Summary

- India’s equity market has outperformed major equity markets in 2021, triggered by signs of economic recovery and an accommodative monetary policy from the Reserve Bank of India (RBI)

- On 26 November the BSE Sensex witnessed its biggest daily fall in the last seven months due to fears about the new COVID variant identified in South Africa and a sell-off by foreign institutional investors (FIIs) who are concerned about overvalue in the equity market

- Gold historically exhibits negative correlation during equity sell-offs and the domestic gold price increased by 1.3% on 26 November.1 Gold may remain attractive to Indian investors who wish to preserve their capital

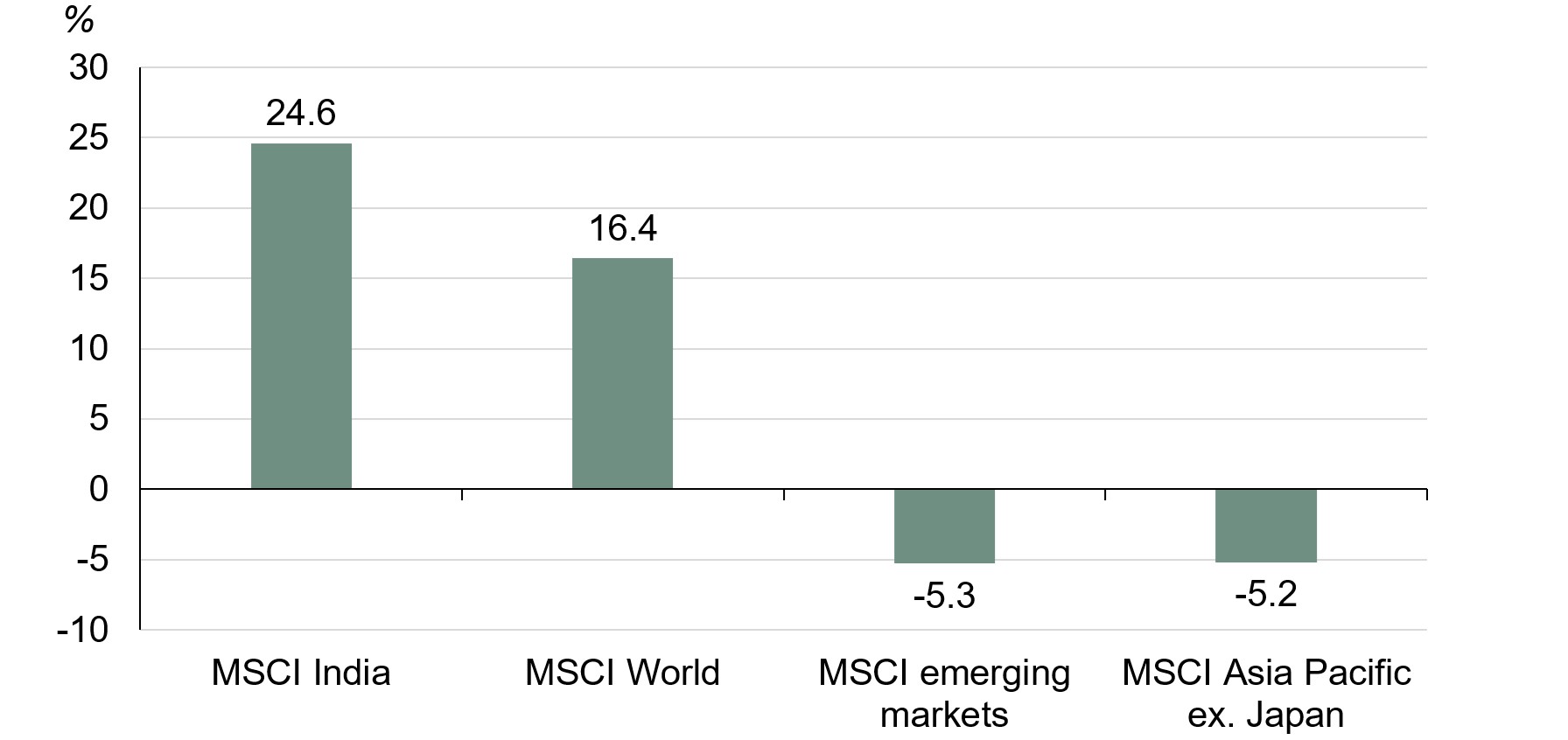

The Indian equity market has outperformed major equity markets in 2021

The Indian equity market witnessed positive returns this year, buoyed by strengthening signs of economic recovery after the second wave of the pandemic and an accommodative monetary policy stance by the RBI (Chart 1).2

