Summary

- Gold consumption during the longer-than-usual 2024 Chinese New Year’s (CNY) holiday was robust, based on preliminary data1

- Indications for 2024 are that gold jewellery demand will be stable, albeit rising at a slower pace than 2023 mainly due to a deceleration in economic growth

- Bar and coin sales should stay strong but are unlikely to replicate 2023’s significant growth

A robust CNY holiday for gold retailers

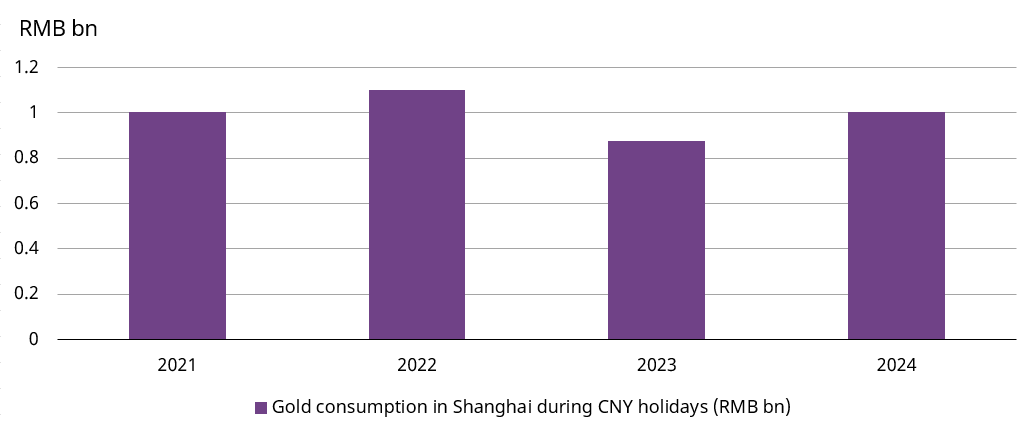

Gold retailers saw a constant flow of customers during the holiday. Data from the Ministry of Commerce shows that gold and jewellery sales in China – dominated by gold products – rose by 24% y/y during the holiday.2 And in Shanghai, gold consumption exceeded RMB1bn (US$141mn), a 14% rise y/y (Chart 1).3 Many other regions also experienced similar, if not stronger, growth in gold jewellery sales, according to the Ministry of Commerce and various news reports.4 Such prosperity was not limited to in-store purchases: sales on T-mall and JD both more than doubled during the holiday.5 We believe gold’s popularity was driven by:

- the ongoing pursuit by consumers for value preservation amid economic uncertainties and local asset volatility; as a result, sales of gold bars surged

- the popularity of Year of the Dragon themed products6

- a sales boost from Valentine’s Day gifting demand

- a longer-than-usual CNY holiday.

Chart 1: The extended 2024 CNY holiday saw robust gold demand in Shanghai

Shanghai’s gold consumption revenue during CNY holidays*

Gold consumption during the period would have been stronger had it not been for wallet share competition from travel and other entertainment options (Chart 2). According to the Ministry of Culture and Tourism, 474 million domestic trips were made during the CNY holiday, accounting for a total tourism revenue of RMB633bn (US$89bn), a record high.7 Meanwhile, box office revenues reached an all-time-high of RMB8bn (US$1bn).8 Consumers’ surging interests in these have limited their budgets on gold consumption, especially given that prices are hovering around its record high.

Chart 2: COVID gone, travel and movies return

Tourism and total box office revenues during CNY holidays*

What next?

