Summary

- The domestic gold price ended 0.5% higher in November at Rs48,031/10g1

- Retail demand remained robust in the month, buoyed by festival and wedding purchases

- Official imports declined m-o-m due to a higher gold price and ample stocks, and the local market flipped back to discount during the month

- Indian gold ETFs saw 1.6t of net inflows amid festive demand and concerns around elevated stock market valuation; total holdings of gold ETFs increased to 37t by the end of the month

- The Reserve Bank of India (RBI) added 2.8t of gold in November, increasing its total gold reserves to 750.4t.

Looking ahead

- Anecdotal evidence points towards mixed momentum so far in December. Demand remains supported by weddings scheduled in the first half of the month but faces challenges from domestic gold price volatility and concerns around the Omicron variant. Retail demand may further weaken as the month progresses, with end of year holidays and fewer auspicious wedding dates.

- We anticipate that official imports may remain flat or lower in December. Gold price volatility, healthy bullion inventory levels and concern over the new Omicron variant may dissuade trade from increasing imports further.

The local gold price flipped back to discount during the month

The LBMA Gold Price PM rose 2% in November, rallying early in the month before declining towards the end of the month as inflation concerns were offset by a stronger US dollar. The LBMA Gold Price AM in USD and the MCX Gold Spot in rupees (INR) rose by 0.1% and 0.5% respectively.2 The stronger Indian local gold price performance was largely due to a depreciating INR, which fell by 0.4% over the month relative to the dollar.

With a higher gold price, ample bullion stocks and a slowdown in gold purchases post-Dhanteras, the local gold price flipped back to discount of US$2-3/oz in the third week of November from a premium of US$1-2/oz in the first half of the month.3 With a correction in the gold price at the end of the month, demand rebounded, narrowing the local market discount to US$0.5-1/oz by end November (Chart 1).4

Chart 1: The local gold price flipped back to discount during November

Difference between MCX Spot Gold price and landed gold price in India derived from LBMA Gold Price AM

Source: NCDEX, World Gold Council

Gold price volatility and concern around the Omicron variant prompted slower bullion purchases by jewellery retailers. As a result, the local gold price remained at an average discount of US$0.5/oz in the first two weeks of December.