Chart 1: The Indian equity market has outperfomed major equity markets in 2021

Return on equity markets in 2021

The lofty returns on Indian equities have raised concerns over valuations; in November the BSE Sensex witnessed its biggest daily fall in the last seven months

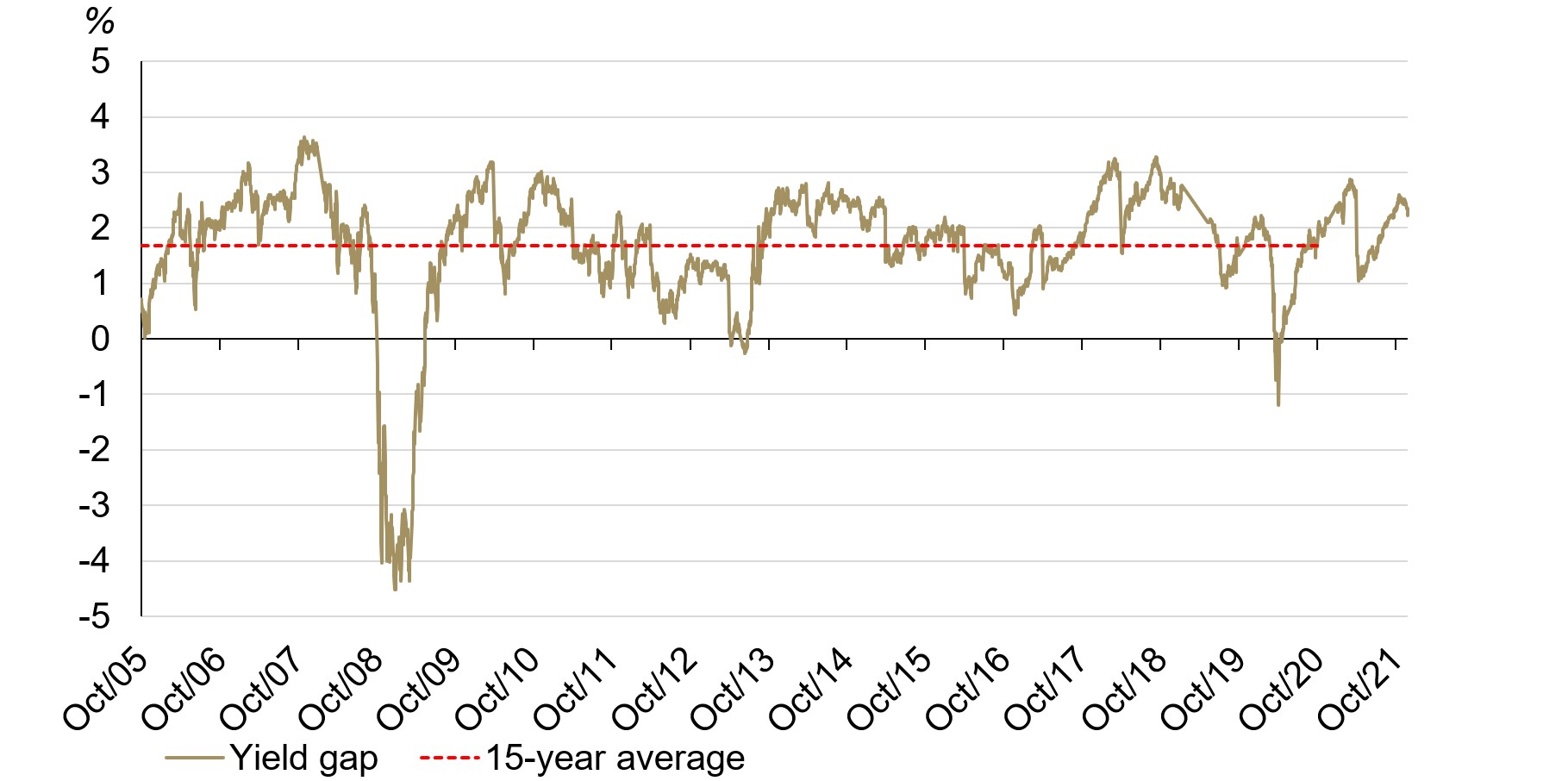

The lofty returns on Indian equities have raised concerns around overstretched valuations and as a result various global financial firms have turned cautious on Indian equity. Traditional valuation metrics, such as the price-to-earnings (P/E) ratio, have remained above the historical average values.3 Also, the current yield gap of 2.23% remains well above the 15-year average of 1.67% – indicative of an overvalued equity market in the country (Chart 2).4

Chart 2: The current yield gap has outstripped its long-term average

Spread between 10-year Indian government bond yield and BSE Sensex earnings yield

