Highlights:

- Gold prices have been on the rise for the last two months and recently scaled record highs, driven by geopolitical risk, growing expectations of cuts in interest rates in early 2024, global economic uncertainty and moderation in the USD

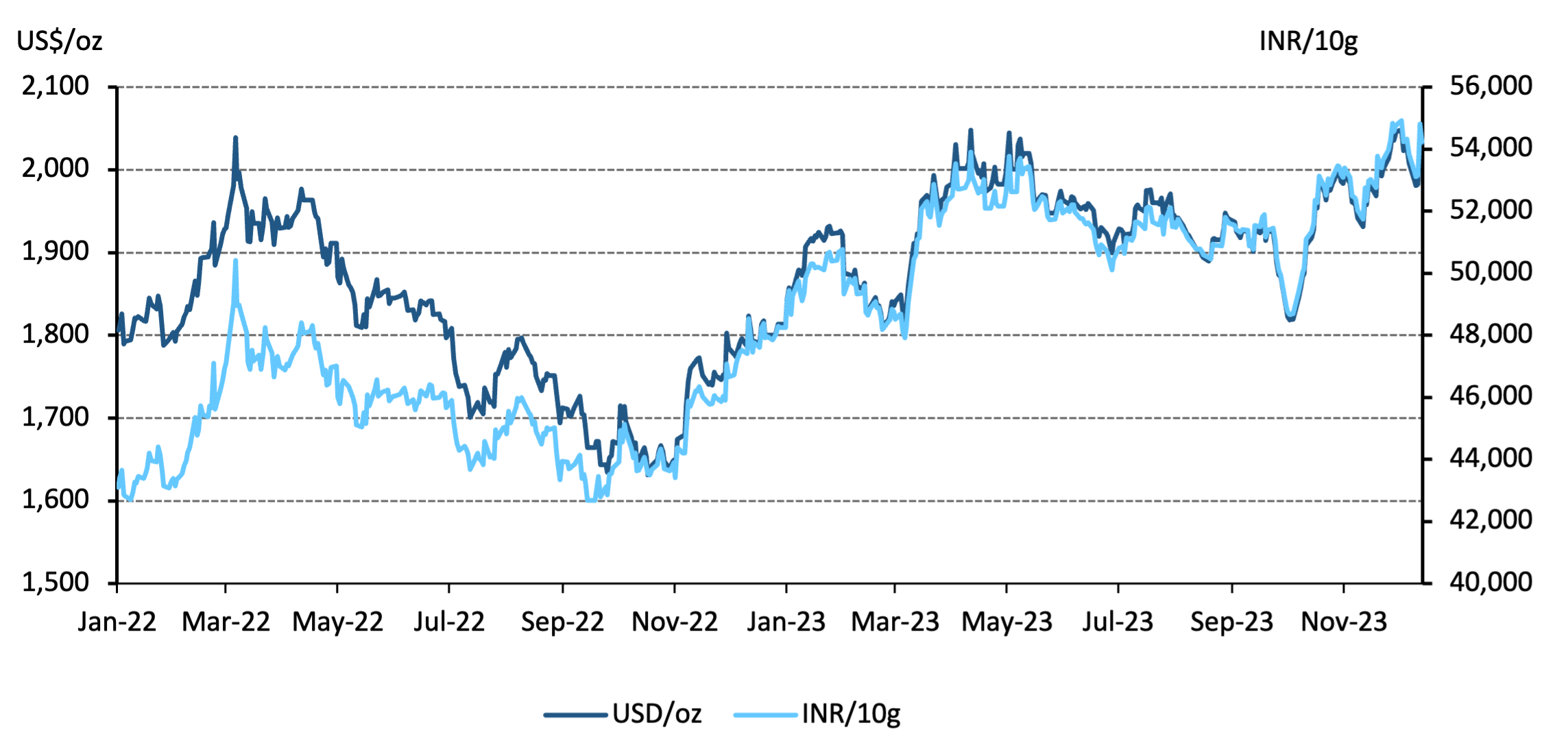

- Gold price in INR1 rose in tandem (11% since October) with the LBMA Gold Price PM in USD, due to the stable INR/USD

- The local gold price is trading at a discount to the international price due to the slowdown in domestic demand

- In November, the RBI refrained from adding to its gold holdings, marking the first such pause in six months

- Indian gold ETFs have seen sustained inflows since April. November saw inflows of US$47mn

- The volume of gold imports has been weighed down by high prices and soft demand even as the gold import bill rises.