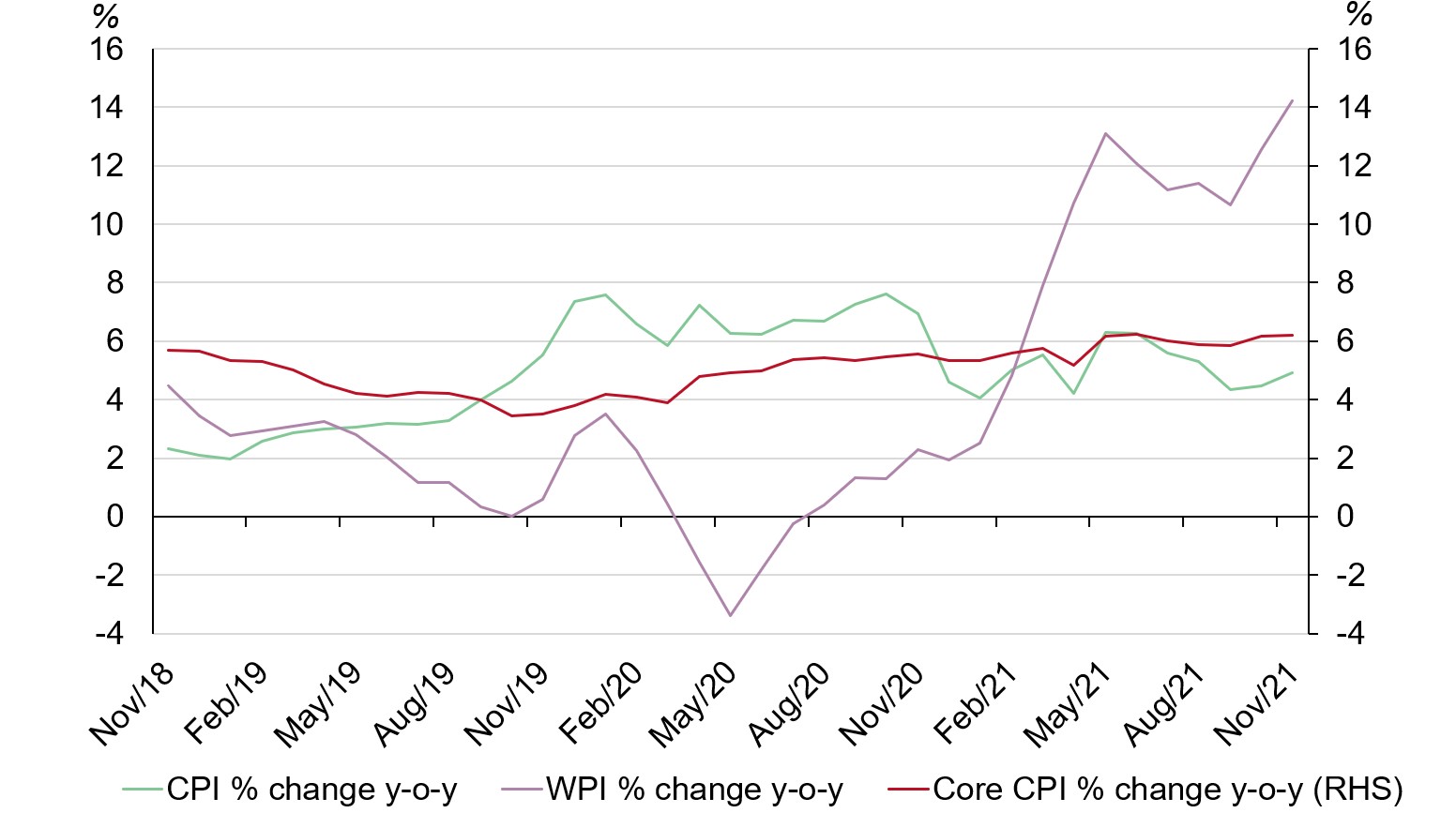

Wholesale and retail inflation rose in the month

India’s wholesale inflation (WPI) rose to a 12-year high (14.23% y-o-y) in November; retail inflation (CPI) also increased (4.9% y-o-y) due to rising food and commodity prices (Chart 2). Expectations for higher inflation are building: Indian households’ median inflation expectations for three months and one year increased by 1.5% and 1.7% respectively.5 In view of this upward trajectory the RBI projected a higher CPI inflation of 5.7% in Q1 2022 from 5.1% in Q4 2021 during its December monetary policy meeting.

Chart 2: India's retail and wholesale inflation rose in November

India CPI % change y-o-y, WPI % change y-o-y and Core CPI % change y-o-y

Source: Bloomberg, World Gold Council

Retail demand remained robust but imports declined

Retail demand got off to a strong start in November helped by robust sales during Dhanteras, with retailers reporting volume sales exceeding the pre-pandemic levels of 2019. Retail demand softened marginally during the third week, coinciding with a rising gold price, but it rebounded in the last week of the month, supported by a correction in the gold price and wedding purchases.

Looking ahead to retail demand in December, anecdotal evidence points towards mixed momentum. Although supported by weddings scheduled in the first half of the month, it faces challenges from volatility in the domestic gold price and concerns around the new Omicron variant. Retail demand may further weaken in the last two weeks of the month due to end-of-year holidays and the lack of auspicious wedding dates.