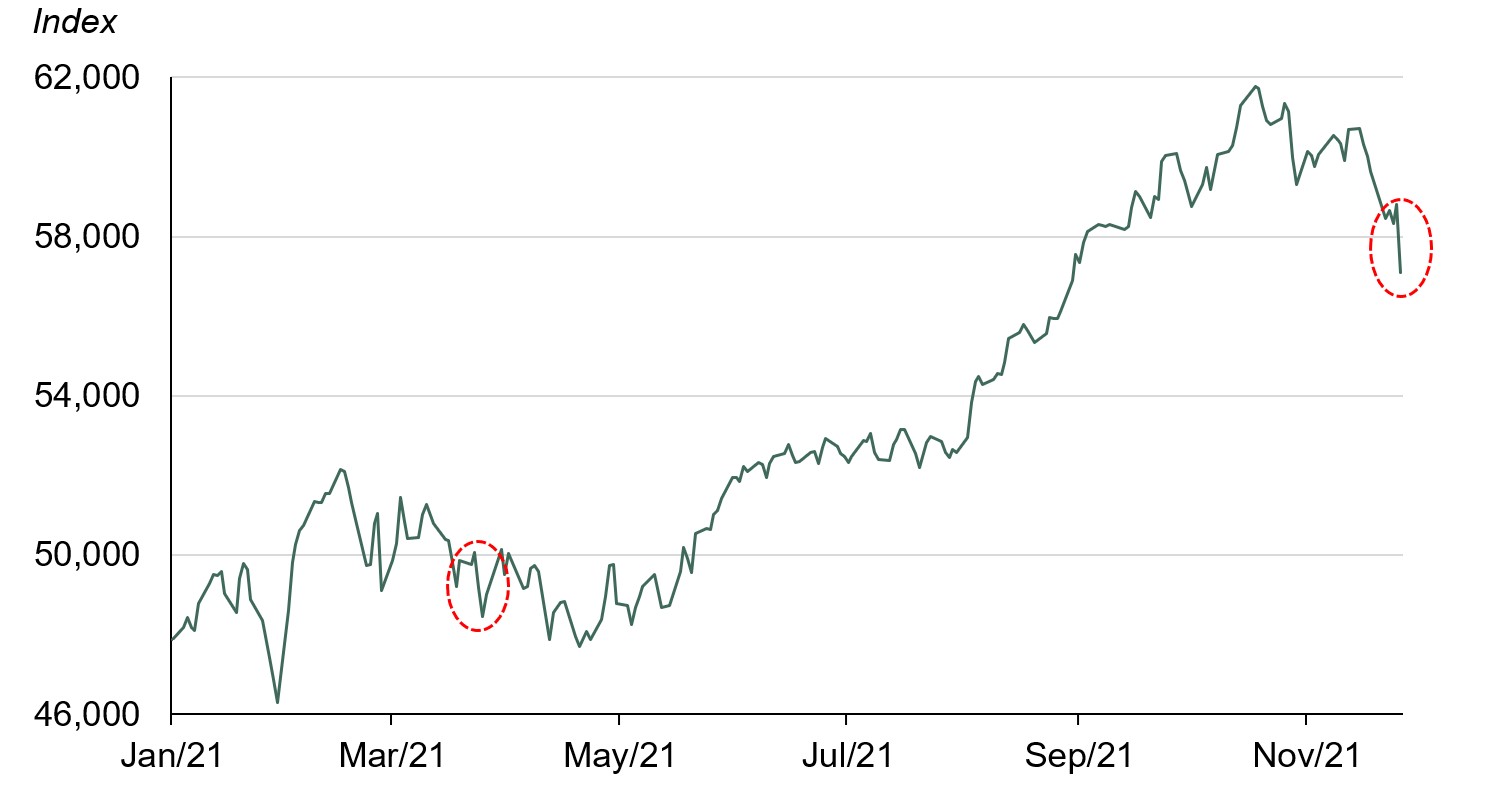

The BSE Sensex started November on a positive note, supported by a higher composite purchasing managers index (PMI) and higher GST collections in October, and as result gained 2.4% during the first half of the month.5 However, it faced challenges in the second half of the month due to various factors such as concerns over global issues, including the new COVID variant, fresh lockdowns in some European countries, and concerns over rising global inflation, as well as domestic concern over high equity valuations in India. On the back of these concerns foreign institutional investors unremittingly withdrew funds from the Indian equity market during the last seven days of the month. The BSE Sensex fell by a sharp 6.1% in the second half of the month with a notable fall of ~1688 points on 26 November 2021 – the biggest daily fall in the last seven months (Chart 3).

Chart 3: On 26 November the BSE Sensex witnessed its biggest daily fall in the last seven months

