Summary

- The domestic gold price ended 1.6% lower in January 2021 at Rs49,205/10g

- Economic recovery momentum remained steady

- Investment and jewellery demand boosted retail demand during the month

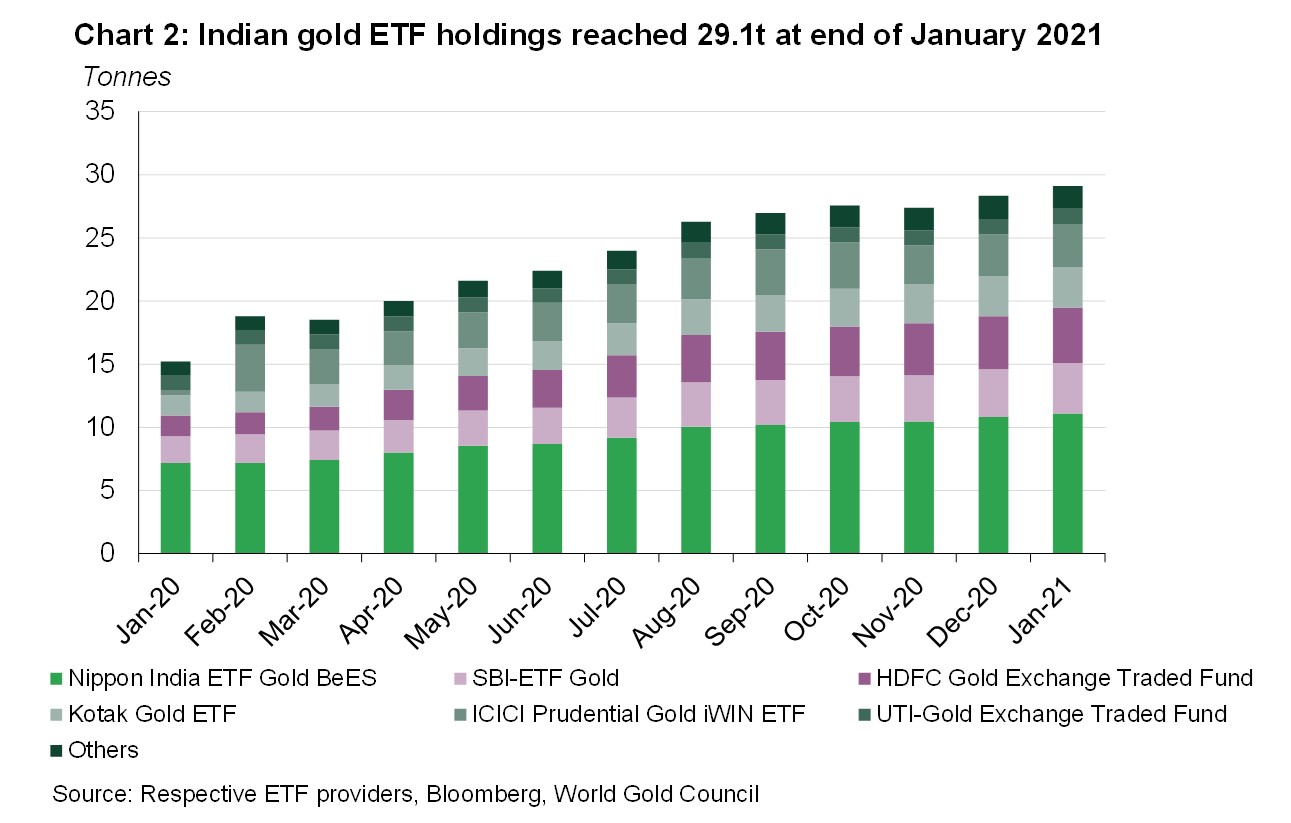

- A correction in the domestic gold price and the expectation of a recovery led to ETF inflows. Total holdings for Indian gold ETFs reached 29.1t at the end of January; a net inflow of 0.8t

