In the recently published 2021 Alternative Assets in Europe report, one thing is clear: alternative assets are en vogue amongst European investors. By the end of 2020, assets under management (AUM) in alternative funds rose above €2bn for the very first time. That’s a 14% increase y-o-y, and 59% growth since December 2016. And increasing allocations to alternative assets is not just a European phenomenon.

Alternative assets hold allure for European investors

27 September, 2021

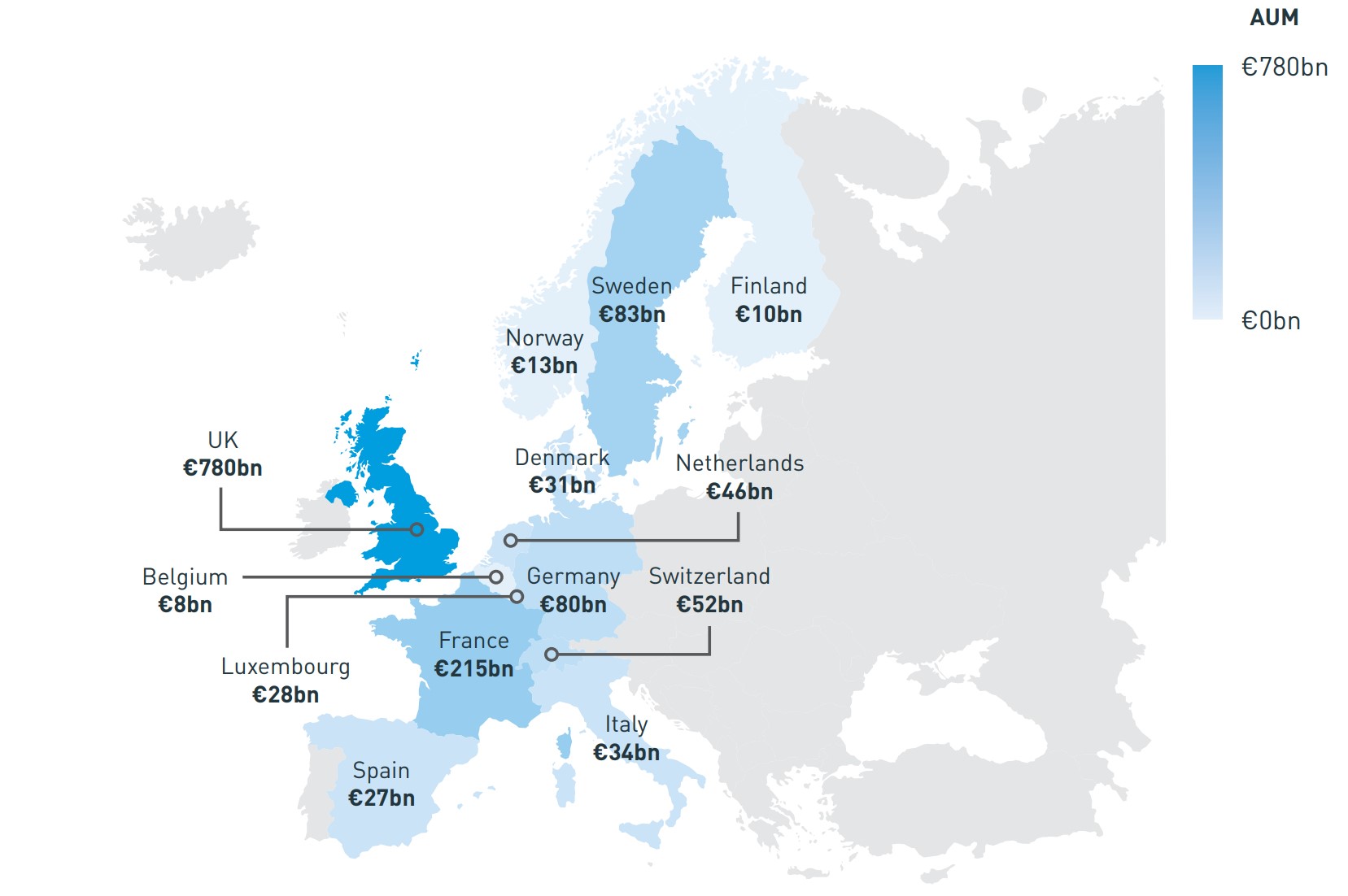

Source: Preqin

This trend of greater allocations to alternative assets comes as no surprise. In Europe, the ultra-low/negative interest rate environment has left investors hunting for yield among real assets, and investments in private equity, venture capital, hedge funds and infrastructure have long offered attractive returns compared to many competing asset classes. But higher returns come with higher risks – higher correlation to equities, lock-down clauses and high entry/exit fees.

Nonetheless, the report indicates that appetite for alternative assets shows little sign of abating. The deal value of private capital activity in H1 2021 hit €236bn, 83% of 2020’s full year total. The authors go on to mention that fundraising is on track to eclipse the previous record of €271bn from 2019.

Post-COVID, European investors will need to reshape their asset allocations. Bonds may no longer offer the returns or protection that they once did. The trend of greater allocations to alternative assets may therefore continue, potentially making portfolios riskier in the process. As a result, appropriate diversification strategies, which could include gold, may become even more necessary in the future.