Key highlights:

- The LBMA Gold Price AM in USD rose by 0.2% in April while the Shanghai Gold Benchmark PM (SHAUPM) in RMB saw a 0.7% gain, due mainly to a depreciating RMB against the USD

- The average Shanghai-London gold price premium fell sharply in April amid easing local supply and demand conditions

- 120t of gold left the Shanghai Gold Exchange (SGE) in the month, a 37t m/m decline as an elevated gold price and seasonality weighed on demand

- Total assets under management (AUM) of Chinese gold ETFs fell marginally (-US$33mn, -RMB230mn) to US$3.2bn (RMB22bn) in April; holdings lowered by 0.5t to 50t

- China’s gold reserves rose further, totalling 2,076t after an 8t increase in April. This sixth consecutive monthly rise means that gold now accounts for 3.9% of China’s total reserves

- China imported 178t of gold in March, according to the latest information from China Customs. China imported 442t of gold in the first quarter – the strongest Q1 since 2015.

Looking ahead:

- The first post-COVID Labour Day Holiday (29 April to 3 May) saw explosive y/y revenue growth in tourism and other service sectors. And local gold, silver and gem jewellery retail sales showed vitality by staging a 23% y/y rise during the period

- But the momentum may not last. Upstream gold manufacturers tell us that retailers are cautious in post-holiday stock replenishment amid an elevated gold price and the anticipation of Q2 as an off season. Further, the slowing economic recovery may pose additional challenges.1

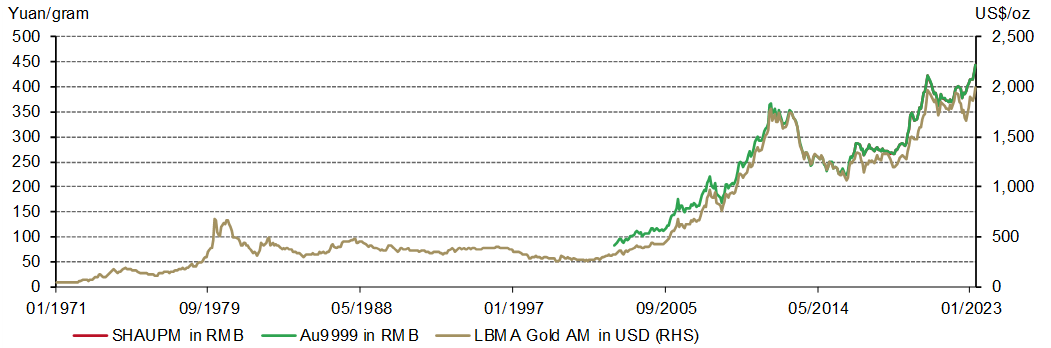

Average gold prices in April hit record levels

Gold prices experienced mild gains in April. As noted in our Gold Monthly Commentary, support from lower Treasury yields and a weaker dollar was partially offset by cooling momentum. Nonetheless, average gold prices in both USD and RMB during April reached the highest on record (Chart 1).

Chart 1: Gold prices reached record highs on a monthly average basis

The SHAUPM in yuan/gram and LBMA Gold Price AM in US$/oz*

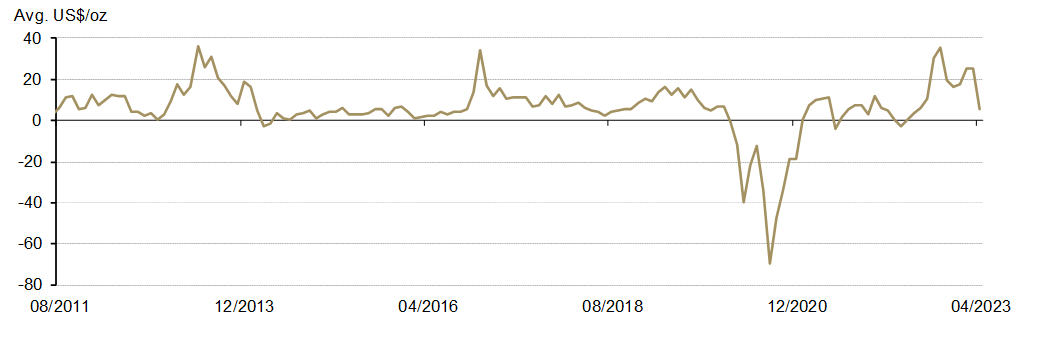

Local premium fell

The local gold price premium averaged US$6/oz last month, a US$20/oz fall m/m (Chart 2). While local gold demand remained relatively stable, easing local supply conditions amid elevated gold imports and rising production reduced the local premium, or put another way, lessened the scarcity of gold in China.2

