The so-called ‘January effect’ – a phenomenon where stock prices generally rise early in the year – has been studied and debated for decades.1 And while its prevalence seems to be waning, it remains a popular internet search term… in January.2

Similarly, investors often ask us if the gold price is subject to any seasonal effects.3 We last wrote about this in the July edition of our Gold Market Commentary. And the short answer is that gold tends to perform well, on average, in both January and late summer.4

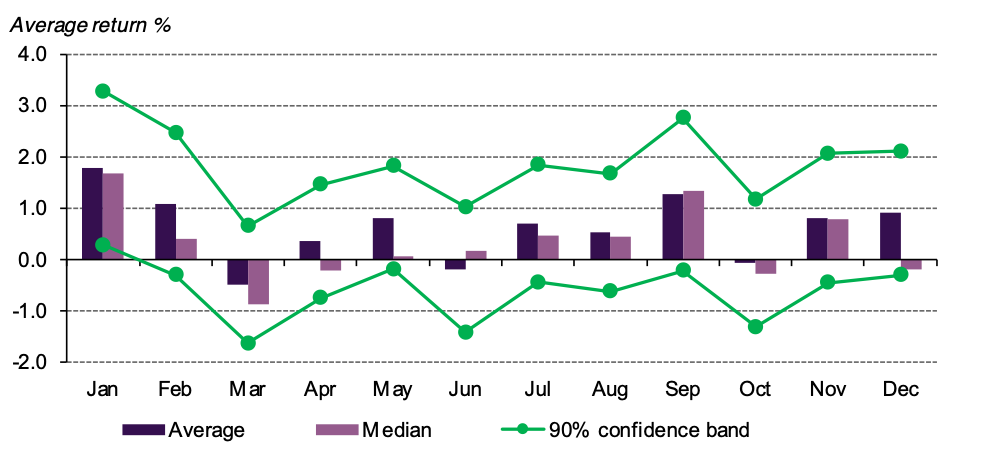

The January effect is, statistically, the strongest.5 Since 1971, gold has had an average return of 1.79% in January – almost three times its long-term monthly average.6 Over the same period, gold has had positive January returns almost 60% of the time, and nearly 70% of the time since 2000.

Chart 1: Gold tends to perform well in January and late summer

Average gold returns by month since 1971*

What’s behind this strength? Our analysis suggests that gold’s January performance may be related to portfolio rebalancing as well as a possible response to seasonal weakness in real yields. The timing also coincides with gold re-stocking in East Asia ahead of the lunar New Year, which could play a role.

Of course, this doesn’t mean that gold prices rise every January. There’s been several years when it hasn’t, most recently in 2021 and 2022. Years with negative returns in January generally coincided with periods when the US dollar has strengthened – often significantly.7

So, what’s next? Evidence suggests that gold tends to do well in January and, given that the Fed’s monetary policy is now on hold, it is unlikely the US dollar – a common headwind – will rise significantly.8 Having said that, beyond any seasonality, there are various fundamental factors that can influence gold’s performance, as we discussed in our Gold Outlook 2024

Footnotes

Is the 'January Effect' a tradeable seasonal strategy? James Chen, Investopedia, December 2023.

January Effect - Explore - Google Trends

We refer here about price performance and not demand, which is also subject to regional seasonality.

The late summer effect historically took place in September but has moved forward to August over the past two decades. The effect has been traditionally thought to be connected to market positioning ahead of a seasonally strong demand period for gold, but our analysis suggests that seasonal US Treasury weakness may be a more likely culprit.

Using returns of the LBMA Gold Price PM from January 1971 to November 2023 at the 90% confidence level

The average monthly return between January 1971 and November 2023 is 0.63%.

Since 1971, the US dollar has strengthened 80% of the time by an average of 1.5% during January in years when the gold price has fallen.

Needless to say, historical performance does not guarantee future performance.