Key highlights:

- The LBMA Gold Price AM in USD and the Shanghai Gold Benchmark PM (SHAUPM) in RMB fell by 3.7% and 2.8% respectively, ending Q3 with diverging performances

- 170t of gold was shipped out of the Shanghai Gold Exchange (SGE), a 9t rise m/m amid the industry’s usual restocking ahead of the traditional peak season for gold consumption. Withdrawals totalled 446t in Q3, 12% lower y/y mainly due to 2022’s distorted seasonality and a higher local gold price1

- September saw the Shanghai-London gold price premium hit a new record, averaging US$75/oz in the month, possibly due to tightening net gold supplies. And during the first trading week of October, the premium has pulled back likely driven by easing local supply and demand conditions

- Total assets under management (AUM) in Chinese gold ETFs have now risen four months in a row, to RMB27bn (US$3.7bn, 59.7t) at the end of September, an inflow of RMB1.9bn (+US$266mn, +4.2t) during the month, and attracting RMB4bn (+US$611mn, +9.5t) in Q3

- The People’s Bank of China (PBoC) reported a further gold purchase of 26t in September, bringing total gold reserves to 2,192t. China’s gold reserves rose by 78t in Q3.

Looking ahead:

- Gold consumption during this year’s eight-day Golden Week Holiday was somewhat disappointing.2 According to the Shanghai Gold and Jewellery Association, Shanghai’s gold jewellery consumption during the holiday totalled RMB780mn, 14% lower than 2022’s seven-day Golden Week (RMB912mn); jewellers in other regions reported a similar picture.

- This weakness in demand during the holiday period can be attributed to the elevated local gold price and the competition for wallet share from travel spend, which is back to pre-pandemic levels.3 And these factors may continue to hinder local gold consumption as Q4, the peak season for gold demand, unfolds. Nonetheless, we expect local demand to draw support from seasonal factors and stronger demand for wedding gold jewellery over the coming months.

Gold prices weakened in September

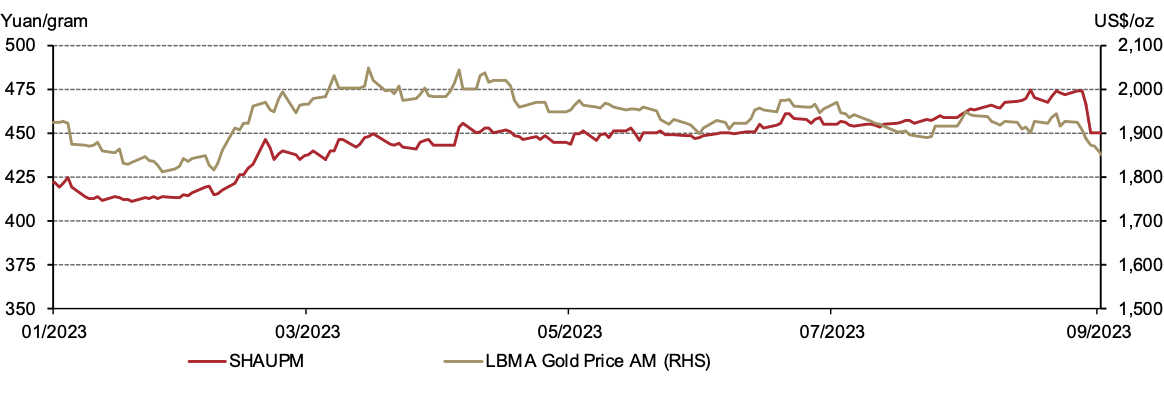

Gold prices in USD and RMB experienced a volatile month (Chart 1). As US Treasury yields continued to rise and the dollar strengthened the LBMA gold price AM in USD weakened further. As shown in the chart below, most of the weakness was concentrated during the last week of September when gold breached the psychological threshold of US$1,900/oz. The SHAUPM in RMB saw a similar but relatively narrower decline as the local currency depreciated against the dollar.