Looking ahead:

- The current high price environment is likely to temper physical gold demand. Domestic gold consumption is foreseen to be primarily driven by the demand for bridal jewellery, with impulsive purchases of jewellery for everyday use likely to be limited

- Investment demand is likely to be boosted by the prevailing global geopolitical and economic uncertainty. Favourable domestic economic growth prospects, an increase in discretionary spending and growing investment inflows could also support investment demand for gold. Growing investor interest in gold ETFs is likely to persist.

Gold’s upsurge continued

The gold price has surged since the beginning of October, although not uniformly across currencies. A decline in bond yields, with markets pricing in an easier monetary policy environment, geopolitical tensions and US dollar weakness have all boosted investor appetite for gold, lifting its price.

From early October to mid-December, the LBMA Gold Price PM rose by 11% to US$2,032/oz.2 The Indian gold price witnessed a similar rise (up 11% to Rs54,233/10g),3 driven by the stable domestic currency. With regard to other currencies, the gold price4 rise in the euro, British pound, Japanese yen, Swiss franc and Australian dollar was lower (around 6%) owing to the appreciation of their currencies against the USD (by over 5%)5. In case of China, the gold price return6 in this period has been 8%, during which the RMB appreciated 2.5% against the USD.

Chart 1: Gold price movement in USD and INR*

Gold has delivered high return y-t-d when compared with the major asset classes*

Gold in INR has risen by 12% compared with the 6.2% returns of bank fixed deposit and 7.1% gains in liquid funds (cash equivalent).

India’s economy: sustained momentum

The domestic economy continues to exhibit strong growth momentum driven by healthy consumption demand and government investment. Various high frequency indicators have seen sustained expansion,7 and there are indications that household discretionary spending is on the rise. Broad-based demand is being led by urban demand, although rural demand is gaining traction on the back of a good harvest of the summer crop and timely sowing of the winter crop. An upturn in rural demand would further strengthen private consumption. Strong corporate earnings and encouraging growth projections have boosted domestic as well as foreign investment inflows.

The strong and above estimate reading of economic activity in the first two quarters of current fiscal year and indications that this trend will be sustained has led to the growth outlook for the whole year being raised.IN its latest forecast, the RBI has raised the country’s GDP growth outlook for FY24 by a sizeable 0.5% to 7%. Consensus growth estimates for India’s growth in FY24 have also been revised upwards, from 6.3-6.5% to 6.8-6.9%. This contrasts with other economies that have seen downward revisions.

Upward revisions in the economic growth outlook bode well for consumption demand including discretionary and investment demand.

The domestic gold market: high prices impact demand

As prices increase, demand is impacted. Despite the busy wedding season, anecdotal evidence suggests that purchases have been lower than in recent years. Jewellery sales volumes seem to have taken a hit and store footfalls has reportedly reduced since the peak festive period (Diwali). Reports suggest that the high gold price has also limited the appetite of jewellers to build their inventories. It appears that consumers are buying gold to meet wedding related needs but are otherwise largely staying away from discretionary purchases. Also, jewellery recycling has risen,8 which could curb imports. The price discount in the market and the lower import volumes underscore the downtrend in physical demand.9

Our econometric analysis shows that over the long term, income and price are the main drivers of gold demand in India. While rising income (proxied by gross national income) bodes well for gold demand, prices tend to weigh it down. In the absence of exogenous shocks, our model shows that a 1% increase in income results in a 0.9% increase in demand. At the same time a 1% increase in price reduces demand by 0.4%. While the price elasticity is lower, price tends to also fluctuate more than income in the short term and, thus, can have a more immediate effect.

Looking ahead, jewellery demand may find it difficult to rebound while the high price environment remains. At the same time, investment demand for gold is likely to get a boost, supported by the favourable domestic economic growth prospects and the trend of growing domestic investment inflows amidst the prevailing global geo-political and economic uncertainty.

