Key highlights:

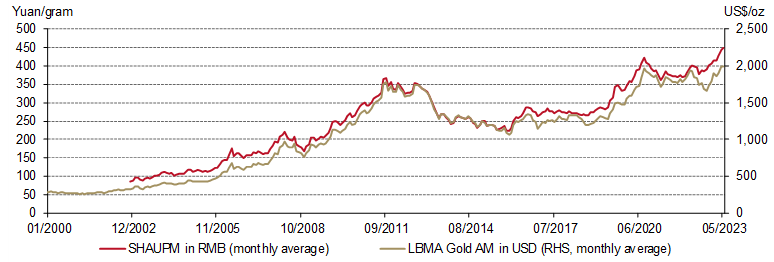

- The LBMA Gold Price AM in USD fell by 1.2% while the Shanghai Gold Benchmark PM (SHAUPM) in RMB rose 1.4% amid a weaker local currency in May

- Gold withdrawals from the Shanghai Gold Exchange (SGE) totalled 113t in May, an 8t decline m/m amid seasonality, slower economic recovery and an elevated local gold price; compared to COVID-troubled 2022 there was a 10t y/y rise

- The average Shanghai-London gold price premium continued to fall amid weaker wholesale gold demand during the month

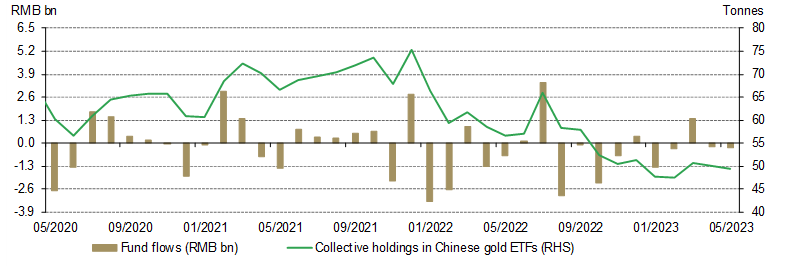

- By the end of May total assets under management (AUM) of Chinese gold ETFs had lowered further to US$3.1bn (RMB22bn); meanwhile, holdings reduced to 49.4t

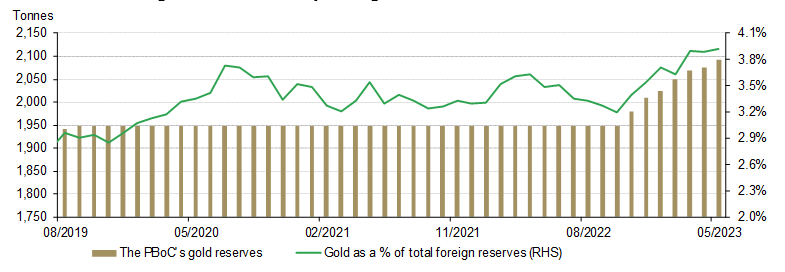

- China’s gold reserves reached 2,092t by the end of the month, a 16t m/m rise and the seventh consecutive increase

- Gold imports fell to 124t in April (-54t), primarily driven by seasonality and the lower local gold price premium.

Looking ahead:

- Historical patterns show that wholesale gold demand may remain tepid in coming months – potentially suppressing the local gold price premium – before picking up around the start of Q3.

- An elevated gold price and slowing momentum in the economic recovery could exacerbate gold manufacturers’ cautiousness in their re-stocking activities.

Gold prices in USD and RMB diverged in May

Gold prices failed to extend the momentum of the previous month. Factors such as a strong dollar and rising yields weighed on the USD gold price in the month. But due to a 3% depreciation in the local currency against the dollar, the SHAUPM in RMB strengthened. It is also worth mentioning that May’s average RMB gold price recorded a historical high on the back of three consecutive monthly rises (Chart 1).