Chart 1: Gold prices fell in both USD and RMB

Daily prices of SHAUPM (red) and LBMA Gold Price AM (gold)*

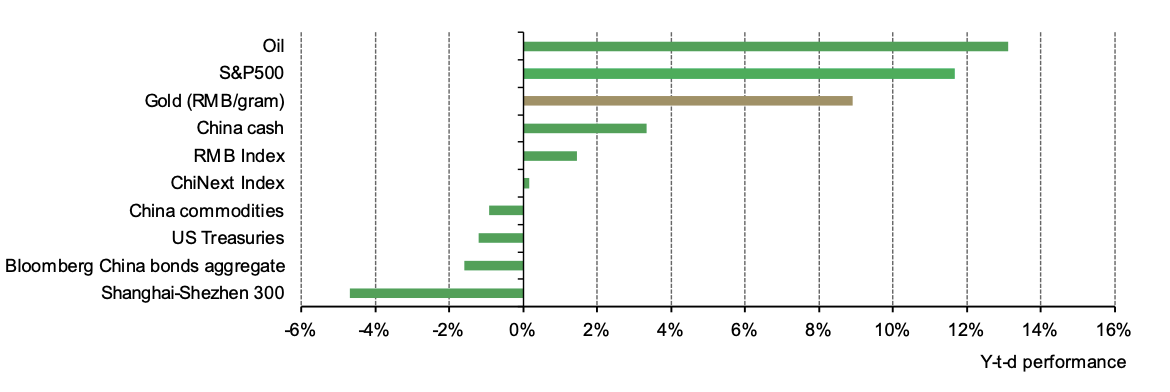

September’s weakness narrowed the SHAUPM’s Q3 strength to 0.4% while its USD peer fell by 2.2% in the quarter. But during the first three quarters of 2023, the SHAUPM registered a 9% gain and remains the top performing RMB asset in China (Chart 2).