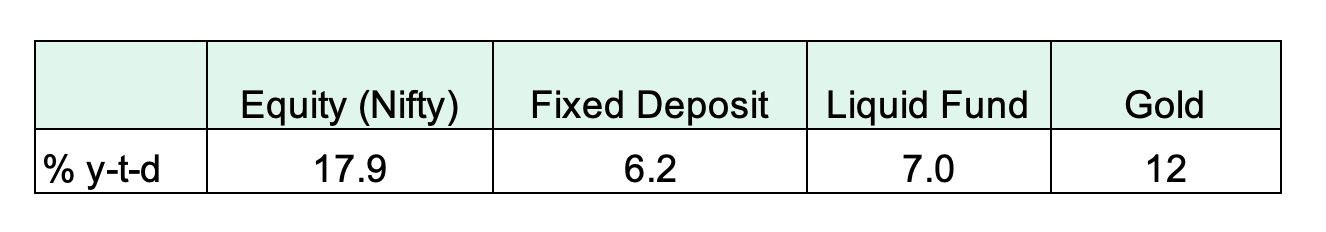

Gold trades at a discount in Indian markets

Domestic gold prices have been trading at a discount to international prices since late October 2023, reflecting subdued local demand. The high domestic prices of gold had been dampening domestic purchases, despite the busy wedding season. As of mid-December, the local price discount - US$17/oz, was the steepest in over eight months. In the first half of December local dealers were offering discounts of US$ 12.7/oz10 (on average) from the official price compared with a premium of US$5/oz in the first half of October this year. Nevertheless, the discount was lower than one year ago (average of US$ -22/oz in December 2022 when prices rose 5% m/m), underscoring the prevalent, although muted demand scenario here.

Physical demand for gold across various regions is being impacted by the surge in global prices.11 In China too, premiums although still elevated have narrowed from the highs of September 2023 (US$75/oz to US$44/oz), indicative of the local demand and supply conditions.12

