- Central banks added 55t to global gold reserves in July

- China and Poland both added around 23t, while Turkey was again among the buyers

- Selling was limited but volumes were still notable

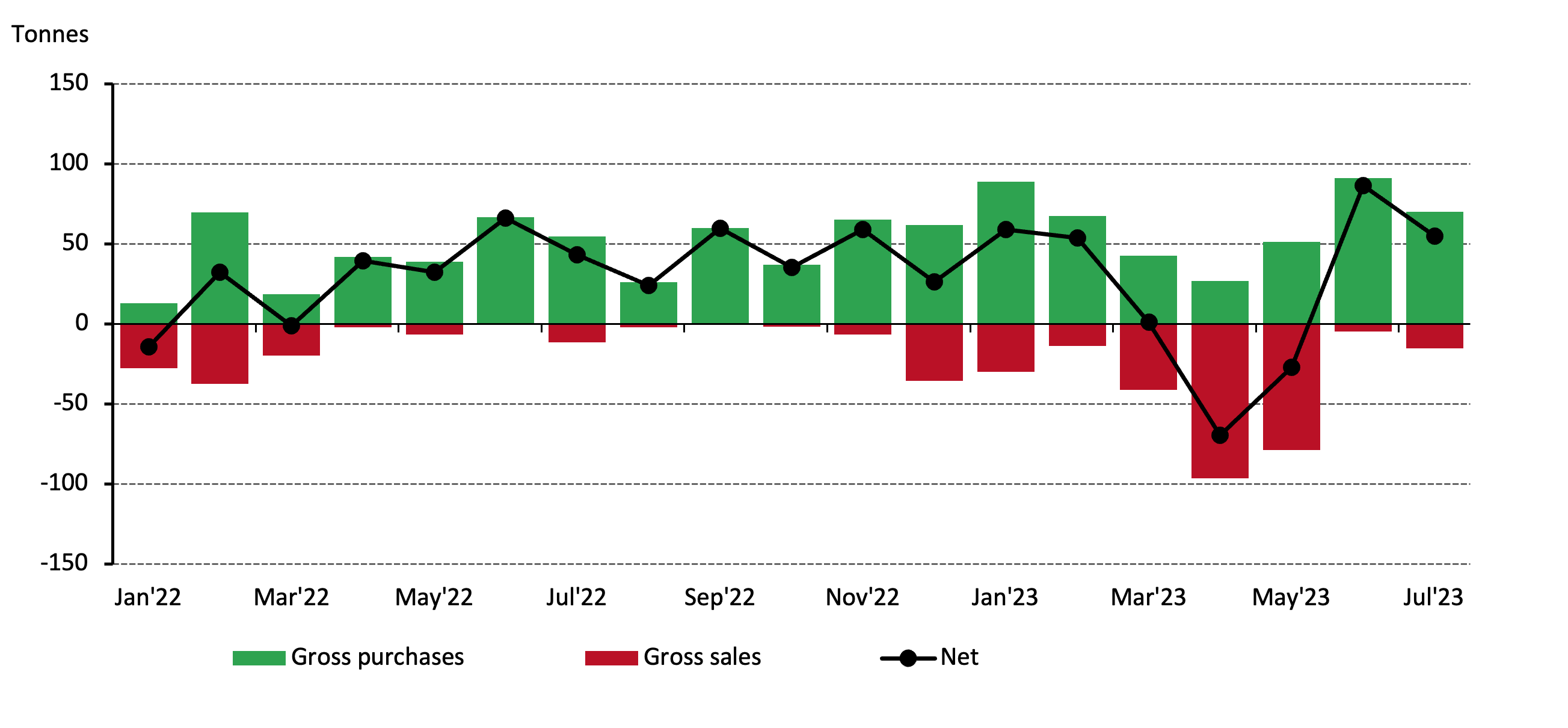

Having reported a return to net buying in June, the latest data shows global central banks continued to add to their gold reserves in July. Central banks reported healthy net purchases of 55t during the month.1 Despite the month-on-month slowdown – owing to the late reporting of a 30t purchase by the Central Bank of Libya in June – the latest data does seem to support our view that the longer-term buying trend remains in place.

