Key highlights:

- The LBMA Gold Price AM in USD continued to rise while the Shanghai Gold Benchmark PM (SHAUPM) in RMB saw a subtle decline due to an appreciating yuan

- The industry withdrew 132t of gold from the Shanghai Gold Exchange (SGE) during November, an uptick of 11t m/m and a 16t rise y/y

- The local gold price premium remained stable and elevated, suggesting that net gold supply remained relatively tight

- Chinese gold ETFs saw marginal net outflows (-RMB124mn, -US$17mn) in November. Their collective holdings dropped to 59.4t (-0.3t) and total assets under management (AUM) fell by 1% to RMB28bn (US$3.9bn)

- The People’s Bank of China (PBoC) disclosed a further gold purchase in November –the thirteenth consecutive monthly purchase – pushing its reported gold reserves up by 12t to 2,226t.

Looking ahead:

- Gold once again headlined local news as the international gold price soared to an all-time high in early December. But this could be a double-edged sword for demand in China, drawing attention to gold for investment but potentially denting gold jewellery consumption due to budget constraints. With the gold price remaining high, we could see an upsurge in recycling activities

- In the near future, we anticipate that wholesale demand will not pick up materially until January, when restocking activities will take place for the Chinese New Year holiday in early February. Meanwhile, investment demand is likely to remain strong.

Gold prices in different directions

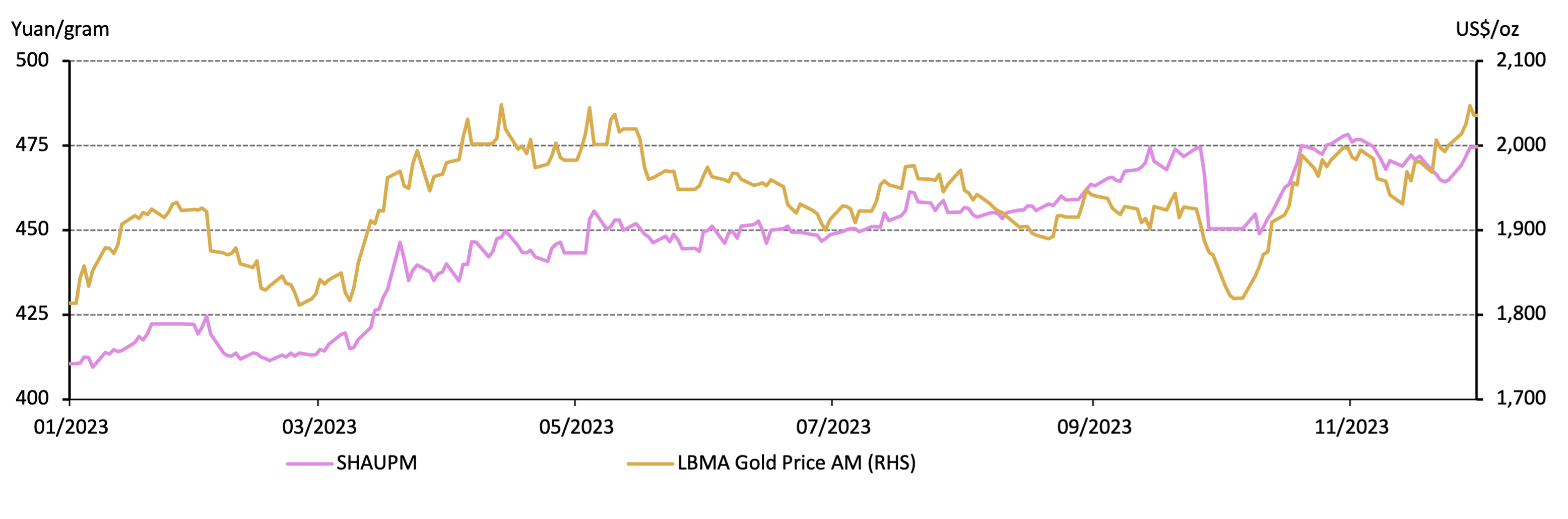

Global gold prices saw mixed performances in different currencies (Chart 1). While the LBMA Gold Price AM in USD rose by 2% and stood firmly above US$2,000/oz, the SHAUPM in RMB dropped by 1%.

The strength in the USD gold price was mainly driven by lower yields and a weaker dollar, as well as heightened geopolitical tension and bullish investor positioning. Meanwhile, the relative weakness of the RMB gold price can be attributed to a stronger local currency: in November the RMB appreciated by 2.5% against the dollar.

