y, sales value has risen aided by the higher gold prices.

Bullion dealers have reportedly stepped-up purchases since early September, likely in anticipation of stronger seasonal demand and a potential boost from increased consumer spending from the forthcoming reduction in Goods and Services Tax (GST).6 The tax cut on a range of items, including consumer goods, durables, and automobiles-takes effect from 22 September, just as the festive season enters its peak following a 16-day inauspicious period.7

Overall, expectations for a strong festive season are building across the gold trade.

ETFs: Sustained inflows and investor momentum

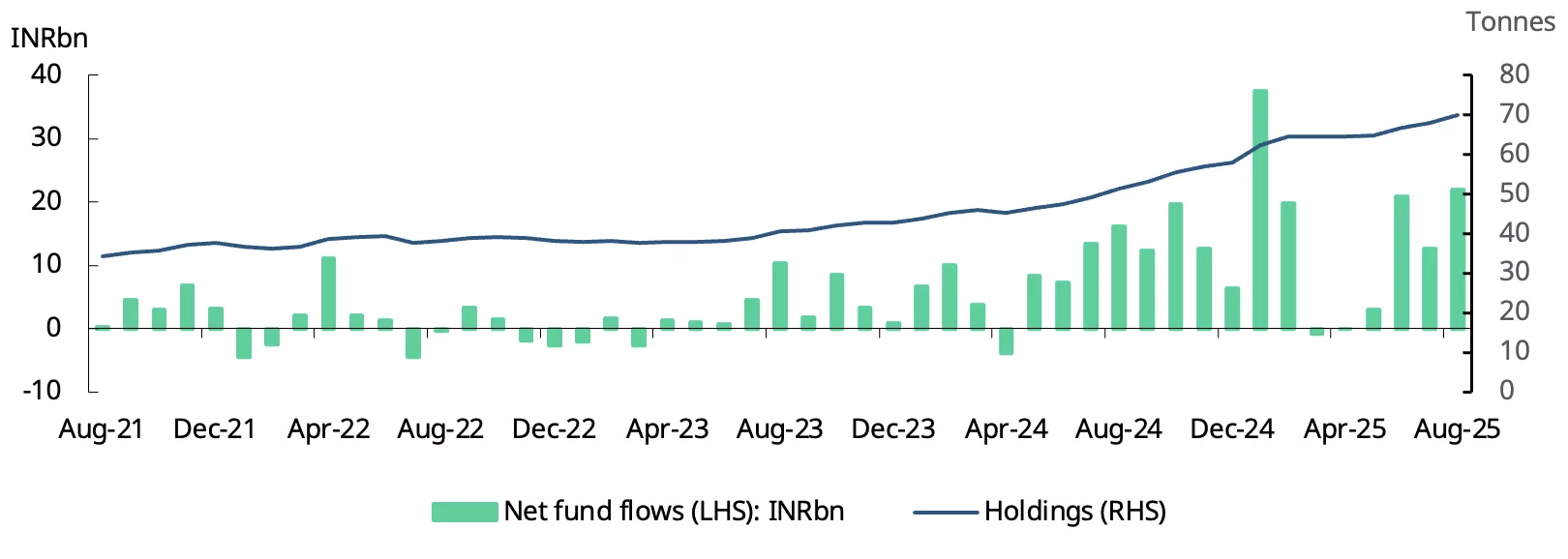

India’s gold ETFs saw a notable surge in inflows in August, marking the fourth consecutive month of positive growth. Cumulative net inflows totalled INR21.9bn (US$250mn), up 74% m/m, aligning closely with our earlier estimate.8 This surge is the second highest of the year, since January.9 The increase is likely driven by the sustained demand for safe-haven assets by investors seeking stability amid weak domestic equities and persistent global trade and geopolitical risks. Initial observations point to a continuation of this momentum, with strong positive net inflows during the first two weeks of September.10

Redemptions during the month were the lowest in seven months, totalling INR1.5bn (US$17mn) - a significant decline from the average redemption of INR7.5bn (US$83mn) recorded in the first seven months of the year. This drop in redemptions suggests that investors are adopting a longer-term perspective, choosing to stay invested rather than cashing out, despite the recent price gains. The total assets under management (AUM) in gold ETFs in India reached record highs of INR724bn (US$8.3bn), with holdings increasing by 2.1t to a total of 70t.

Along with strong inflows, investor participation also saw a significant increase, with 164 thousand news accounts (folios) added, pushing the total number of active folios to 8.03mn, a 24% increase since the start of the year.

Furthermore, a new gold ETF was launched in August,11 bringing the total number of gold ETFs listed in India to 22.12

Chart 3: Inflows gained pace in August

Monthly gold ETF flows in INRbn, and total holdings in tonnes*

*As of end August 2025.

Source: AMFI, ICRA Analytics, CMIE, World Gold Council

RBI stays on hold

The RBI’s gold purchases have moderated in 2025, with no additions for the second straight month in August. Gold was bought in only three of the first eight months of the year, compared with near-consistent monthly additions through 2024. The scale of buying has also slowed sharply, with cumulative purchases at just 3.8t between January and August 2025, against 45.4t in the same period last year.

Despite this moderation, India’s gold reserves have climbed to a record 880t.While volumes rose by a modest 4% y/y, the valuation gains have been pronounced, with the value of the holdings up nearly 40%, on the back of higher gold prices. Gold now accounts for 12.5% of India’s foreign exchange reserves as of end-August, up from 9% a year earlier. This highlights how price appreciation has significantly strengthened reserves, even amid restrained buying.