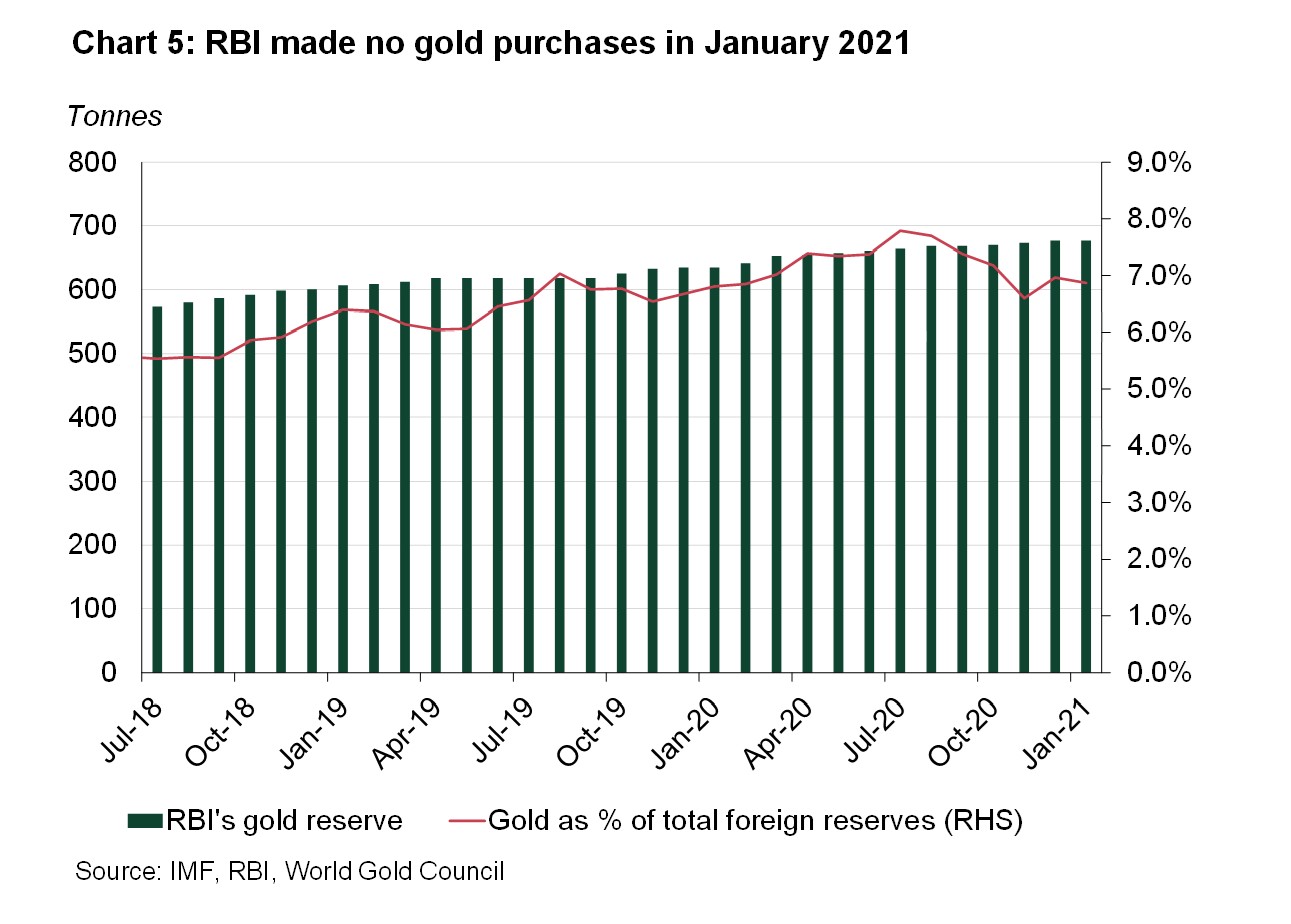

- The Reserve Bank of India (RBI) made no gold purchases during the month, maintaining its gold reserves at 676.6t.