Chart 1: The RMB gold price fell slightly while its USD peer rose

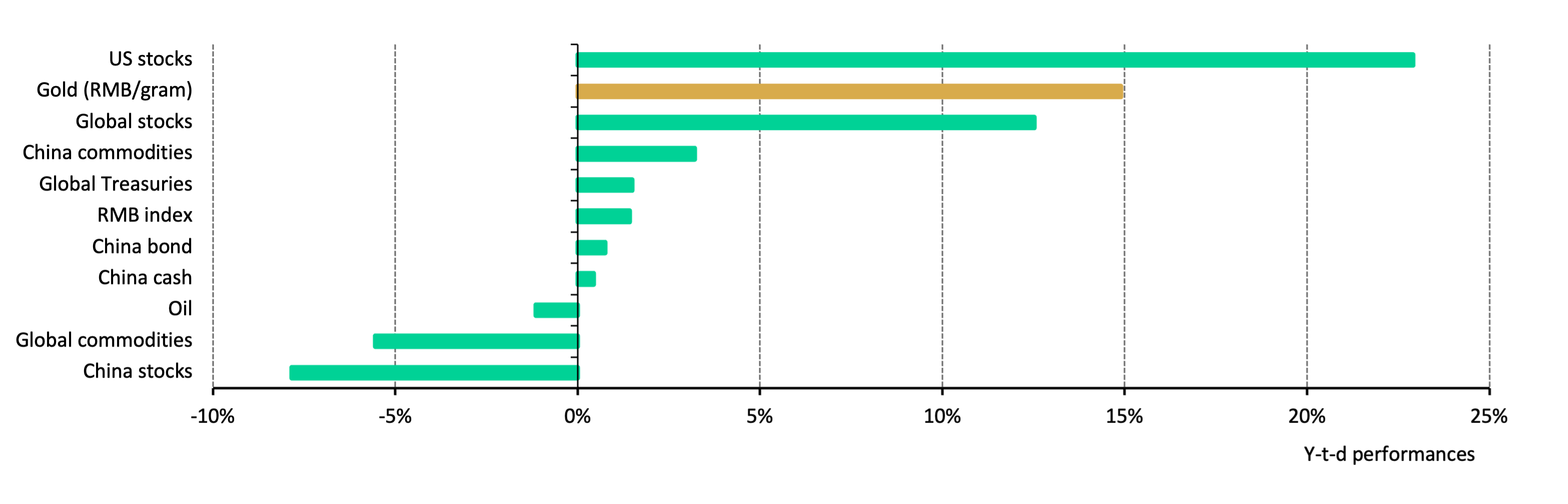

Y-t-d the SHAUPM has delivered a 15% return, dwarfing other major assets (Chart 2). Meanwhile, the LBMA Gold Price AM in USD rose by 12%. Strong central bank purchases, geopolitical risks and intensifying expectations that major central banks will end their tightening cycles have driven gold prices higher. And the Chinese gold price has received an additional boost from a weaker RMB.