Chart 2: The local gold price premium saw a sharp fall in April

The monthly average spread between SHAUPM and LBMA Gold Price AM in US$/oz*

Wholesale demand saw a seasonal fall

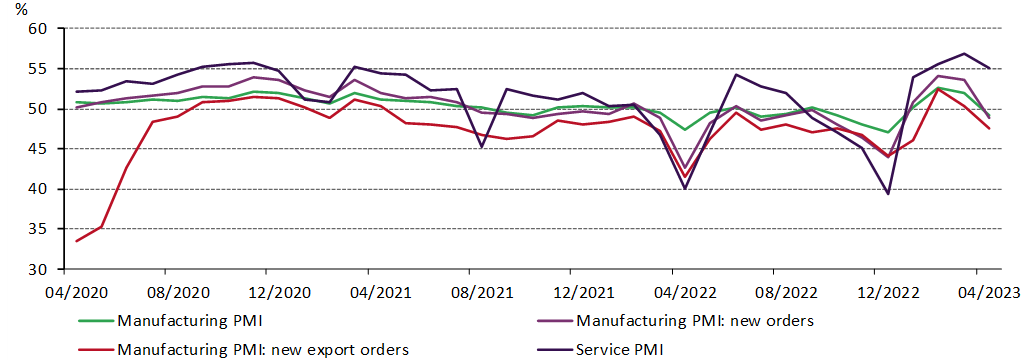

China’s economy is recovering but the momentum seen to date might be cooling. A clear indicator can be found in manufacturing and service sector activities, both of which contracted in April (Chart 3). And a notable y/y decline in China’s imports, as well as continued deceleration in CPI and PPI growth, signals weaker domestic demand. Meanwhile, slower growth in exports reflects the challenging global economic environment.

Momentum from pent-up domestic demand may have run its course and local consumption stimulation could be key to provide sustainable economic support. While we remain confident in the trajectory of China’s economic recovery, short-term volatilities may slow the process.

Chart 3: PMIs contracted in April

Local wholesale demand pulled back: gold withdrawals from the SGE totalled 120t in April, a 37t m/m decline. As previously noted, the elevated gold price and the fact that China is entering what is traditionally an off season for gold consumption are weighing on near-future demand. And weaker economic recovery momentum is contributing. The 37t y/y rise is chiefly due to a low base, as Shanghai was in lockdown during April 2022.

Chart 4: Gold withdrawals fell in April

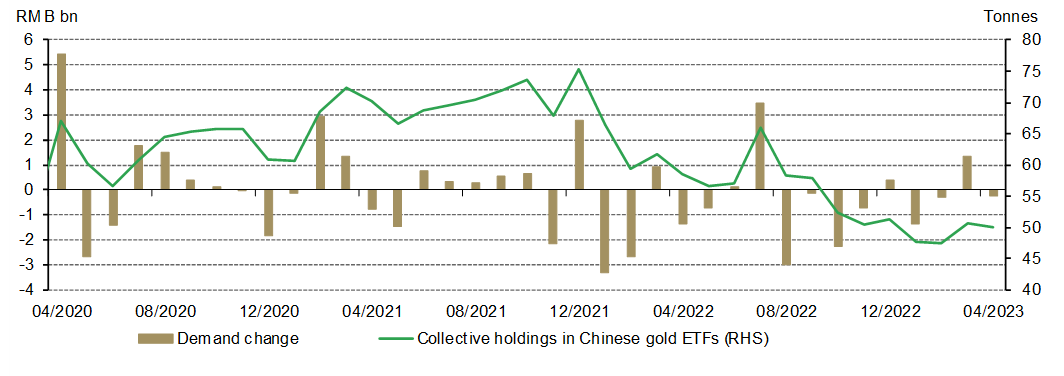

Chinese gold ETF flows turned negative again in April

With a modest outflow of US$33mn (-RMB229mn), total AUM of Chinese gold ETFs stood at US$3.2bn (RMB22bn) at the end of April. Meanwhile, holdings totalled 50t, a 0.5t reduction from the end-March figure (Chart 5). We believe profit taking played a major role as the local gold price stabilised in April after a surge in March.