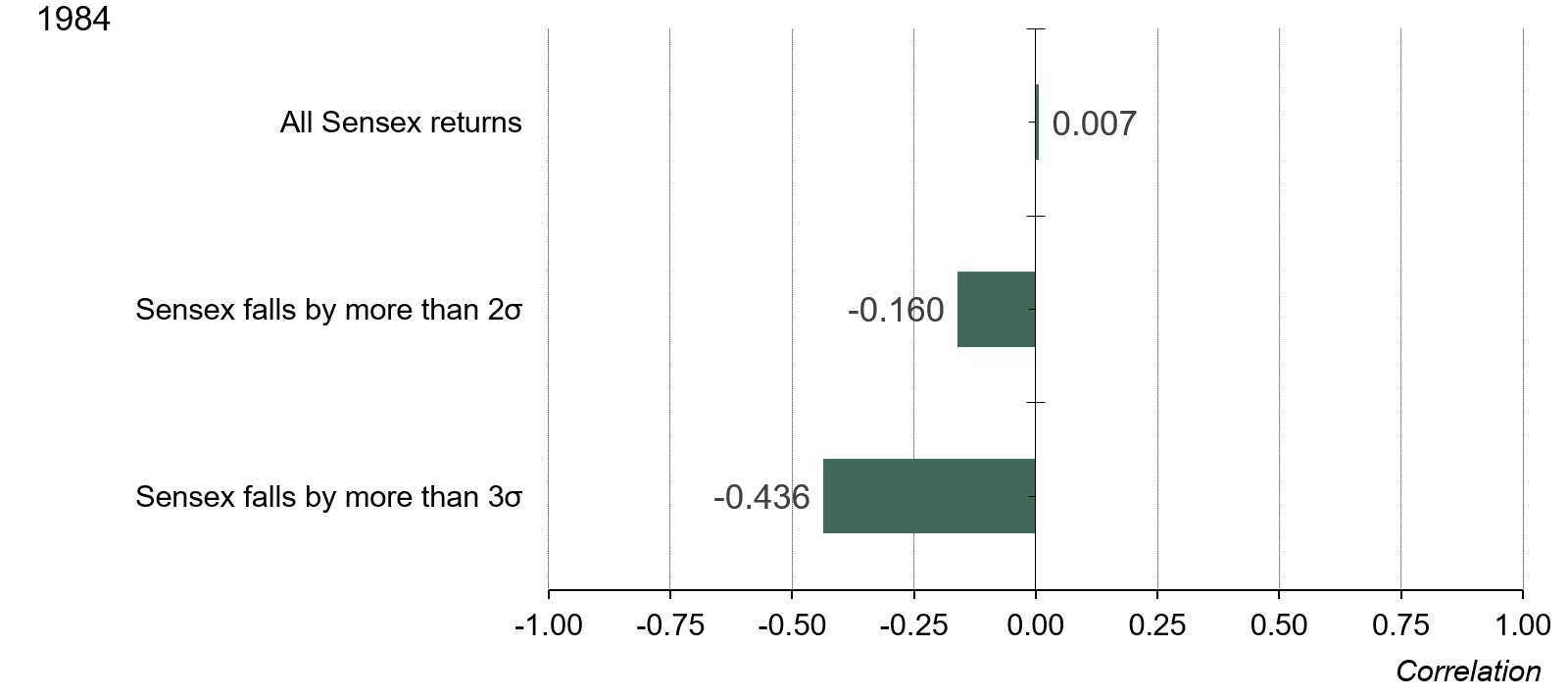

Gold’s role during a market sell-off The diversification benefits of gold are widely acknowledged, as its negative correlation to equities and other risk assets generally increases as these assets sell off (Chart 4). Historically, gold has worked to preserve capital during stock market downturns. For example, during the global financial crisis, equities and other risk assets tumbled in value; gold, by contrast, held its own and increased in price, rising 53% in rupees from December 2007 to February 2009.6 And in the most recent sharp equity market pullbacks of 2018 and 2020, gold’s performance remained positive.7 Also, during the recent sell-off on 26 November, domestic gold price increased by 1.3% to end at Rs48,153/10g. Considering gold’s role during equity sell-offs, it may remain an attractive investment for Indian investors who wish to preserve their capital.

Chart 4: Gold has been more negatively correlated with Sensex in extreme market sell-off conditions

Correlation between gold and Sensex in various environments of equity performance since

