- Interest rates have been a key driver for gold in both 2020 and 2021

- As interest rates have moved higher, the gold price has decreased…

- …but higher inflation expectations may provide some support for gold.

Interest rates as a key driver

One of the four key drivers of gold is the opportunity cost of holding it.1 In particular, the level and direction of interest rates are good indicators of gold’s performance, especially in the short and medium term.

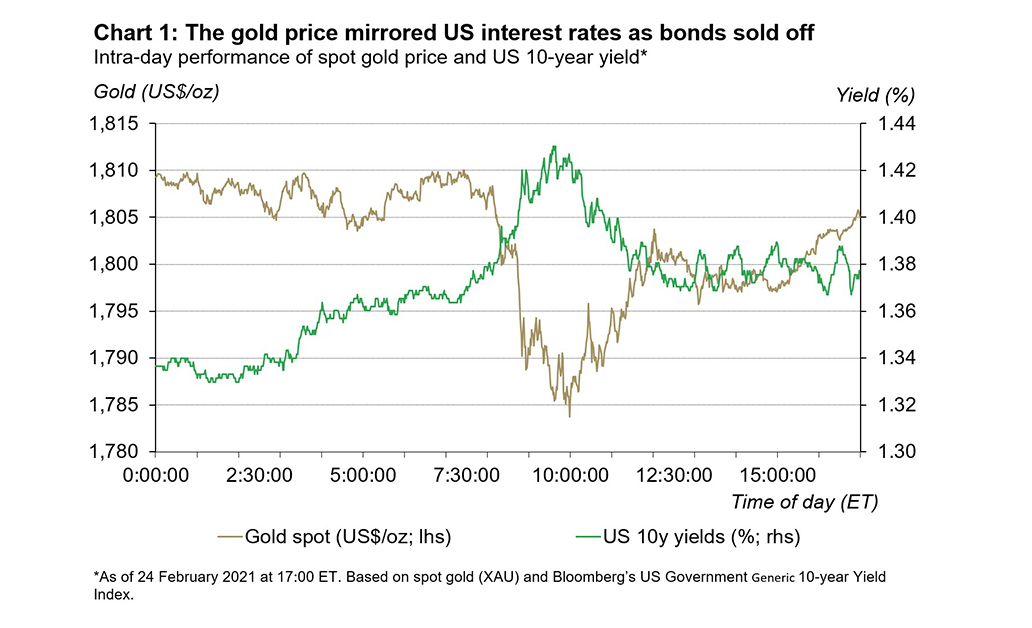

The recent movement in US rates, on the back of the testimony of the Federal Reserve’s (Fed) Chair Jerome Powell to the US Congress, is a good example. The intra-day movement in the gold price on 24 February mirrored the behaviour of the US 10-year yield (Chart 1). As the 10-year yield topped 1.42%, the gold price dropped below US$1,785/oz, but as rates settled back to around 1.37%, the gold price climbed up again to above US$1,800/oz…

…But the influence of interest rates on gold goes beyond the past 24 hours.

Rates have risen sharply in 2021

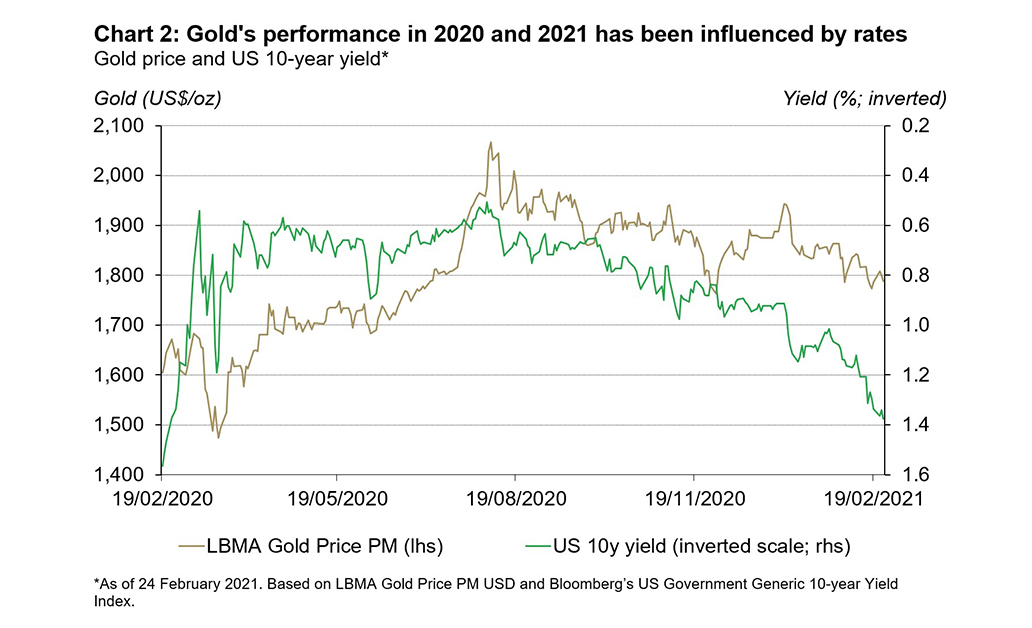

During 2020, gold benefited from the significant fall in interest rates worldwide. As rates reached historic lows and real rates across developed markets turned negative, the opportunity cost - relative to rates - of holding gold all but disappeared.

