Summary

- The domestic gold price ended 5.8% higher in February at Rs50,479/10g1

- Retail demand weakened as a sudden spike in the gold price resulted in the postponement of gold purchases in the second half of the month

- Weak retail demand widened the local market discount to US$14-15/oz by the end of the month compared to a small premium of US$1-2/oz in the first half of the month

- Official imports rebounded from January but were still 14% lower y-o-y as the higher gold price curtailed purchases

- India signed a Comprehensive Economic Partnership Agreement (CEPA) agreement in February under which it extended a 1% custom duty concession for up to 200t of bullion imported from the UAE; this is expected to come into effect in April or May 2022

- Indian gold ETFs saw a second consecutive month of net outflows (0.5t), primarily driven by investors taking profits; total holdings of gold ETFs were 36.2t2

- The Reserve Bank of India (RBI) added 2.6t of gold in February, increasing its total gold reserves to 758t.

Looking ahead

- The rising gold price may continue to impact demand in March. Local trade is expecting weak y-o-y demand due to muted festival and regular purchases3

- The volatility in the international gold price amid the conflict between Russia and the Ukraine may cause uncertainty around official imports.

Discount in the local market widened during the month

Gold prices rose sharply in February amid heightened geopolitical risks and safe-haven demand. The LBMA Gold Price AM in USD and the MCX Gold Spot in rupees (INR) rose by 6.3% and 5.8% respectively over the month.4

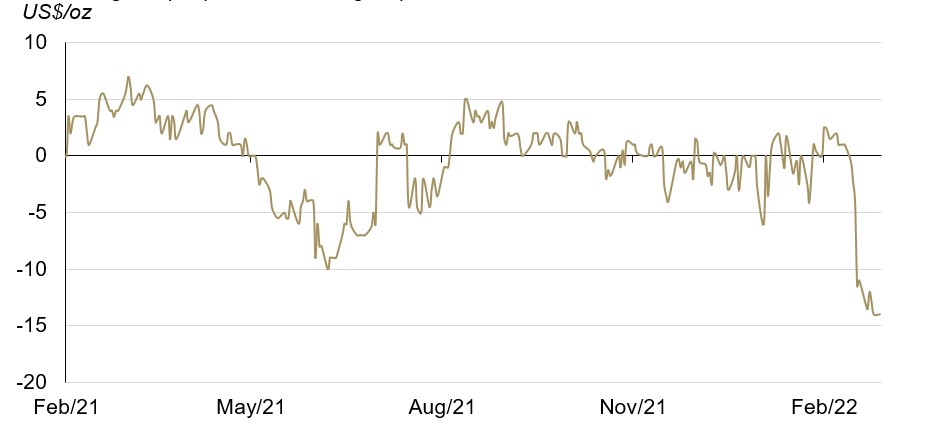

The sudden spike in the gold price resulted in the postponement of gold purchases during the second half of the month. As a result, the discount in the local market widened to US$14-15/oz by month-end, compared to a small premium of US$1-2/oz in the first half of the month (Chart 1).5

As the international gold price trajectory continued upwards, the domestic price discount widened to US$25-30/oz by the first week of March.

Chart 1: Weak retail demand widened the local market discount during February

National Commodity & Derivatives Exchange Limited (NCDEX) polled premia/discount for domestic gold spot price vs landed gold price in India

Retail demand weakened further but imports rebounded

Following soft demand in January, retail demand weakened further in February. The spike in the price of gold on the back of the Ukraine invasion caught consumers off guard and resulted in a postponement of gold purchases during the second half of the month. Anecdotal evidence suggests that sales in rural areas were less impacted than those in metros as rural consumers bought despite the higher price – perhaps in anticipation of further hikes. Retail demand during the month was primarily driven by wedding purchases; gifting and regular purchases remained muted.