The momentum in economic recovery remained steady in January

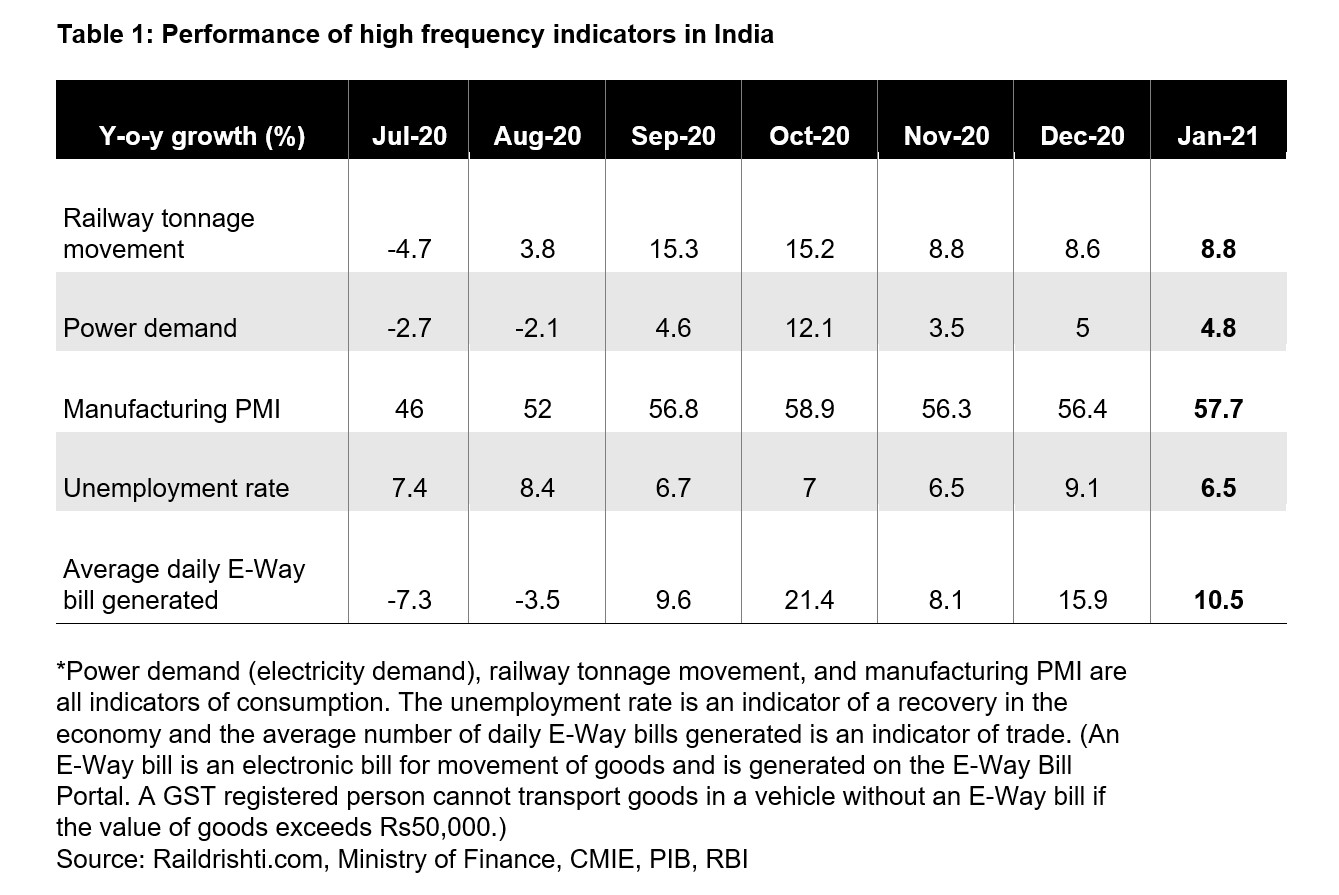

The recovery in economic activity that started in September 2020 has been sustained so far this year with various high frequency indicators expanding in January y-o-y (Table 1).

