You asked, we answered: What's a bear case for gold?

10 July, 2025

Gold’s impressive rally takes a breather

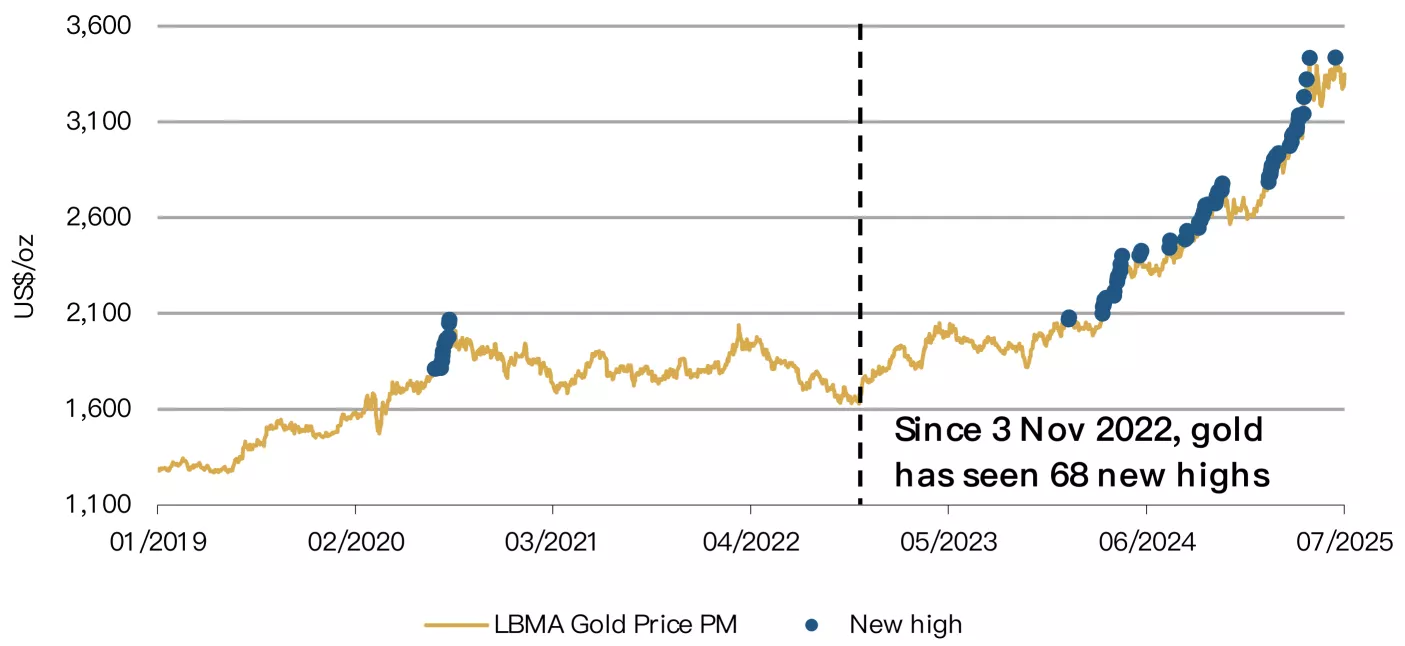

Gold has experienced a prolonged bull run in recent years. After bottoming at US$1,429/oz on 3 November 2022, the gold price has more than doubled: on 30 June 2025 it stood at US$3,287/oz, having refreshed its historical record 68 times over that period (Chart 1).1 Such impressive strength was mainly driven by consistent central bank purchases as well as soaring geopolitical and, more recently, trade risks.2

But since the start of Q2 gold’s bullish momentum has softened. During the entire second quarter gold rose by 5.5%. While this represents decent growth by any measure, it’s well below Q1’s 19% surge. Some investors have questioned whether the gold rally run its course or it can resume its upward trend. To answer that, we look back at history for clues.

