India gold market update: Investment upheld amid seasonal lull

17 July, 2025

Highlights

- Gold steady with gains in August; discounts narrow in India

- Retailers gear up for festive boost, ramping up inventories

- Positive inflows1 and one new fund entry drive continued gold ETF growth

- RBI holds steady on gold reserves in July

- July’s gold imports surge, bracing for festive demand.

Looking ahead

- As the festive and wedding season approaches there are signs that gold jewellery demand is gaining momentum, and with investment interest holding firm, overall gold demand could receive a boost.

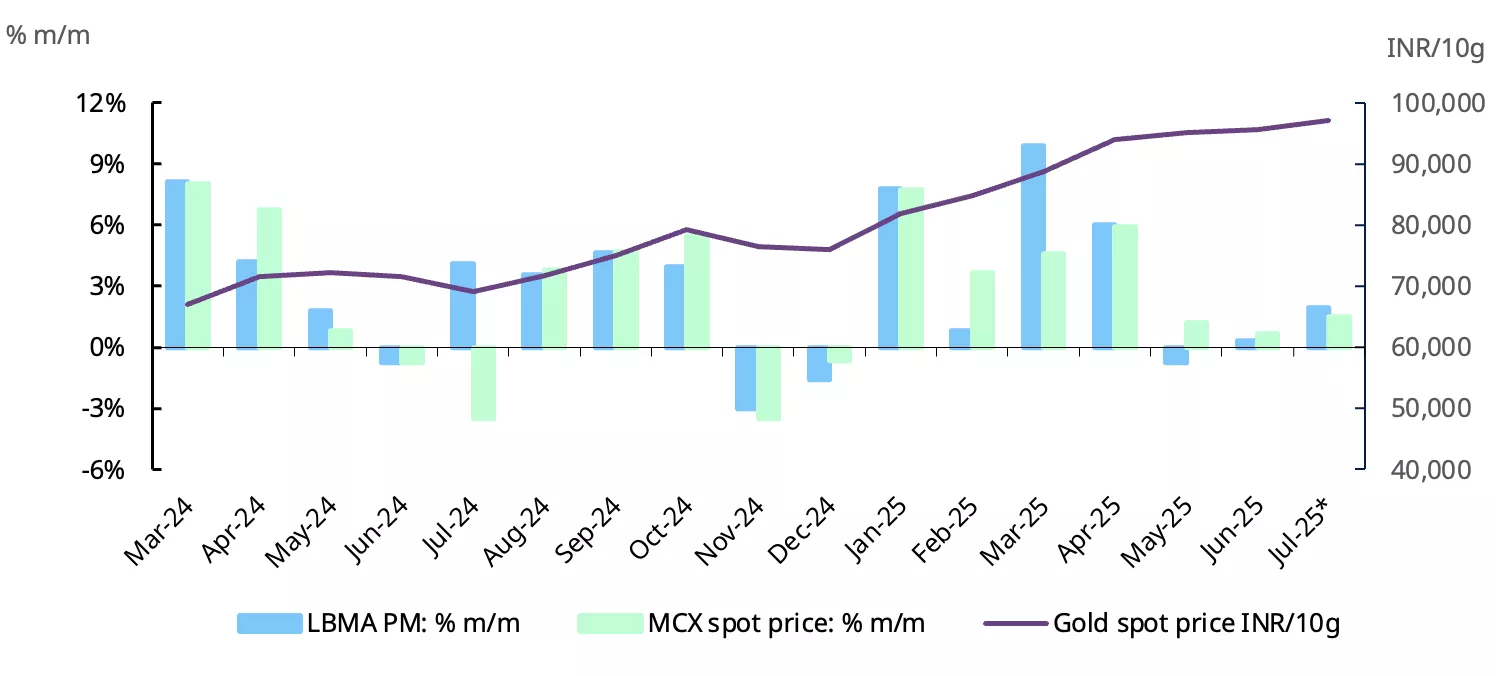

Gold gains but remains range bound

Gold prices have gained renewed strength in August, with international gold prices rising over 1% in the first half of the month to reach US$3,335/oz, building on the modest 0.3% gain in July.2 A combination of factors, including a weaker US dollar, expectations of a Fed rate cut, rising inflation expectations, and ongoing tariff developments has driven the recent price movement. Similarly, gold price movement in July was supported by tariff tensions, geopolitical risks, and inflation concerns, with market momentum also contributing. However, overall price movement has remained range-bound. Despite short-term fluctuations, gold continues to outperform in 2025, delivering a 28% return in US dollar terms year-to-date.3

Chart 1: Gold prices rise; bound by range

End of month LBMA Price PM and domestic spot price changes and movement*

*Based on the LBMA Gold Price PM in USD and MCX spot gold price as of 14 August 2025.