Chart 2: Domestic gold prices move from premium to discount

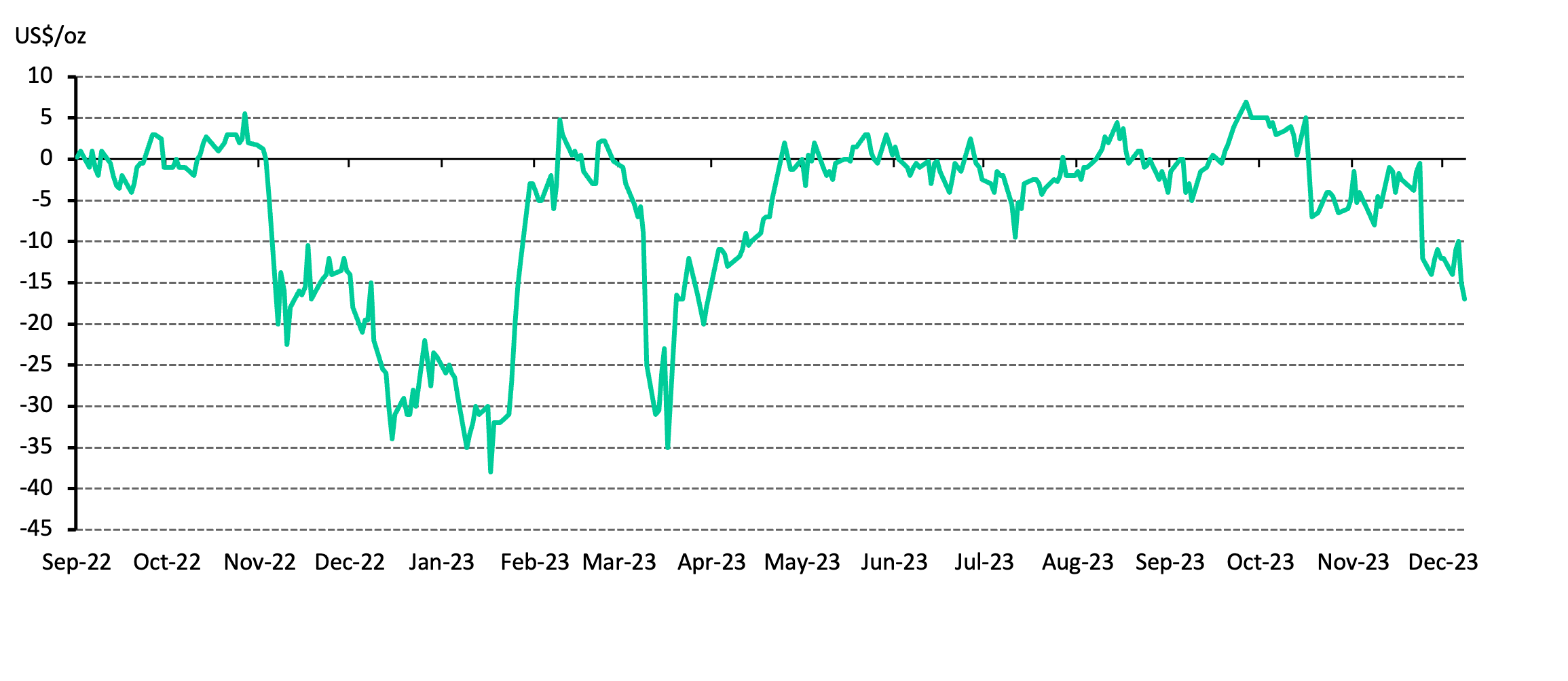

India gold ETF’s: sustained inflows

Indian gold ETFs continue to attract inflows. November marks the eighth consecutive month of net inflows, although lower than October inflows by US$6.6mn (12.3%). Fund inflows (net) totalled US$46.6mn at the end of November 2023. Y-t-d, Indian ETFs have recorded net inflows of US$289mn, a more than fourfold increase from the net inflows of US$69mn in the comparable period of 2022, reflecting the growing investor interest in gold that has been supported by its strong price performance.

Assets under management (AUM) of Indian Gold ETFs as of mid-December stood at approximately Rs26,500crore (US$3.2bn) with holdings amounting to 42.1t, a 27% and 9% increase y/y respectively.

