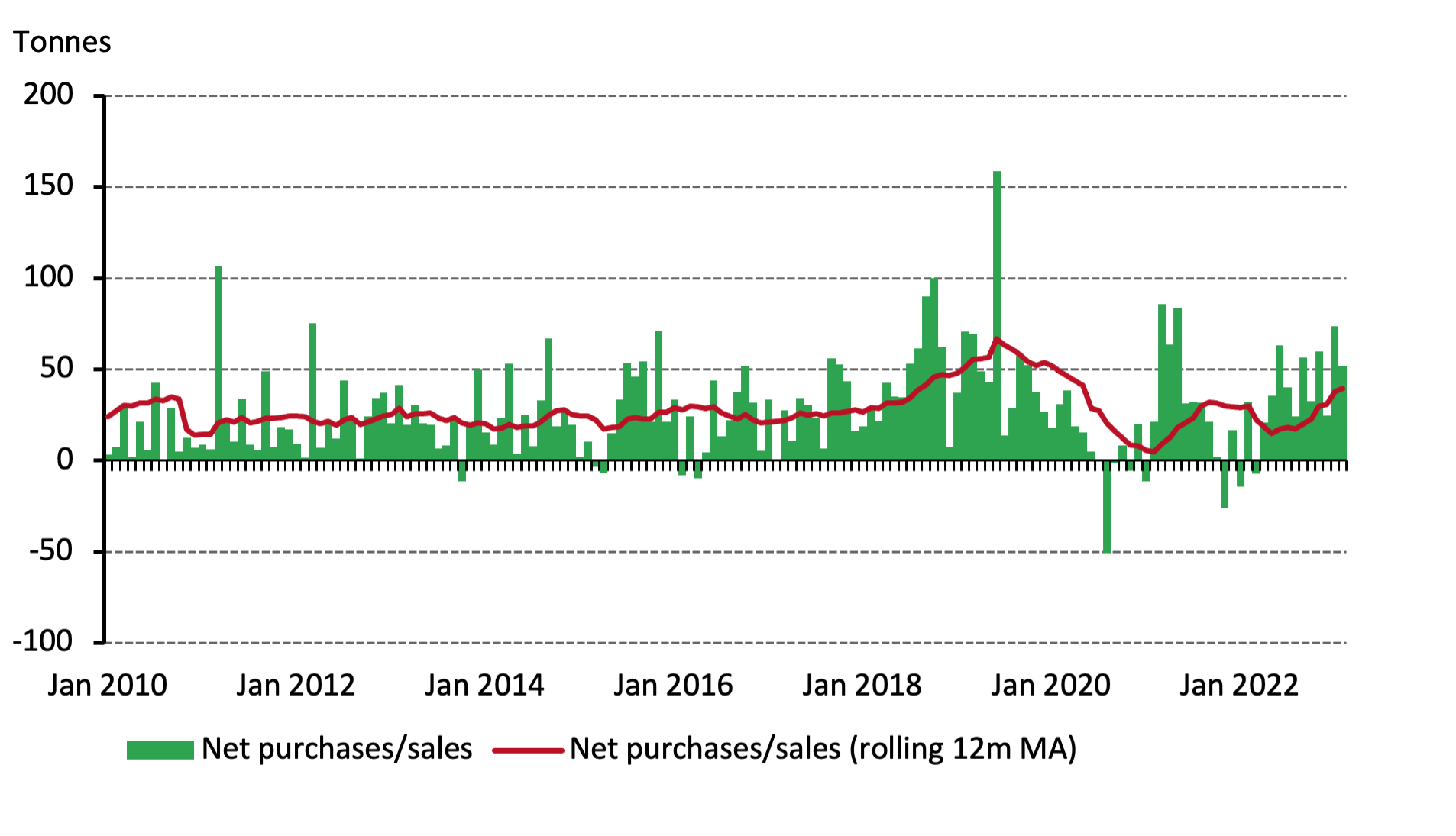

Central bank gold buying momentum showed no signs of stalling in February. Reported global gold reserves rose by 52t during the month – the eleventh consecutive month of net purchases – following January's 74t. 1 This excludes updated data for Russia (more on that below ), but still maintains the upward trend (based on the 12-month moving average) since June 2022.

Central banks maintain momentum in gold *

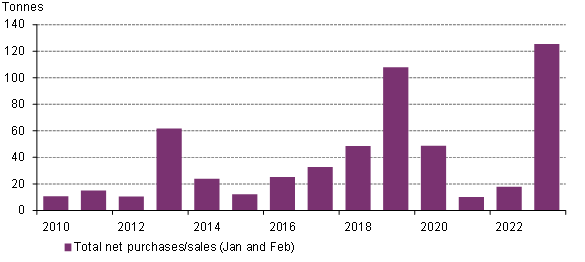

On a y-t-d basis, central banks have reported net purchases of 125t. This is the strongest start to a year back to at least 2010 – when central banks became net buyers on an annual basis.

Central bank demand in 2023 has had the strongest start since at least 2010*

One of the more significant updates for February came from the Central Bank of Russia, which published its gold reserves for the first time in over a year. 2 It reported gold holdings of 2,330t at the end of February 2023, 31t more than at the end of January 2022 when it last reported . However, no indication was given on the exact timing of the gold purchases over this period so we have assigned the reported change to February until more information is available.3 Based on the new information, gold reserves now account for 24% of Russia’s international reserves.

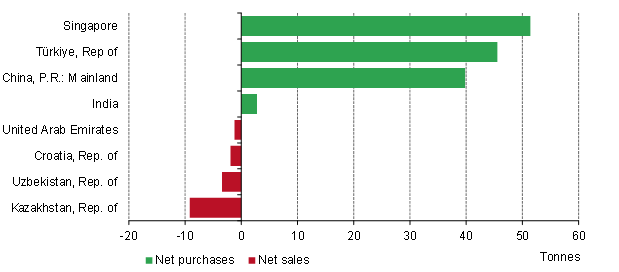

The People’s Bank of China reported its gold reserves rose by 25t during the month, to 2,050t. This was the largest single purchase in February, and is the fourth consecutive month in which China’s gold reserves have risen, growing by 102t over that period. The Central Bank of Türkiye also continued its recent buying spree – now 15 consecutive months – adding over 22t. Its official gold reserves (central bank and Treasury holdings) are now 587t, 33% of its international reserves.4

The Central Bank of Uzbekistan added 8t to its gold reserves, following three consecutive months of sales. Its official gold reserves now stand at 393t (67% of total reserves). The Monetary Authority of Singapore increased its gold reserves by nearly 7t, lifting them to 205t and over 51 tonnes higher than at the end of 2022. The Reserve Bank of India (RBI) resumed buying in February, having kept its powder dry in January. It added a modest 3t to lift its gold reserves to 790t. However, a recent recovery in the RBI’s FX reserves means gold’s share of total reserves has fallen marginally to 8%.

The National Bank of Kazakhstan was the sole notable net seller during the month. Its official gold reserves fell by 13t, to 342t – their lowest level since October 2018. Since 2021, monthly net sales from Kazakhstan have increased in magnitude and frequency, but it is not uncommon for central banks that purchase gold from domestic sources to be frequent sellers of gold.

Year-to-date, purchases have heavily outweighed sales*

We’ll be revisiting all central bank gold demand for Q1 in our upcoming Gold Demand Trends report, due for publication at the start of May.5