Source: Bloomberg, World Gold Council

Domestic gold prices in India have closely tracked international trends, with a weaker rupee amplifying gains. As of mid-August, prices had risen 1.6% month-to-date.4 to INR 99,665/10g, taking the year-to-date increase to 31%. Importantly, signs of improving demand have led to a narrowing of domestic market discounts5 – from an average of US$27/oz in June to US$3.7/oz as of mid-August.

Gold jewellery market eyes festive season revival

Signs of demand revival are emerging as the gold jewellery market gears up for the upcoming festive and wedding season (from early August to year-end). Anecdotal reports from industry stakeholders suggest a positive outlook. This optimism was evident at the recent India International Jewellery Show (IIJS),6 the country’s largest jewellery trade fair. As per anecdotal reports from the event, many manufacturers reported stronger-than-expected buying interest and a noticeable pickup in orders from both large chain stores and independent retailers. Retailers who had been cautious about their inventories in recent months due to lacklustre demand reported active restocking in anticipation of improved festive sales. And gold price stability also reportedly supported buyer sentiment. Furthermore, to appeal to price-sensitive customers and to drive volumes, manufacturers are focusing on lighter- weight jewellery.

Meanwhile, market reports suggest that investment demand for physical gold, i.e. bars and coins, remains healthy.

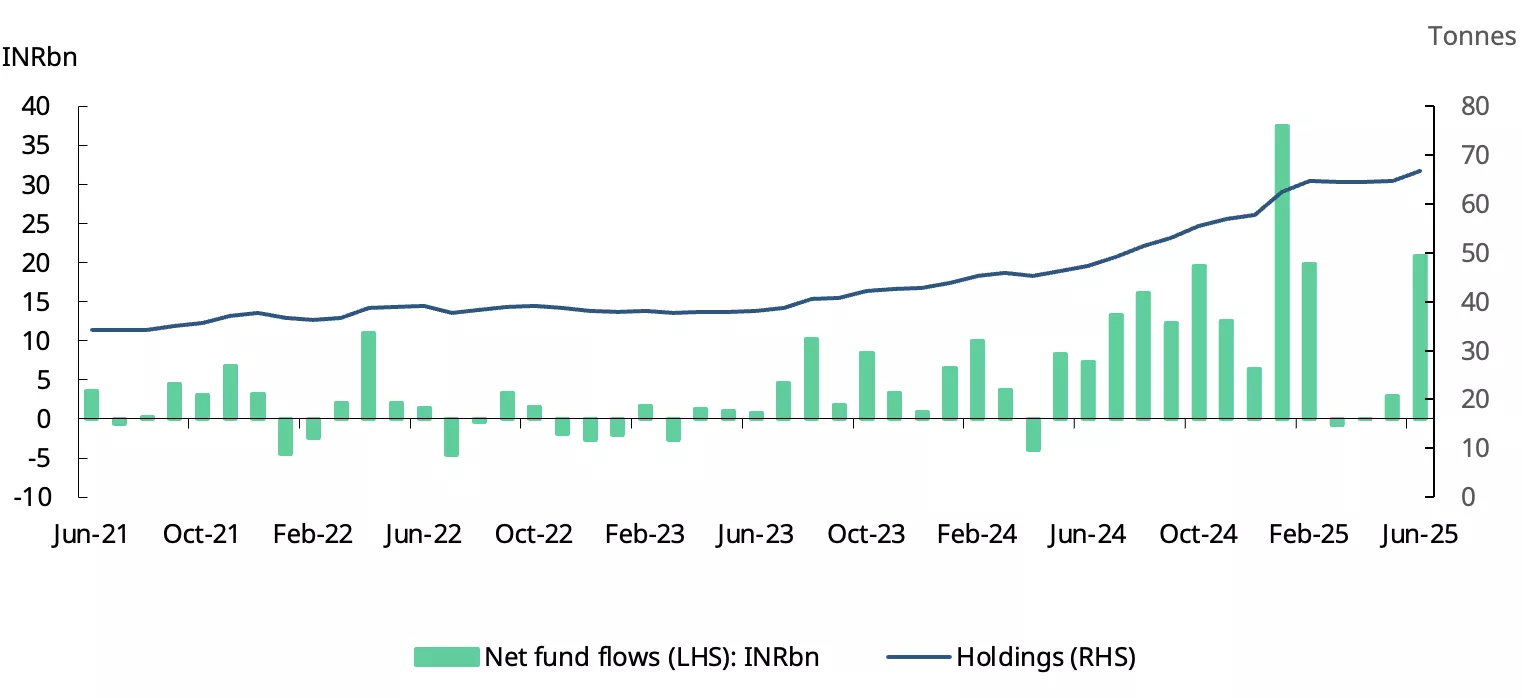

Positive flows and expansion in gold ETFs

Flows into Indian gold ETFs remained positive in July, marking the third consecutive month of net inflows. Global policy-related uncertainties and geopolitical tensions have been major drivers of this trend. But, the pace of net inflows slowed, declining to INR12.6bn (US$146mn) in July, down 41% from the previous month. This was broadly in line with our initial estimate7 and nearly 34% higher than the 2024 monthly average of INR 9.4bn. The positive momentum has carried into August, with partial data for the first two weeks indicating higher inflows into Indian gold ETFs.

