November summary

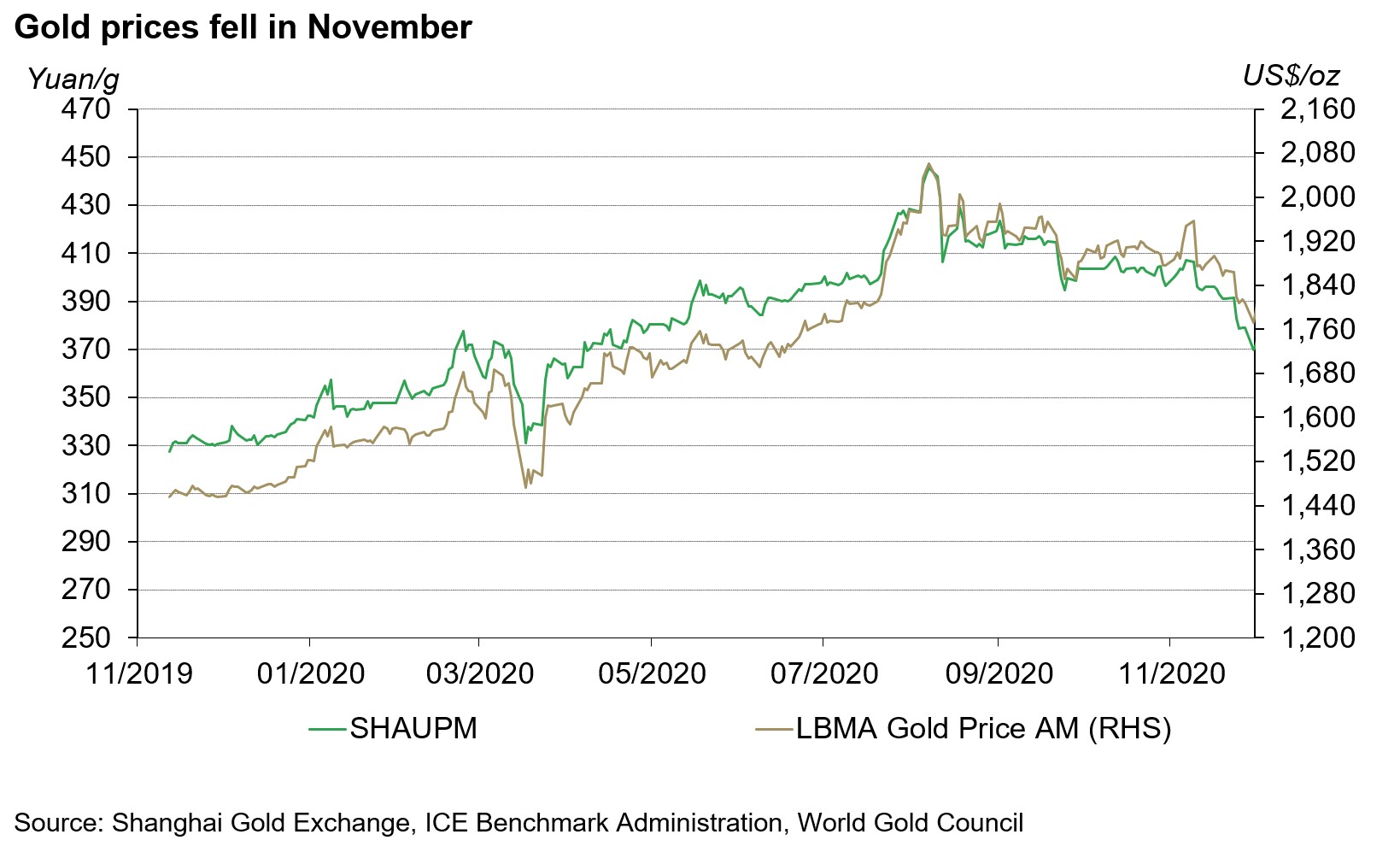

- The LBMA Gold Price AM in US dollars (USD) and the Shanghai Gold Benchmark Price PM (SHAUPM) in renminbi (RMB) extended October’s declines1

