- Over the past few weeks, the Chinese gold price premium has rocketed to a record high

- Our analysis shows that local demand and supply conditions constitute a key driver of premium

- Looking ahead, supply needs to ease for the premium to return to its normal parameters; meanwhile, the record-level RMB gold price may negatively impact local demand

China’s local gold price premium has surged to record levels

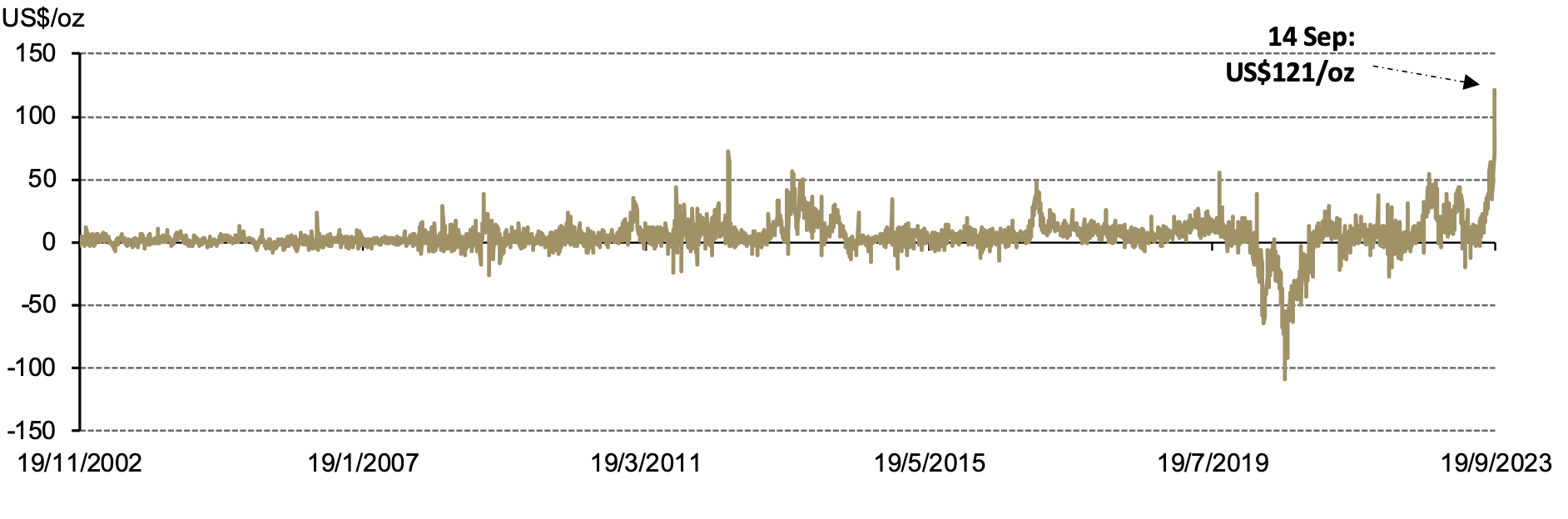

China’s local gold price premium has rocketed to previously unseen levels, reaching US$121/oz on 14 September (Chart 1). And August’s US$41/oz monthly average already marked a record since the Shanghai Gold Exchange’s establishment in 2002.