Central banks remained net buyers in July*

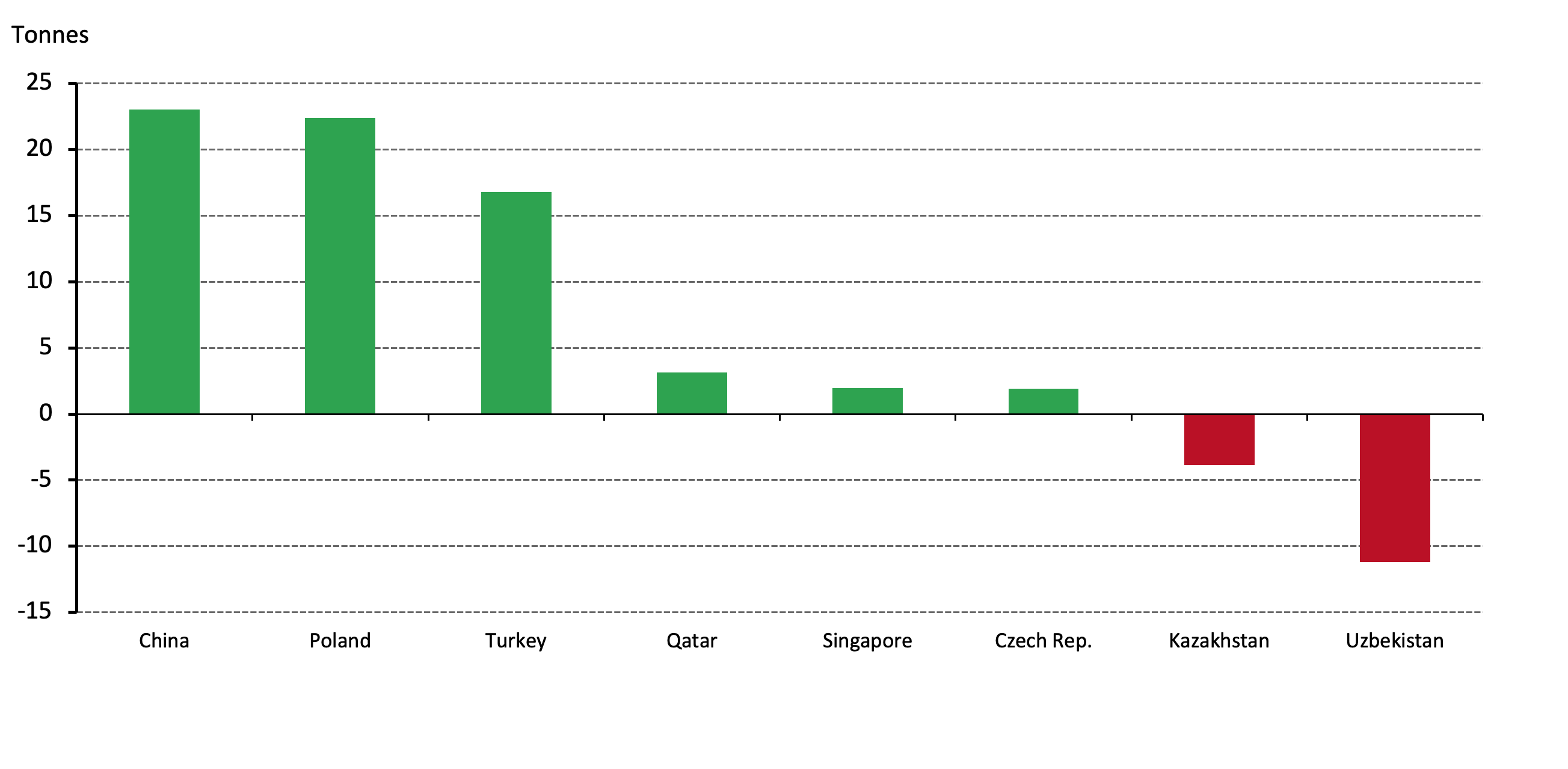

Looking at the detailed activity during July, two things are notable: 1) relatively few banks altered their gold holdings in July, and 2) many that did buy/sell did so sizeably.

The People’s Bank of China (PBoC) was once again the largest buyer, adding 23t during the month and cementing its place as the largest buyer year-to-date (126t). Since it began regularly reporting gold buying in November, the PBoC has bought a net 188t, lifting its total gold reserves to 2,136t (4% of total reserves). The National Bank of Poland (NBP) was a close second, increasing its gold reserves by 22t during July, boosting its total gold holdings to 299t. This is the fourth consecutive month of net buying, with purchases over this period totalling 71t – just 29t shy of the NBP’s stated aim of increasing its gold reserves by 100t.2

The Central Bank of Turkey was again among the buyers in July.3 Having flipped back to net purchases in June (11t), it added a further 17t in July. However, on a year-to-date basis the central bank remains a net seller (85t) owing to the heavy selling between March and May. Gold import quotas were reinstated in early August so it remains to be seen whether this will lead to renewed selling from the central bank should local gold demand remain elevated.4 Qatar (3t), Singapore (2t) and the Czech Republic (2t) also bought gold during the month.

In early August, it was also reported that Russia would recommence the buying of foreign currency and gold.5 However, scant information was available on the size or timing of any future gold purchases so we just need to watch the monthly data.

Buying and selling was limited in July, but volumes were sizeable*

There were fewer sales than purchases in July, but volumes were still meaningful. The Central Bank of Uzbekistan (11t) and the National Bank of Kazakhstan (4t) were the two noteworthy and familiar sellers in the month. Further sales from central banks should not be discounted, especially from those that buy from domestic sources, such as the two above. In fact, the National Bank of Kazakhstan has been upfront on its plans to further reduce its gold reserves by the end of the year.6

Following the release of our latest Gold Demand Trends report, it’s undeniable that strength of central bank gold demand remains headline news. After recent heavy selling – largely from Turkey – monthly net purchases have re-established themselves in June and July. As such, we think this is a sector gold observers should continue to pay attention to.