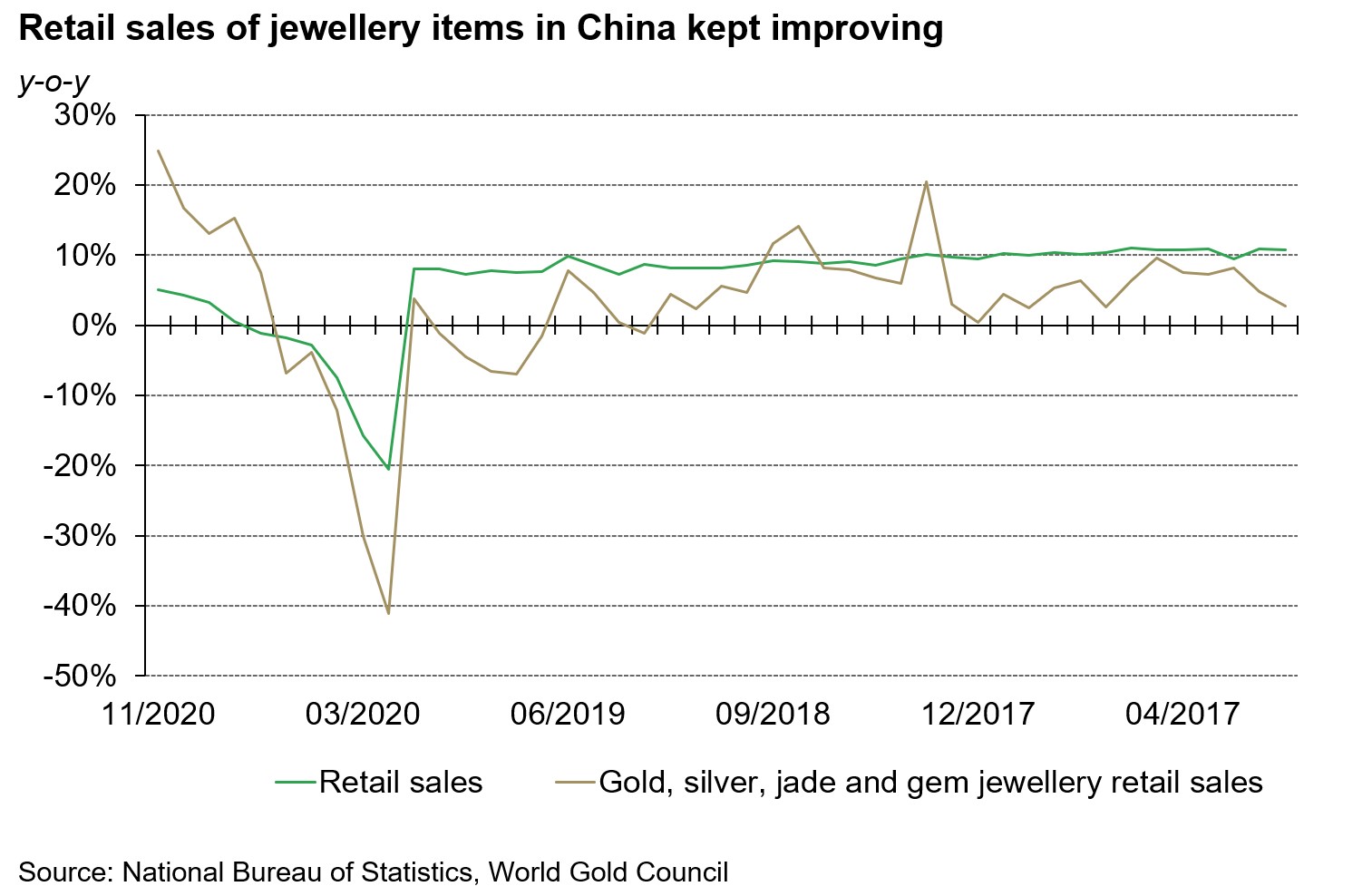

- China’s economy continued to recover, leading to notable improvements in the local jewellery consumption during the month

