Since the Global Financial Crisis, it has been a turbulent ride for investors the world over. Europe has certainly been no exception: investors in the region have had to adapt to a high-risk environment. And as COVID-19 has introduced a new set of challenges to portfolio construction and return generation, robust risk management strategies are a top priority; wealth protection is as important as growth.

The ultra-low rate environment presents challenges to portfolio construction

The lack of yield on offer in the prolonged ultra-low rate environment has prompted many investors to extend maturities, move further along the credit curve, or increase allocations to alternative assets. These strategies may generate greater returns, but they also bring with them greater risk. And while bonds have traditionally been considered a hedge against downside risks and market corrections, the low yields currently on offer mean they may no longer bring the same diversification and protection benefits from decades past.

Inflation risks have undoubtedly increased

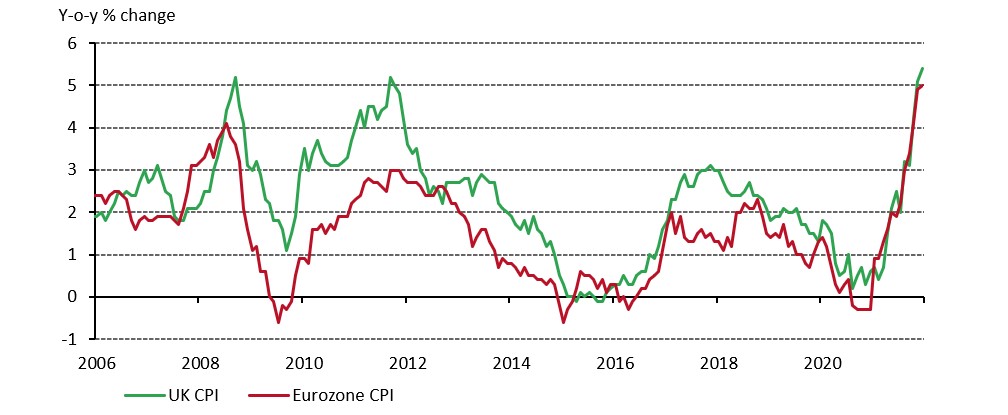

Rising inflation has become the number one topic for investors in Europe and initial hopes that it would quickly subside have begun to fade. Like many other central banks across the world, the Bank of England (BoE) and the European Central Bank (ECB) now face the difficult challenge of reining in rapid price rises while nurturing the nascent economic recovery (Chart 1). Despite recent record CPI readings, the ECB currently remains committed to its accommodative monetary stance. And in the face of multi-decade high inflation, the BoE has suggested that interest rates will only rise modestly going forward. But concerns around the persistence of inflation have intensified speculation as to the speed at which fiscal and monetary support is adjusted. These changes could threaten markets: tightening too soon could run the risk of tipping the economy back into recession, while tightening too late could result in inflation getting out of control. Investors may therefore need to review their strategic asset allocations to ensure they have the appropriate portfolio protection in place.

Chart 1: UK and European inflation moved sharply higher in 2021

ESG considerations are also shaping portfolios

Environmental, social and governance (ESG) issues are beginning to influence the shaping of asset selection and strategies. Not only is this in line with wider societal expectations but it is also driven by a host of legal and regulatory changes. In Europe, for example, the Sustainable Finance Disclosure Regulation has imposed mandatory disclosures on ESG for asset managers and financial market participants. This is part of a wider set of measures which form the European Commission’s Action Plan on Sustainable Finance. As a result, investors of all stripes are searching for ways to align their portfolios with the global transition to more responsible and sustainable investments.

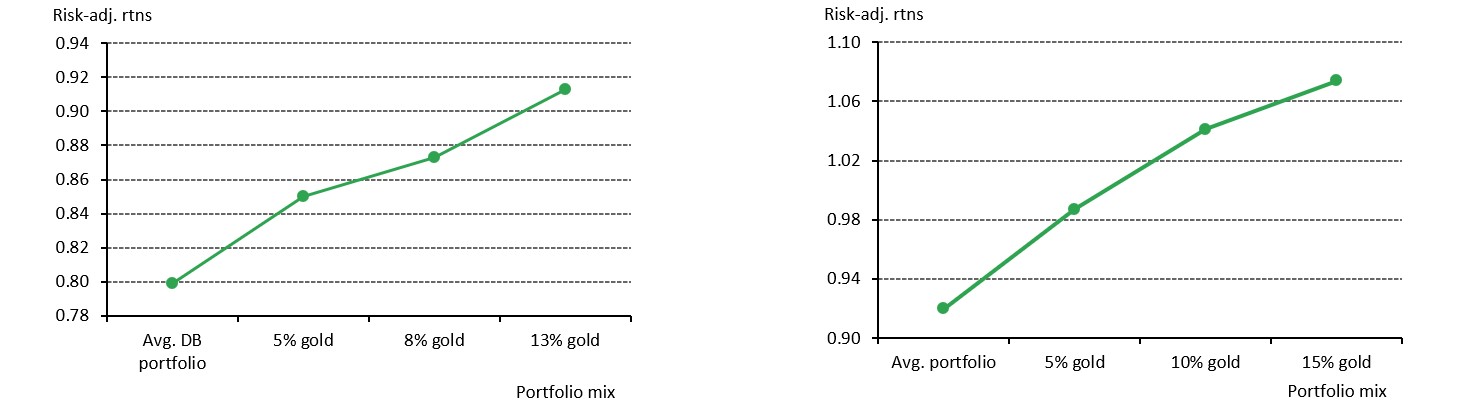

Investors in Europe recognise the strategic benefits of owning gold

Europe has long been a significant source of demand for retail gold investment. Per capita gold consumption in Germany and Switzerland is among the highest in the world.1 However, we believe institutional investors also recognise the benefit from allocating a proportion of their portfolio to gold. Despite potential rate hikes, both nominal and real interest rates remain historically low, keeping the opportunity cost of holding gold supressed. Low rates also highlight gold’s attributes as a source of genuine, long-term returns – particularly when compared to historically high levels of global negative real-yielding debt. Our back-testing analysis has found that adding gold to a hypothetical average UK or European pension portfolio over the past 20 years would have resulted in higher risk-adjusted returns (Chart 2).

Chart 2: Adding gold would have increased risk-adjusted returns of a hypothetical UK (left-hand side) and European (right-hand side) pension fund over the last 20 years

Through robust optimisation analysis, we also find that the higher the portfolio risk, the larger the required gold allocation to offset that risk. More detail on this analysis, as well as gold’s unique attributes as an investment asset, is available in our recently updated Relevance of Gold as a Strategic Asset report. As a result, we continue to believe that gold has an increasingly relevant role to play in helping UK and European investors navigate the evolving landscape of risk and uncertainty.