But as rates have moved higher in 2021 - particularly in February - this trend has reversed. For example, the US 10-year yield has risen from 1% in late January to over close to 1.4% at the time of writing.2 The recent move has been relatively sharp: it took almost five months for the US 10-year yield to move 40bps from 0.6% to 1%, but only a little more than one month to reach 1.4%.

In this context, gold’s 5% decline in the year-to-date3 can be explained in good part by the movement in rates (Chart 2).

A reflationary environment

Much of the recent movement in rates can be linked to the so-called reflation trade. Real assets like homes, lumber, copper and oil have all moved sharply higher partly due to expectations of economic recovery, but also in anticipation of potentially higher inflation – especially given the large amounts of money that have been pumped into the economy.

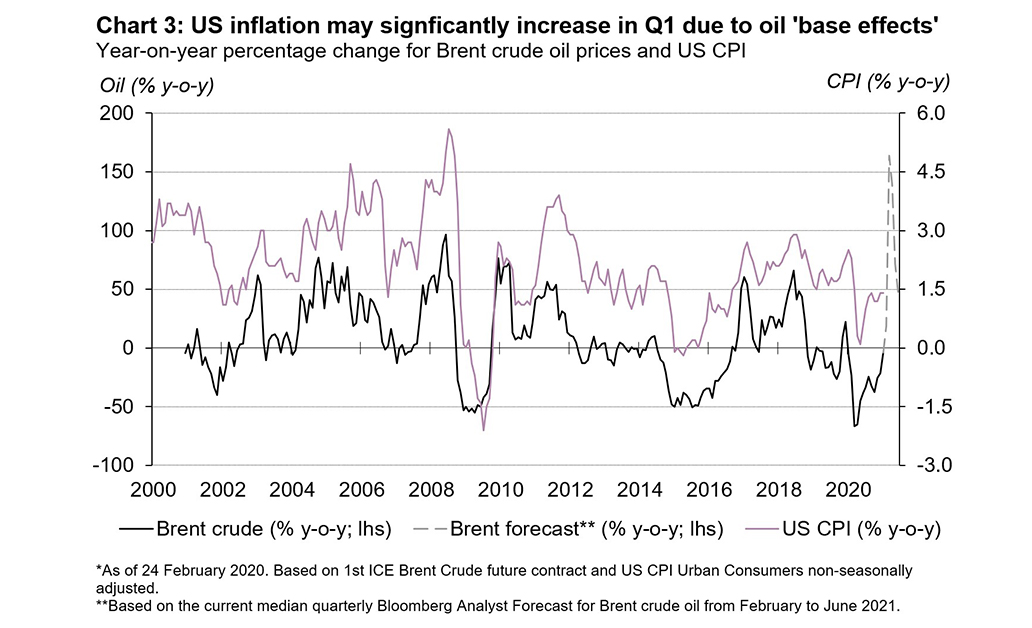

Inflation expectations are also ticking higher. It is likely that investors are positioning for a higher (non-seasonally adjusted) US Consumer Price Index (CPI) print during Q1. This could be partly due to the significant increase in oil prices which, in turn, make up a sizable component of the US CPI. If history serves as a guide, and given that the year-on-year increase in the price will be measured against its near-zero level in late Q1 2020, we could see the US CPI in March shoot up to levels not seen in over a decade (Chart 3). This ‘base effect’ will likely be temporary, but it may nonetheless rattle markets. Looking forward, however, an increase in money supply and the effect of fiscal stimulus could materialise in a more consistent higher inflation level.

Fed expectations

During his testimony to the US Congress, Fed Chair Jerome Powell highlighted that the recovery in housing, business investment and manufacturing has likely been driven by fiscal and monetary stimulus.

He also highlighted that monetary policy tightening – when it occurs – will not be solely linked to a strong labour market. Most importantly, he emphasised that inflation should exceed 2% for some time before the Fed will consider tightening.

For the time being, they expect to keep increasing their holdings of Treasuries and Agency mortgage-backed securities at the current pace through their asset purchase program.

What this means for gold

While higher interest rates may continue to pose headwinds for gold in the short and medium term, inflation expectations are also likely to move higher. Historically, gold has performed well in high inflationary environments globally. In addition, despite their recent increase, interest rates remain structurally low. This is reshaping asset allocation partly as investors search for yield and partly because, at such low levels, bonds may be less effective at providing the diversification investors may need in the event of equity market pullbacks. This concern has prompted some investors to increase strategic allocations to gold, which continue to be seen through inflows in low-cost gold ETFs despite overall outflows in the gold ETF space during the month.

For more on our 2021 Gold Outlook, visit Goldhub.com.

Footnotes

1 See Gold Outlook 2021, January 2021, p.4.

2 As of 24 February 2021. Based on Bloomberg’s US Government Generic 10-year Yield Index.

3 Based on the LBMA Gold Price PM as of 24 February 2021.