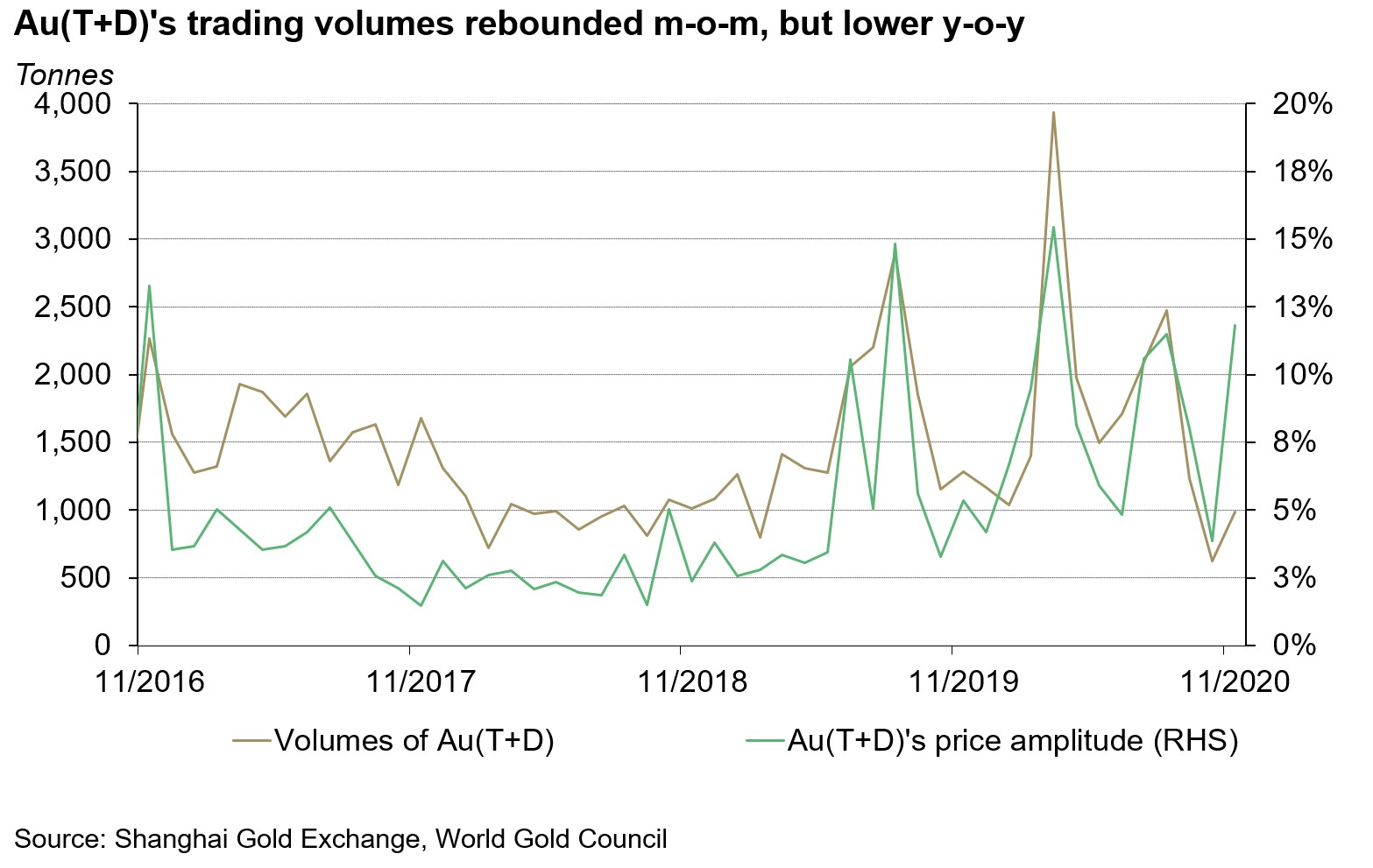

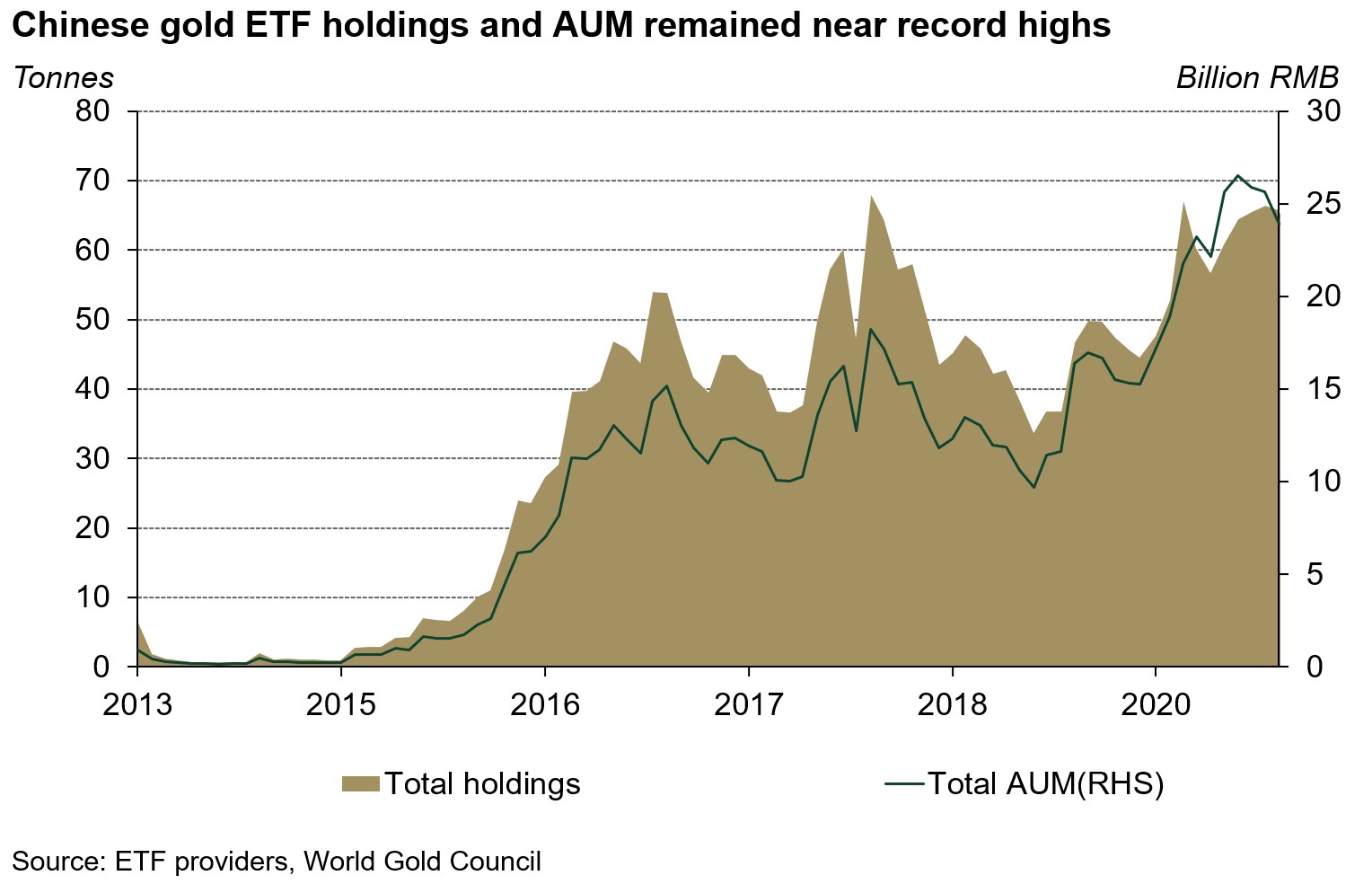

- Au(T+D)’s trading volumes saw a m-o-m rebound yet remained below 2019 levels. Meanwhile, holdings in Chinese gold ETFs were stable