At the end of July Indian gold ETFs’ cumulative assets under management (AUM) stood at INR676bn (US$7.85bn), a 96% y/y increase. Total gold holdings rose to 68t, with 1.2t added during the month8 Investor interest in gold ETFs continues to strengthen as indicated by the steady growth in new accounts (folios); 215k new folios were added in July, bringing the total to 7.86mn, a 42% y/y increase.9

One new gold ETF was also launched in July,10 bringing the total number of gold ETFs listed in India to 21.11

Chart 2: Healthy inflows and rising holdings

Monthly gold ETF fund flows in INRbn, and total holdings in tonnes*

*As of end June 2025

Source: AMFI, ICRA Analytics, CMIE, World Gold Council

RBI’s gold reserves unchanged

The Reserve Bank of India did not add to its gold reserves in July, following a modest addition of 0.4t in June. Over the first seven months this year it increased its gold reserves by 4t, a sharp contrast to the 40t bought during the same period in 2024. We believe that this suggests a measured approach in the RBI’s gold reserve management amid significant gains in the gold prices. Despite the slowdown, RBI’s gold holdings remain at a record high of 880t, now accounting for 12% of its foreign exchange reserves, up 4% y/y.

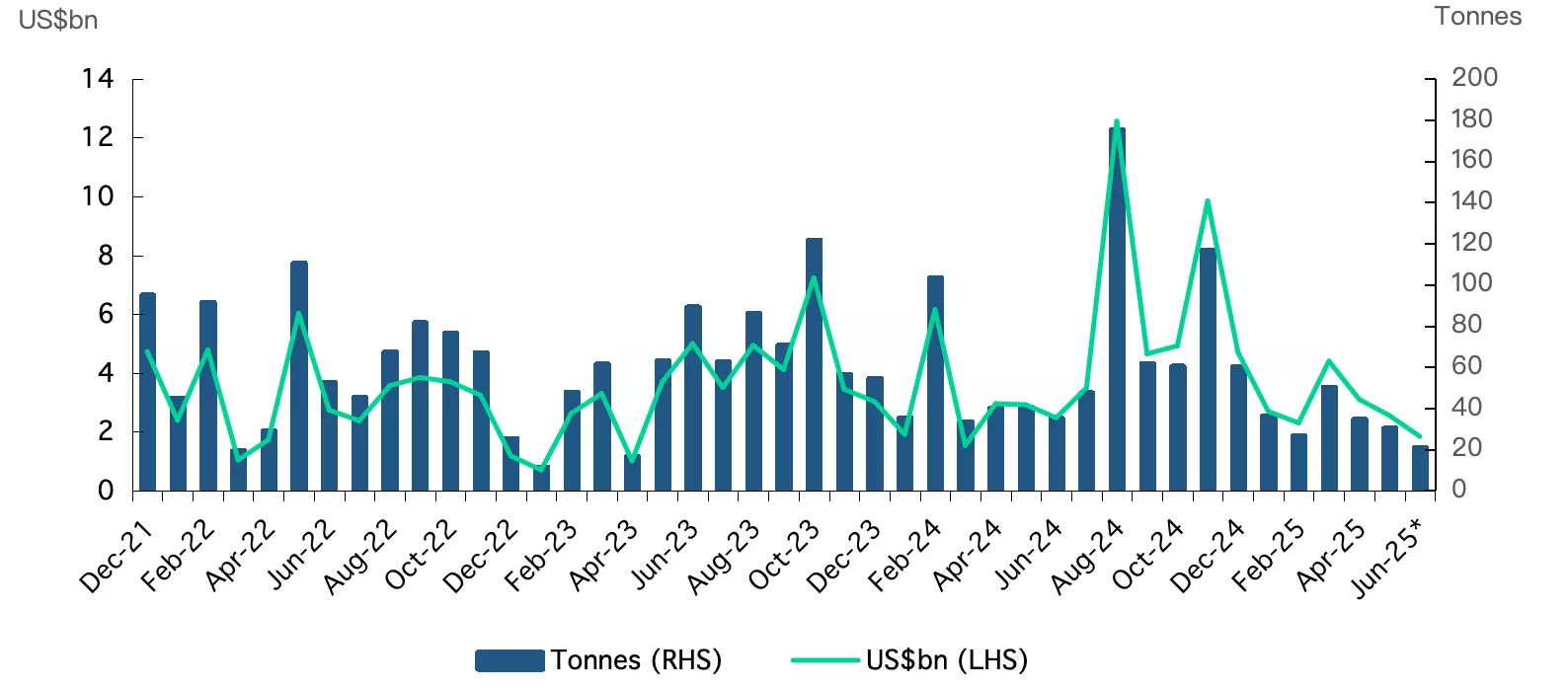

Chart 3: Uptick in imports

Monthly gold imports in tonnes and US$bn*

* Includes World Gold Council estimates

Source: Ministry of Commerce and Industry, CMIE, World Gold Council

Spurt in imports

Gold imports saw a significant rebound, following three months of declines. At US$4bn, imports in July notably surpassed the monthly average imports for the first six months of 2025 (US$3bn); up 14% y/y and more than double the value of those during June. Our estimates indicate that the volume of gold imported in July ranged from 42t to 48t. The higher import levels suggest that manufacturers are likely preparing for festive season demand, beginning in August.

Footnotes

1July and 1-13 August 2025.

2Based on the LBMA Gold Price PM as of 14 August and 31 July 2025, respectively.

3Based on the LBMA Gold Price PM as of 14 August 2025.

4Based on the MCX spot gold price as of 14 August 2025.

5The premium/discount of local gold prices is based on the LBMA Gold Price AM adjusted for import taxes and exchange rate, which is also referred to as the ‘landed price’.

6IIJS was held in Mumbai from 31 July to 4 August 2025.

7WGC’s preliminary estimate, based on partial data, indicated net fund inflows of INR1,286cr (US$156mn).

8WGC’s preliminary estimate, based on partial data, indicated a net addition of 1.4t in July.

9As per data from the Association of Mutual Funds of India (AMFI).

10Motilal Oswal Gold ETF was launched in July 2025, as detailed in AMFI’s website.

11A full list of the physically-backed gold ETFs we tracked can be found in: Gold ETF: Stock, Holdings and Flows | World Gold Council

Disclaimer

Important information and disclaimers

© 2025 World Gold Council. All rights reserved. World Gold Council and the Circle device are trademarks of the World Gold Council or its affiliates.

All references to LBMA Gold Price are used with the permission of ICE Benchmark Administration Limited and have been provided for informational purposes only. ICE Benchmark Administration Limited accepts no liability or responsibility for the accuracy of the prices or the underlying product to which the prices may be referenced. Other content is the intellectual property of the respective third party and all rights are reserved to them.