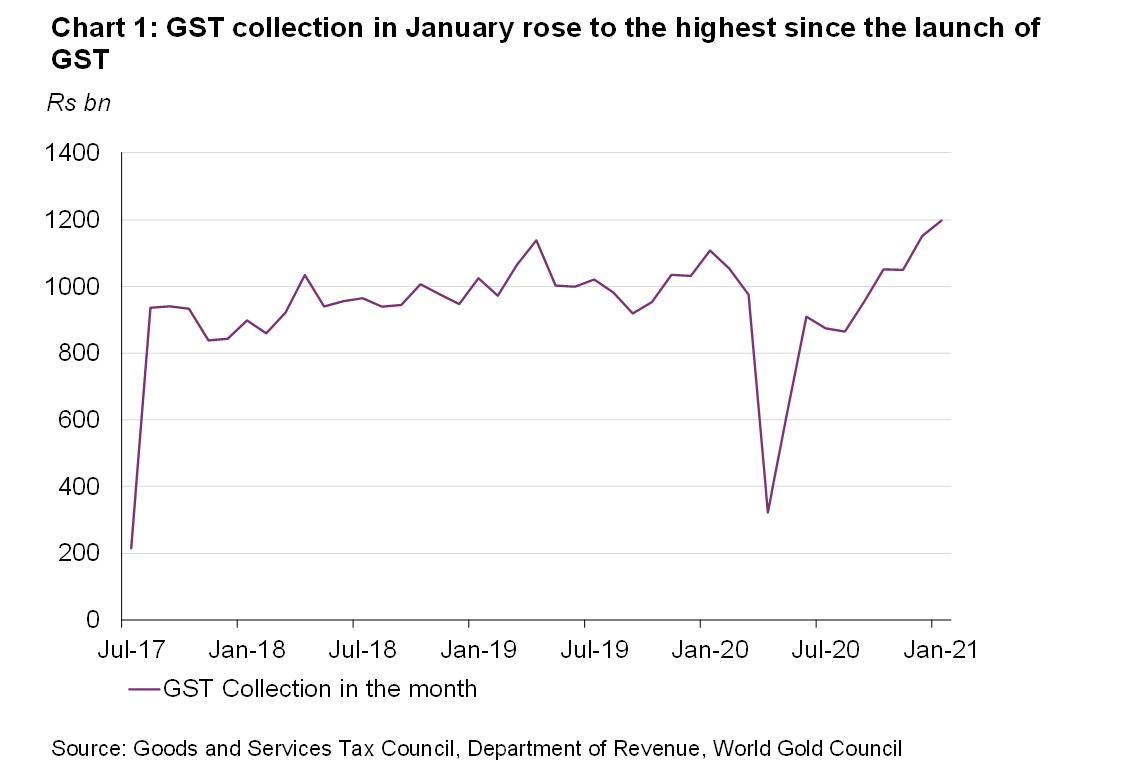

The reopening of the economy and the vaccination roll-out also boosted consumer sentiment – the Reserve Bank of India’s Consumer Confidence Index increased to 55.5 in January 2021 from 52.3 in November. With a pickup in economic activity, GST collection in January hit Rs1.2tn, the highest since the launch of the GST system in July 2017 (Chart 1).

Investment and jewellery demand boosted retail demand

Amid market volatility the US dollar gained strength due to its safe-haven appeal. As a result, both the LBMA Gold Price AM (USD) and MCX Gold Spot fell sharply by 2% and 1.6% respectively.1

Retail demand, particularly for small gold bars (100g denomination) and coins, gained strength following the price correction during the month. Chain stores reported a good increase in coin sales, while jewellery sales picked up with the onset of Makar Sankranti.2 Weddings postponed from Q2 and Q3 2020 due to COVID-19, as well as new weddings, supported demand in the month. With the reopening of the economy, consumer sentiment improving and prices correcting, footfall increased to support casual purchases during the month.

Commenting on its performance in January 2021, Titan – in its Q3 earnings call for FY 2020-21, which was released on 10 February – mentioned that “retail growth was actually 13% in Q3…..we are seeing about 28% retail growth in the month of January.”3 With the average gold price ~24% higher y-o-y, anecdotal evidence from chain stores points towards ~4-5% y-o-y volume growth in January.

Gold ETFs continued to attract inflows in January

A correction in the domestic gold price provided a welcome entry point for investors. Expectations of higher gold prices, due to US President Biden’s plan for US$1.9tn fiscal stimulus, further supported inflows in gold ETFs. Inflows into Indian gold ETFs increased by 0.8t in January taking total gold ETFs to 29.1t (Chart 2).