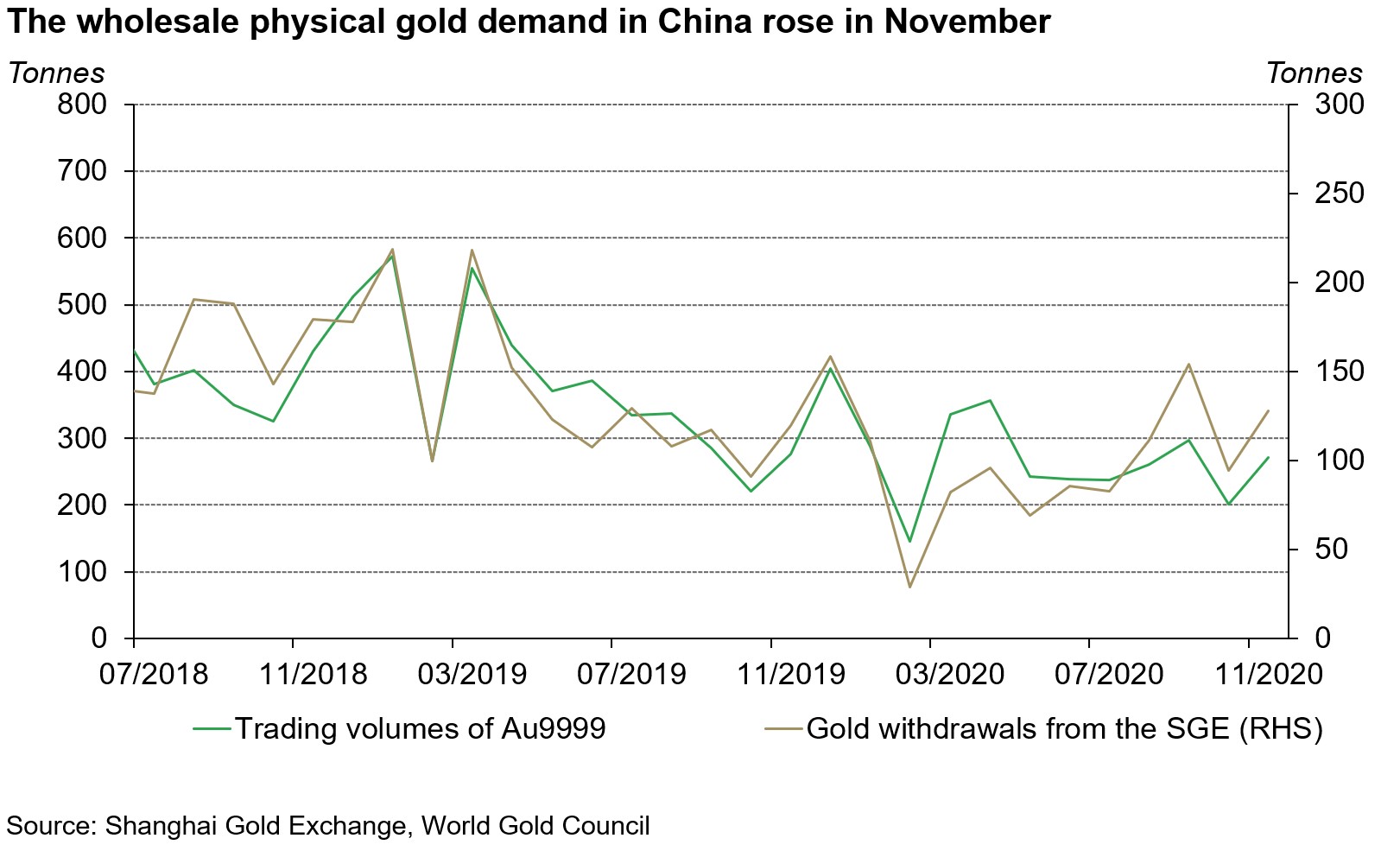

- Wholesale physical gold demand in China witnessed a seasonal rebound as manufacturers were actively preparing for the gold products’ peak season in December

