While 2020 marked the eleventh consecutive year of central bank net purchases, it nonetheless finished on a somewhat uncertain note. A slowdown in the pace of purchasing by several banks in the second half of the year coincided with a sizeable pick-up in sales by others, causing overall central bank demand to swing between modest net purchases and sales. As I wrote in my last blog post on this topic, more data was needed to see how things might develop going forward.

Central banks continue to swing between net purchases and sales

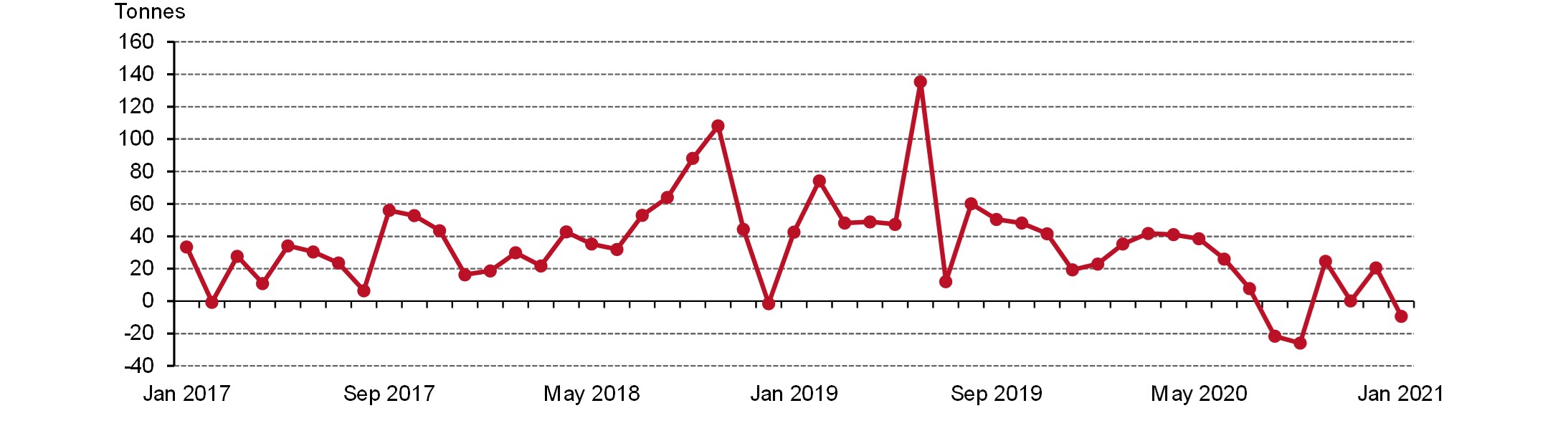

Monthly central bank demand on a net basis

Source: IMF IFS, Respective Central Banks, World Gold Council

Since then, we have seen net purchases of 20.6t in December 2020, and now we have published data showing that central banks switched back to small net sales of 9.4t in January. This is the third month of net sales since June 2020 and the smallest in scale.

Activity on both sides was limited: just four central banks accounted for the overall change. On the buying side, Uzbekistan (8.1t) and Kazakhstan (2.8t), both gold producers and frequent purchasers in recent years, were the only banks to meaningfully increase gold reserves. On the other hand, Turkey (-17.2t) and Russia (-3.1t) were the notable sellers. Russia’s sale is likely related to the January announcement that the central bank will begin minting a 2021 commemorative gold coin. This is part of the bank’s 2021 coin-mining plan, which itself is a part of its long-standing coin-minting programme and similar to programmes from other central banks, such as the Bundesbank, which often result in small sporadic sales.

So, what does the latest information tell us, and does it help make an assessment on the prospects for central bank demand in 2021?

While these are useful data points, it may still be too early to determine the direction of any new trend. As we noted in our recent Gold Demand Trends report: “These intermittent sales have resulted in a more complex picture of central bank demand at the end of 2020, having created a small interruption in the pattern of consistent buying since 2010”. We will continue to monitor the demand from central banks over the next several months to see if the picture becomes any clearer.

Until then, our expectation remains that central banks will stay net buyers in 2021, albeit at a moderate pace which is below the record levels seen previous years. For example, early data for February indicates that the Reserve Bank of India added 11.2t to its gold reserves. While this data is not yet reflected on our monthly statistics, it highlights the relevant role that gold plays in foreign reserve management.

As we look forward, we believe that the possibility of capital inflows into emerging markets and the low interest rate environment may lead to central banks adding gold for diversification purposes.

Our detailed central bank statistics can be found here.