Chart 1: The local gold price premium rocketed

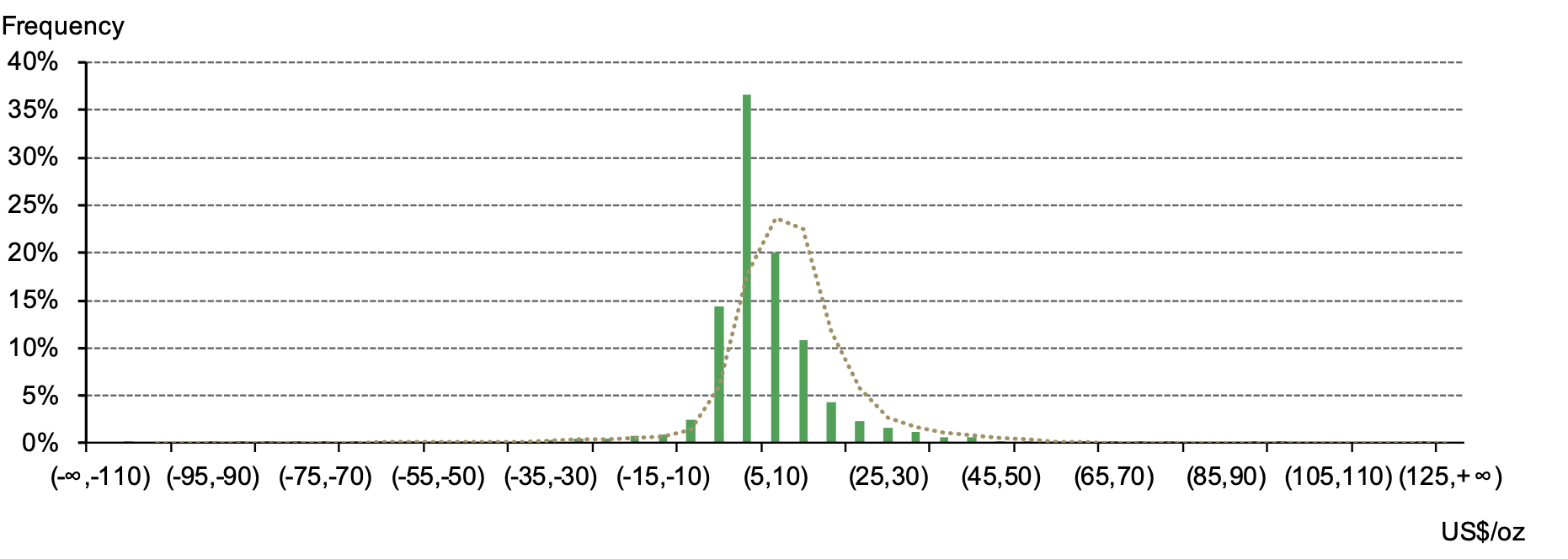

As we noted in a previous report, China’s local gold price, after adjusting for exchange rate differences, is normally higher than its international peer. This can be explained by the fact that prior to the pandemic, over 60% of China’s gold supply came from imports, as domestic production simply could not meet demand.1 And due to import controls, gold has become a scarcer commodity relative to other markets where it flows freely. As such, we believe the local gold price premium, typically between US$5/oz~US$15/oz (Chart 2), is a result of gold’s scarcity in China and import costs. 2

Chart 2: Normally, the local gold price premium ranges between US$5/oz and US$15/oz

Distribution of daily local gold price premium by frequency*

Net supply conditions have been a main contributor to the changes in premium

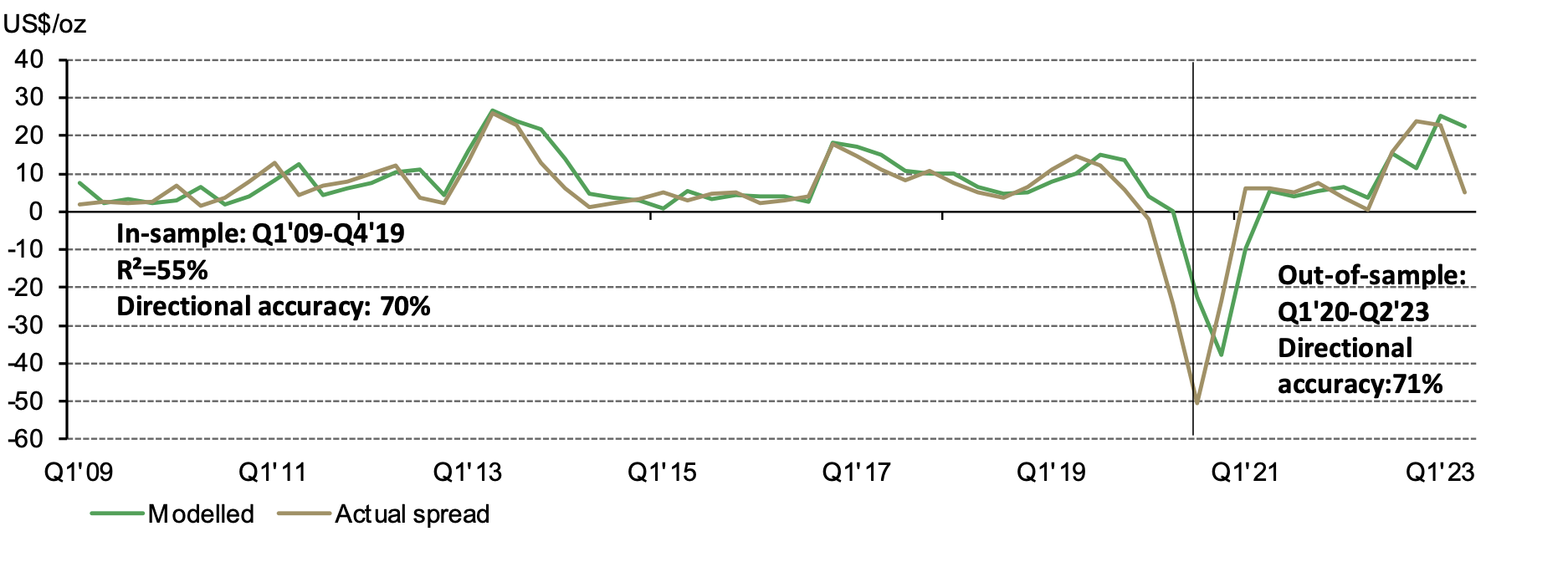

The question we have been hearing a lot lately is: what’s driving the spread’s significant deviation from its mean? In our monthly China gold market blog series we attributed this change to tighter local supply and demand conditions. Our quarterly spread model suggests similar drivers: mean reversion and net supply changes explain 55% of the Shanghai-London spread variations3 (Chart 3).

