- Central banks reported adding 77t of gold to global reserves in August

- China, Poland and Turkey were again buyers; no notable sales during the month

- As we head into Q4, central banks remain on course for a strong annual total.

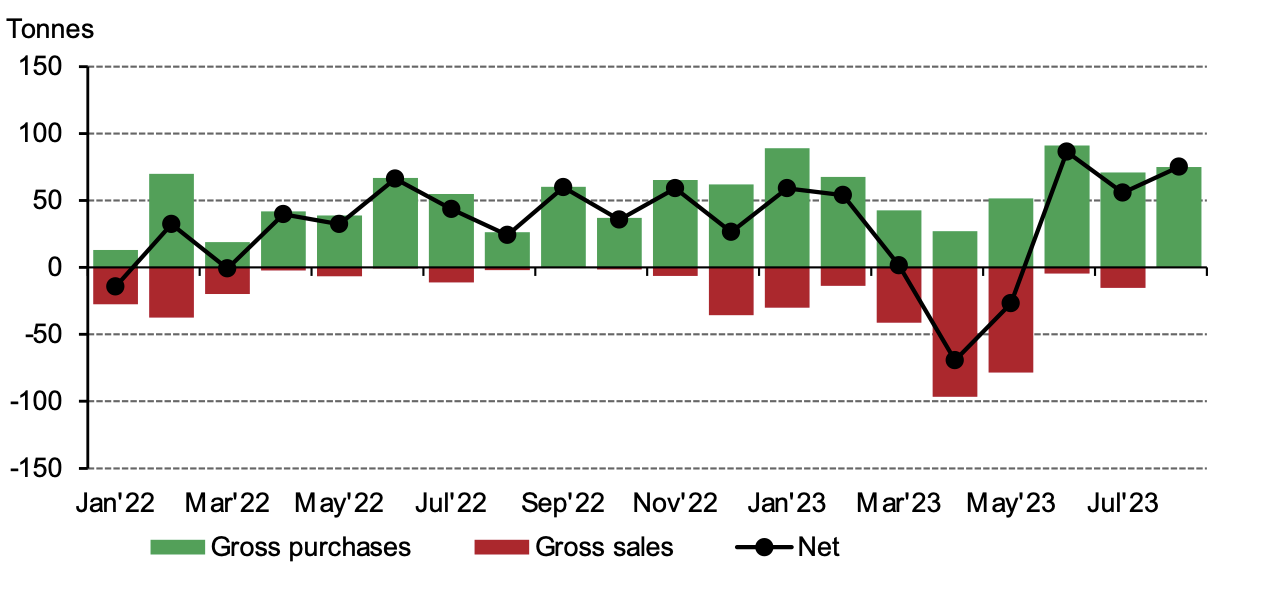

Central banks collectively increased their gold reserves in August for the third consecutive month. They added – based on the reported data at the time of writing – 77t to global official reserves during the month, a 38% up-tick from July’s buying.1 Over the last three months, their combined net buying has totalled 219t, comfortably outweighing the combined net sales from April and May (96t).

Central banks post another month of strong gold buying in August*

This recent buying suggests that we have now firmly moved past the net selling we saw in April and May, which was primarily driven by heavy, non-strategic selling from Turkey. We are therefore confident that the long-term trend of healthy central bank demand remains in place.

Buying, however, continues to be sizeable but limited to a small number of banks. The People’s Bank of China once again led the pack, adding a further 29t during the month. This brings its y-t-d net purchases to 155t, and its total buying since last November – when it began regularly reporting purchases – to 217t. As a result, gold holdings climbed to 2,165t at the end of August, accounting for just over 4% of total reserves.

The National Bank of Poland (NBP) also remained a significant buyer during the month. The NBP bought a further 18t, bringing its y-t-d net buying to 88t and a step closer to its previously stated 100t buying target.2 Its gold reserves now amount to 314t (11% of total reserves). Meanwhile, the Central Bank of Turkey added 15t to its gold reserves in August as it continues to rebuild its reserves following the sales mentioned above.3

The Central Bank of Uzbekistan (9t), the Reserve Bank of India (2t), the Czech National Bank (2t), Singapore (2t) and National Bank of the Kyrgyz Republic (1t), were the other buyers in the month. The Central Bank of Russia also reported a 3t increase in its gold reserves in August, taking its gold reserves back to where they started the year at 2,333 tonnes.

