- Central banks remained net sellers in May; global official gold reserves fell 27t1

- Monthly net total was again impacted by significant offloading from Türkiye

- Excluding Türkiye’s sales, the positive trend in central bank buying continued

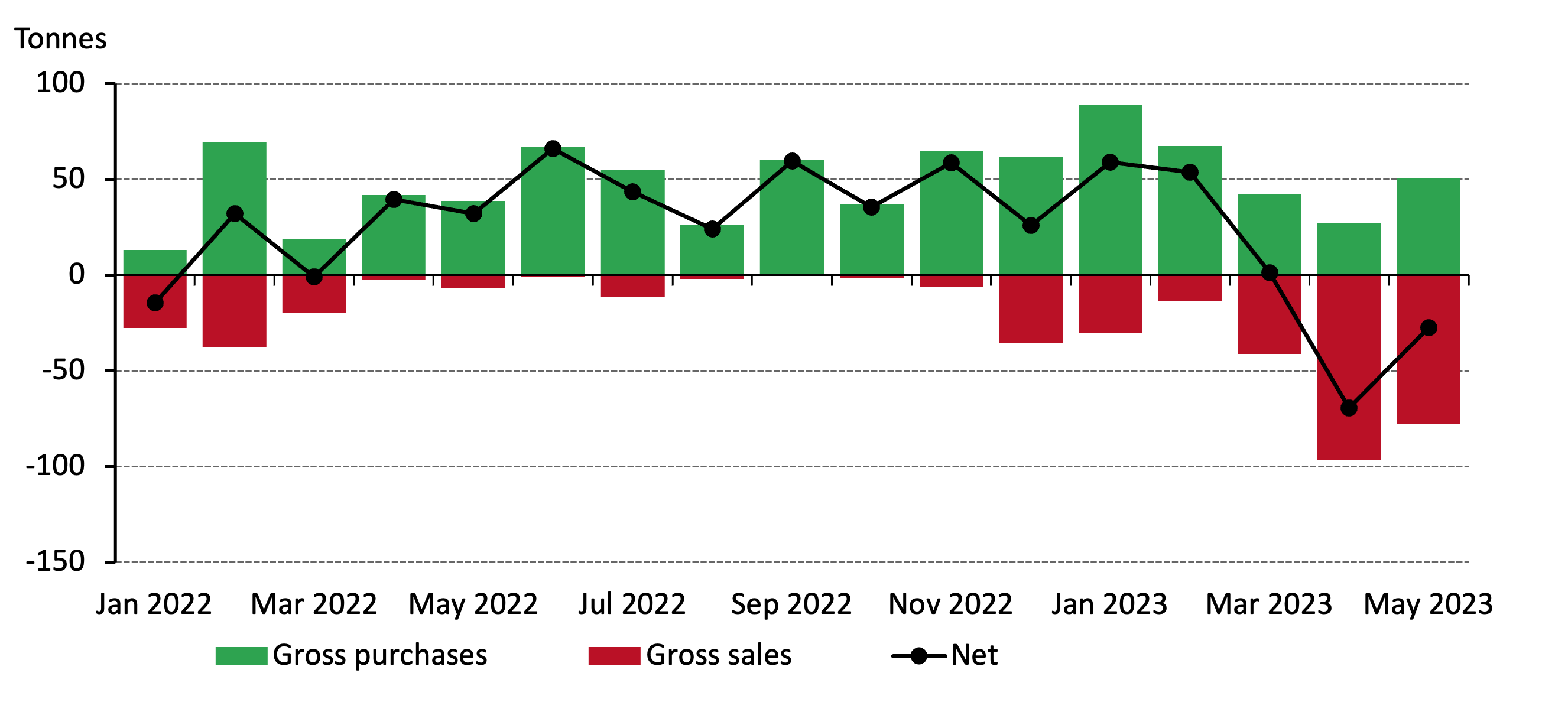

Central banks as a whole reported net sales in May: global official gold reserves fell by 27t, less than half the 69t of net sales seen in April.