Chart 2: Gold in RMB remained stronger than other major assets

Major asset performance between January and November 2023*

Wholesale demand improved

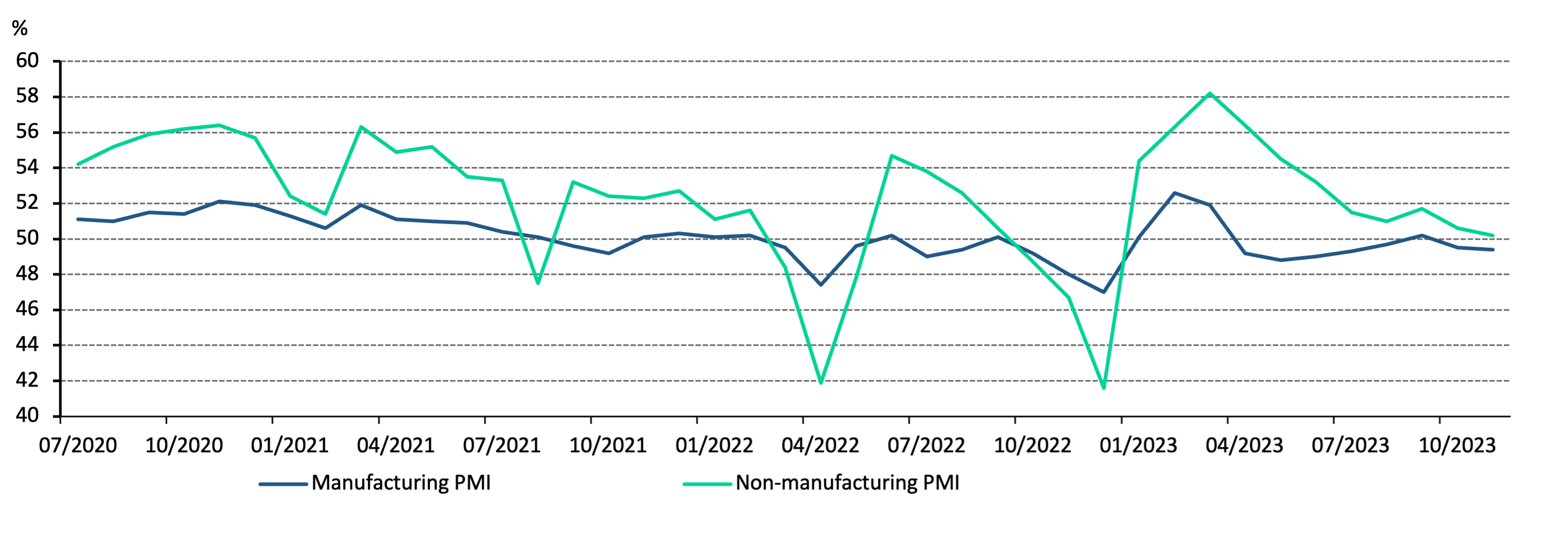

China’s economy remained under pressure. According to the National Bureau of Statistics, China’s official manufacturing PMI fell further to 49.4 (Chart 3). And the non-manufacturing PMI also saw continued declines, although it remained above the 50 expansion-contraction threshold. On the bright side, exports rose by 0.5% y/y, defying the consensus of a 1.1% y/y decline.

