Key highlights:

- The LBMA Gold Price rose by 7% last month in USD; however, the Shanghai Gold Price Benchmark PM (SHAUPM) in RMB only rose 3.6%, partially driven by an appreciating RMB against the dollar

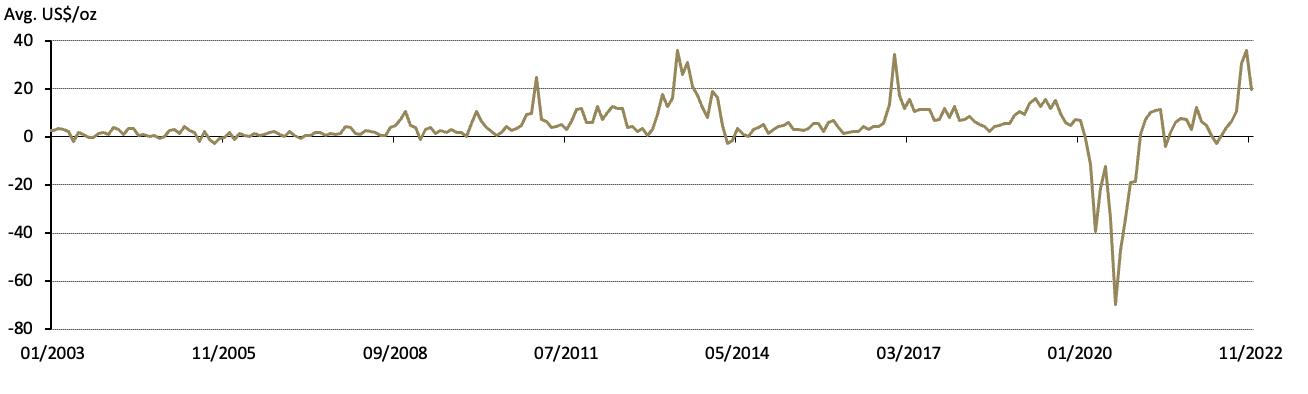

- Although it remains elevated, the Shanghai-London gold price premium extended its decline from late October, averaging US$20/oz in November, a US$17/oz m-o-m fall1

- Gold withdrawals from the Shanghai Gold Exchange (SGE) saw the weakest November since 2013, despite a seasonal m-o-m rebound

- Chinese gold ETFs had net outflows of 1.8t (US$102mn, RMB730mn) in November,2 pushing collective holdings to 50.5t (US$2.9bn, RMB20.5bn) by month end

- The People’s Bank of China (PBoC) added 32t of gold to its reserves in November, its first announcement since September 2019.

Looking ahead:

- China is rapidly relaxing COVID restrictions, sending positive signals of economic recovery. An improved economy should bode well for local gold consumption as it is closely tied to China’s economic strength

- Additionally, as the Chinese New Year’s holiday approaches – from 22 to 28 January – gifting demand should provide a festive boost to local gold consumption. But the elevated RMB gold price may create headwinds.

The monthly average local gold price premium fell

The divergence between the RMB and USD gold prices widened. The weakening US dollar and lowering yields helped pushed the LBMA Gold Price AM in USD 7.4% higher in November, the best month since July 2020. However, due to the local currency’s appreciation and sluggish gold demand in China during the month, the SHAUPM in RMB saw a smaller increase of 3.6% compared to its USD peer.

The local gold price premium averaged US$20/oz in November, US$16/oz lower m-o-m (Chart 1). With COVID infection cases surging, mobility restrictions persisted in many regions, weighing on the local gold demand. Consequently, the Shanghai-London gold price premium narrowed.

Nonetheless, the spread remained well above the annual averages of previous years. Factors such as tighter local supply conditions – as noted in our last blog – may have played a key role in keeping the local gold price premium elevated.