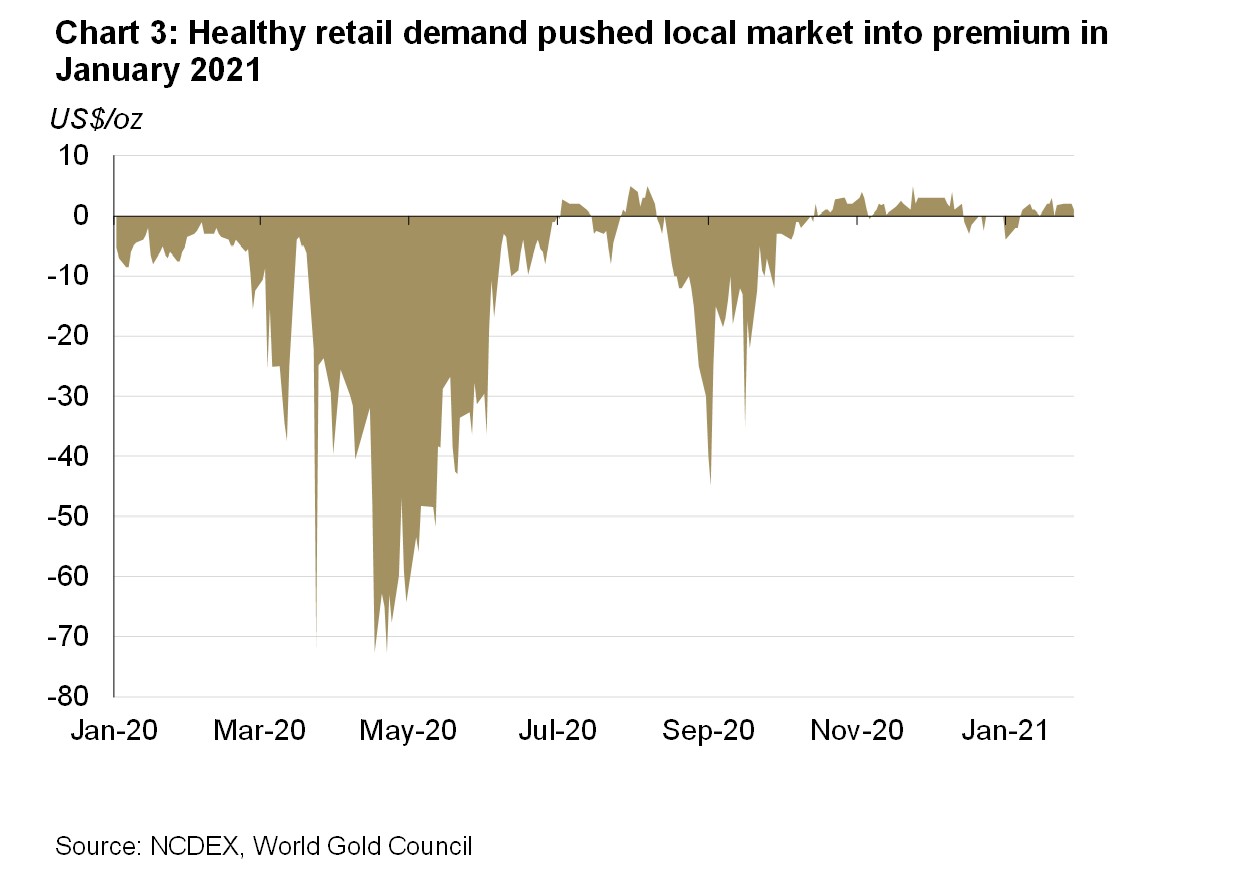

Healthy retail demand pushed local market into premium

With a pick up in retail demand ahead of Makar Sankranti, the Indian gold market went back into premium in the first week of January. The market remained in premium for the entire month, averaging US$0.6/oz. This was in sharp contrast to January 2020, where weak retail demand kept the market consistently in discount, averaging US$6/oz that month (Chart 3).

Indian official imports in January 2021 were higher y-o-y but lower than December 2020