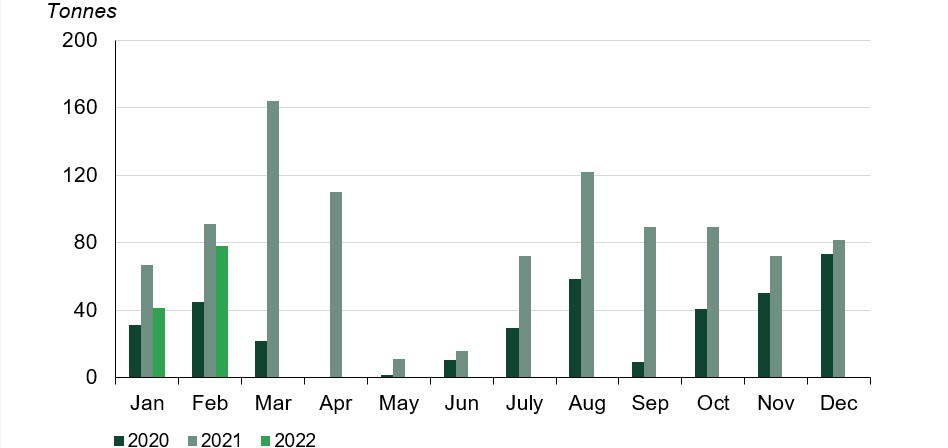

Indian official gold imports totalled 78.5t in February, 14% lower y-o-y but 91% higher m-o-m (Chart 2). Official imports were driven by the following:

- No change in duty was announced in the Union Budget on 1 February

- Trade re-stocking in preparation for the IIJS Signature 2022 from 18 to 21 February (IIJS Signature is one of the leading B2B events in India)

- The sudden gold price spike in the second half of the month.

Chart 2: India imported 79t of gold in February 2022

Indian monthly official imports from January 2020 to February 2022

Looking ahead, the rising gold price may continue to impact gold demand in March. Local trade expects weak y-o-y demand due to muted festival and regular purchases. The international gold price volatility due to geopolitical instability may cause uncertainty around official imports in the month.

India extended 1% duty concession on bullion imports from the UAE under a Comprehensive Economic Partnership Agreement (CEPA)

India signed a CEPA agreement in February under which it extended a 1% custom duty concession for up to 200t of bullion imports from the UAE. The trade agreement is expected to come into effect in April or May 2022. There is no clarity as how 200t of imports may be pro-rated over time as the details of the trade agreement have yet to be made public. However, industry contacts believe that the 1% duty concession may be linked to the Indian jewellery export performance to UAE and as a result, the 200t is likely to be released gradually. If the entire 200t was allocated it could cause a price arbitrage in India; refineries would be impacted and the local gold price could be pushed into discount for at least a couple of months.

The Securities and Exchange Board of India (SEBI) issued guidelines on trading features of electronic gold receipts (EGR) and operating guidelines for vault managers6

After a January circular provided a framework to operationalise the domestic gold spot exchange in India, SEBI issued further guidelines for trading features of EGRs and operating guidelines for vault managers in the EGR segment. Under the new guidelines, trading in the EGR segment will be permitted from Monday to Friday and stock exchanges can set their trading hours within a time frame of 09.00 to 23.30/23:55. SEBI’s circular for vault managers notified them that they will need to provide a financial security deposit of Rs10 lakh to either the NSDL or CDSL depository before obtaining a certificate of registration from the Markets Regulator.