Chart 1: The local gold price premium pulled back in November

The average monthly spread between SHAUPM and LBMA Gold Price AM in US$/oz*

Wholesale gold demand weak

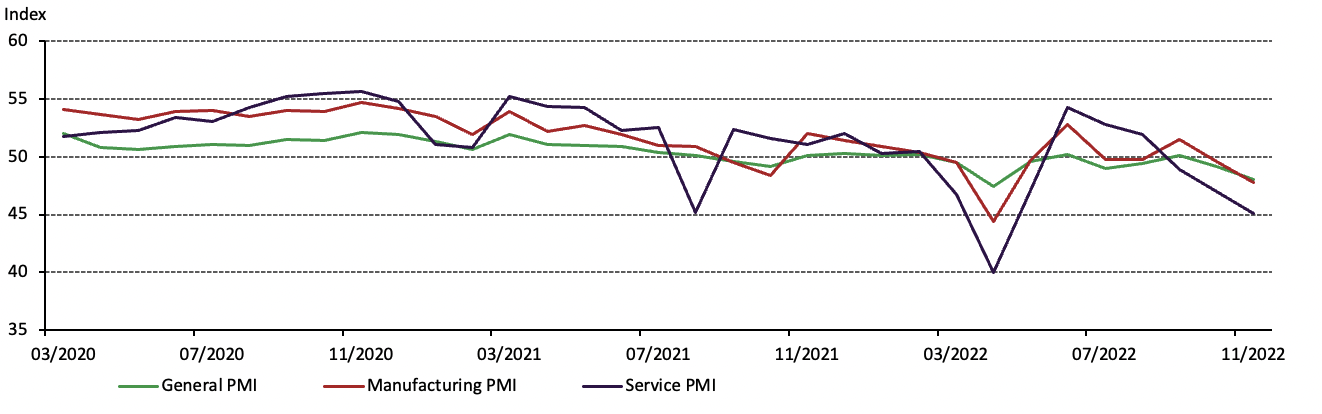

China’s economy remained under pressure. With daily COVID cases surging, regional lockdowns and mobility restrictions remained in place, although measures were introduced to ease pandemic controls.3 Contracting economic activities led to a continued slide in China’s Purchase Managers Index (PMIs) (Chart 2).

Chart 2: Chinese economy continued to contract in November

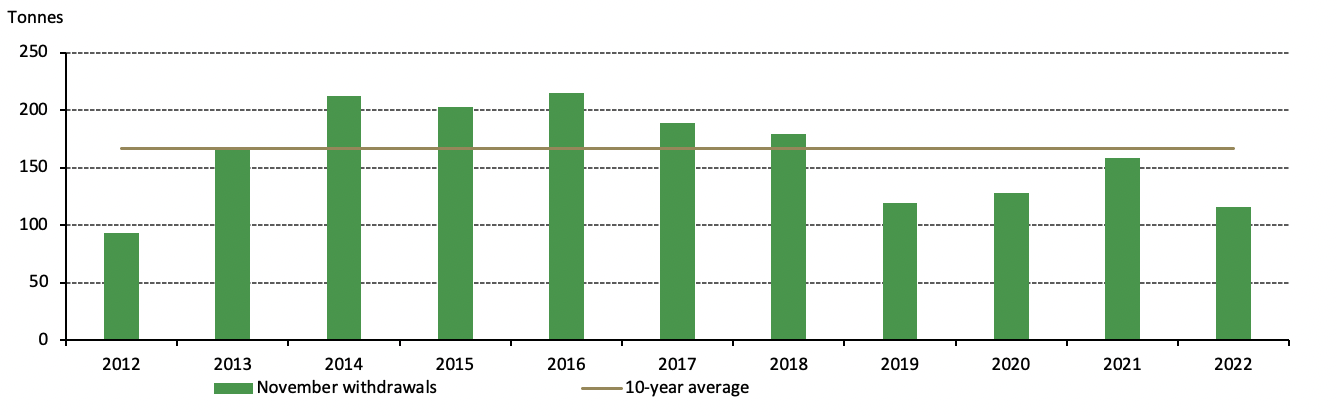

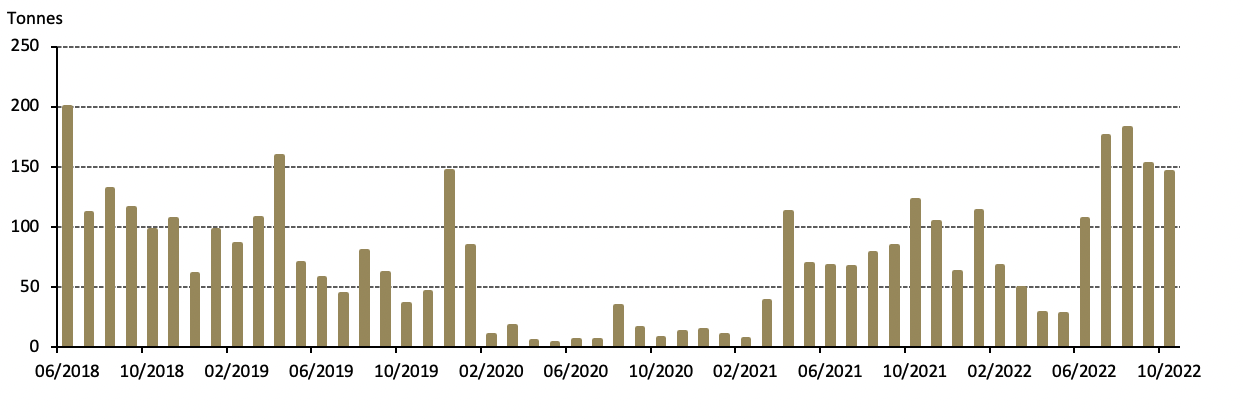

As a result, wholesale gold demand in China was weak in November despite a seasonal m-o-m rebound (Chart 3). At 115t, November gold withdrawals from the SGE were 17t higher than October but 43t lower y-o-y.

