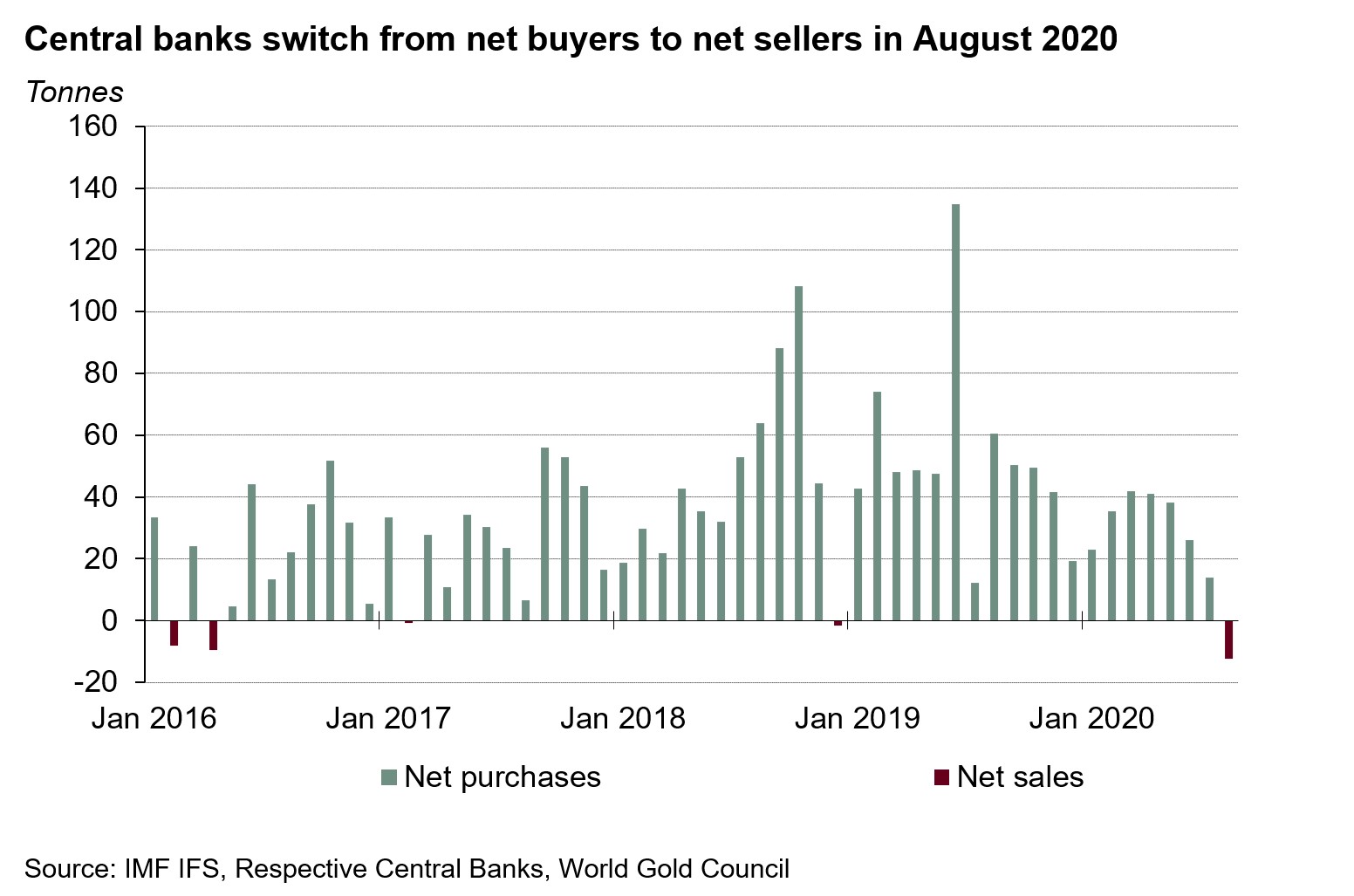

In August, central banks switched from net buyers to net sellers for the first time in around a year and a half. Global central banks sold a net 12.3 tonnes (t) during the month, continuing this year’s trend of a slower pace of accumulation compared to recent years. Monthly net sales are not unheard of – we have seen it on five separate occasions since the start of 2016, although the decline in August 2020 is the largest drop over this period.

Tracking and tracing central bank demand in August

7 October, 2020

Despite the most recent data, we remain firm in our expectation for central banks to remain net purchasers for 2020. Global central banks have accumulated between 200-300t year-to-date. And this expectation was recently reiterated by Shaokai Fan, our Head of Central Banks Relationships, in an interview with Kitco.

Diversification of reserves, particularly away from the US dollar, continues to be a driving factor, as does the ultra-low interest rate environment. And, given recent announcements from the Fed, it seems this will support central bank gold demand for some time to come.

Gold buyers’ bubble

While the overall picture was one of net sales in August, there is value in looking at the finer detail.1 Seven central banks increased their gold reserves during the month, the highest number this year (matching February). Their combined net purchases totalled 19.5 tonnes.

And as has been the case for some time, purchases were concentrated amongst regular buyers. In August, Kyrgyz Republic was the month’s biggest buyer (5t), accompanied by India (4t), Turkey (3.9t), UAE (2.4t), Qatar (1.6t), Mongolia (1.3t), and Kazakhstan (1.3t) in adding to their holdings. Year-to-date, Turkey remains the largest accumulator of gold, having bought 194t, taking total gold holdings to 607t (49% of total reserves).

But these purchases were comfortably outweighed by the single seller in August. Uzbekistan reduced its gold reserves by almost 32t, bringing its remaining gold reserves to just under 300t (54% of total reserves). The country’s gold exports have jumped this year, as it looks to generate additional income to counter the economic impact of the COVID-19 pandemic.2

Look out for our summary of central bank demand during Q3 in our next Gold Demand Trends report which will be published at the end of October.

Footnotes

1 Country-level commentary includes net purchases/sales of a tonne or more only.

2 www.eurasianet.org/uzbekistan-pins-economic-fightback-on-gold-sales