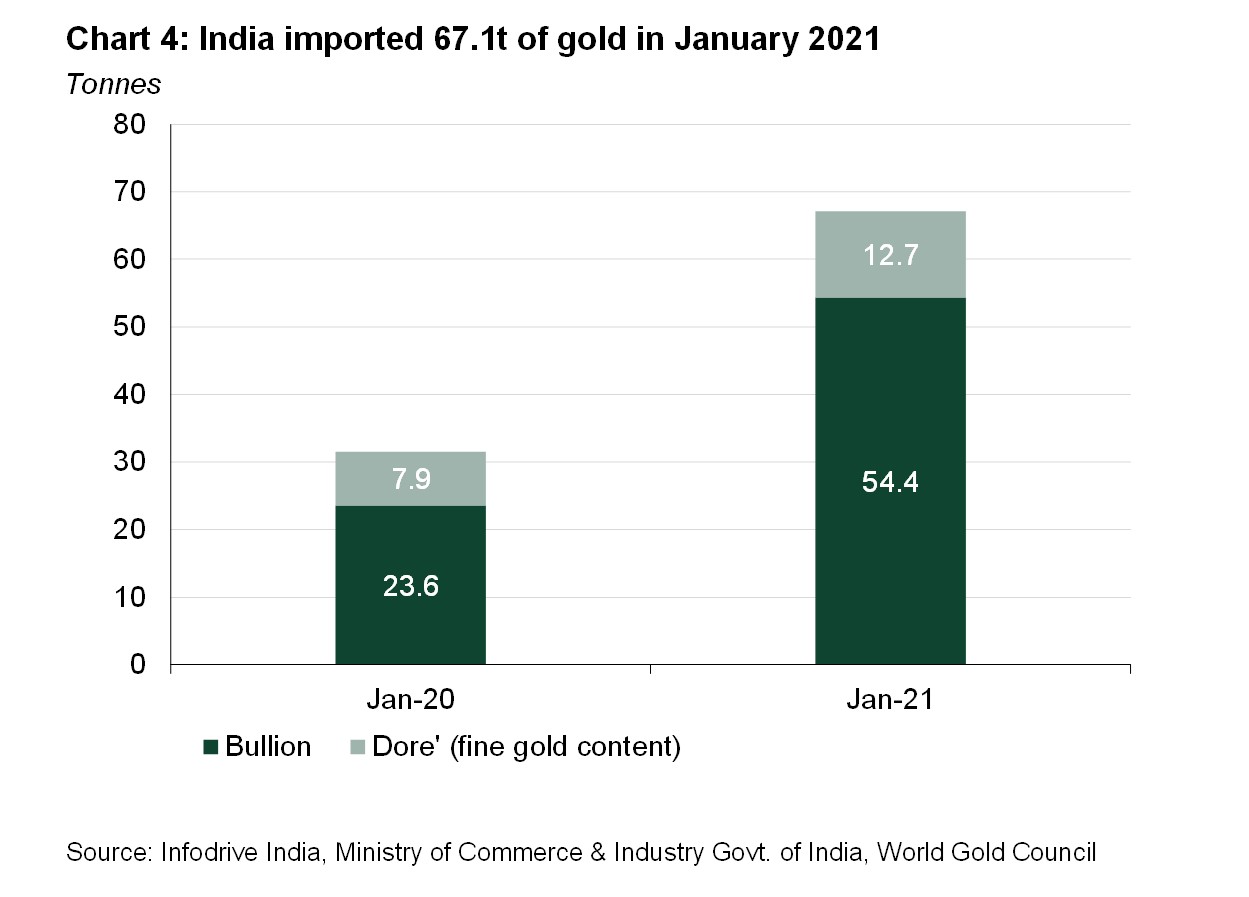

Indian official gold imports totalled 67.1t in January 2021 – 113% higher y-o-y but 8.3% lower m-o-m (Chart 4). Speculation around an increase in the custom duty on gold – which did not materialise – together with healthy retail demand, drove official imports. A total of 11 banks, nominated agencies and exporters imported 54.4t of bullion during the month, and 18 refineries imported 12.7t of gold doré (fine gold content).

Further, from a total of 67.1t of official imports, 28.7t were imported via the Sri City Free Trade Warehousing Zone (FTWZ).4 Six overseas banks accounted for these imports with JP Morgan, ANZ and Standard Chartered accounting for 85%. Looking at official imports in January, ~70% landed in the last two weeks of the month, indicating a healthy upturn in retail demand as well as re-stocking by retailers and manufacturers for the ongoing wedding season.

RBI made no gold purchases in January 2021

After adding 41.6t of gold to its reserves in 2020, RBI made no further gold purchases during January, maintaining its gold reserves at 676.6t, or 6.9% of total reserves (Chart 5).5 The RBI has stepped up its gold purchases in recent years with the aim of diversifying its foreign reserves and maintaining the safety and liquidity of its forex reserves.

Footnotes

1 We compare the LBMA Gold Price AM with MCX Gold Spot price as their trading hours are closer to each other than the most commonly referenced LBMA Gold Price PM.

2 Makar Sankranti is a harvest festival that is celebrated across the country under different names. It is considered an auspicious day to purchase gold.

3 FY refers to financial year (April to March). Q3 of FY 2020-21 refers to Q4 of calendar year 2020 (January-December)

4 FTWZ offers a distinct advantage as overseas suppliers can import gold into the custom-bonded warehouse of FTWZ without paying customs duty for authorised operations. Imported gold can be stored in FTWZ for a long period – as long as the letter of approval (LOA) is valid – thus reducing the logistics time in supplying to the domestic market as compared to importing from the overseas market.

5 Central Bank data is taken from IMF-IFS; IFS up until December and weekly statistics from RBI for January. Please refer to our latest Central Bank Statistics https://www.gold.org/goldhub/data/monthly-central-bank-statistics.