Reproduction or redistribution of any of this information is expressly prohibited without the prior written consent of World Gold Council or the appropriate copyright owners, except as specifically provided below. Information and statistics are copyright © and/or other intellectual property of the World Gold Council or its affiliates or third-party providers identified herein. All rights of the respective owners are reserved.

The use of the statistics in this information is permitted for the purposes of review and commentary (including media commentary) in line with fair industry practice, subject to the following two pre-conditions: (i) only limited extracts of data or analysis be used; and (ii) any and all use of these statistics is accompanied by a citation to World Gold Council and, where appropriate, to Metals Focus or other identified copyright owners as their source. World Gold Council is affiliated with Metals Focus.

The World Gold Council and its affiliates do not guarantee the accuracy or completeness of any information nor accept responsibility for any losses or damages arising directly or indirectly from the use of this information.

This information is for educational purposes only and by receiving this information, you agree with its intended purpose. Nothing contained herein is intended to constitute a recommendation, investment advice, or offer for the purchase or sale of gold, any gold-related products or services or any other products, services, securities or financial instruments (collectively, “Services”). This information does not take into account any investment objectives, financial situation or particular needs of any particular person.

Diversification does not guarantee any investment returns and does not eliminate the risk of loss. Past performance is not necessarily indicative of future results. The resulting performance of any investment outcomes that can be generated through allocation to gold are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. The World Gold Council and its affiliates do not guarantee or warranty any calculations and models used in any hypothetical portfolios or any outcomes resulting from any such use. Investors should discuss their individual circumstances with their appropriate investment professionals before making any decision regarding any Services or investments.

This information may contain forward-looking statements, such as statements which use the words “believes”, “expects”, “may”, or “suggests”, or similar terminology, which are based on current expectations and are subject to change. Forward-looking statements involve a number of risks and uncertainties. There can be no assurance that any forward-looking statements will be achieved. World Gold Council and its affiliates assume no responsibility for updating any forward-looking statements.

Information regarding QaurumSM and the Gold Valuation Framework

Note that the resulting performance of various investment outcomes that can be generated through use of Qaurum, the Gold Valuation Framework and other information are hypothetical in nature, may not reflect actual investment results and are not guarantees of future results. Neither World Gold Council (including its affiliates) nor Oxford Economics provides any warranty or guarantee regarding the functionality of the tool, including without limitation any projections, estimates or calculations.