Chart 1: Gold has witnessed a strong rally since late 2022

Source: ICE Benchmark Administration, World Gold Council

An anatomy of gold’s past bear runs

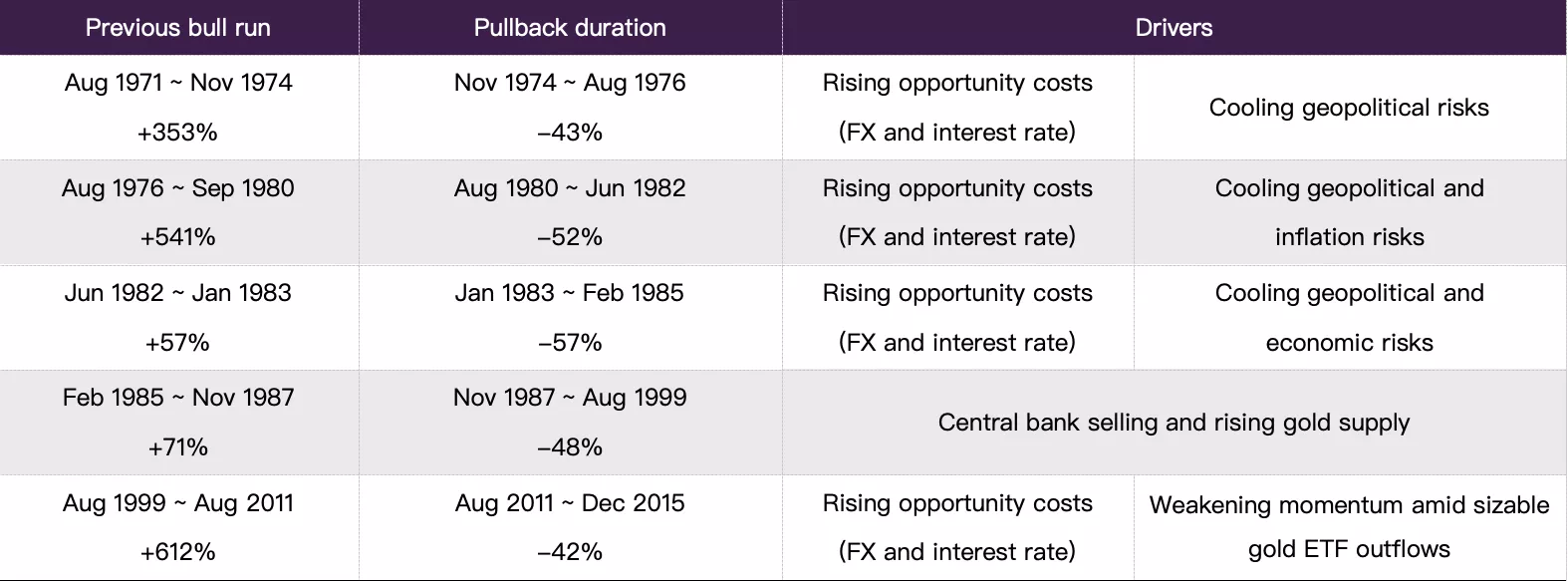

Since the collapse of the Bretton Woods system in 1971, when gold's fixed exchange rate with the dollar ceased, gold has undergone five major bear runs3 (Table 1). During these pullbacks we noticed some common trends, which we summarise below and explore in more detail in our report: What’s a bear case for gold?

Most major drops were linked to rising opportunity costs relating to real rates and the dollar, driven by a booming economy or rapid US Fed rate hikes. During such periods investors typically prefer riskier assets for higher returns.

Another key factor was reduced risk and uncertainty. In most of the five major pullbacks we studied, geopolitical tensions eased, economies performed well, and inflation cooled in major markets. These conditions often coincided with strong stock market rallies, drawing investors away from gold.

In some cases, decelerating momentum can also lead to gold price weakness: central bank gold sales or gold ETF outflows have, historically, added to gold’s downward pressure.

What’s a bear case for gold?

If we put historical perspectives into today’s context we find that gold prices could face short- to mid-term pressure if:

- Geopolitical or trade risks ease – cooling risk and uncertainty, or

- The dollar strengthens and yields rise – higher opportunity costs, or

- Gold investment demand (central bank purchases, or ETF buying, or retail bullion demand) slows – weakening momentum.

And a sustained drop in gold would require a major structural change. While unlikely, here are three scenarios that could push gold into a longer-term downturn:

- Central bank demand dries up

- Competition from other assets is more intense

- Consumer affection for gold wanes

- Gold supply increases significantly.

Table 1: Summary of past gold pullbacks*

*Based on monthly LBMA Gold Price PM in USD.

Source: ICE Benchmark Administration, World Gold Council

Conclusion

All markets rise and fall, and gold’s recent ease in momentum has made some investors wary. We have analysed key risks from past downturns and find that while some may slow gold’s rally, others could fuel a prolonged decline.

In today’s fragmenting world, global government debt keeps ballooning, especially in the US, and competition among major powers may continue to spark risks – economic or geopolitical. Against this backdrop we believe that gold’s role as a strategic asset that diversifies portfolio risk and improves performance will continue to shine. And the likelihood of above-mentioned factors which may drive gold into bear runs is low.

Footnotes

1Based on the LBMA Gold Price PM in USD between 3 November and 30 June 2025.

2For more, see: Gold Demand & Supply by Country | World Gold Council and Gold Return Attribution Model | World Gold Council.

3Based on various sources of definitions, we similarly define a period where gold’s price falls more than 20% as a bear run. For more: Bear Market Guide: Definition, Phases, Examples & How to Invest During One.

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.