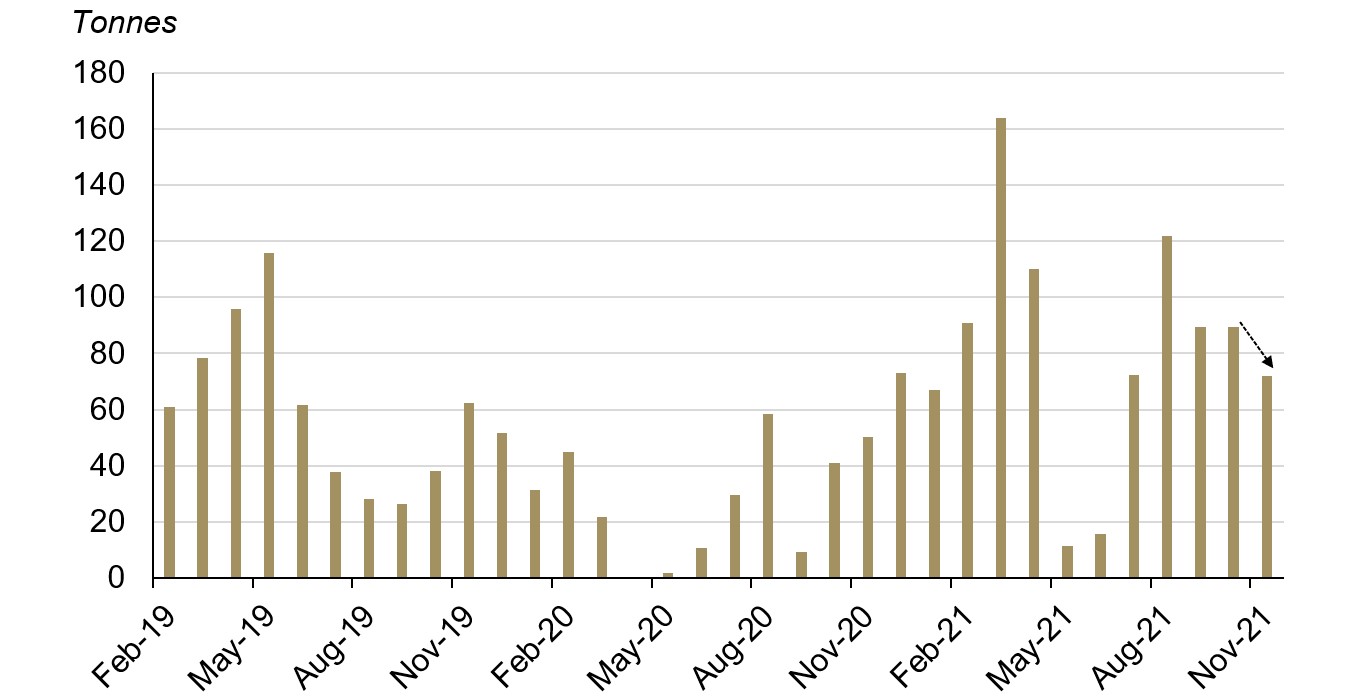

In line with our expectations, official imports declined to 72.1t in November – 19% lower m-o-m but 43% higher y-o-y (Chart 3).

A total of seven banks, nominated agencies and exporters imported 41t of bullion, and 21 refineries imported an equivalent 31.1t of fine gold content in the form of gold doré.

We anticipate that official imports may remain flat or lower in December. Gold price volatility, healthy bullion inventory levels and concerns over new Omicron variant may dissuade trade from increasing imports further.