Chart 3: PMIs remained subdued in November

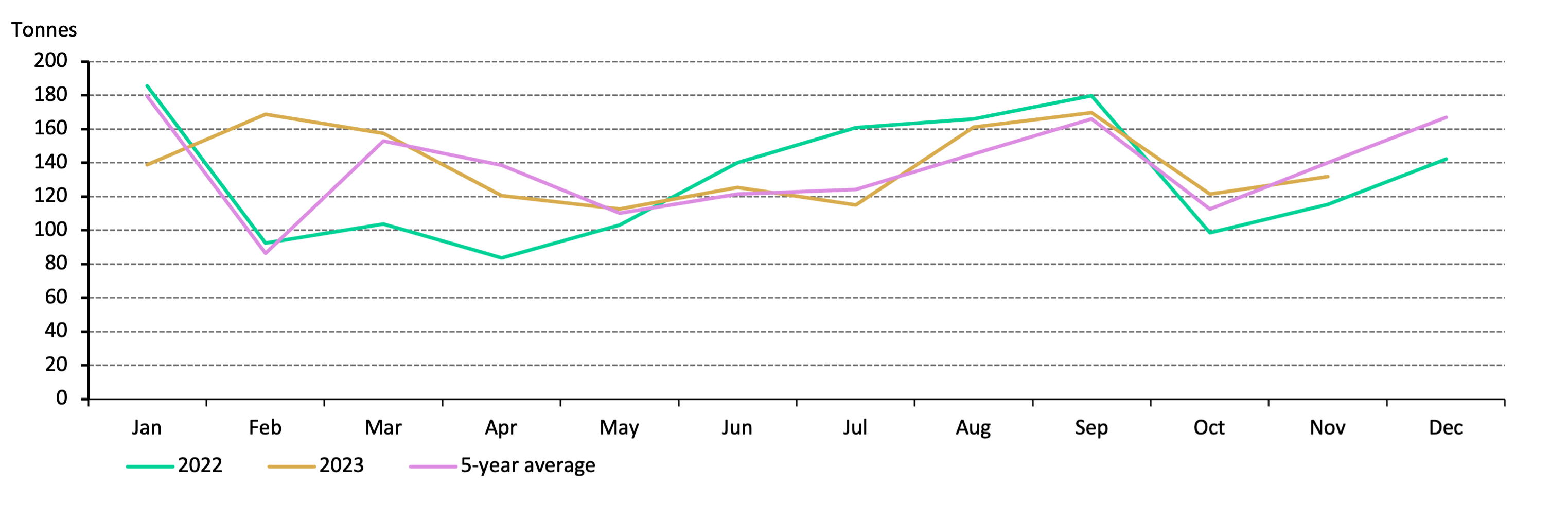

The industry withdrew 132t of gold from the SGE in November, 11t higher m/m and 16t higher y/y (Chart 4). Seasonality was once again the key driver of this m/m rise in wholesale gold demand. Historical data suggests that replenishing activities from gold manufacturers tend to pick up ahead of the traditional peak season for gold consumption during the Chinese New Year holiday, which usually occurs in January or February.

But compared to the five-year average, withdrawals were slightly weaker (by 8t). We believe there were two reasons for this:

- The record-level local gold price and weaker-than-expected sales during the Golden Week in early October led to conservative re-stocking by manufacturers

- This year’s later-than-usual Chinese New Year holiday (10-17 February) may have delayed the industry’s pre-peak-season replenishment.

Chart 4: Gold withdrawals improved

Local premium unchanged in November

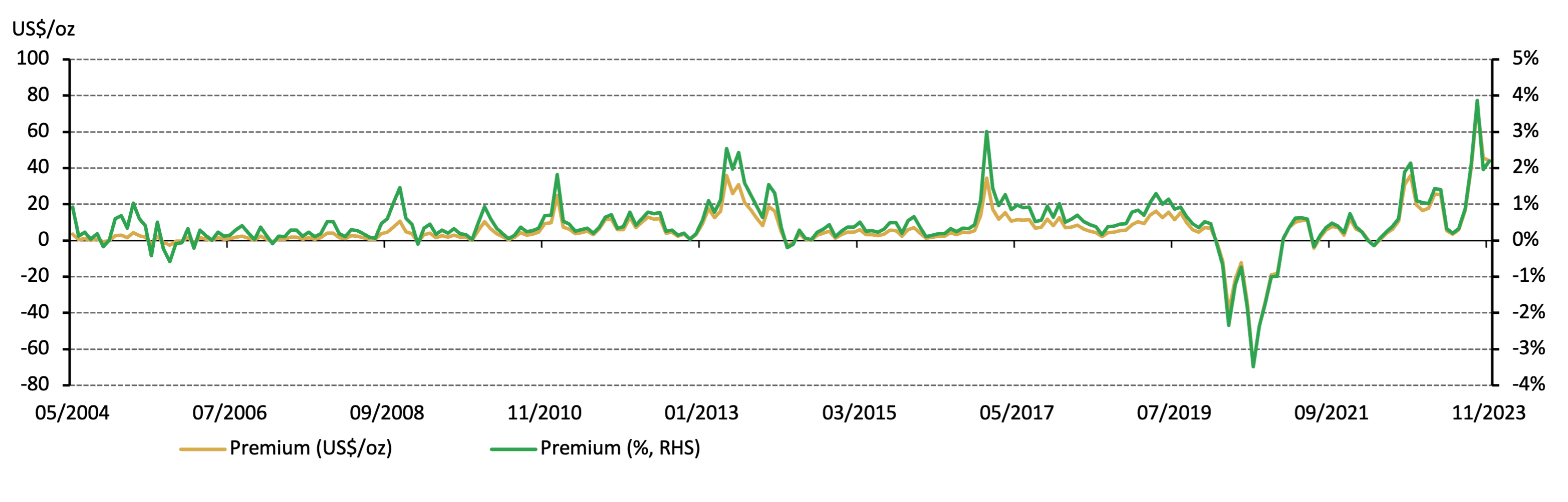

The average Shanghai gold price premium in November was US$44/oz, or 2%, virtually unchanged from October’s US$45/oz (2%) (Chart 5). Lower imports in recent months, compared to earlier this year, and relatively stable demand may have kept local net gold supply tight, supporting the Shanghai-London gold price premium.