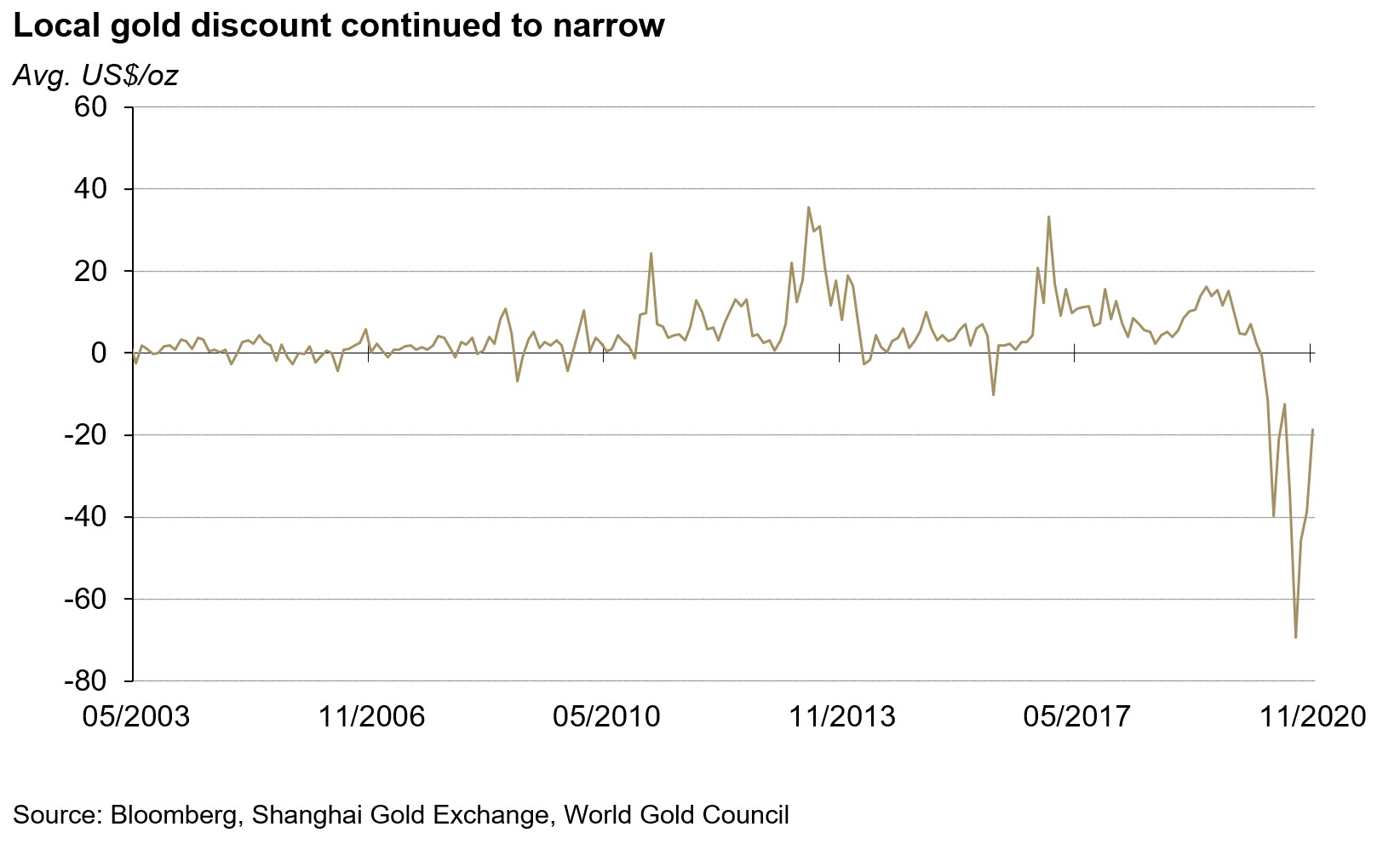

- With domestic gold consumption recovering, the local gold price discount continued to narrow2

- The People’s Bank of China’s gold reserves remained at 1,948t, accounting for 3.3% of its total reserves.