Central banks remained net sellers in May, although at half the level of April*

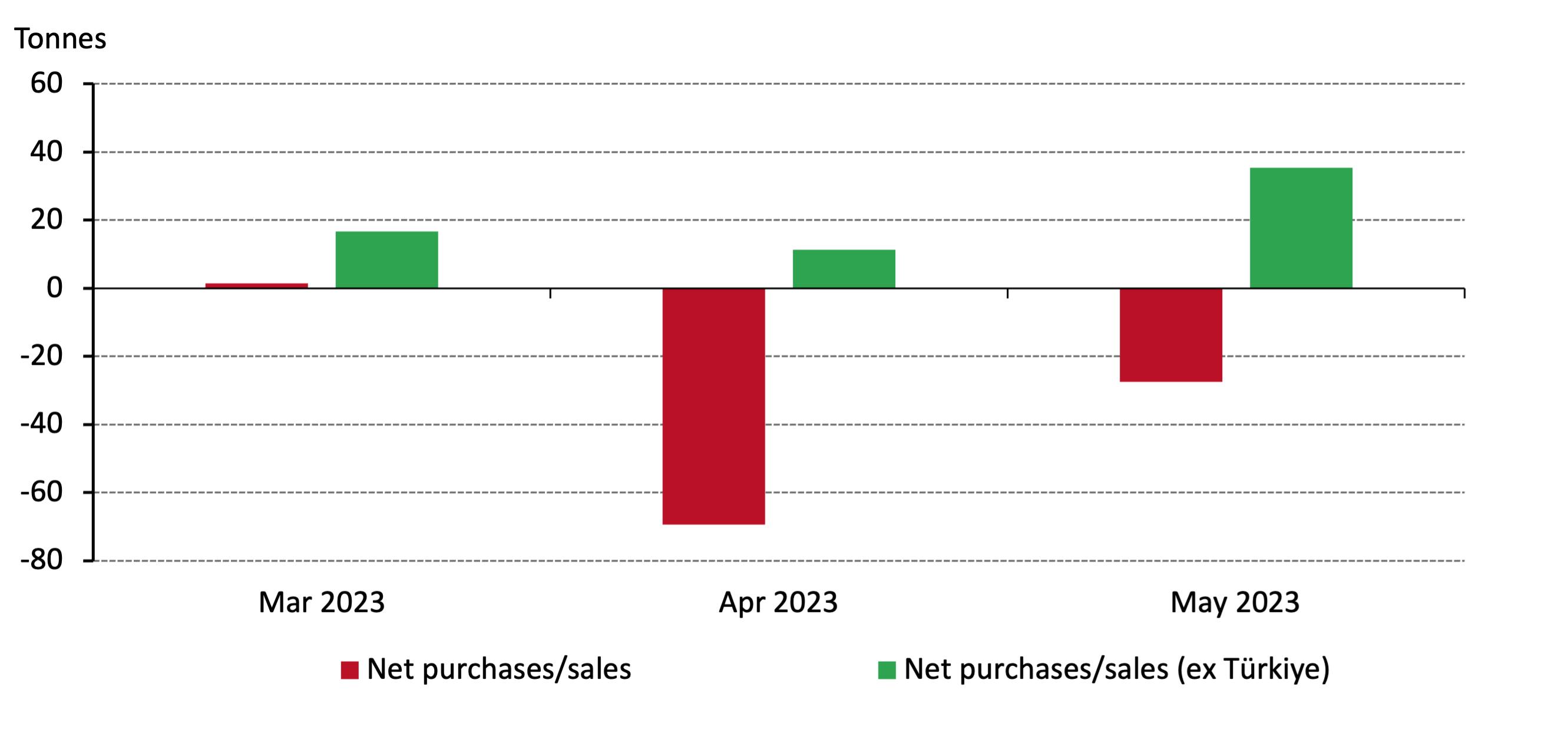

The Central Bank of Türkiye was again the largest seller in May, offloading 63t of gold.2 Since March, the central bank has sold nearly 160t, equivalent to its cumulative purchases over the preceding 12 months. As noted previously, these sales are a response to local market dynamics (very strong gold demand and a temporary partial ban on gold bullion imports) rather than a change to their long-term gold policy.

The chart below illustrates the impact of Türkiye’s sales on the net total: excluding them shows that central banks globally would have been net purchasers over the last three months.