Chart 3: Our quarterly premium model suggests mean reversion and net supply are main drivers*

Data analysis confirms our thesis. The rebound in the local premium began in June after a sharp contraction in supply (proxied by imports as monthly production data is not available) and relatively stable demand. Relative to earlier this year, imports remained limited in July and August; just when wholesale demand had started to pick up and purchases announced by the central bank led to continued rises in the Shanghai-London gold price premium. The possibility of Shanghai-COMEX futures spread short covering may also have fuelled the premium’s rise.

Outlook

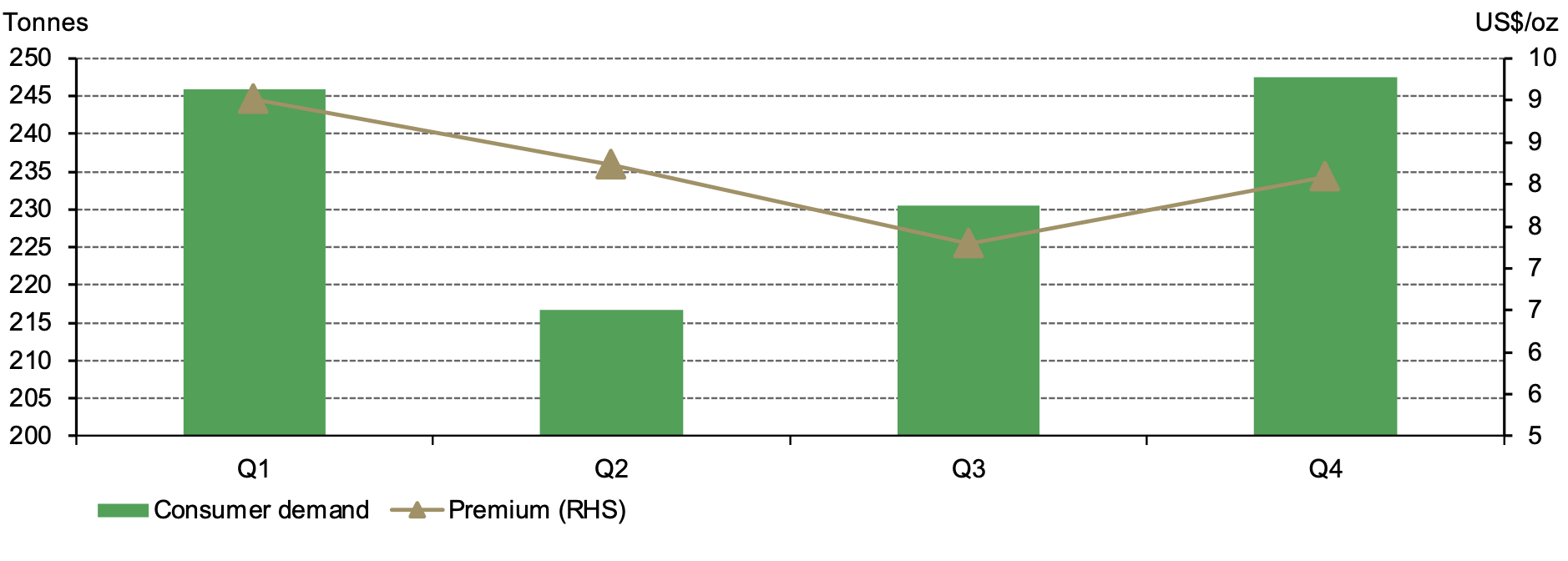

Has the dust settled on the premium’s recent run? At the time of writing the premium has come down from its record level of US$121/oz to US$84/oz (as at 22 September). Mean reversion, which is possibly intensified by fresh spread shorts amid the record deviation from its mean, may have weighed on the local premium. But we believe China’s gold supply needs to ease for the spread to return to normal, especially as Q4 – the peak season for local demand, which positively impacts premium – rapidly approaches (Chart 4).

Meanwhile, the record-level RMB gold price may hurt local gold consumption. The rising gold price in China has been a key deterrent to demand recovery so far in 2023 and may continue to dampen consumer interest, potentially leading to weaker-than-expected sales during the traditional boost from the upcoming Golden Week. One way or another, we expect gold demand and supply to eventually reach equilibrium.

Chart 4: Local gold price premium usually rises in Q4

Average quarterly premium and gold demand*

Footnotes

Based on the five-year average supply and import data before the pandemic, between 2015 and 2019.

Including costs of various transportation, insurance, swap or refining – from London Good Delivery bars of 400oz at 99.5% to kilo bars at 99.5% or 99.99% fineness, which are main trading formats at the SGE – custom clearing and other SGE related costs.

We started with quarterly spread model due to the fact that demand and supply data are typically updated on a quarterly basis.