Gold prices fell in November

Positive news around the COVID-19 vaccine development and a balanced result in the US presidential election (Democratic President and House of Representative; Republican Senate) spurred investors’ risk appetite in key markets, driving gold prices down as a result. In China, with the RMB appreciating and real interest rates remaining considerably higher than many other key markets, gold’s appeal waned for many investors, leading to a weaker performance in the RMB gold price than in the USD gold price in November. Last month, the SHAUPM (RMB) witnessed a 6.8% decline while the LBMA Gold Price AM (USD) fell by 5.5%.

China’s economy continued to improve in November

As the COVID-19 pandemic remained under control throughout the country, key economic indicators, including exports, Purchasing Managers’ Indexes (PMI) and retail sales, rose further. Continuous improvements in China’s economy could be supportive of local gold consumption as gold jewellery demand and economic growth are positively correlated according to our past analysis.

In November, Au(T+D)’s trading volumes totalled 985t, 57% higher m-o-m

More trading days in November than October and increased gold price volatility – giving more profit opportunities for shorter-term traders – drove the rebound.3 However, as the gold price lost momentum and some investors turned to riskier assets, the contract’s trading volumes last month were 23% lower y-o-y.

Total gold holdings in Chinese gold-backed ETFs fell fractionally by 0.6t, ending the month at 65.7t

The strong performance of riskier assets, such as stocks and commodities, rising interest rates and a falling gold price in China, contributed to the slight outflow last month. Despite the marginal decline, Chinese gold ETF holdings and assets under management remained near record levels.

Wholesale physical gold demand increased

Last month, 128t of gold were withdrawn from the Shanghai Gold Exchange (SGE) and Au9999’s trading volumes increased to 272t – both 35% higher m-o-m. And both were approximately on a par with 2019 levels.

Chinese gold product manufacturers were actively stocking up last month. Due to December’s proximity to New Year’s Day, as well as the rising popularity among the young of international festivals, such as Christmas, many jewellery retailers regard December as an important opportunity to launch promotions and new products.4 Combined with the fact that many Chinese consumers tend to hoard gold products – either for self-reward or gifting – ahead of the Chinese Spring Festival, which usually occurs in late January or early February, December has become a peak season for sales of gold products.5 In China, gold, silver, jade and gem jewellery retail sales have been 22% higher during December than the annual average over the past 20 years, according to the National Bureau of Statistics.

The Chinese gold price discount narrowed to US$18/oz in November, a 51% contraction m-o-m

Driven by the recovering local gold consumption and the expectation of further improvements in December ahead of the Chinese New Year Festival, the discount witnessed another contraction last month.

Note: SHAUPM vs LBMA Gold Price AM after April 2014; before that, Au9999 vs LBMA Gold Price AM is used. Click here for more.

But China’s spot gold price remained at a discount to the LBMA Gold Price AM. Even though recent data has showed sizable improvements both in the wholesale and retail gold demand in China, y-t-d gold consumption has not yet recovered to 2019 levels. Gold withdrawn from the SGE between January and November was still 30% lower y-o-y whilst retail sales of gold, silver, jade and gem jewellery during the same period fell by 6.7% from 2019 levels.

Footnotes

1 We compare the LBMA Gold Price AM to SHAUPM because the trading windows used to determine them are closer to each other than those for the LBMA Gold Price PM. For more information about Shanghai Gold Benchmark Prices, please visit en.sge.com.cn/data_BenchmarkPrice.

2 For more information about premium calculation, please visit www.gold.org/goldhub/data/local-gold-price-premiumdiscount

3 Due to the National Day Holiday and Mid-Autumn Festival in early October there were only 16 trading days during the month; in November there were 21 trading days.

4 For more information, please visit: www.chinadaily.com.cn/opinion/2015-12/29/content_22855326.htm

5 The 2020 Chinese Spring Festival (Chinese New Year’s Day) will occur on 12 February 2021.