Chart 5: Chinese gold ETF flows returned to negative territory in April

Monthly fund flows and Chinese gold ETF holdings

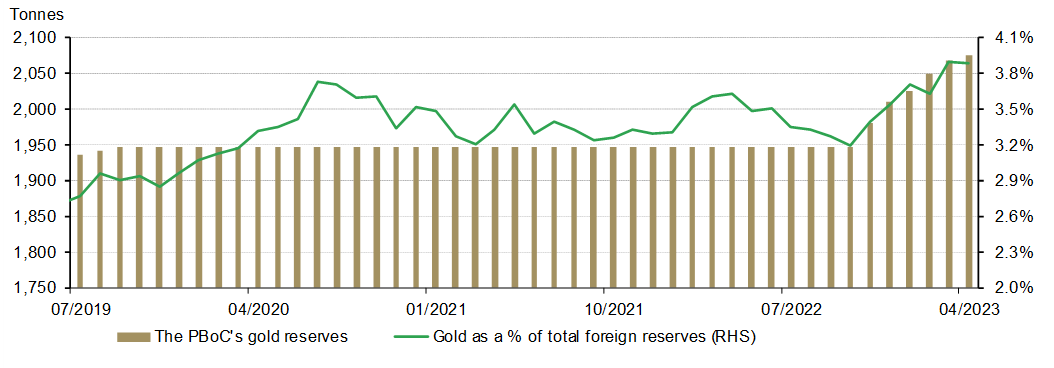

China announced another gold purchase

China announced another gold purchase recently. This additional 8.1t takes the country’s total gold reserves to 2,076.5t at the end of April and marks the sixth consecutive monthly increase in China’s gold reserves since last November (Chart 6). Currently, gold accounts for 3.9% of China’s total foreign exchange reserves.

Since last November, when China broke its silence regarding gold purchases, the country’s gold reserves have increased by 128t.

Chart 6: China’s gold reserves keep rising

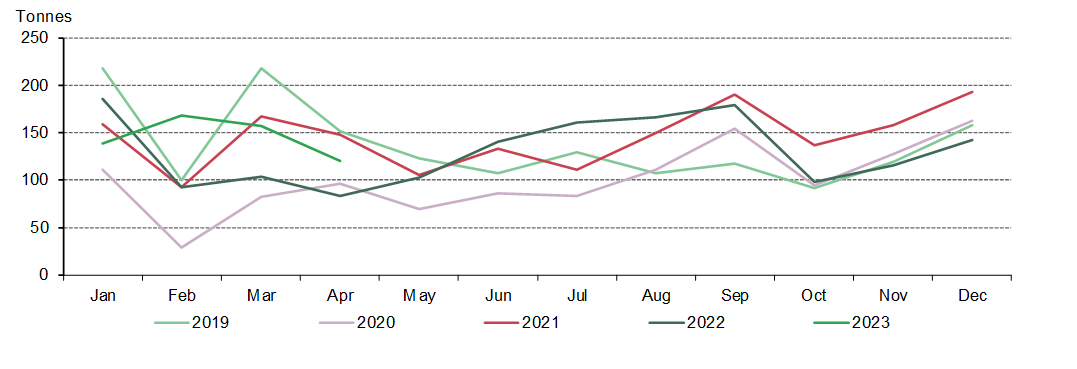

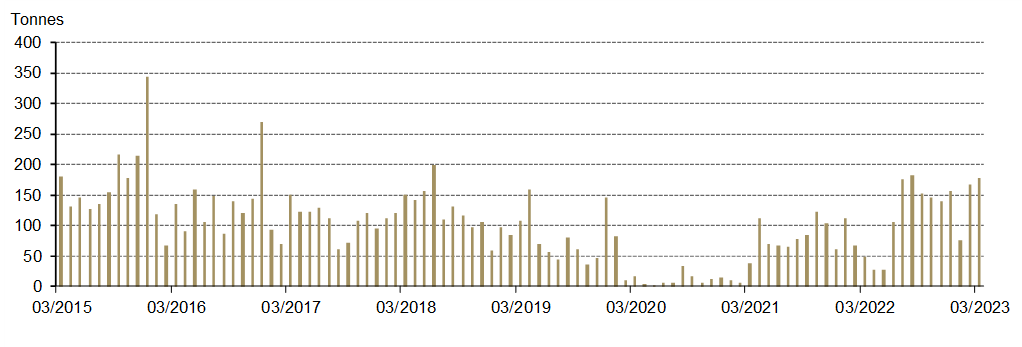

Gold imports saw the strongest Q1 since 2015

China imported 178t of gold in March, bringing its Q1 total imports to 422t, the highest since 2015 (Chart 7). This mirrors China’s strong gold demand during the first quarter, resulting from the end of the zero-COVID policy and the start of a recovery in the local economy, as noted in our Gold Demand Trends report. Meanwhile, an elevated local gold price premium throughout the quarter encouraged imports.

Chart 7: China’s gold imports continued to rise in March

footnotes