Chart 3: Indian official imports declined in November

Indian monthly imports from February 2019 to November 2021

Source: Infodrive India, Ministry of Commerce and Industry, World Gold Council

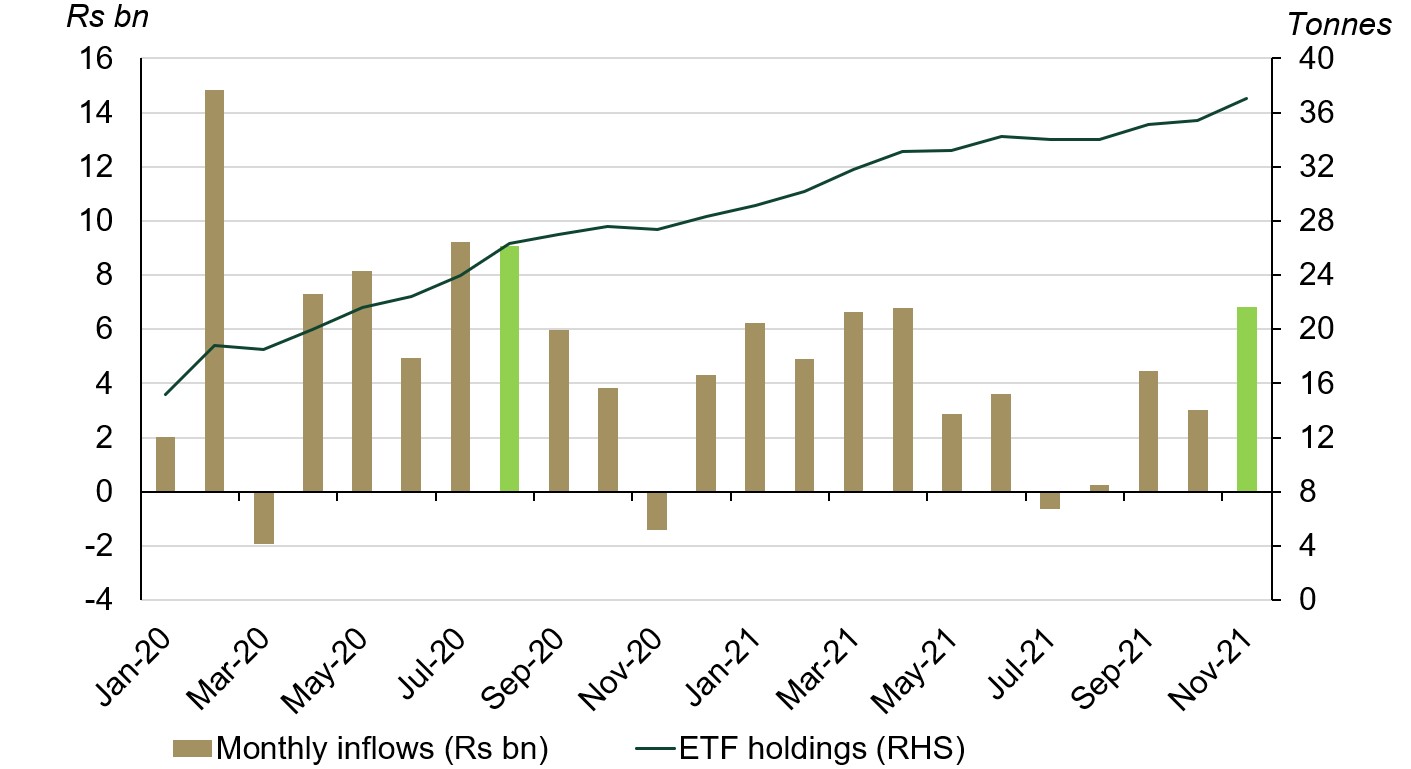

Gold ETF holdings saw 1.6t of inflows during the month

Indian gold ETFs continued to attract inflows, driven by seasonal demand surrounding the Diwali festival and concerns around elevated equities, which led to a correction in the local stock market later in the month. Net November inflows of 1.6t (Rs6.83bn, US$91.3mn) took total Indian gold ETF holdings to 37t. The rupee value of monthly inflows reached a 15-month high (Chart 4). Inflows have continued in December amid investor concerns around the new COVID variant. Latest available data show total holdings had reached 37.3t.6

Chart 4: Inflows into Indian gold ETFs touched 15-month high during November

Source: Association of Mutual Funds of India, Bloomberg, Respective ETF providers, World Gold Council

The RBI added 2.8t to its gold reserves

After purchasing 3.8t of gold in October, the RBI bought an additional 2.8t in November, taking its gold reserves to 750.4t or 6.8% of total reserves (Chart 5).7 The RBI has stepped up gold purchases over recent years and has added 72.8t to its gold reserves y-t-d; 2021 looks set to see the biggest annual increase in India’s official gold reserves since 2009.8

Chart 5: RBI added 2.8t to its gold reserves in November

Source: IMF, RBI, World Gold Council

Footnotes

Based on the MCX Gold Spot price in INR as of 30 November 2021.

We compare the LBMA Gold Price AM with the MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

For more details, please refer to the monthly blog on Indian gold market in October.

The premium/discount data is based on the gold premium polled spot price from National Commodity & Derivatives Exchange Ltd.

RBI’s inflation expectations survey (carried out between 25 October and 3 November 2021) was conducted via telephone interviews with 5,910 urban households living in 18 major Indian cities.

Data till 10 December 2021 as per the Association of Mutual Funds of India (AMFI) daily database.

Central bank data is taken from IMF-IFS; IFS up until October and weekly statistics from the RBI for November. Please refer to our latest central bank statistics: https://www.gold.org/goldhub/data/monthly-central-bank-statistics.

In 2009, the RBI purchased 200t of gold from the IMF.