Chart 2: Gold in RMB delivered a 9% increase y-t-d

Major asset performance during the first nine months of 2023*

Wholesale demand rebounded further

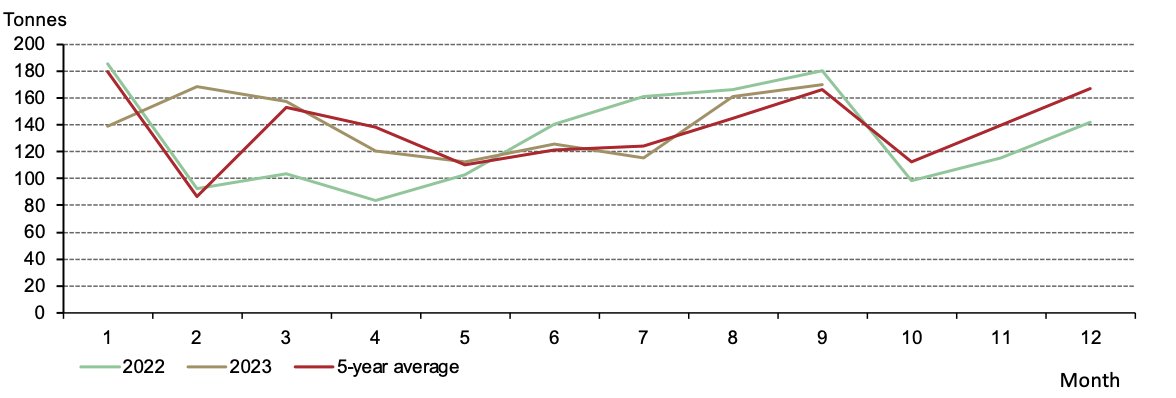

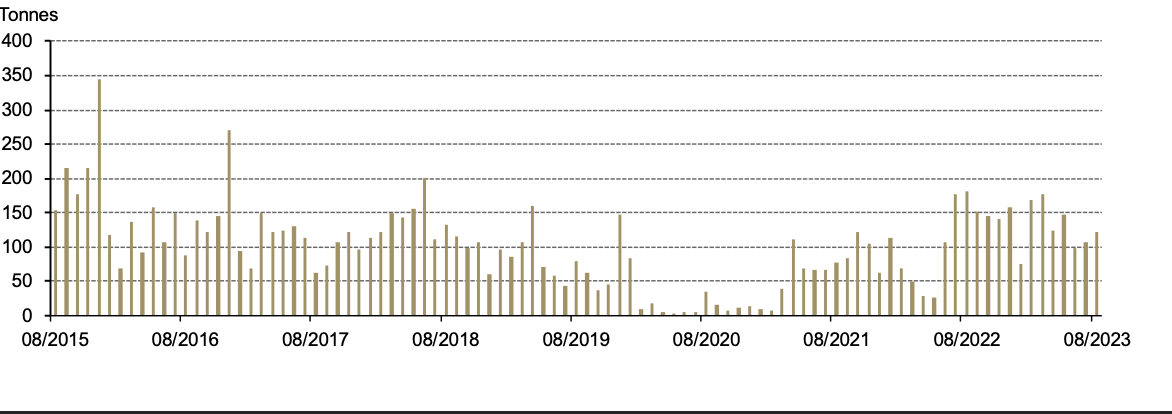

Gold withdrawals from the SGE experienced a typical September, registering a seasonal m/m rebound of 9t (Chart 3). The 170t wholesale gold demand was also slightly above the five-year average of 166t. The industry’s active stock replenishing ahead of the Golden Week Holiday added to support from key jewellery fairs – which boded well for the jewellery trades – drove the seasonal rise.

However, there was a small 10t y/y fall in last month’s wholesale gold demand. We believe this was mainly due to:

- Distorted demand seasonality in 2022 due to COVID-related restrictions

- The record-level local gold price and rising price volatility, which led to some jewellers to hesitate over stock replenishment.

Chart 3: Gold withdrawals rose further in September

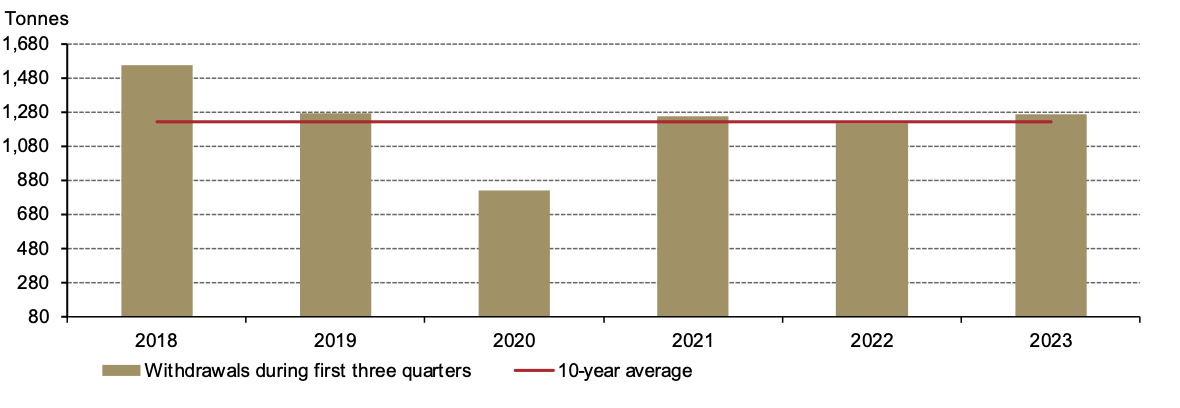

In Q3 the industry withdrew 446t gold from the SGE, 12% lower y/y due to factors similar to those mentioned above. But Q3 gold withdrawals were 2% higher than the five-year average, reflecting a relative healthy recovery during the first post-COVID year. During the first three quarters local wholesale gold demand reached 1,269t, 4% higher than 2022 and rising above the five-year average.