Chart 1: The average RMB gold price in May reached a new historical high*

Average monthly SHAUPM in yuan/gram and LBMA Gold Price AM in US$/oz**

Wholesale demand declined further

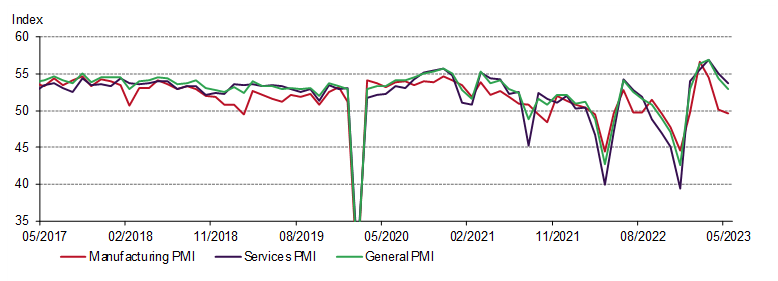

China’s economic recovery continued to slow (Chart 2). Further contractions in Chinese PMIs, the decelerating PPI and weaker-than-expected exports during May (-7.5% y/y vs -1.8% Bloomberg median forecast) are indicative of the challenges facing the nation’s economy: the weak domestic demand and the concerning external environment – particularly the global economic downturn and intensifying geopolitical tensions between the US and China.1

Chart 2: PMIs contracted further in May

Volumes of gold leaving the SGE vaults saw another m/m fall in May. As mentioned in our last blog, the expected sales boost from the five-day Labour-Day Holiday in early May led to a notable y/y pick-up in local gold consumption during the period. But this momentum didn’t last. Seasonality plays a key role: wholesale demand tends to weaken through Q2 as it is the off-season for gold consumption. In addition, manufacturers are cautious about stock replenishment due to the elevated gold price, the slowing economic recovery, and travel needs that create competition for the consumer purse.

Chart 3: Gold withdrawals decreased further in May

Local premium continued to drop

The Shanghai-London gold price spread fell for the second consecutive month, averaging US$3/oz in May, US$3/oz lower m/m (Chart 2). This reflected the weaker local gold demand as mentioned above.

Chart 4: The local gold price premium fell further in May

The monthly average spread between SHAUPM and LBMA Gold Price AM in US$/oz*

Chinese gold ETFs witnessed another mild monthly outflow

Chinese gold ETFs saw outflows of US$41mn (RMB294mn) in May, ending the month with an AUM of US$3.1bn (RMB22bn). Holdings decreased slightly by 0.6t to 49.4t (Chart 5). Profit-taking activities are likely a main driver of the negative ETF demand as the local gold price rose during May, stabilising around a record high.

Chart 5: Chinese gold ETFs saw another outflow in May

Monthly fund flows and Chinese gold ETF holdings

China’s gold reserves’ rising streak extends through May

May saw another reported increase in China’s gold reserves to 2,092t, a 16t rise during the month and the seventh consecutive reported purchase. During the seven-month period, China’s gold reserves gained 144t. Gold’s share of China’s total foreign exchange reserves remained stable at 3.9% (Chart 6).

Chart 6: China’s gold reserves keep rising

Imports slowed in April

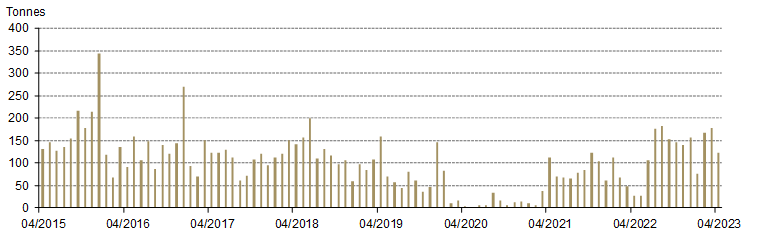

124t of gold was imported into China during April. While this represents a sizable y/y jump compared to the COVID-impacted 2022, imports fell by 54t m/m (Chart 7). Two factors, detailed in our last blog, weighed on imports:

Chart 7: China’s gold imports slowed in April

Footnotes