- Rising rates and a strong dollar have had a significant negative effect on gold’s performance despite support from geopolitics and inflation

- We believe gold’s headwinds may start to subside while supportive factors will likely remain, thus encouraging demand for gold as a long-term investment hedge

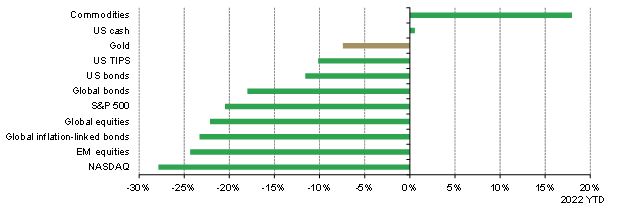

Many of the investors we talk to feel that gold’s performance should be much stronger considering multi-decade high inflation across the world. Yet, what may not be evident to everyone is that gold has outperformed most major assets so far in 2022 (Chart 1). In fact, gold has done much better than inflation-linked bonds both in the US and elsewhere. And we believe that gold’s performance so far this year reflects the behaviour of its underlying drivers.

Chart 1: Gold has been a top-performing asset so far in 2022*

Let us expand. Gold is generally driven by four key drivers: economic expansion; risk and uncertainty; opportunity cost; and momentum.

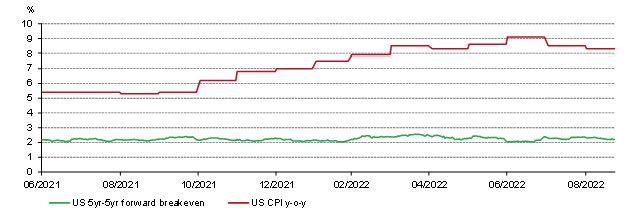

In 2022, gold has been supported by greater risk and uncertainty, the most obvious coming from geopolitical tensions. High inflation has also been a contributing factor – but not all investors have perceived the inflation risk in the same way. This is most clearly seen by the stark difference between US CPI and long-term inflation expectations implied by the bond market (Chart 2). In short, while inflation has been high, US bond investors believe that the Fed will do whatever is necessary to bring inflation down and will do so effectively. Not all investors may agree.

Chart 2: Bond investors expect the Fed to effectively bring inflation down*

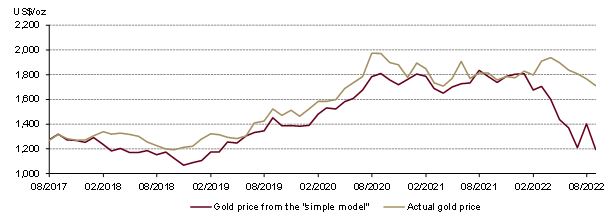

Gold has also had to contend with much higher opportunity costs: both from continuously increasing interest rates and the strongest US dollar for 20 years.1 A commonly used simple (but reductive) model for gold – based solely on real rates and the dollar – suggests that gold should have fallen by more than 30% thus far (Chart 3). Further, our Gold Return Attribution Model (GRAM) indicates that negative investor sentiment, with heavy gold ETF outflows and weak positioning in the futures market, has put additional pressure on gold. Weak Chinese demand earlier in the year did not help either.

The fact that gold has performed as well as it has, all things considered, is a testament to its global appeal and more nuanced reaction to a wider set of variables.

Chart 3: The gold price would’ve been much weaker if it were solely determined by interest rates and the dollar

Looking forward…

We believe that both interest rates and the dollar still pose risks for gold.

Despite a sluggish start, central banks have acted aggressively to curb rising inflation. The US Fed delivered another 75bps hike this week, bringing its Fed funds target rate to 3.25%. And dot-plot projections suggest they may deliver an additional 75-125bps by year end. Similarly, the Bank of England increased its target rate by an additional 50bps and the Swiss National Bank by 75bps. Other central banks will likely follow suit.

With central banks playing catch up, the frequency and magnitude of these decisions has resulted in markets being more sensitive than usual to monetary policy – and gold has been no exception.

However, we are cautiously optimistic. For one, given how much tightening has occurred so far, we would expect rate hikes to slow down, allowing some of gold’s other supporting factors to play a more important role. Also, the fact the other central banks are being more resolute in their policy decisions – partly to curb inflation, partly to defend their currencies – should weigh on the US dollar.

Further, positioning in gold futures has turned net short again and this, historically, has not lasted long – often mean reverting in subsequent weeks. At the same time, central bank demand for gold remains quite strong. Finally, as recessionary and geopolitical risks increase, 2 investors may shift to more defensive strategies, looking for high quality liquid assets such as gold to reduce portfolio losses.