Chart 3: Gold ETF fund flows and holdings

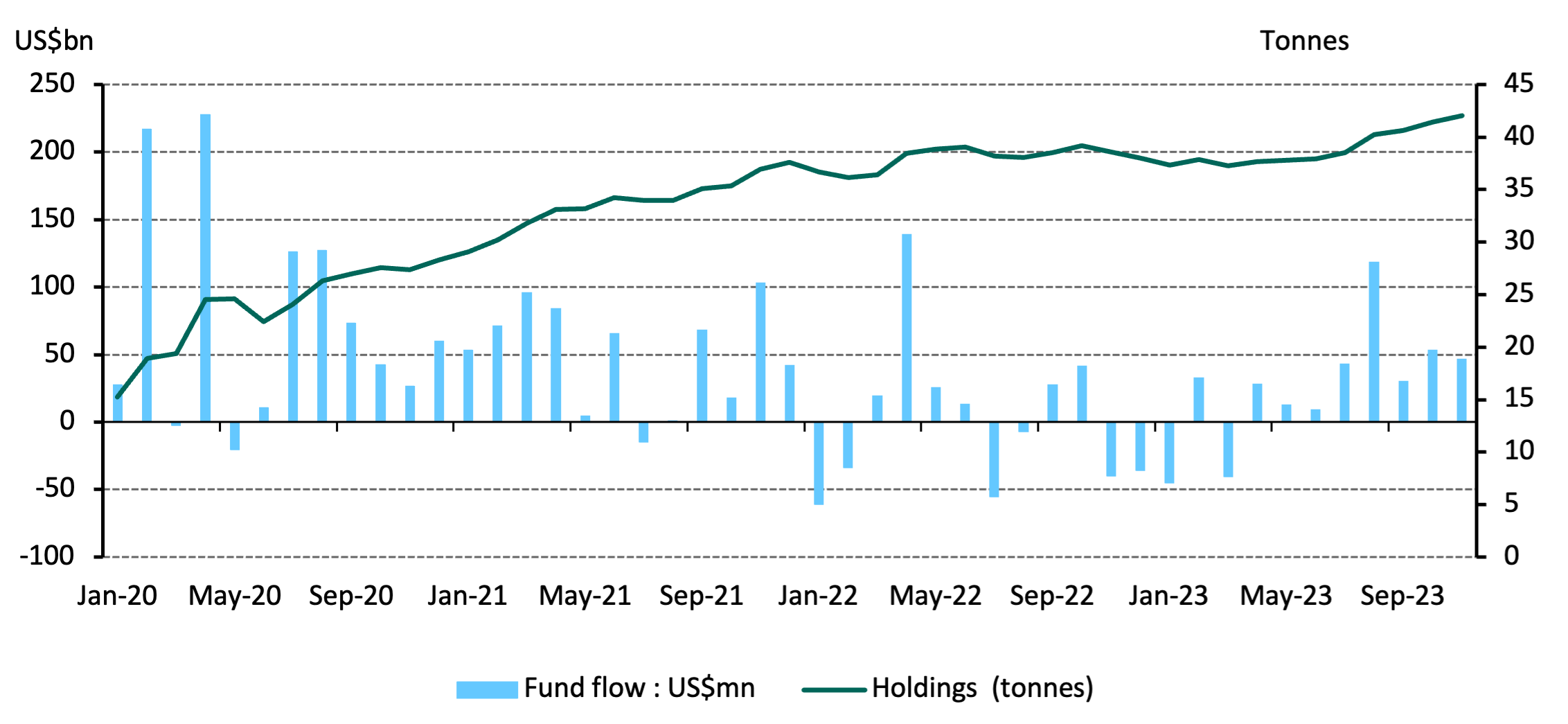

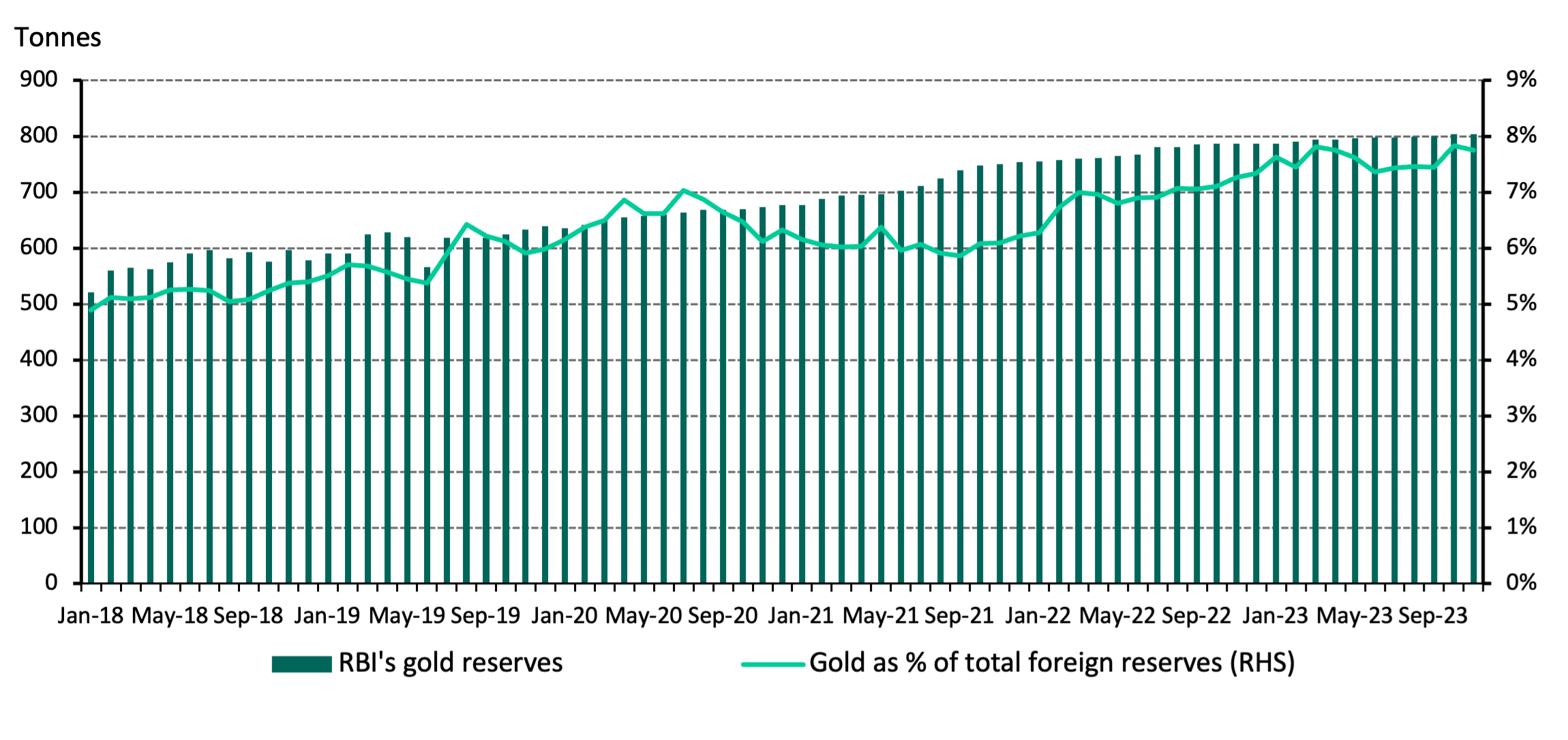

RBI gold reserves: high prices restrict buying

The RBI has been steadily adding to its gold reserves in recent years13 in what is being viewed by some as a way of diversifying its forex reserves given the volatility in bonds and currencies.14

RBI data and our estimates indicate that the central bank did not purchase gold in November,15 the first pause in six months. During eight of the first eleven months of 2023, the RBI has been a net buyer of gold, adding a total of 16.2t to its gold holdings. This is however notably lower demand than previous years. Annual net gold purchases by the RBI averaged 47t from 2018 to 2022.16 The central bank’s gold reserves as at the end of November are estimated to be 803.6t. During 2023, it has been buying an average 1.5t of gold per month.

As a percentage of forex reserves, gold accounts for 7.75% as at the end of November, marginally higher than the 7.26% share one year ago.