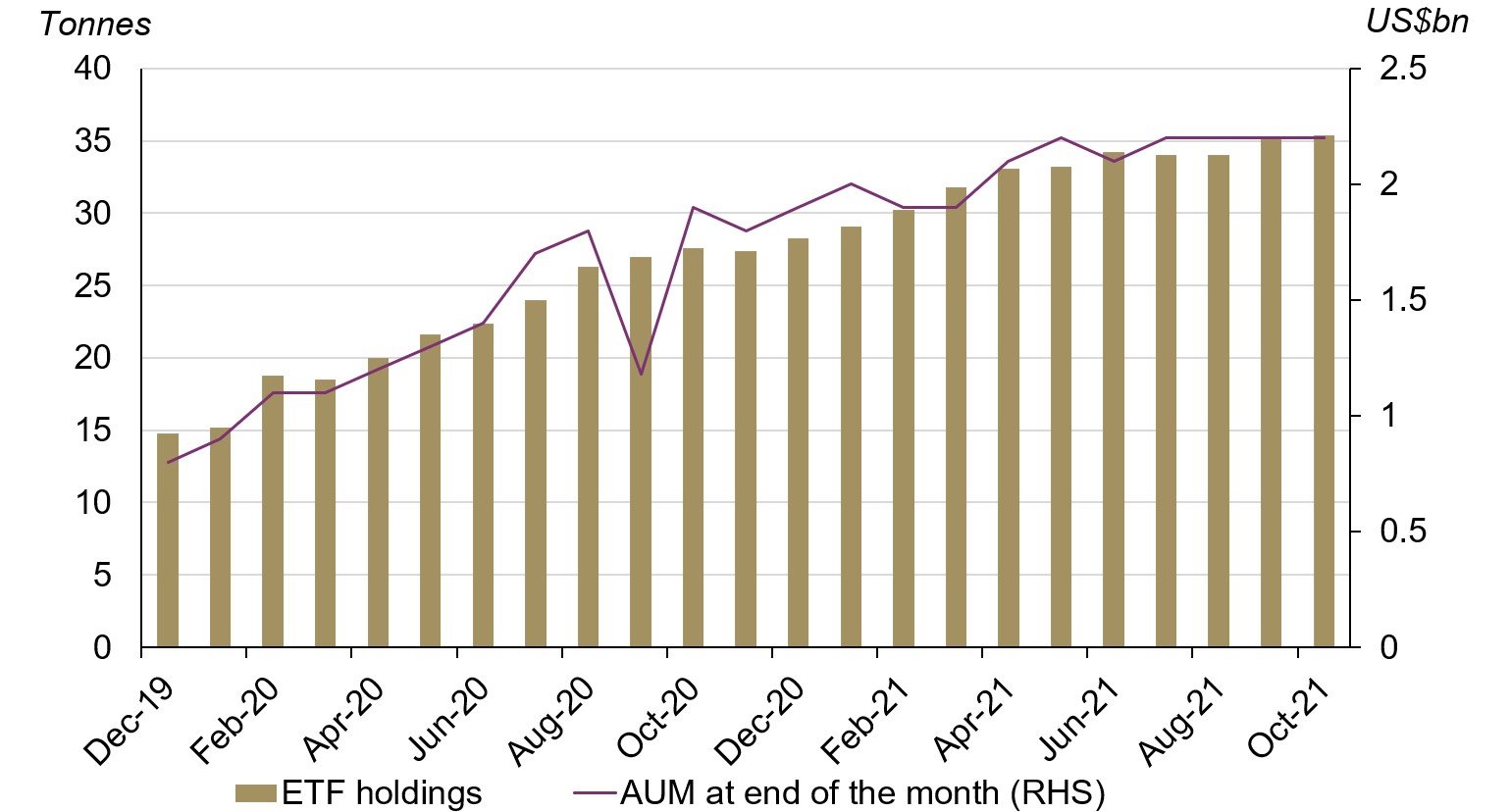

The heightened equity market valuation has attracted inflows into Indian gold ETFs Indian gold ETF holdings almost doubled in 2020 to 28.3t from 14.8t at the end of 2019, led by safe-haven demand during the pandemic and higher returns on gold. The inflows into gold ETFs continued in 2021 amid a correction in the gold price, with gold ETF holdings increasing to 35.4t by the end of October. The high equity market valuation in India has supported these inflows, both during last year and to date in 2021, as concerns around over-valuation have led investors to turn to gold to preserve their capital against a possible equity market downturn (Chart 5).

Chart 5: Indian gold ETFs continued to attract inflows amid concerns over heightened stock market valuation

Conclusion

The Indian equity market has outperformed major equity markets, witnessing positive m-o-m returns from May to October triggered by strengthening signs of economic recovery after the second wave of the pandemic. But in November it has faced challenges due to global concerns, such as the new COVID variant and the continuous withdrawal of funds from FIIs on the back of an overstretched equity market valuation. Indian investors may benefit from turning to gold in such a scenario due to gold’s role as a diversifier and its downside risk protection. And concerns over higher equity valuations in India have attracted investors towards gold ETFs over the last two years. Going forward, the high equity market valuation may be one of the key factors persuading Indian investors to invest in gold.

Footnotes

MCX Gold Spot in INR ended 1.3% higher on 26 November at Rs48,153/10g

The RBI initially cut its policy rate by 75bps in March 2020 and subsequently by 40bps in May 2020. It has kept its policy rate at 4% since May 2020 with an accommodative monetary stance.

As of 26 November 2021 the P/E value of BSE Sensex at 26.7 is well above the 10-year and 5-year average P/E value of 22 and 25.9 respectively.

The current yield gap is as of 26 November 2021.

India’s composite PMI increased to 58.7 in October from 55.3 in September. GST collections increased to Rs1.3tn in October from Rs1.17tn in September to reach the second highest GST collections ever since the GST system came into force.

Based on the MCX Gold Spot price in INR from 1 December 2007 to 27 February 2009.

Based on the MCX Gold Spot price in INR from 1 October 2018 to 27 December 2018 and from 31 January 2020 to 31 March 2020.