Chart 4: Wholesale gold demand improved*

Local premium rocketed to unseen levels

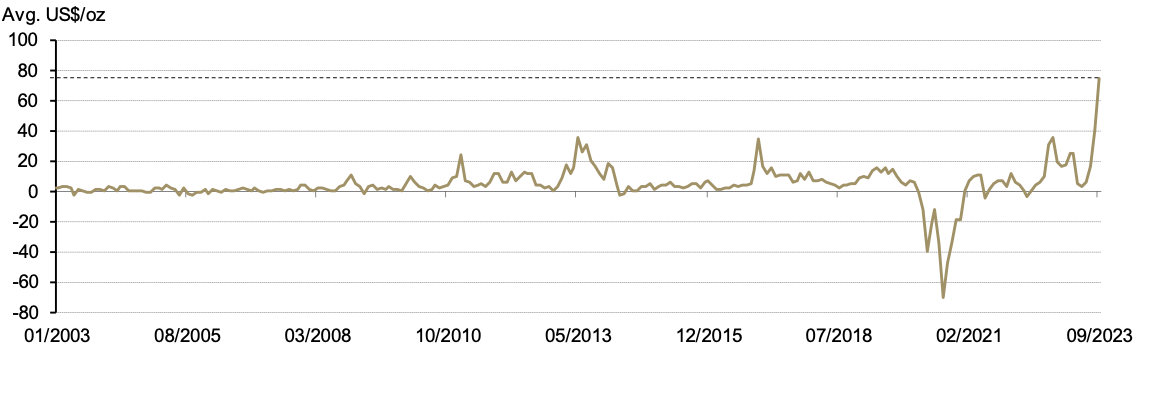

The local gold price premium’s record surge became headline news.4 September’s average Shanghai-London gold price premium soared to US$75/oz, beating the previous record set in August of US$40/oz (Chart 5); the daily premium record of US$121/oz was reached on 14 September. As noted in a previous blog, we believe tightening of net gold supplies in China was the main contributor.

Chart 5: September pushed the average premium to another record high

The monthly average spread between SHAUPM and LBMA Gold Price AM in US$/oz*

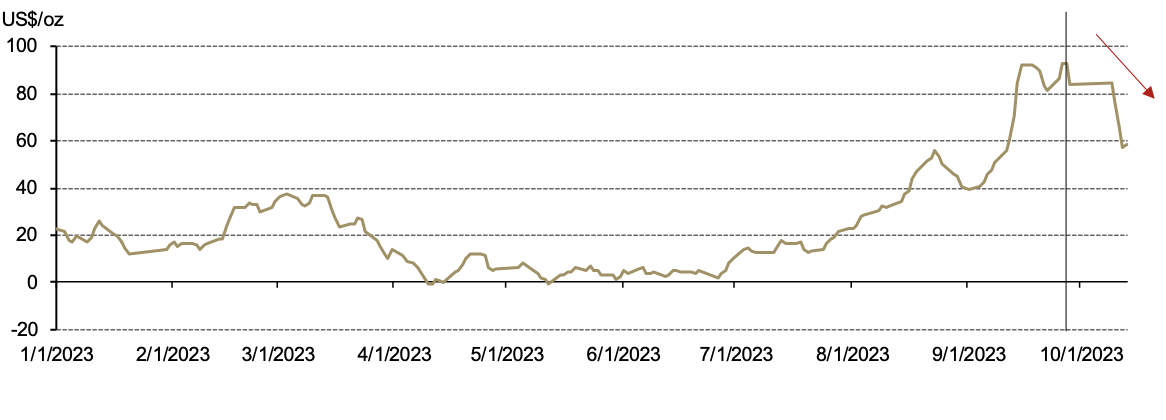

And the premium has come down notably after the Golden Week Holiday (Chart 6), possibly due to relatively easing supply conditions after the Golden Week Holiday and softer wholesale demand – we will continue to track changes in the premium and the physical market status in our next blog.