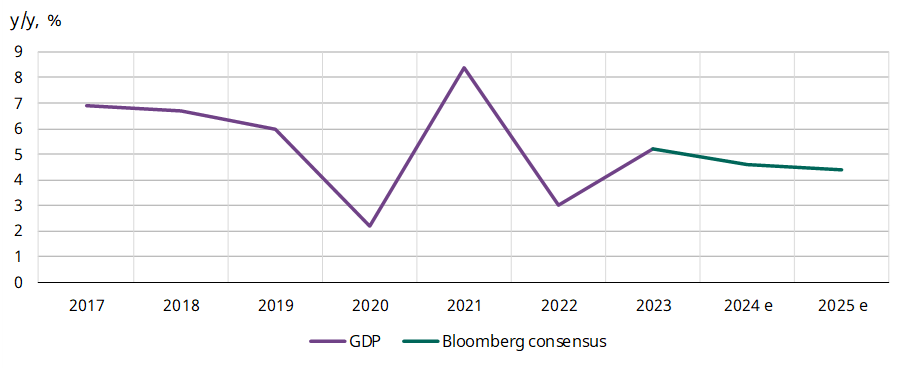

Macro factors will continue to be key in driving China’s gold demand in 2024. For instance, China’s economic growth has been the fundamental driver of gold demand over the past few years, demonstrating strong positive correlation with gold consumption. The Bloomberg consensus forecasts a 4.6% rise in China’s GDP this year (Chart 3), compared to 5.2% in 2023.9 This potential deceleration likely stems from continued stress in the housing sector, depressed consumer confidence, as well as the challenging outlook for exports amid a global slowdown and the rising diversification in supply chains.10

Chart 3: Consensus expectations project slower growth for China’s GDP

China’s GDP and Bloomberg economist survey forecasts.

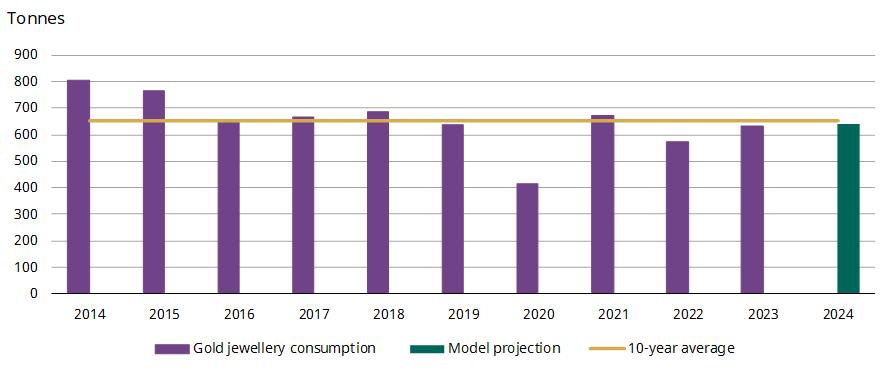

Changes in the gold price matter when projecting China’s gold jewellery demand (Chart 4). In general, jewellery consumption tends to fall as the gold price rises. Our Gold Outlook 2024 sees a stable gold price with some upside potential in the baseline scenario. And this may translate to mild headwinds for gold jewellery demand in China.

Combined with slower GDP growth and the assumption that the number of marriages will continue to decline, our model projects a small increase of 1% in China’s gold jewellery consumption in 2024. This is compared to 2023’s 10% y/y rise, which was supported by pent-up demand following the removal of COVID restrictions in late 2022. Nonetheless, 2024 gold jewellery demand is likely to stabilise at or near its 10-year average, signaling continued strength in the sector.

Chart 4: Gold jewellery demand looks stable for 2024

Model projection of 2024 Chinese gold jewellery demand*

Models are useful but simplify reality. For example, consumers’ pursuit of value preservation has provided meaningful support for gold jewellery sales in past years, and we expect this to continue. Meanwhile, the industry’s constant innovation will offer young buyers more stylish choices and this should help to solidify the dominance of gold products in jewellery stores.

But industry participants need to be mindful of risks, such as squeezing profits amid fierce competition in order to attract customers who are increasingly seeking low-labour-charged products. And this, combined with the fact that China’s gold jewellery market is becoming saturated, could lead to an industry consolidation. Finally, Chinese traditions consider 2024 a less auspicious year to get married, and this could result in lower-than-expected gold jewellery wedding demand.