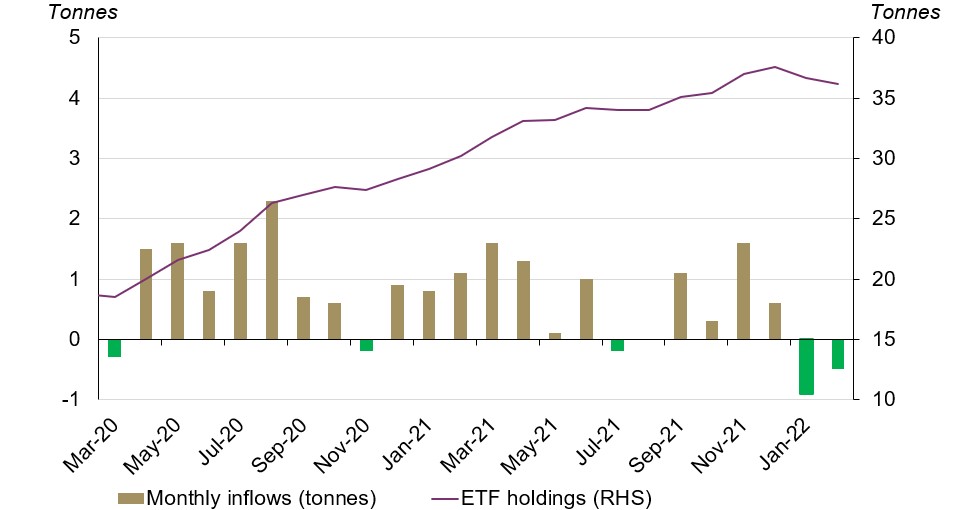

Gold ETF holdings saw 0.5t of outflows during the month

Indian gold ETFs saw a second month of consecutive outflows (0.5t, Rs2.6bn, US$34mn) in February after 0.9t of outflows in January. This was primarily driven by the higher gold price, which likely led to profit taking. Net February outflows took total gold holdings to 36.2t by the end of the month (Chart 3).

Chart 3:Outflows from the Indian gold ETFs continued for the second consecutive month amid a rising gold price

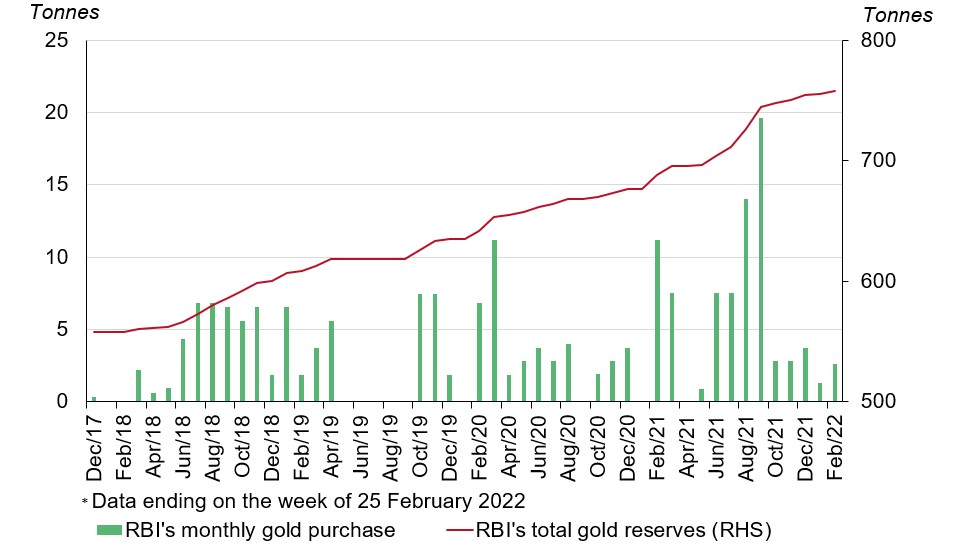

The RBI added 2.6t to its gold reserves

The RBI’s gold purchases increased marginally in February to 2.6t (purchases in January amounted to 1.3t), taking its gold reserves to 758t or 6.7% of total reserves (Chart 4)7. The RBI added 77.5t in 2021 – its highest annual purchase since 2009.8

Chart 4: RBI added 2.6t to its gold reserves in February

Footnotes

Based on the MCX Gold Spot price in INR as of 28 February 2021.

Indian 10-year government bond yield rose to 6.68% on 31 January 2022 from 6.45% on 31 December 2021.

Gudi Padwa is a spring festival celebrated in the state of Maharashtra. It is considered auspicious to purchase gold before Gudi Padwa or on the day of the festival. Gudi Padwa falls on 2 April 2022.

We compare the LBMA Gold Price AM with the MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

The premium/discount data is based on the gold premium polled spot price from National Commodity & Derivatives Exchange Ltd.

Trading on domestic spot gold exchange will happen through electronic gold receipts (EGRs). EGRs will be created when physical gold is deposited with vault managers, after assuring the quality of the gold. EGRs will be credited to the demat account of the beneficiary and will be traded on the exchange.

Central bank data is taken from IMF-IFS: IFS up until December and weekly statistics from the RBI for January and February. February’s purchases are as of the week ending 25 February 2022. Please refer to our latest central bank statistics: https://www.gold.org/goldhub/data/monthly-central-bank-statistics.

In 2009, the RBI purchased 200t of gold from the IMF.