Chart 6: The premium has pulled back in early October

Five-day rolling average of daily premium

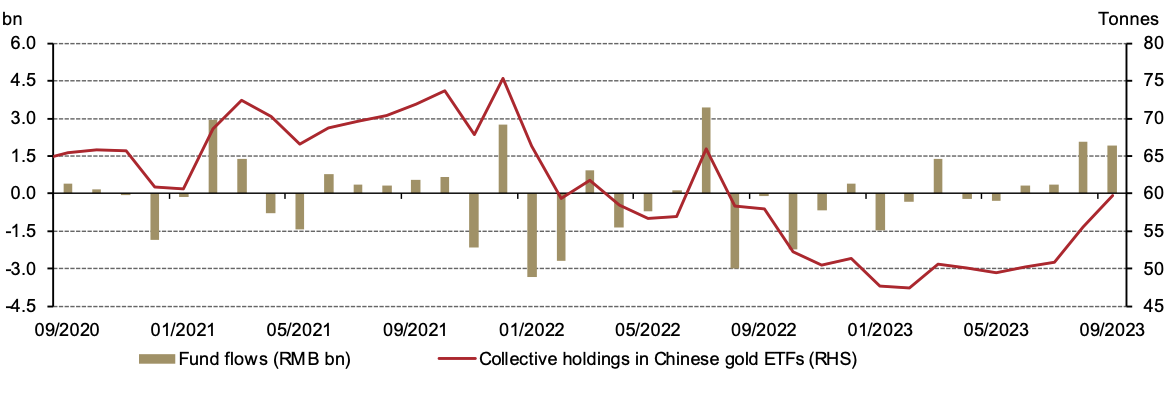

Chinese gold ETFs continued to attract notable inflows

Chinese gold ETFs saw their fourth consecutive monthly inflow in September, attracting RMB1.9bn (+US$266mn, +4.2t). While the surging local gold price during September has already attracted investor attention, ETF providers are increasing their promotional efforts and this too boded well for demand. And as the CSI300 stock index fell further (-2%), we believe a rise in safe-haven demand added to gold’s appeal.

By the end of Q3, total AUM in Chinese gold ETFs reached RMB27bn (US$3.7bn), accumulating an inflow of RMB4bn (US$611mn) during the quarter, the strongest since Q3 2020 in RMB terms. Meanwhile, holdings rose 9.5t in Q3 to 59.7t. The strong Q3 completely reversed H1’s minor outflows, leading to a y-t-d rise in collective holdings of 16% or 8.3t, equivalent to positive flows of RMB3.9bn (US$536mn).

Chart 7: Gold ETF demand continued to rise in September

Monthly fund flows and Chinese gold ETF holdings

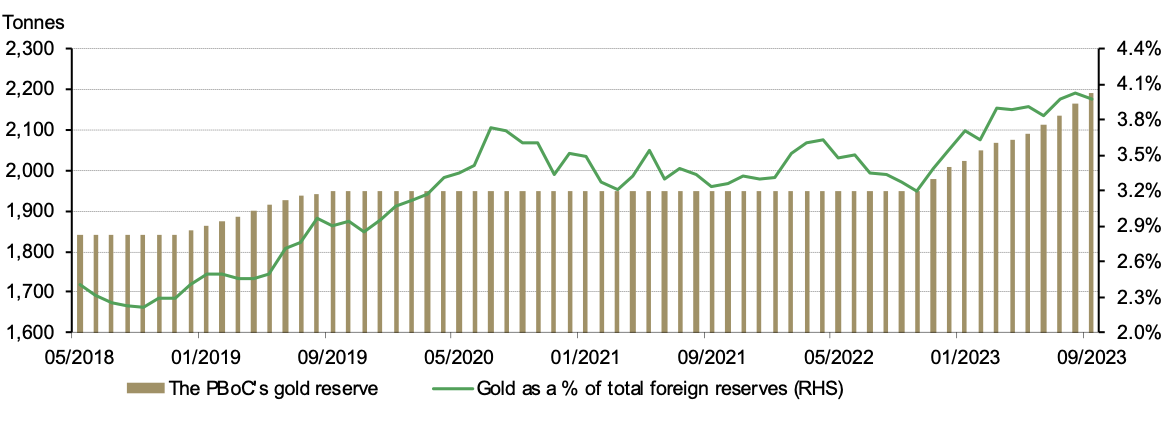

The rising streak in the PBoC’s gold reserves continued

China’s gold reserves reached 2,191t at the end of September, a 26t increase m/m and stretching the rising streak to 11 months (Chart 8). In USD terms, gold’s share in China’s total foreign reserves remains at 4%. September’s addition puts the PBoC’s reported gold purchases in Q3 to 78t, and 181t so far in 2023.

Chart 8: The PBoC announced its 11th consecutive gold purchase

August’s imports remained stable

August saw 119t gold imported into China (Chart 9), a 15t m/m rise but a 61t y/y plunge, according to the most recent data from China Customs. We believe August’s wholesale gold demand rebound contributed to the minor m/m rise, although imports remained below last H2’s average of 156t and this H1’s 130t.

Chart 9: August’s imports rebounded m/m but lowered notably y/y

Footnotes