Chart 4: RBI adding to gold reserves, albeit gradually

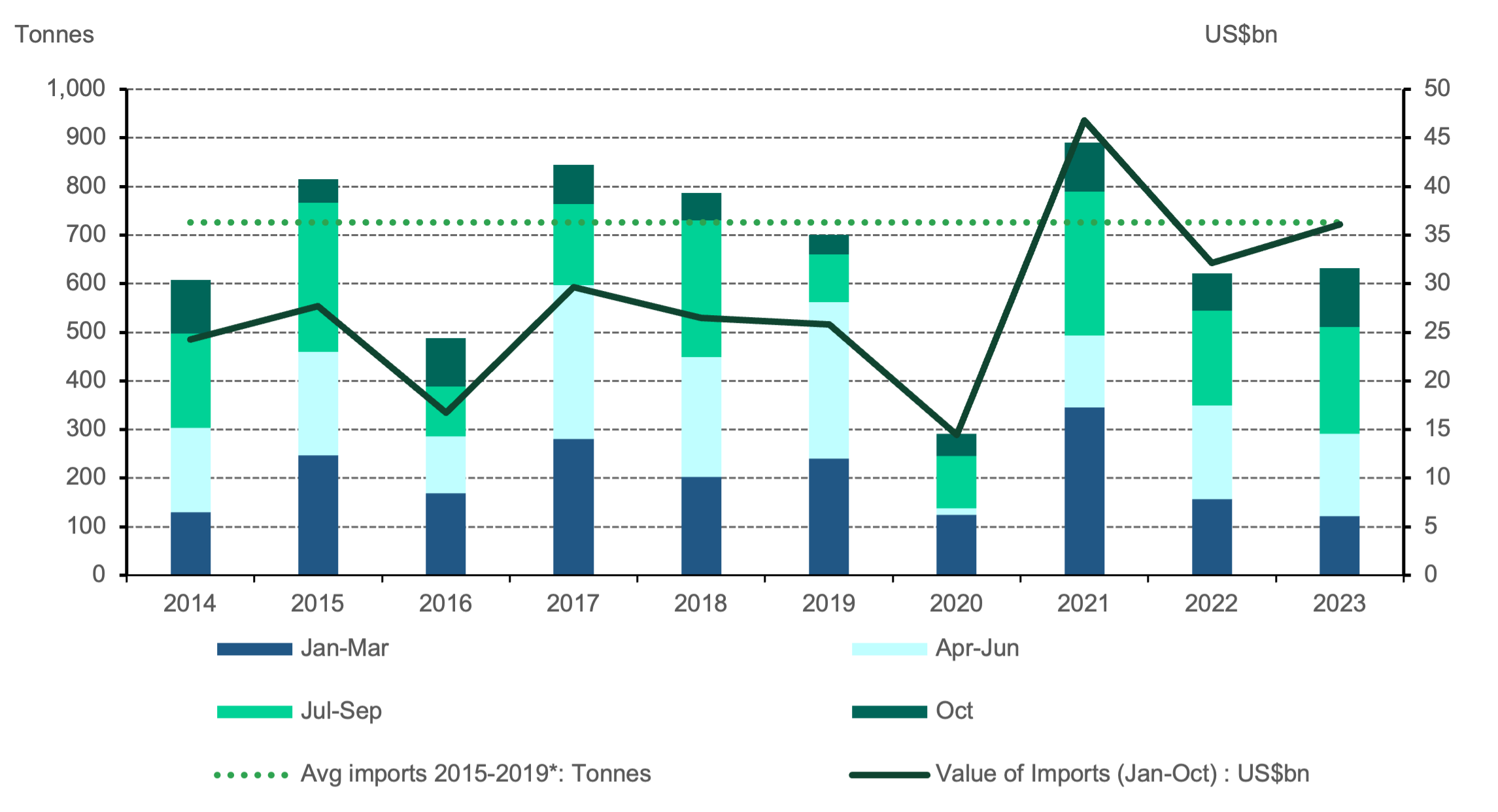

Gold imports: reduced volume

High prices and soft demand have weighed on the volume of gold imports even as the value of those imports has risen. The quantum of gold imports in the last two years has been 14% lower than the pre-Covid 5-year average (2015-2019),17 while in value terms it has risen by 35% due to the uplift in the price of gold.18 Gold prices in 2022 and 2023 were 59% higher than pre-pandemic levels (i.e. 2019).19

Cumulative imports for the first ten months of 2023 (Jan-Oct) were 630t, 2% higher y/y. However, in value terms, gold imports for this period were higher by 12% y/y, attributable to the 15% y/y increase in prices.

Gold imports have been underpinned by fluctuations in 2023. Monthly import volumes have ranged from 11t to 121 t. Q1 import volumes were at a decadal low. The pickup in the quantum of imports in Q3 and early Q4, can be associated with the festive season. Monthly import volumes averaged 73t in Q3, a notable increase from the 40t of Q1. In value terms, gold imports in October this year rose 95% y/y (to US$7.23bn) and in volume terms by 59% (121t). This increase can be ascribed to the 16% y/y rise in the price of the metal alongside higher festive season demand. But this momentum has not been sustained - gold imports in value terms (US$3.5bn in November) were almost half those of the preceding month indicative of the subdued demand for gold.

Chart 5: Price surge led rise in gold import bill

Footnotes

LBMA Gold Price PM expressed in INR (excludes taxes). All gold prices are expressed in LBMA Gold Price PM unless otherwise specified

2 October to 15 December 2023

LBMA Gold Price PM expressed in INR (excludes taxes) from 2 October to 15 December 2023

LBMA Gold Price PM expressed in local currency for the period 2 October-15 December

For the period 2 October-15 December

Based on the LBMA Gold Price PM expressed in local currency for the period 2 October-15 December

PMI manufacturing/services, industrial output, electricity and energy consumption, freight traffic, goods movement, tax collections, vehicle sales among others

https://www.thehindubusinessline.com/markets/gold/jewellery-recycling-to-touch-150-tn-as-gold-prices-soar/article67621155.ece

By importers, wholesalers etc

Based on NCDEX polled premium/discounts prevailing in the market from importers, wholesalers, etc

https://www.reuters.com/markets/commodities/asia-gold-india-discounts-hit-7-month-high-price-surge-dents-demand-2023-12-08/

China’s gold market in November: premium elevated, gold reserves rose further | Post by Ray Jia | Gold Focus blog | World Gold Council

From issues of weekly statistical supplement and monthly bulletin

https://www.livemint.com/market/commodities/rbi-joins-central-bank-gold-rush-buys-9-tonnes-in-julsep-11700408356510.html

Based on the RBIs weekly statistical supplement

Apr-Nov

For the period Jan-Oct

Average value of import in US$ during Jan-Oct

Average for 2022 and 2023 during Jan-Oct