Gold imports rise signals resilient demand

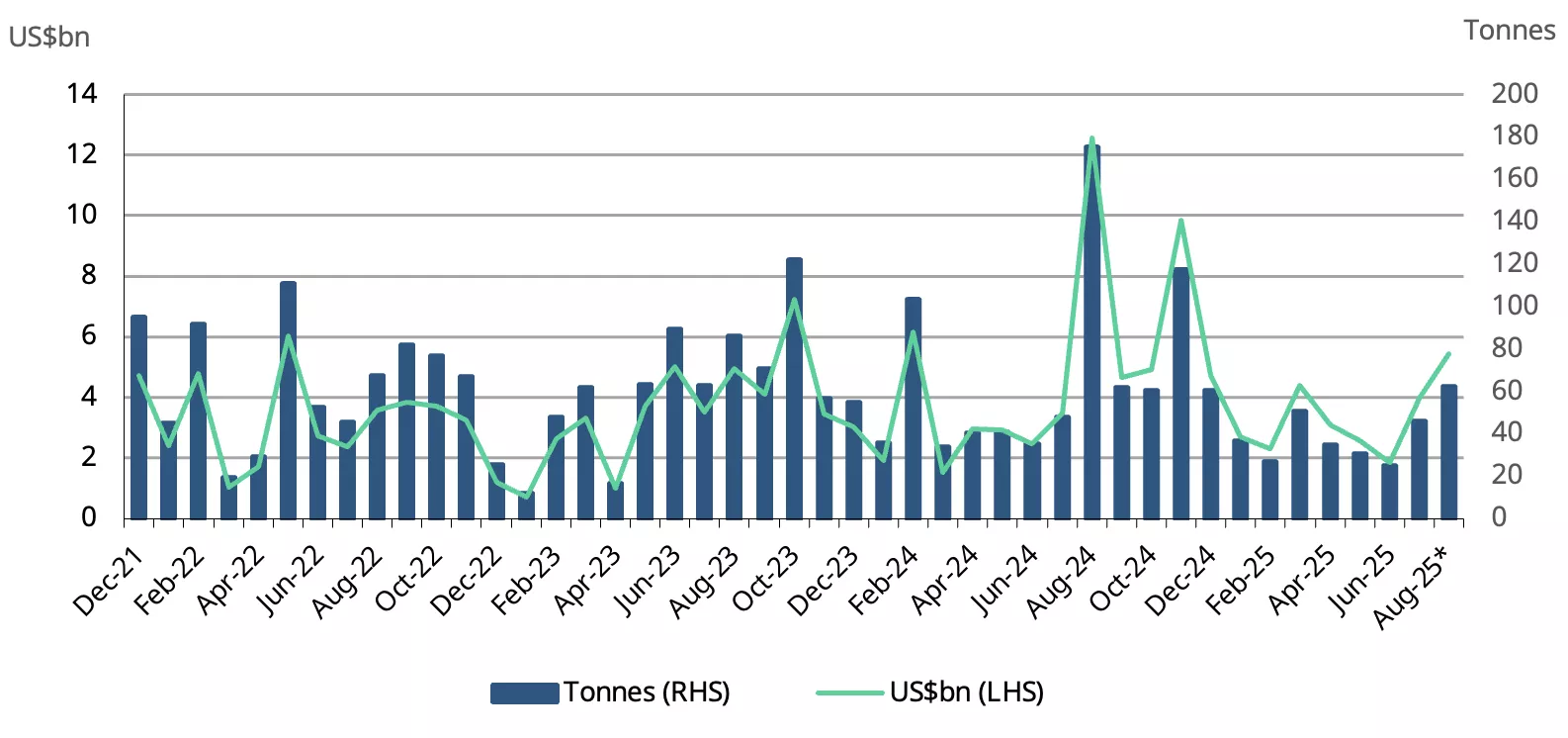

India’s gold imports rose sharply in August, reaching a nine-month high and marking the second consecutive month of high imports, underscoring resilient domestic demand. Imports during the month totalled US$5.2bn, a 37% m/m increase, reflecting seasonal buying interest despite elevated prices. We estimate import volumes of 60-65t, up from 46t in July.

Chart 4: Imports rise to a multi-month in August

Monthly gold imports in tonnes and US$bn*

*Includes World Gold Council estimates.

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Footnotes

1Based on the LBMA Gold Price PM as of 15 September 2025.

21-15 September 2025.

3Based on MCX Spot gold price PM as of 15 September 2025

4The premium/discount of local gold prices is based on the LBMA Gold Price AM adjusted for import taxes and exchange rate, which is also referred to as the ‘landed price’

5Jewellery brands boost festive advertising spends: Storyboard18.com, 05 September 2025.

6GST council approves rates rationalisation: Ministry of Finance, 03 September 2025.

7Pitru Paksha 2025 start and end date: Times of India, 09 September 2025.

8WGC’s preliminary estimate, based on partial data, indicated net fund inflows of INR2,184cr (US$233mn).

9Net fund inflows in January 2025 of Indian gold ETFs totalled INR3751cr (US$435mn).

10Based on World Gold Council’s estimates of fund-wise net inflows.

11Angel One Gold ETF was launched in August 2025.

12A full list of the physically-backed gold ETFs we tracked can be found in: Gold ETF: Stock, Holdings and Flows | World Gold Council

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.