Retail investors were enthusiastic buyers of cryptocurrencies last year. A global study by Hall Partners shows that cryptos were one of the most popular investments in 2021, with 31% of respondents investing in them over the first 10 months of the year.1

These investors might be suffering. The crypto universe has been extremely volatile over the past six months, unsettled by a mix of tightening liquidity and negative economic data prints. More recently, the collapse of Luna and TerraUSD caused stablecoin Tether to temporarily decouple from its $1 peg, sparking additional jitters. Bitcoin has halved in value in a little over six months, while the Bloomberg Galaxy Crypto Index has lost almost two-thirds of its value over the same period.2

We’ve been here before with Bitcoin. More than once. The crypto behemoth has previously lost 50% of its value on five separate occasions since its inception, so the latest move is not without precedent.

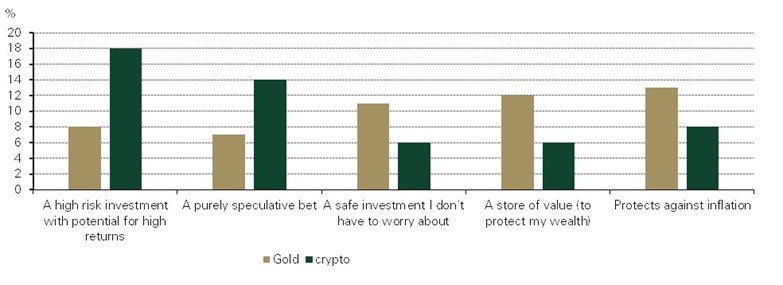

But the research suggests that these investors seem to be aware of the potential pitfalls of investing in cryptos: 32% of investors viewed their crypto investment either as ‘high risk with the potential for high returns’ or as a ‘purely speculative bet’. Mirroring that sentiment, only 6% agreed that cryptocurrencies are ‘a safe investment that I don’t have to worry about’.3

Retail investors recognise the different risk profiles of gold and cryptos

% assigning top ranking to each statement*

Attitudes towards gold among these investors are contrastingly different – they recognise its safe-haven, inflation hedging qualities. One third of investors view their gold investment as either ‘a store of value (to protect my wealth)’, a way to ‘protect against inflation’ or as ‘a safe investment that I don’t have to worry about’. 4

Which may explain why even more investors bought gold than crypto last year. According to the research, 44% invested in gold in the first 10 months of 2021, with bars and coins among the most popular options. That’s reflected in our Gold Demand Trends data, which showed 2021 bar and coin investment reaching an eight-year high.

Of those investors who bought cryptos in 2021, just over half also made an investment in gold. Assuming they still hold both assets, that group could be forgiven for feeling smug. At the time of writing, gold is one of the best performing assets since the start of 2021.5

While a gold investment may not have made stellar returns over that time, it’s at least likely still to be in the black, fulfilling that role of being a store of wealth and a safe worry-free investment. And giving those investors who hold it more dry powder to invest elsewhere.

Footnotes

The World Gold Council commissioned Hall & Partners to survey 10,000 retail investors across five markets US, Canada, Germany, India and China. Retail investors were defined as people who are aware of both gold and cryptocurrencies as an investment product, and who had made at least one investment (from a defined set of investment products) since the beginning of 2021. Online fieldwork was conducted in late October/early November 2021.

Drawdown between 10 Nov 2021 and 20 May 2022. The Bloomberg Galaxy Crypto Index tracks the performance of the largest cryptocurrencies traded in USD. See: BGCI Quote - Bloomberg Galaxy Crypto Index - Bloomberg Markets

The survey asked investors to select up to three statements to describe the role of each of the investment products they currently owned. The statements were selected in order of importance, with the first selection being the main role of this investment. Sample sizes: owners of gold, responding for each gold investment product, (7,352); crypto owners (2,983)

Respondents ranking each statements between 1 and 3 for all gold products

For gold’s performance versus a range of stock, bond and commodity indices in various currencies, see Gold Price Returns 2021 | Gold Prices | World Gold Council. Customising the data to start from end-Dec 2020 shows that, as at end-April 2022, gold (in US dollars) had outperformed all other variables except the MSCI US Index and the BBG Commodity index.