Chart 5: The local gold price premium was little changed

The monthly average spread between SHAUPM and LBMA Gold Price AM in US$/oz and %*

Chinese gold ETFs saw mild outflows

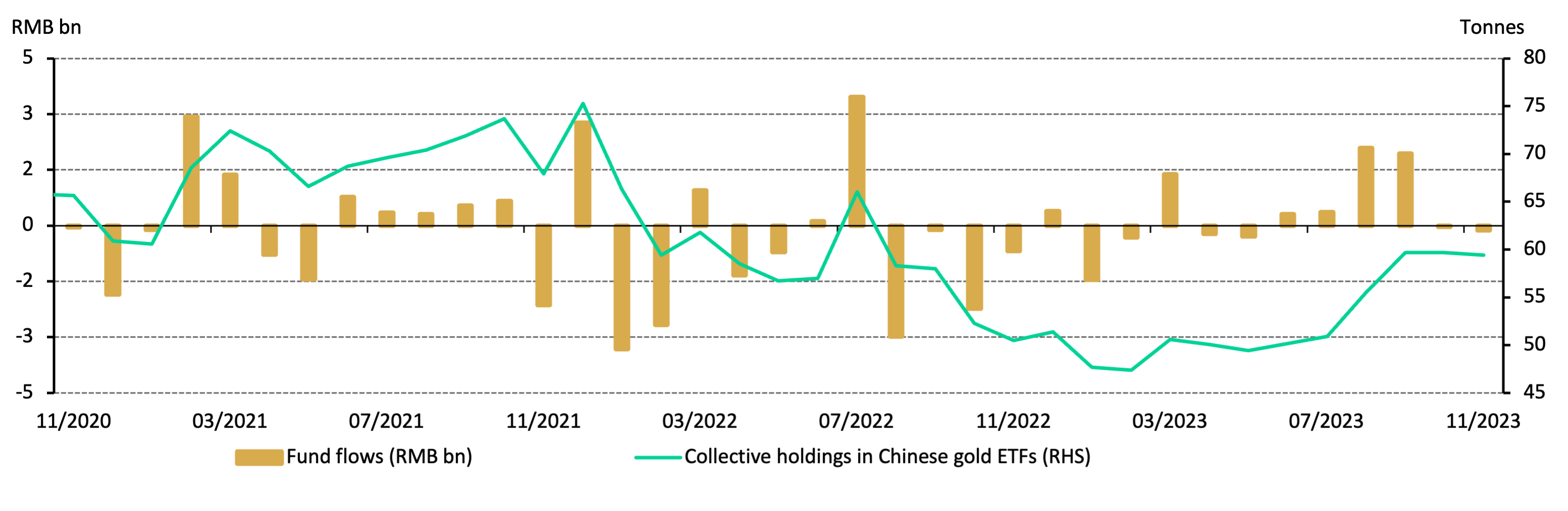

Chinese gold ETFs shed RMB124mn (US$17mn) in November (Chart 6). Their total AUM fell by 1% to RMB28bn (US$3.9bn) and collective holdings dropped by 0.3t to 59.4t. A range-bound local gold price and the strengthening RMB may have limited investor interest in gold ETFs during the month.