And when compared to previous years, 2022 saw the lowest November withdrawals since 2013; 51t below their 10-year average. The m-o-m rebound is due to seasonal factors as manufacturers tend to replenish their inventories ahead of the traditional increase in demand around year-end and the Chinese New Year Holiday, which usually occurs in January.

Chart 3: November gold withdrawals were the weakest in 10 years*

Chinese gold ETF holdings continued to see outflows

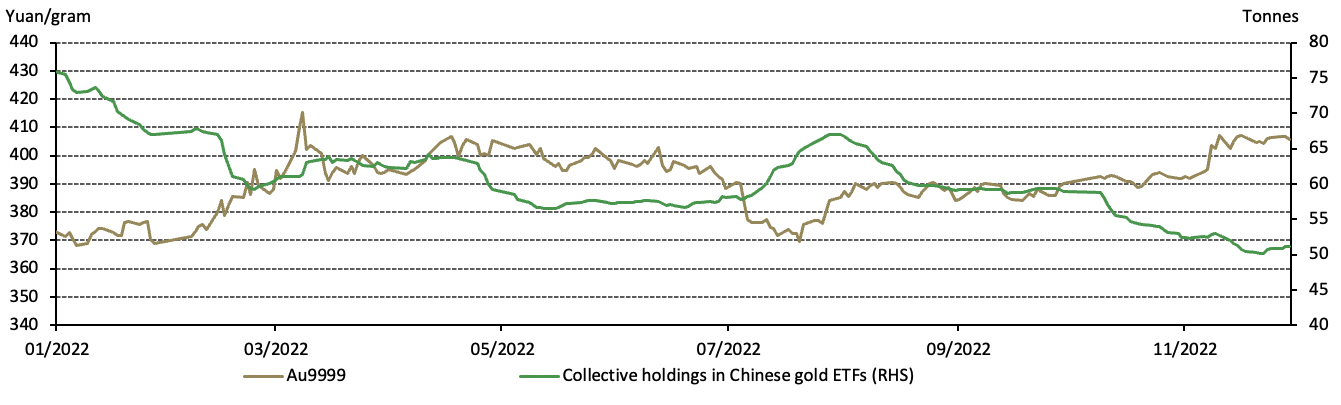

Total holdings in Chinese gold ETFs slipped to 50.5t (US$2.9bn, RMB20.5bn), a 1.8t (US$102mn, RMB730mn) net outflow during the month (Chart 4). This is likely a result of investors taking profit on their holdings due to the 4% local gold price rise in November.