While reported sales were virtually non-existent in the month, Bloomberg reported claims that the Central Bank of Bolivia had “monetised” 17t of its gold reserves between May and August. This follows new legislation in May enabling the central bank to utilise its gold reserves.4 If confirmed, this would represent a 40% decline in its gold reserves (tonnage terms). Until confirmed, however, there is ambiguity in the use of “monetise” as this could mean several things, including, for example, outright sales or swap agreements. Currently, data on gold reserves at the Central Bank of Bolivia is not available after April, so we await more information.

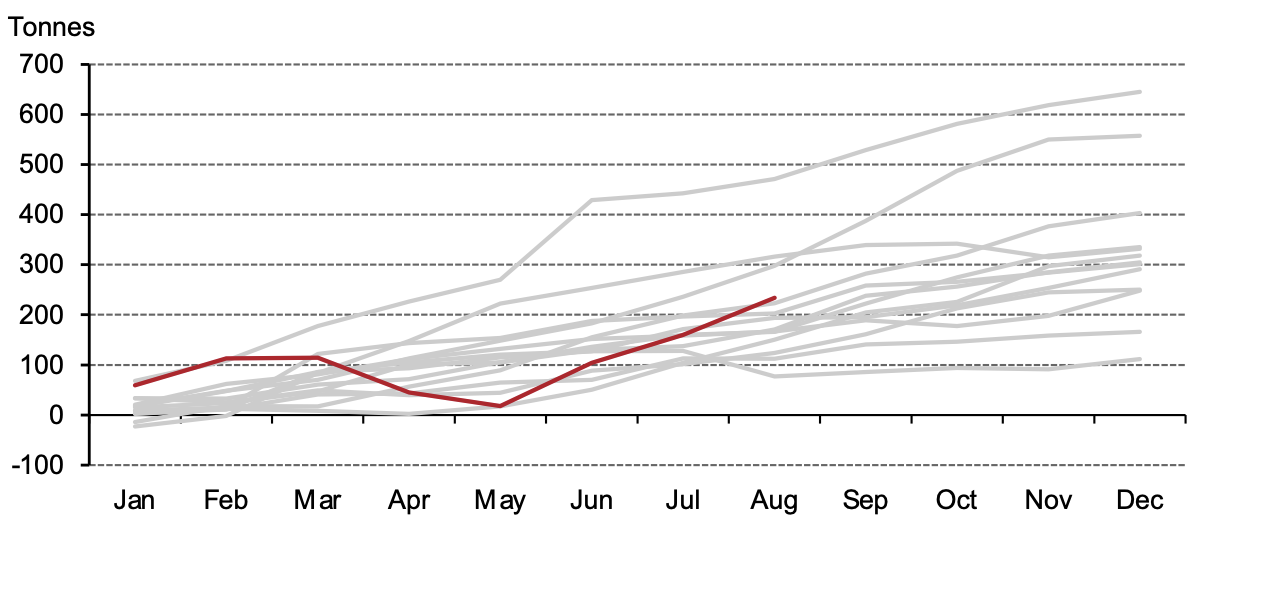

Cumulative reported central bank demand by year since 2010 (red line: YTD 2023)*

Suffice to say, central bank buying remains healthy. Even accounting for the net sales earlier in the year, the pace of buying so far this year suggests that we are on course for another strong annual total. We’ll cover overall central bank demand for Q3 and y-t-d in our next Gold Demand Trends report, which will be published at the end of October.

Footnotes

Based on monthly IMF IFS data and supplemented with data from respective central banks where available and not reported through the IMF at the time of publication. IMF IFS data is reported with a two-month lag, and while most institutions report on a regular basis, some may report with a – sometimes significant – delay. Figures may be subsequently revised as more data becomes available. The data used here informs but is distinct from the central bank demand estimates we report in Gold Demand Trends. Please see footnote 3 for more information.

www.biznes.interia.pl/gospodarka/news-adam-glapinski-prezes-nbp-bede-namawiac-rpp-do-kolejnej-podw,nId,5823037

Turkey’s official sector gold reserves are the sum of central bank-owned gold and Treasury gold holdings. This is equivalent to gross gold reserves less all gold held at the central bank in relation to commercial sector gold policies (such as the Reserve Option Mechanism (ROM), collateral, deposits and swaps). For information on this methodology, click here.

www.bloomberg.com/news/articles/2023-05-05/bolivian-senate-approves-general-terms-of-bill-to-monetize-gold