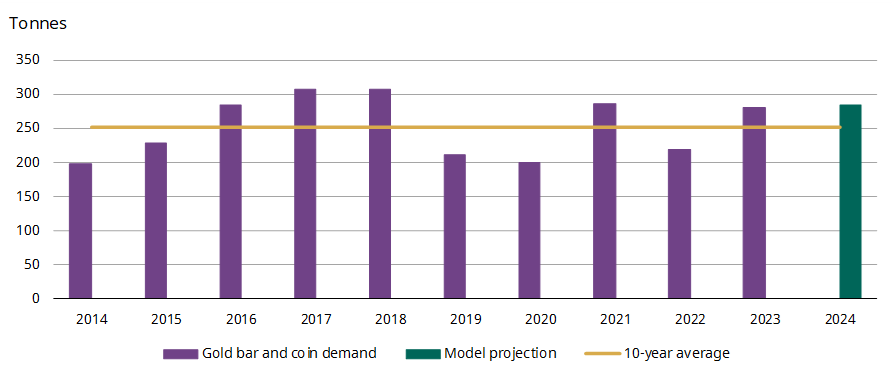

Gold bar and coin demand should remain solid this year, although sales may not repeat the 28% growth surge of 2023 (Chart 5). Support from potentially lower interest rates may offset slower economic growth, leading to stable bar and coin sales in 2024 (flat y/y), according to our model.

2024 investment demand for gold in China may show stronger growth than anticipated if:

- the local central bank continues to report gold purchases, thus encouraging physical gold investors

- the housing market remains weak, pushing investors to other safe-haven choices such as gold

- the local currency weakens in the face of a widening interest rate spread between China and the US – such a scenario could result in higher demand for value preservation.

Chart 5: Bar and coin demand should remain robust in 2024 and above its long-term average

Model projection of 2024 Chinese gold bar and coin demand*

Footnotes

The 2024 CNY holiday occurred between 10 and 17 February 2024, lasting for eight days as opposed to the usual seven days.

For more, see: 春节期间,年味浓、活力足、人气旺—— 消费市场实现良好开局 - 中国日报网 (chinadaily.com.cn).

For more, see: 上海黄金饰品行业协会 (shgjta.com.cn).

For more, see: (新春走基层)商文旅深度融合激发新活力 浙江新春消费暖意浓-中新网 (chinanews.com.cn); 全国主要城市2024春节销售数据出炉-36氪 (36kr.com); 江苏省人民政府 要闻关注 消费引擎动力强 春节经济活力足 (jiangsu.gov.cn); 春节期间淄博掀起“黄金热”,金银珠宝类产品销售额同比增长34.86%_山东站_中华网 (china.com); 金银珠宝消费增长21%(图)-中国江西网-大江网(中国江西网) (jxcn.cn); 销售总额同比增长7.1%!广西春节假期消费市场“热辣滚烫” (gmw.cn).

For more, see: 京东2024春节消费观察:90后、00后买走近6成珠宝首饰_腾讯新闻 (qq.com) and 天猫跑步鞋服开春成交翻倍 --经济·科技--人民网 (people.com.cn).

According to the Zodiac tradition, the lunar year of 2024 is the Year of the Dragon. The image of dragon is usually associated with good fortune and success in China; for more, see: It’s the Year of the Dragon in the Chinese Zodiac − associated with good fortune, wisdom and success (theconversation.com).

For more, see: Tourism industry hits record highs over Spring Festival holiday - Chinadaily.com.cn. Based on the RMB exchange rate on 19 February 2024, the first trading day after the CNY holiday.

For more, see: Comedy films dominate as China's Spring Festival box office hits record high - China.org.cn.

According to median economist forecast from Bloomberg’s survey.

For more, see: China Outlook 2024: Bear with it | J.P. Morgan Private Bank Asia (jpmorgan.com).