Excluding Türkiye’s sales, the trend in central bank buying is still in place*

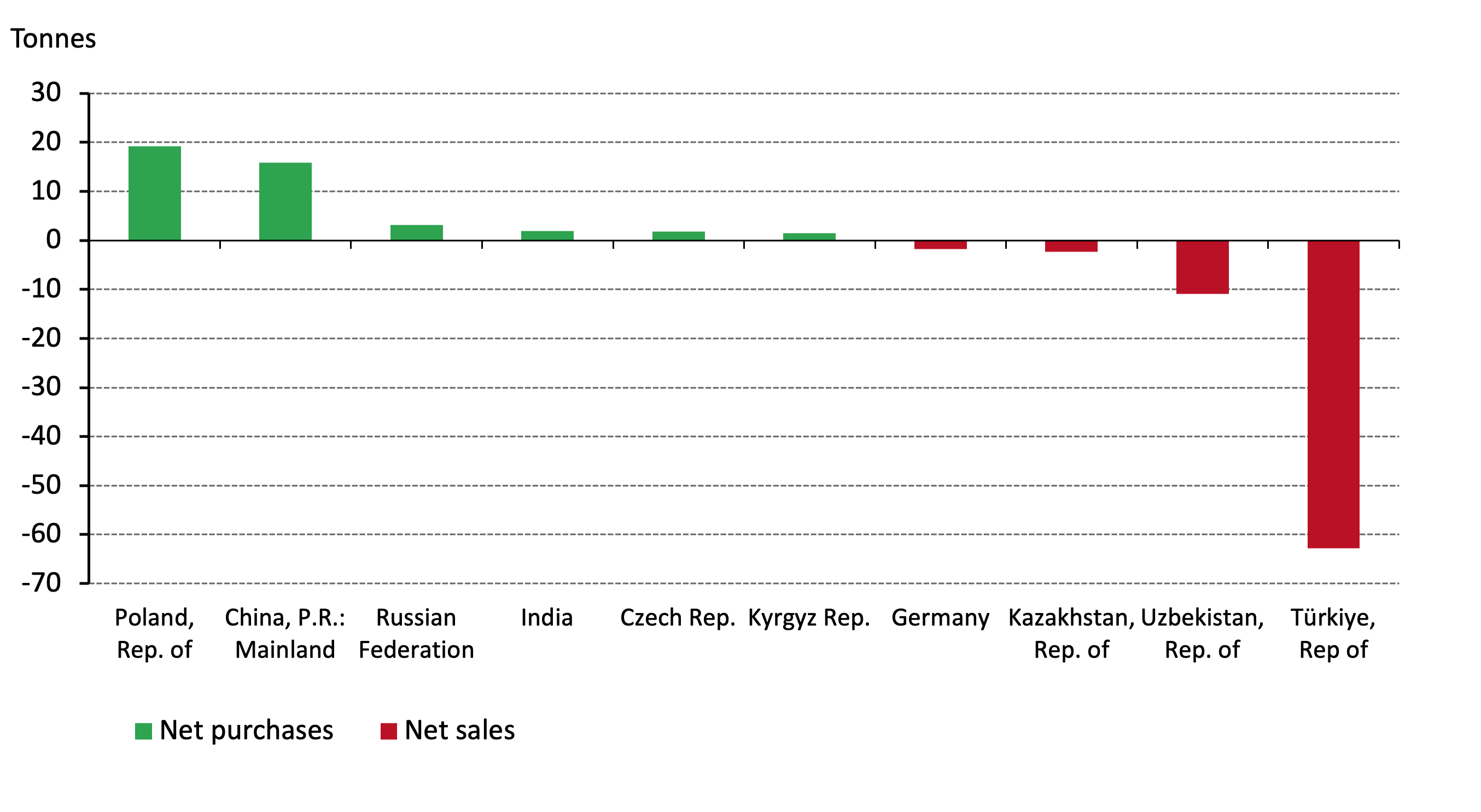

Aside from Türkiye, the Central Bank of Uzbekistan (11t), the National Bank of Kazakhstan (2t) and Germany (2t) were the other significant sellers during the month. Selling by banks who buy gold from domestic production – such as Uzbekistan and Kazakhstan is not uncommon, while Germany’s sale is likely related to its coin-minting programme.

Eight central banks increased their official gold reserves in May, led by Poland. The National Bank of Poland added 19t during the month, lifting its gold reserves to 263t. The People’s Bank of China reported buying 16t in May, its seventh consecutive month of purchases. Its gold reserves now stand at 2,092t. The central banks of Singapore (4t), Russia (3t), India (2t), the Czech Republic (2t) and the Kyrgyz Republic (2t) were the other notable buyers.

As noted in last month’s blog, the Central Bank of Iraq boosted its gold reserves by just over 2 tonnes in May, lifting its gold reserves to 133 tonnes. According to the central bank: “the purchase came with the aim of increasing its holdings of gold in light of the economic and political conditions that the world is witnessing.”3

Key central bank purchases and sales in May by country*

In other news, Russia’s National Wealth Fund has reduced its gold holdings by 37t since the start of the year. There is little publicly-available information around this activity, but suggestions are that the sales of gold (and yuan) have been used to finance the budget deficit.

Commentary for central bank gold demand in Q2 2023 will be available in our next Gold Demand Trends report, which will be released at the start of August.4