Chart 6: Chinese gold ETFs saw minor outflows

Monthly fund flows and Chinese gold ETF holdings

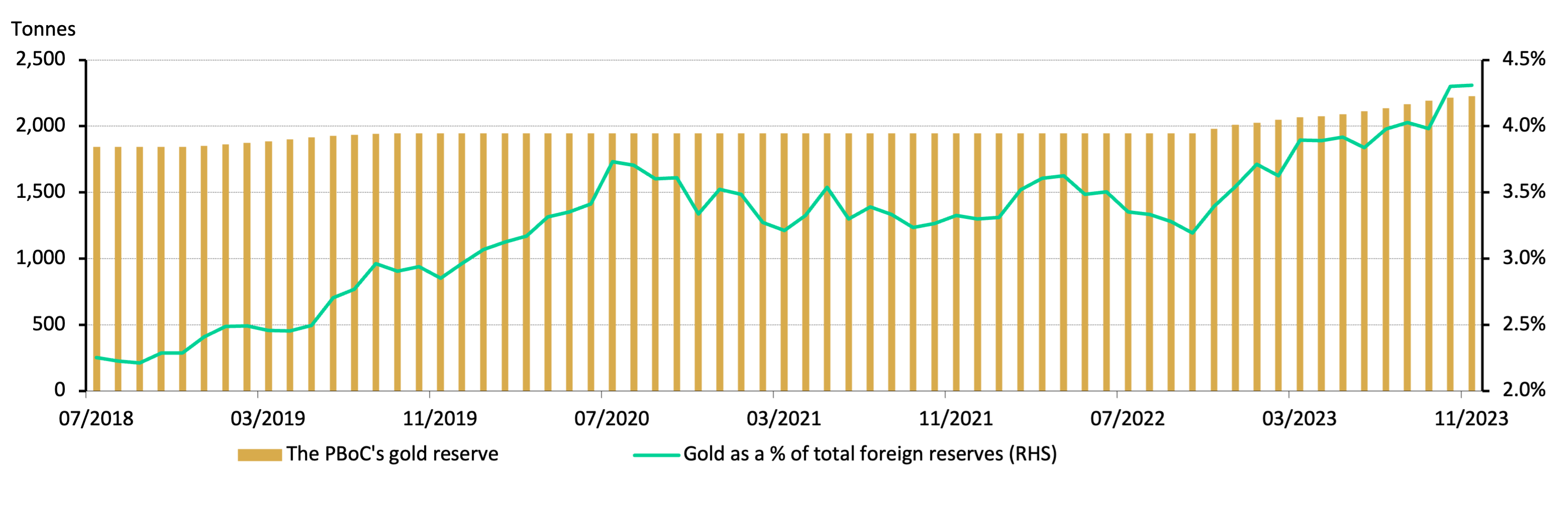

The PBoC gold-buying spree continued

China’s gold reserves climbed to 2,226t by the end of November, a 12t m/m increase and the thirteenth successive reported purchase (Chart 7). During this 13-month period, 278t of gold has been added to the PBoC’s gold reserves. So far in 2023 China has announced gold purchases amounting to 216t.

Chart 7: China’s gold reserves rose further

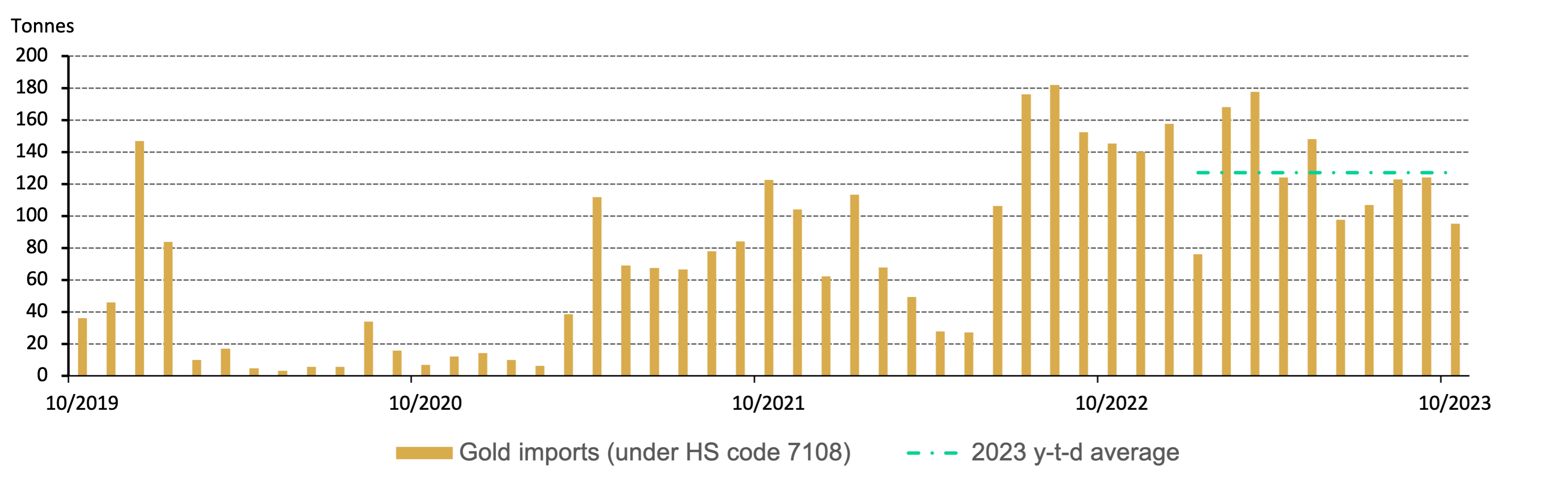

Imports lowered in October

According to the latest information, China imported 95t of gold in October, a 29t decline m/m and 32t lower than the y-t-d average (Chart 8). Seasonal weakness in wholesale demand and the retreating premium, among other factors, may have impacted October’s imports. Y-t- d, gold imports into China totalled 1,241t, 105t lower y/y.

Chart 8: China’s gold imports fell in October*