Chart 4: Chinese gold ETF holdings reduced further

Daily Chinese gold ETF holdings and close of Au9999 price

China’s gold reserves rose

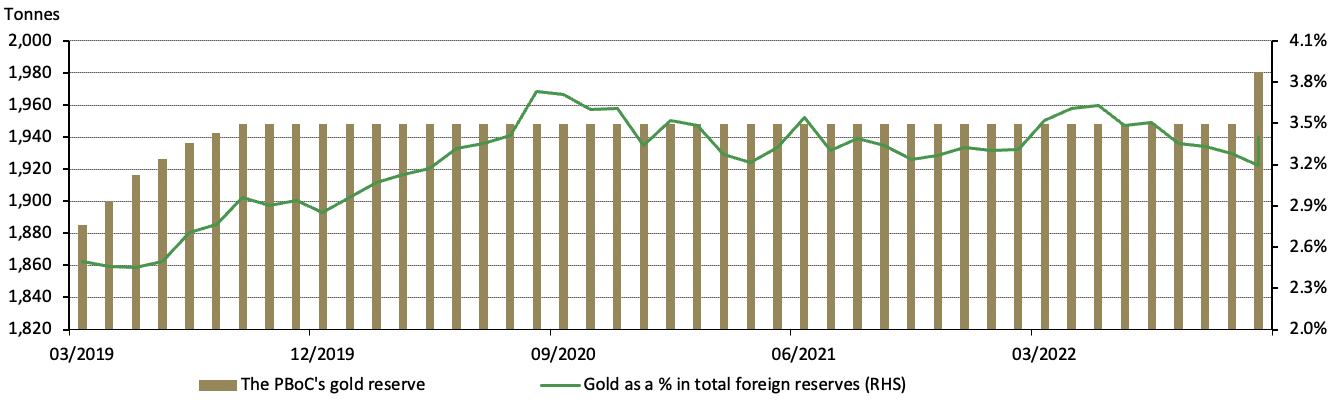

As of November, China’s gold reserves stood at 1980t, 32t higher m-o-m and accounting for 3.4% of its total foreign exchange reserves (Chart 5). Having remained quiet for 38 months, the PBoC made an announcement of gold reserve increase in November.

Chart 5: The PBoC’s gold reserves rose in November

Gold imports fell marginally in October4

Gold imports totalled 146t in October, 6t lower m-o-m and 23t higher y-o-y (Chart 6). The small m-o-m decline likely reflects softer wholesale gold demand compared to September, while the year-on-year increase was partly supported by the record level in the local gold price premium over the past few months.

Chart 6: China’s gold imports fell in October but remained at elevated levels

China’s gold imports under HS7108*

Looking ahead

The zero-COVID policy (ZCP) might be near its end. Following announcements to cancel mandatory COVID tests in major cities, China made another leap forward by rolling out measures such as easing COVID quarantine rules, loosening access restrictions to most areas and relaxing domestic travel requirements.5 And China has softened its tone on COVID severity too, potentially signalling the end of the ZCP.6

This should spell good news for future local gold consumption. Our analysis shows that local economic growth is a dominating driver of Chinese gold consumption. With COVID disruptions fading, China’s economic recovery could accelerate, boosting growth and consumption.

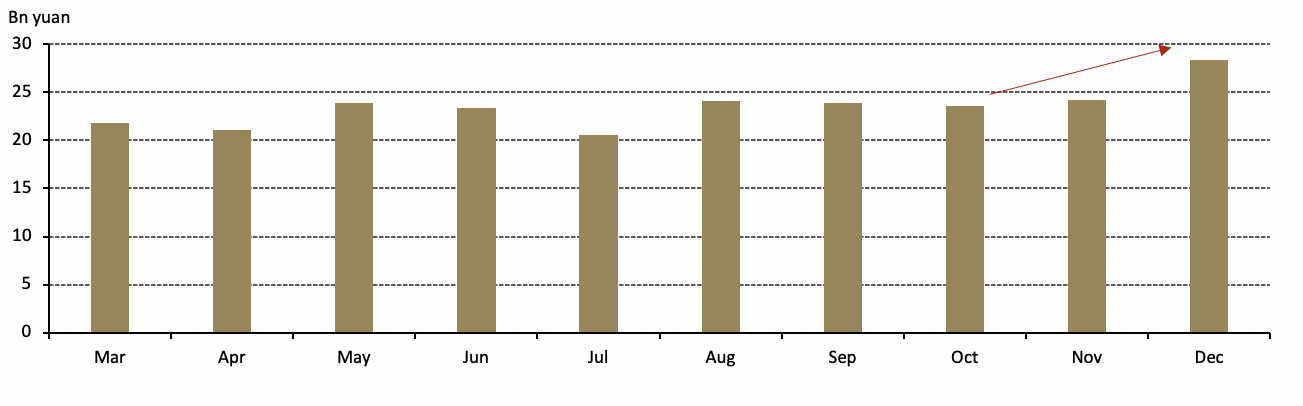

And with the Chinese New Year’s holiday – one of the most important gold purchasing occasions in the year – approaching, gold consumption should receive an additional boost (Chart 7). However, the elevated RMB gold price may create some headwinds.

Chart 7: Jewellery retail sales tend to pick up towards the end of the year

Average monthly jewellery retail sales (gold, silver, gem and others) during the past 10 years in bn yuan*

Footnotes

We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit Shanghai Gold Exchange.

Please note that the inflow/outflow value term calculation is based on the tonnage difference between end-of-period assets under management, the end-of-period Au9999 prices in RMB and the USD/CNY exchange rate.

For more, see: China's 20 optimized measures; a refinement on previous effective measures against COVID-19: health official - Global Times

The lag is due to China Custom’s data releasing schedule.

For more, see: Chinese cities ease curbs, full zero-COVID exit seen some way off | Reuters and China Announces Rollback of Strict Anti-COVID-19 Measures (usnews.com)

For more, see: China Set to Loosen COVID Curbs After Week of Historic Protests (usnews.com)